Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

April 11, 2023

Equity markets declined during the month of March, the result of turmoil in the global financial sector. Nevertheless, throughout the first quarter, the S&P 500 was up 7.4% (total return in C$), while the S&P/TSX rose 4.6%, MSCI Europe 10.7%, MSCI ACWI 7.2% and MSCI Emerging Markets 3.8%. The failures of Silicon Valley Bank and Signature Bank, two U.S. regional banks, and the acquisition of a struggling Credit Suisse by UBS have heightened investor concerns. While we are not discounting the possibility of further volatility in the financial sector, the issues appear idiosyncratic and specific to banks with poor risk management practices. The swift action undertaken by regulators in response to these issues has largely restored confidence. Though banks will likely become more conservative in their lending practices, and the prospect of an overall tightening in credit conditions raises the risk of a more pronounced economic slowdown, we believe the U.S. and global financial systems are on a solid footing. A comprehensive review of our global economic forecast is detailed in the April edition of our Economic and Capital Markets Outlook.

Risk to Outlook: Concerns in the Financial System

In 2022, central banks embarked on the most rapid pace of monetary tightening ever recorded, aiming to lower inflation which had reached 40-year highs. The rise in interest rates resulted in a slowdown in global growth and a moderation of price pressures, a process that is still ongoing. In addition, this had various knock-on effects: a repricing of long-term bonds to lower levels, a correction in high multiple stocks and cryptocurrency and, most recently, the exposure of weaknesses in the global financial sector.

As depositors shift funds from zero-interest accounts to interest-bearing instruments, banks are required to sell assets in order to meet withdrawal commitments. This trend proved critical for smaller regional players, notably those with a concentrated client base and poor risk management practices. In 2019, the relaxation of the Dodd-Frank Act overseeing banking regulation in United States enabled banks with less than $250 billion in assets to avoid the scrutiny of extensive stress tests while also introducing some leniency in the treatment of their government bonds holdings when calculating solvency ratios.

Looking at the situation with Silicon Valley Bank (SVB) more closely, the issues that led to their failure appear idiosyncratic and specific to their business model, strategy, and client base. While the collapse occurred within a matter of days, the factors behind it can be traced back to the start of the pandemic when government support payments together with a shutdown in activity, led to a significant increase in deposits. This growth in deposits exceeded the bank’s appetite to increase lending and the resulting surplus capital was largely invested in high-quality fixed-income investments. Unfortunately, the bank acquired longer-term fixed rate investments against its shorter-term variable rate liabilities. As interest rates rose rapidly, the price of fixed-income securities, SVB’s assets, fell. To make matters worse, the bank’s client base is largely comprised of venture capital-backed startups. These types of firms are typically cash flow negative, thus consistently drawing on deposits. The combination of the drawdown of deposits, the decline in asset values, and the mismatch between assets and liabilities resulted in a substantial impairment of the bank’s equity. As concerns over its ability to cover future withdrawals rose, other clients began to pull their deposits, ultimately causing a bank run and SVB’s collapse. To restore stability in the financial system, the government and regulatory agencies reacted swiftly: fully guaranteeing the deposits of the banks that failed and enabling all banks, regardless of size, to borrow directly from the Federal Reserve to meet the needs of their depositors, if necessary. This new lending facility allows banks to borrow against the face value of their government securities, without realizing losses. For the time being, these measures to support liquidity and restore confidence appear sufficient.

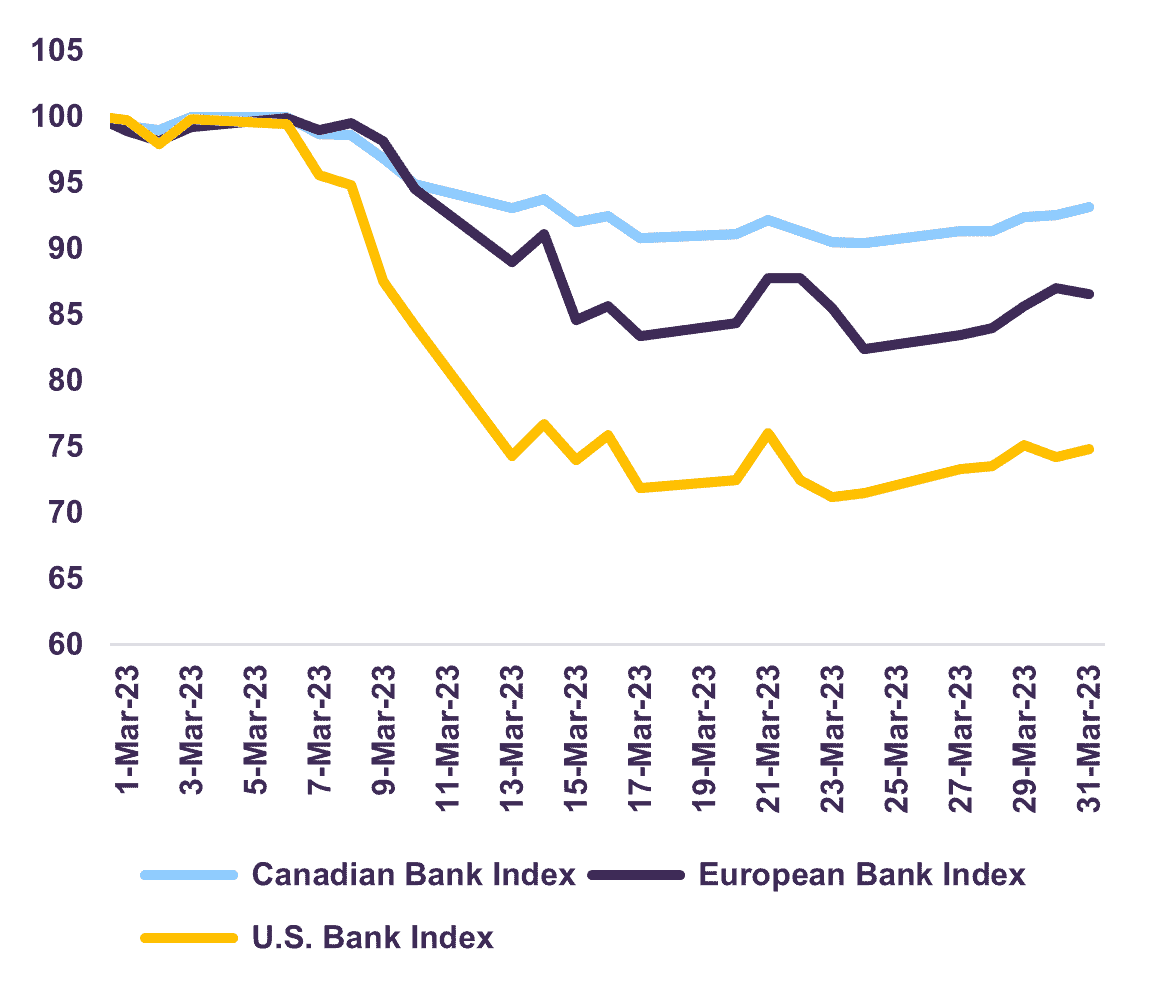

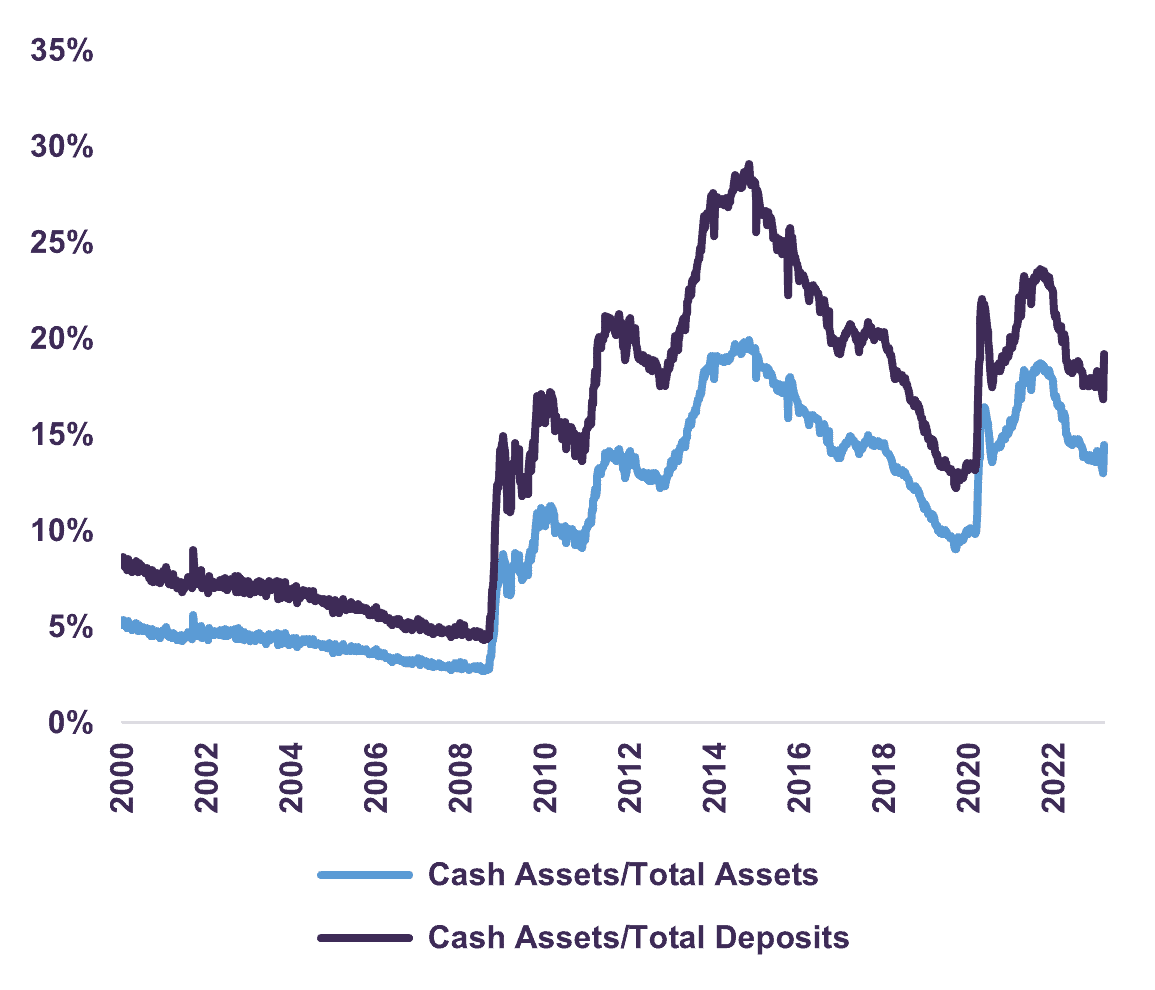

At this juncture, it is fitting to review our portfolios’ exposure to financial services. Our global equity portfolio is diversified across all sectors with positions in Canadian, U.S. and European banks, insurers, and other financial services firms, totaling 18% of the portfolio. We had no exposure to SVB, Signature Bank or Credit Suisse. While global bank stocks were down considerably in March as investors feared contagion, Canadian banks, which forms our largest exposure, performed better than their U.S. and European counterparts (Graph 1). Our analysis leads us to conclude that our bank investments are attractively valued and offer substantial upside over the medium- to long-term. They are well capitalized, have robust balance sheets comprised of high-quality assets and a diversified and stable deposit base. In fact, the top 25 U.S. banks, where we own all our U.S. bank holdings, collectively experienced net customer deposit inflows during the week of heightened volatility in early March, a sign of confidence in their stability. We also take confidence in the fact that banks, particularly so-called systemically important financial institutions, are in a better position today to deal with stressors in the financial system than in the past. These banks are backed by a strong regulatory risk management framework – a framework put in place post-2009 and designed to absorb future shocks – and are better capitalized with much lower leverage levels. Moreover, levels of liquidity across the U.S. banking system are three times higher today than in 2008 (Graph 2).

Performance of Banking Sector

Sources: Factset (www.factset.com) financial data and analytics and LBA calculations

Greater Asset Liquidity

Source: Federal Reserve Board’s Data Download Program (DDP), Letko Brosseau. Cash assets includes vault cash, cash items in process of collection, balances due from depository institutions, and balances due from Federal Reserve Banks.

Conclusion

We continue to believe Letko Brosseau portfolios are poised to generate value in the long-term and are well positioned to address shorter-term economic headwinds. Our focus on longer-term opportunities is not meant to downplay the importance of understanding near-term challenges. We constantly monitor risks and determine if action is necessary. As noted above, our holdings within the financial sector are concentrated in larger banks and insurers. We would also like to highlight that our equity portfolios are well diversified and have a marked exposure to less economically sensitive industries such as utilities, consumer staples, telecommunications, and healthcare. As highlighted in our recent note, A strategy that pays off: maximizing returns through a risk/reward approach, we believe that equating risk with volatility and asset price fluctuations ignores the danger of investing in overvalued and/or troubled securities. Risk is better viewed as the potential to suffer a permanent loss of capital. As such, we are sensitive to the quality of the investments we make and the price we pay for them. On average, the companies we hold have lower leverage levels than their industry peers, translating to lower borrowing costs and better solvency. Additionally, our global equity portfolio trades at a compelling 11 times 2023 earnings and provides an attractive 3.3% dividend yield. Overall, we do not advocate any changes in asset allocation strategy and are maintaining a tilt towards equities over cash and bonds within balanced portfolios. We believe our equity holdings, well diversified by sector and geography, provide more attractive return prospects over the medium- and long-term. While short-term volatility is likely to continue, we remain confident our disciplined investment strategy will continue to contribute to the preservation and growth of your capital.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN