Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

October 11, 2022

Equity markets declined during September, with the recent sell-off leaving major indices near June lows. Year-to-date, the S&P 500 returned -17.2% (in Canadian dollars), S&P/TSX -11.1%, MSCI World -18.9% and the MSCI Emerging Markets Index -20.8%. Persistently high inflation and expectations of further monetary tightening are heightening recession concerns. Global economies are adjusting to a slower growth path and recession risk varies across regions. On balance, we believe robust labour markets and healthy consumer balance sheets provide a significant buffer against the impact of rising interest rates. As we detail in our October Economic and Capital Markets Outlook, share price weakness is explained by a sharp contraction in market multiples as company earnings have remained relatively resilient. With investors discounting a pessimistic economic scenario unfolding, we see more compelling valuations beginning to emerge.

Equities continue to offer a higher return potential in the medium term

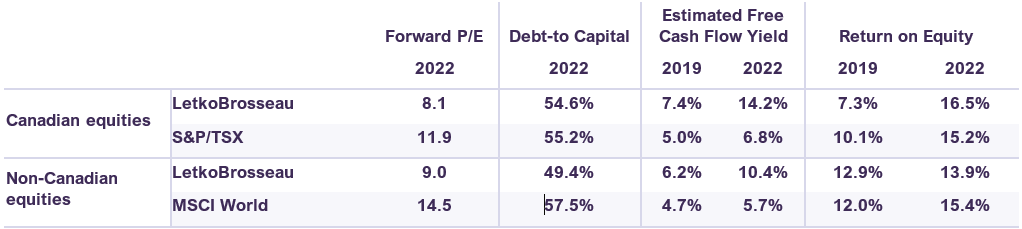

Despite continued market turbulence, we are maintaining a tilt to equities within balanced mandates. To begin with, we believe stocks provide greater longer-term return potential than fixed income securities at this juncture. Even as 30-year government yields have risen by 142 basis points year-to-date, a backdrop of monetary tightening and a period of higher-than-average inflation spells trouble for long-term bonds. Second, the recent declines in the equity market appear to reflect a pessimistic outlook on the global economy. Our read of economic data suggests that while there are risks in the short-term, a global recession is not a foregone conclusion. And even if there is a period of economic weakness ahead, we believe the companies held in our portfolios are well-positioned to weather the economic weakness. Our portfolio companies are showing lower leverage than their respective benchmarks. In addition, profitability and cash flow generation is higher today than in the year before the pandemic. Third, valuations are inexpensive: our Canadian equity portfolio is trading at 8.1 times estimated 2023 earnings and our international equity portfolio is valued at 9.0 times (Table 1). A lot of bad news has been priced in.

Key metrics of Letko Brosseau equity portfolios

Based on equity prices as of September 30th, 2022. Sources: Factset (www.factset.com) financial data and analytics and LBA calculations, Letko Brosseau Canadian Equity Fund and Letko Brosseau International Equity Fund. Ratios are calculated on a weighted average methodology based on the Letko Brosseau Canadian Equity Fund and Letko Brosseau International Equity Fund. All ratios, except the forward P/E ratio, exclude holdings in the financial sector. The forward price-to-earnings (P/E) ratio measures the earnings per share a company is expected to earn next fiscal year against its market value per share. The total debt-to-capital ratio measures the amount of outstanding company debt as a percentage of the firm’s total capital. The estimated free cash flow (FCF) yield measures the free cash flow per share a company is expected to earn next fiscal year against its market value per share. The Return on Equity (ROE) ratio measures the return that a company earns on equity.

Historically, investors who have entered the market at these low valuation levels have benefitted. Finally, the choice to sell equities and invest the proceeds in fixed income or cash ultimately entails two decisions: when to sell and when to re-enter the market. As highlighted in our August Portfolio Update, getting the timing on both decisions right is very difficult. Missing the best-performing days in the equity market can be damaging to the long-term growth of a portfolio.

Mitigating the risks in forecasting earnings

We have discussed at length the risk of rising interest rates on stocks trading at high multiples (June Portfolio Update). However, the risk to these companies extends beyond just rising interest rates. High-multiple stocks derive more of their economic value from future forecasted earnings. We are not immune from the challenges and risks in forecasting earnings: company-specific and economy-wide events require a continuous review of our estimates. However, we mitigate this risk by investing in companies trading at lower valuations and by forecasting over a 3-5 year cycle. Companies trading at low valuations derive a greater portion of their value from near-term earnings which have higher visibility and are generally less volatile than earnings forecasted long into the future. The companies held in our portfolios do not depend on near-perfect execution of high-growth projections to justify their market price. In addition, should the economic cycle enter a difficult phase, with earnings growth at risk of being temporarily challenged, we believe our companies can navigate these headwinds more effectively.

Concluding thoughts

Our portfolios are constructed to generate value-added performance over medium- and long-term horizons. Companies trading at stretched valuations embed ambitious growth prospects: increased competition and execution errors can significantly weaken their outlook, resulting in lower than anticipated future profits. Our avoidance of excessive share price valuations and emphasis on allocating capital to companies with a strong management team and a sustainable long-term strategy which trade at a reasonable multiple of earnings has benefited our portfolios. Our patient approach as volatility increases is one of the keys to prudent investing. We are confident this disciplined investment strategy will continue to contribute to preservation and growth of your capital.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN