Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Horizon

Tax Bulletin 2021-2022February, 2022

Introduction

Since 2020, the different levels of Canadian government have focused most of their resources on implementing various programs in order to deal with the pandemic. From the standpoint of the economy, the aim was to make the transition through this turbulent period as painless as possible for individuals and businesses. In 2021, even though the pandemic was not completely behind us, governments were able to start thinking about the post-pandemic period. Taxation, which was used to apply budget support measures, has slowly started to make a come-back with the tabling, in April 2021, of the first federal budget in two years.

Personal Taxation

Registered Retirement Savings Plan (RRSP)

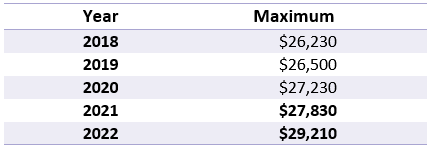

You have up to March 1, 2022 to make your RRSP contribution if you want to use your contribution room for the 2021 taxation year. Individuals may contribute 18% of their previous year’s income, subject to the annual limits in the accompanying table, and adjusted by the pension adjustment (PA, PAR and PSPA). Previous years’ unused contribution room can also be added.

Annual RRSP contribution limits

To know the exact amount of your deductible contributions for 2021, just log in to My Account for Individuals – Canada.ca on the Canada Revenue Agency (CRA) website or check your most recent federal Notice of Assessment.

It should be noted that if you are turning 71 in 2022 and wish to make a final RRSP contribution, you have until December 31, 2022 (and not until March 1, 2023) to do so. You can also contribute to your spouse’s plan by December 31 of the calendar year in which your spouse turns 71.

Tax-Free Savings Account (TFSA)

For 2022, the new TFSA contribution room is $6,000, for a cumulative total of $81,500 since the account was introduced in 2009. Unused contribution room may be carried forward to any of the following years. Moreover, TFSA withdrawals made in any given year will result in new contribution room for the same amount the very next year.

It is important to maintain a record of TFSA deposits and withdrawals, which can be complex. The exact amount of your current cumulative room can also be found in My Account for Individuals – Canada.ca on the CRA website.

Contributions are not deductible from income, but investment income earned in a TFSA is tax free. Withdrawals are not taxable and may be made for any purpose.

Registered Retirement Income Fund (RRIF)

Individuals who turn 71 in 2022 must convert their RRSP into a RRIF before the end of the year, and the first required minimum withdrawal is to be made in 2023.

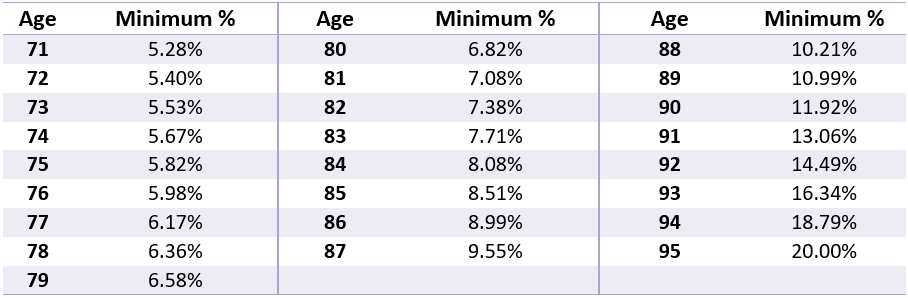

The amount of the annual minimum required withdrawal is determined based on the value of the RRIF on January 1st of each year and a percentage applied on the holder’s age according to the following table:

Age 71 and over as at January 1st

The rate remains 20% once the individual turns 95.

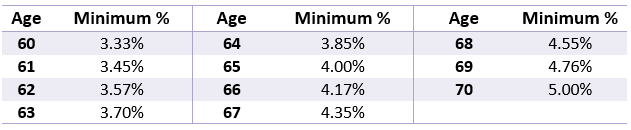

When establishing the RRIF, it is possible to choose the younger spouse’s age for the determination of minimum withdrawals. In addition, the RRSP conversion to a RRIF can be done before age 71 if the taxpayer wishes to start receiving an income. In such cases, the required minimum withdrawal is applied based on the table below:

Under age 71 as at January 1st

Other Interesting Measures

Home Office

In 2020, the CRA allowed employees who had worked from home as a result of the pandemic to claim a deduction using a simplified flat rate method. The claim was based on the hours they worked at home, without being required to track their expenses in detail. The federal government extended this method to 2021 and 2022, in addition to increasing the maximum deductible to $500.

Investment Income in a Management Company

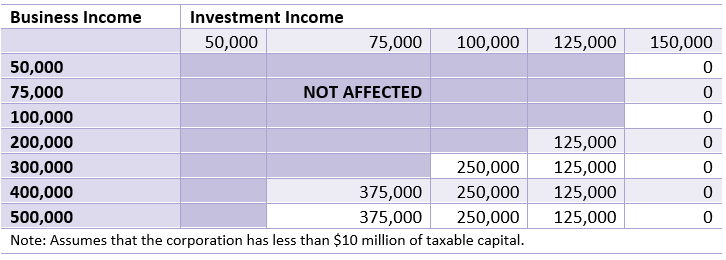

In the March 2018 federal budget, the government announced new rules for investment income. For taxation years beginning after December 31, 2018, corporations could steadily lose the right to a reduced rate (the Small Business Deduction or SBD) on the first $500,000 of active business income if they (and their associated corporations) earn too much passive income (investments). The table below shows how the SBD is reduced by investment income of up to a maximum of $150,000, which would eliminate the SBD entirely.

Active business income qualifying for the small business tax rate under new business limit for illustrative passive assets ($)

Reminder of Capital Loss Rules

Capital losses incurred in 2021 may be claimed against capital gains only (except in the event of death where special rules apply) in any of the three preceding years or in any future year. Such capital losses claimed, when triggered in 2021, can be carried back to 2018. It should be noted that a capital loss realized in 2021 must be applied, first and foremost, to reduce the capital gains realized in 2021.

Cryptocurrency transactions can also result in a capital gain or loss. However, if the transactions happen to be speculative, it may be a business income or loss rather than a capital gain or loss.

Conclusion

This bulletin is a reminder of the general tax measures. The Investment Services team at Letko Brosseau is available to answer your questions or comments. However, in order to find out if these measures apply to your situation, we invite you to consult with your accounting or tax professional. [1]

Legal notes

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN