Le Devoir : À l’attention du ministre des Finances du Canada et des ministres provinciaux des Finances (French only)

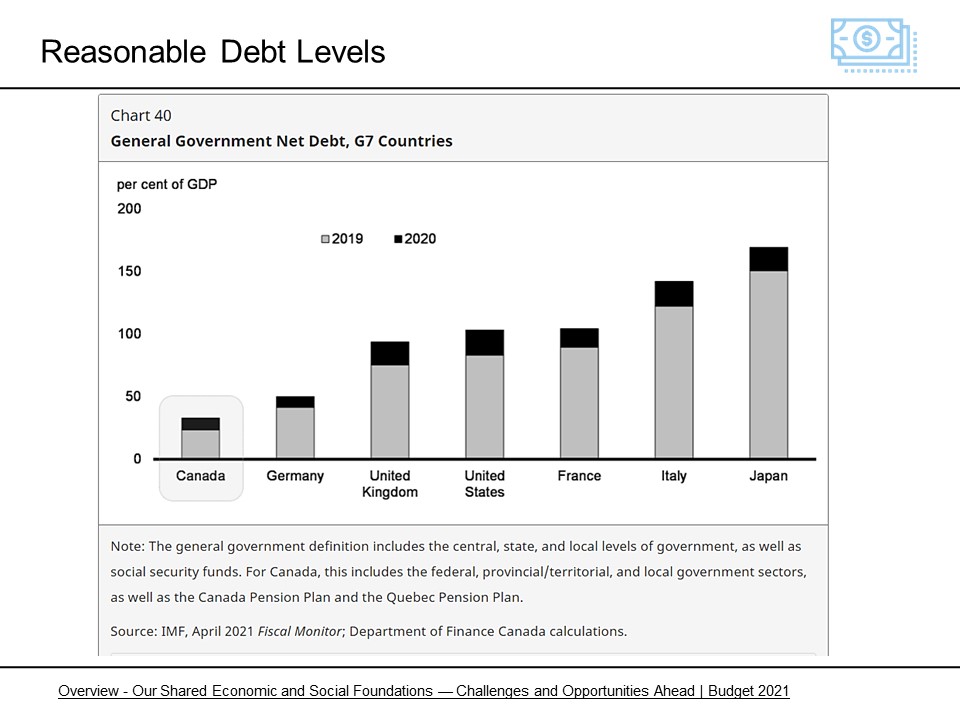

"Nous sommes préoccupés par la baisse des investissements faits au Canada par les fonds de pension et par l’impact que cela entraine sur l’économie canadienne. Rappelons que les fonds de pension se financent à même les salaires gagnés par des millions de Canadiens."

LaPresse: "L’inquiétante érosion du marché des actions canadiennes"

“La Caisse de dépôt est la caisse de retraite canadienne qui maintient un pourcentage d’actions canadiennes parmi les plus élevés au Canada, avec près de 20 % d’actions canadiennes dans son vaste portefeuille de 191 milliards. Chez LetkoBrosseau, le pourcentage d’actions canadiennes atteint 40 %.”

BNN:

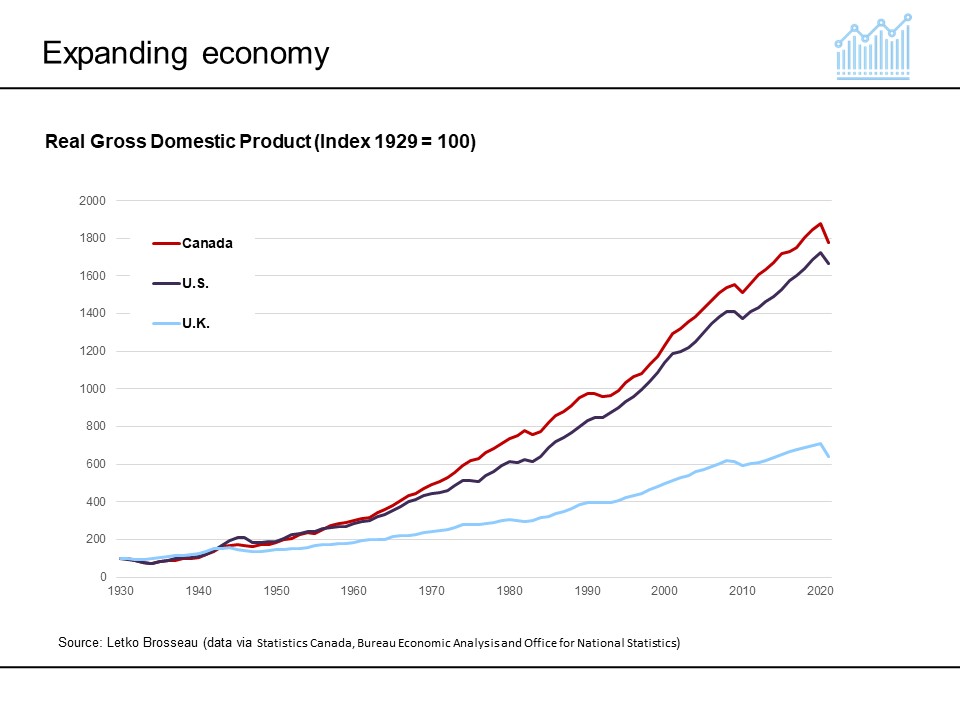

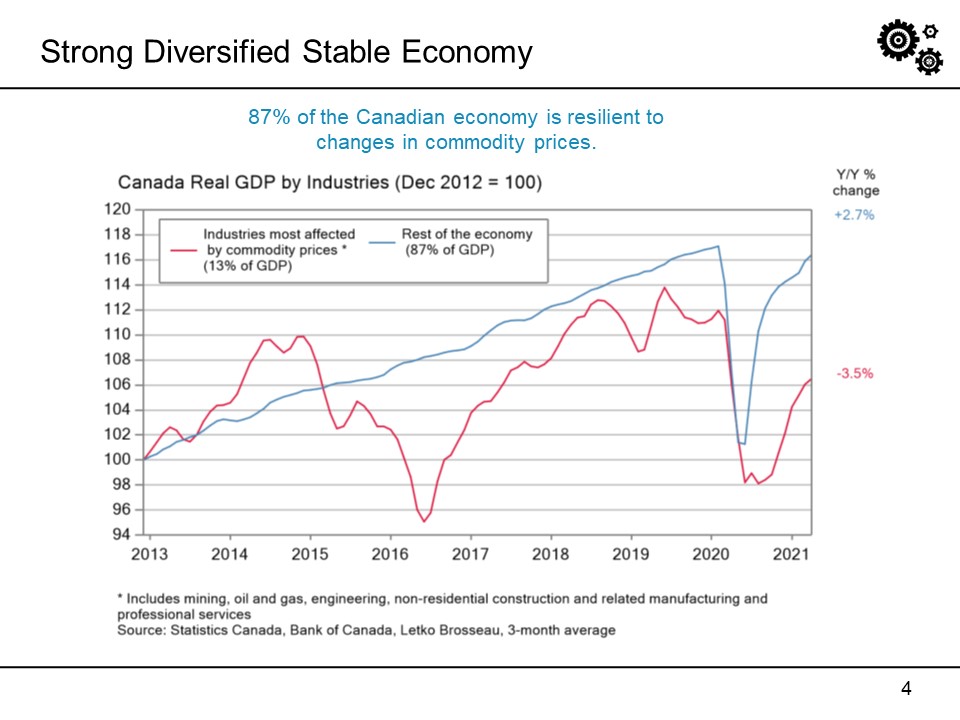

“While we understand the need for international diversification, a principle we have followed for many years, balance is required. That said, the strength of the Canadian economy and self-sustaining benefits of investing in our own industries should be an equally important priority.” – Peter Letko, Senior Vice President at LetkoBrosseau, comments on the firm’s recent press release in this BNN interview.

The Suburban:

Private pension funds should invest more in Canadian businesses

“Research conducted by the Montreal-based global investment management firm Letko-Brosseau recently revealed that Canadian-listed equities accounted for nearly 80% of Canadian pension fund equity investments in 1990. By 2020, this proportion had fallen to only 10%.”

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Canada - FR

Canada - FR U.S. - EN

U.S. - EN

![Value of $1 million invested in the Canadian Equity Composite since 1995 <sup>[3][5]</sup>](https://www.lba.ca/wp-content/uploads/2024/04/chart-en-2023-12-Inv-In-Canada.png)