Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Horizon

Tax Bulletin 2022-2023February 2023

Introduction

The purpose of this bulletin is to inform you of general terms and conditions as well as the new 2023 parameters of the various tax plans for individuals.

Personal Taxation

Registered Retirement Savings Plan (RRSP)

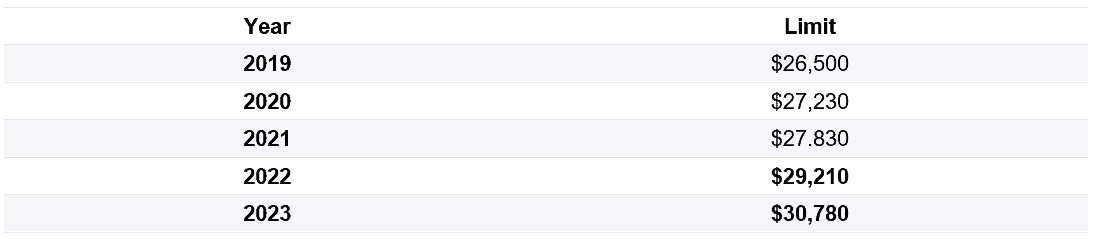

You have up to March 1st, 2023, to make your RRSP contribution if you want to use the deduction for the 2022 taxation year. Individuals may contribute 18% of their previous year’s income, subject to the annual limits in the accompanying table and adjusted for the pension adjustment (PA, PAR and PSPA), as required. Previous years’ unused contribution room can also be added.

Annual RRSP contribution limits

In order to find out the exact amount of your deductible contributions for 2021, simply go to My Account for Individuals – Canada ca on the Canada Revenue Agency (CRA) website or to check your most recent federal Notice of Assessment.

Please note that if you are turning 71 years of age in 2023 and wish to make a final contribution to your RRSP, you have until December 31st, 2023 (and not until March 1st, 2024) to do so. You can also contribute to your spouse’s plan by December 31st of the calendar year in which your spouse turns 71.

Tax-Free Savings Account (TFSA)

For 2023, the new TFSA contribution room is $6,500, for total cumulative contribution room of $88,000 since the account was introduced in 2009. Unused contribution room may be carried forward to any of the following years. In addition, TFSA withdrawals carried out during the course of one year will result in new contribution room for the same amount the next year.

You can also see the exact amount of your current cumulative contribution room at My Account for Individuals – Canada ca on the CRA website.

Contributions are not deductible from income, but investment income earned in a TFSA is tax free. Withdrawals are not taxable and can be made for any purpose. A number of attractive investment strategies can therefore be considered.

Registered Retirement Income Fund (RRIF)

Individuals who turn 71 in 2023 must convert their RRSP into a RRIF before the end of the year, and the first required minimum withdrawal is to be made in 2024.

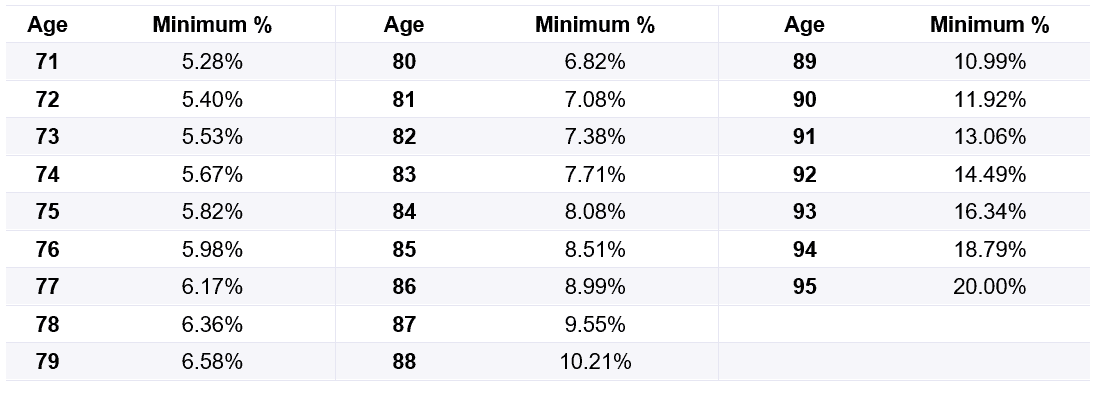

The annual required minimum withdrawal is determined according to the value of the RRIF as of January 1st of each year multiplied by a percentage based on the individual’s age, as shown in the table below:

Age 71 and over as of January 1st

The rate remains at 20% once the individual turns 95.

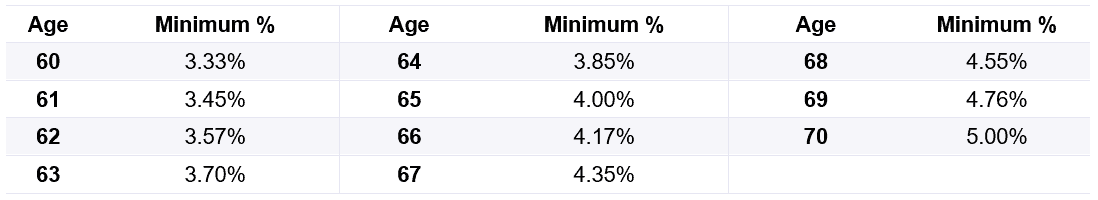

When the RRIF is set up, the age of an individual’s spouse can be selected, if the spouse is younger, to determine minimum withdrawals. In addition, an RRSP can be converted into a RRIF before the age of 71 if the taxpayer wishes to start drawing income from the plan. In such cases, the required minimum withdrawal is applied based on the table below:

Under age 71 as of January 1st

Other Interesting Measures

Introduction of the FHSA for First-Time Home Buyers

In order to support access to home ownership for Canadians, the Federal Budget 2022 proposed the introduction of the Tax-Free First Home Savings Account (FHSA). This new registered plan will make it possible for first-time home buyers to save for a first home and is a hybrid formula, combining an RRSP, an HBP and a TFSA.

Officially, the legislation will be enacted on April 1st, 2023, with the objective of being implemented by the end of 2023. Below is an overview of this plan. For full details, you can go to the federal government website: Department of Finance Canada: Design of the Tax-Free First Home Savings Account.

Conditions for opening an FHSA

- Be a Canadian resident of 18 years and over.

- During the part of the year before the account is opened and any time in the preceding four calendar years, the individual has not lived in a dwelling qualifying as a principal residence that is owned by the individual or his or her spouse.

Summary of terms and conditions

- The annual contribution limit will be $8,000 for a lifetime contribution limit of $40,000 regardless of the individual’s income.

- The contributions will be deductible in computing the individual’s net income and the income earned in the plan will not be generally subject to tax.

- FHSA contributions will not affect the individual’s RRSP contribution room.

- The maximum duration of the plan is 15 years after the opening of the FHSA, or if the individual turns 70 years old.

- The holder may make non-taxable withdrawals to purchase a first-time property that is a qualifying dwelling. Withdrawals made for other purposes will be taxable.

- Amounts withdrawn will not need to be reimbursed, contrary to an HBP.

- An individual may make a tax-free withdrawal from an FHSA as well as a withdrawal from an HBP to buy the same qualifying housing unit.

- The amounts accumulated in an FHSA may be transferred to an RRSP or a RRIF without any tax consequences.

- Special rules apply in the case of separation, death or non-residents.

Indexation of Public Plans

Following the higher rise in the Consumer Price Index over the past year, here is a brief overview of the indexation of the main government plans.

1. Quebec Pension Plan (for Quebec taxpayers)

In general, Quebec workers contribute to the Quebec Pension Plan (QPP) at the rate of 12.8% of their salaries, which is split between the employee and employer. However, the contribution is capped above a certain limit. This is what is known as Maximum Pensionable Earnings (MPE).

The MPE is therefore the maximum employment income considered for the calculation of a worker’s annual retirement contribution. The portion of income in excess of such amount is not considered when calculating the contribution or the pension. The MPE amount varies every year.

For 2023, the Maximum Pensionable Earnings (MPE) used for QPP purposes is up $1,700 to total $66,600. This adjustment reflects the annual growth in average weekly wages and salaries in Canada for 12 months, ended June 30th, 2022.

For pensioners who receive a QPP pension, the indexation rate for pensions paid as of January 1st, 2023, has been set at 6.5%. This adjustment represents the change in the Consumer Price Index in Canada for the 12 months ended October 31st, 2022.

2. Canada Pension Plan (CPP)

With only a few exceptions, CPP contributions are compulsory for all working Canadians over the age of 18, except for Quebec residents, where benefits are paid by the Quebec Pension Plan.

The amount of contributions depends on employment earnings up to the Year’s Maximum Pensionable Earnings (YMPE), which is set in January of each year, based on the increases in average salaries in Canada. The contribution rate on these earnings is 11.9% in 2023, divided equally between employees and employers.

In 2022, the YMPE was $64,900, rising to $66,600 in 2023.

CPP benefits will be indexed at 6.5% in 2023.

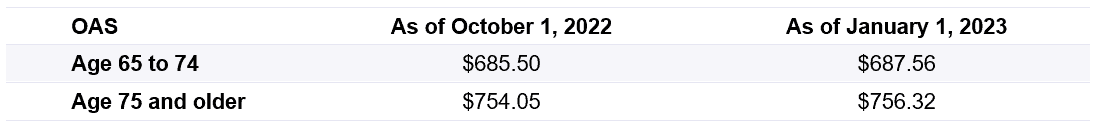

3. Old Age Security (OAS) for Canadian Residents

Not everyone receives the full Old Age Security (OAS) pension. The amount received depends on the number of years that an individual has lived in Canada. In order to receive the maximum amount, you need to have lived in Canada for 40 years or more, after the age of 18. Otherwise, you will receive an amount based on the number of years in Canada divided by 40.

As for OAS monthly benefits, they are indexed quarterly (in January, April, July, and October) based on the increase in the Consumer Price Index. The total percentage increase for 2022 was 7.9%, compared to 3.4% in 2021.

Since July 2022, people aged 75 and older have been receiving an automatic 10% increase in their Old Age Security pension.

Maximum monthly benefit

If a person’s income was $81,761 in 2022, OAS benefits are reduced by 15% of any income in excess of this threshold and will become nil if income climbs to $134,253 ($136,920 starting at age 75).

Concluding Thoughts

This bulletin is a reminder of general tax measures. Your client team at Letko Brosseau would be pleased to answer any questions or comments you may have.

However, please consult with your professional accountant or tax specialist to determine if these measures apply to your personal circumstances.

Mentions légales

1 The information contained herein is provided for informational purposes only, is subject to change and is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Where the information contained in this document has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but Letko, Brosseau & Associates Inc. has not independently verified such information. No representation or warranty is provided as to the accuracy, completeness or reliability of such information.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN