Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

June 9, 2022

Global equity markets extended their declines during the month of May, with high-priced technology shares once again suffering the steepest pullbacks. Year-to-date, the total return in Canadian dollars for all major indices was negative: the S&P 500 dropped 12.6%, the S&P/TSX declined 1.3%, the MSCI World lost 12.8% and the MSCI Emerging Markets index fell 11.6%. High inflation, monetary policy tightening and COVID lockdowns in China are heightening concerns that global economic growth may be at risk. We believe it is too soon to forecast that we are headed for a recession, though we acknowledge that risks are rising. In our view, our portfolios are well positioned to navigate this uncertain environment and we do not advocate for any major shifts in asset mix. We continue to expect that equities will deliver far superior returns than fixed income investments over the next 3-5 years.

Navigating through the stock market’s volatility

Although our portfolios have not been immune to market volatility, they have held up much better than their benchmarks in all asset classes year-to-date. This is partly due to our exposure to companies supplying energy and materials – which are reaping cash windfalls in the current environment of high commodity prices – as well as to high dividend-paying companies in defensive sectors such as telecommunications, healthcare and utilities.

Another significant factor behind our portfolios’ relative resilience is our avoidance of businesses with elevated valuations that are largely dependent on extraordinary future growth. The remarkable decline from 2021 highs experienced by many big-name firms, such as Shopify (-77.8%), Netflix (-71.5%) and, most recently, Snap (-83.0%), has been an important feature of the recent weakness in the broad indices. As shown in Table 1, share prices for the most expensively valued stock quintile in the S&P 500 (as measured by its average estimated 2022 P/E ratio) decreased by 21.0% year-to-date. In contrast, the 100 least expensive companies in the S&P 500 saw an average share price rise of 7.3%. Our global equity portfolio has consistently traded at a valuation level well below that of major indices, closer to the bottom quintile of the S&P 500 (Table 1).

Financial Market Performance

Based on equity and fixed income prices as of May 31st, 2022, in Canadian dollars

Sources: FactSet (www.factset.com) financial data and analytics consensus estimates and LBA calculations. (1) Letko Brosseau Equity Fund. (2) Letko Brosseau RSP Bond Fund. The price-to-earnings ratio measures the current share price of a company or benchmark relative to its earnings per share (EPS). The Yield to maturity is the total return anticipated on a bond if the bond is held until it matures (expressed at an annual rate).

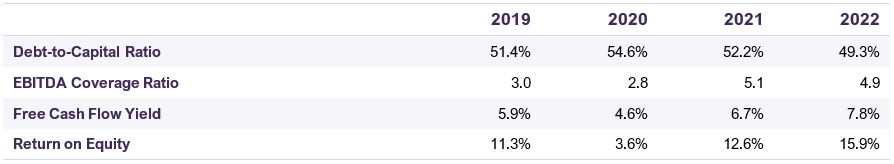

With interest rates trending higher, companies are facing rising borrowing costs. This additional cost is likely to act as a drag on firms’ earnings, most notably for those with higher debt levels. We believe the companies in our portfolio have the balance sheet strength to absorb higher future borrowing costs. In general, our companies have lowered leverage, improved their profitability and cash flow generation, and are in a better position today to address rising costs than before the pandemic (Table 2).

Key metrics of companies in the Letko Brosseau equity portfolio

Based on equity prices as of May 25th, 2022. Sources: Factset (www.factset.com) financial data and analytics and LBA calculations, Letko Brosseau Equity Fund. Ratios are calculated on a weighted average methodology based on the Letko Brosseau Equity Fund. The total debt-to-capital ratio measures the amount of outstanding company debt as a percentage of the firm’s total capital. The EBITDA coverage ratio measures the ability of a company to pay off its interest obligations. The free cash flow (FCF) yield measures the free cash flow per share a company is expected to earn against its market value per share. The Return on Equity (ROE) ratio measures the return that a company earns on equity.

Long-term fixed income instruments are another casualty of rising rates. As shown in Table 1, U.S. and Canadian 10-year bonds declined 11.0% and 11.7% year-to-date, respectively. It is interesting to note that the wild gyrations in yields over the past decade has led to very mediocre returns for Canadian bonds. Even considering that between May 2012 and May 2022, there were two equity market corrections of 20% and a pandemic-induced stock market decline of 32%, stocks still far outperformed bonds during the period. The FTSE Canada Universe Bond Total Return Index delivered compound annual returns of 1.9% over the last ten years and a dismal 0.4% over the last five years. Meanwhile the S&P/TSX generated total annual returns of 9.3% over the past decade and 9.4% during the last five years, while the returns for the MSCI World Index were 13.3% and 8.3% over the same timespans.

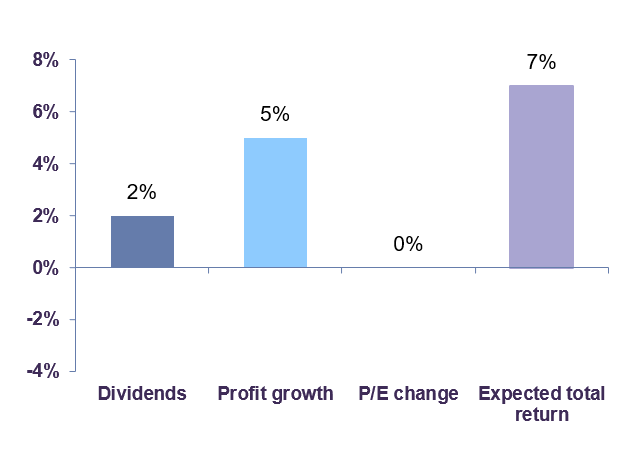

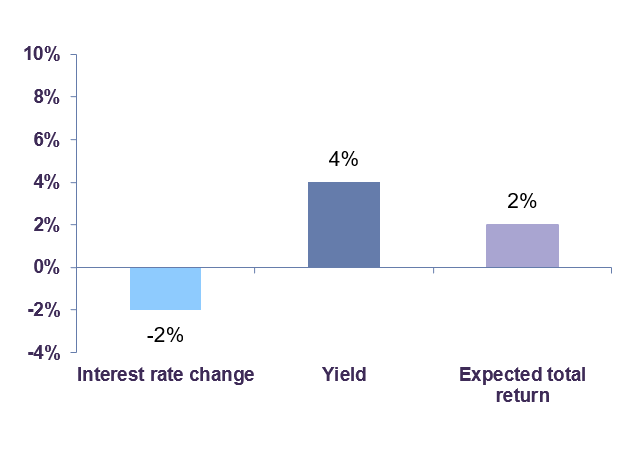

Our balanced portfolio strategy has been to maintain a higher-than-benchmark allocation to reasonably-valued stocks while ensuring our fixed income investments were of high credit quality and had no exposure to long-term bonds. This strategy has protected against rising interest rates and benefited the portfolio greatly overall as equity returns have been substantially higher than the returns on Canadian bonds of virtually any maturity and credit quality over the last decade. Though interest rates are up about 200 basis points from their 2020 troughs, we do not believe now is the time to shift into fixed income. With a backdrop of rising central bank policy rates and inflation lingering above 2% for some time, expected returns for fixed income investments are likely to continue to be lackluster. Our forecasts for equity and fixed income returns over the next 3-5 years continue to call for an overweight allocation to equity (Graph 1).

Equity Returns Forecast

Fixed Income Returns Forecast

Concluding Thoughts

We believe that a prudent portfolio manager needs to weigh all risks, refrain from focusing on short-term volatility, and concentrate on the best strategy for the medium-term. Our investment strategy aims to provide a buffer against significant downside while positioning the portfolio for interesting growth potential. Our equity holdings are currently valued at only 10.4 times 2022 earnings, offer an average 3.0% dividend yield and include defensive stocks such as telecommunications and healthcare companies. We are mitigating inflation risk by minimizing exposure to bonds and maintaining an allocation to commodity companies. Our focus on firms with strong fundamentals and solid growth prospects that trade at attractive valuations has sheltered our portfolio from the severity of the declines experienced year to date. We are confident that your capital is well positioned to navigate the current uncertain environment.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN