Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

April 2023

- The cumulative impact of monetary tightening is expected to weigh more heavily on the world economy this year. The IMF forecasts global real GDP growth of 2.9% in 2023.

- The Federal Reserve and its global counterparts took quick and decisive action to restore stability and confidence following signs of stress in the financial system triggered by the collapse of a U.S. regional bank. The situation is contained at present.

- We believe the U.S. economy has sufficient momentum to navigate higher interest rates and tighter credit, but we expect growth to slow. Our outlook is for U.S real GDP to grow in a range of 0-1% in 2023.

- Excess savings of more than C$300 billion (13% of GDP) should help Canadian households weather a period of higher unemployment, tighter financial conditions and still-high inflation in the coming months. Consequently, we forecast Canadian real GDP growth to moderate to 0.5-1.5% in 2023.

- Given persistent inflation, further ECB policy rate increases are likely in the pipeline. There is a high probability that the Eurozone enters recession this year.

- The abandonment of strict “Zero-COVID” restrictions has set the stage for a meaningful economic rebound in China. The IMF forecasts China’s real GDP to grow by 5.2% in 2023.

- China’s anticipated rebound should help offset slowing growth in other major emerging market economies. In 2023, real GDP in the developing world is expected to increase by 4.0%.

- We believe we are nearing the terminal point of global tightening as price pressures should continue to ease in the coming months.

- While we expect the global economy faces a challenging period of adjustment, we do not believe an unduly pessimistic scenario is about to unfold. Our portfolios continue to trade at reasonable valuations. We believe the best course of action is to remain invested through this period of economic uncertainty

Summary

The world economy is adjusting to a more restrictive policy environment. Recent readings of economic data confirm tighter financial conditions are having their intended effect: economic growth and inflation are on slowing trajectories. However, in most major economies, inflation remains well above targeted levels, and tight labour markets remain a source of concern for central banks.

The impact of cumulative tightening is expected to extend beyond interest rate-sensitive sectors and will begin to weigh more heavily on the broader economy. We are attentive to the risk that inflation could fail to converge to target levels in a timely manner, and the prospect of tighter lending standards following the failure of Silicon Valley Bank (SVB) adds an additional threat to global growth.

We note, however, that price pressures appear to be easing and strong household balance sheets present a key counterweight to economic headwinds. The timely and coordinated efforts of monetary authorities to restore stability and confidence in the financial sector is a significant positive development. Indeed, the recent turmoil in the banking sector may well deter central banks from raising policy rates much further.

Our base case forecast is for global growth to slow, though we do not exclude the possibility of recession in certain regions. The IMF expects the world economy to expand by 2.9% in real terms in 2023, compared to the long-term average growth rate of 3.4%.

U.S. financial system buffeted by troubles among domestic regional banks

Recent turmoil in the banking sector can be traced directly to the knock-on effects of rising interest rates. As customers continue to shift funds from zero-interest accounts to interest-bearing instruments, commercial banks are facing deposit outflows. Meanwhile, on the asset side of the balance sheet, banks’ fixed income portfolios have suffered losses as rates have risen. In the case of SVB, these headwinds proved impossible to navigate and the bank collapsed in March.

The failure of the 16th largest bank in the U.S. triggered fears of contagion in the financial sector. In our assessment, however, SVB’s collapse occurred mainly due to idiosyncratic factors. SVB’s customer base was poorly diversified, with a client concentration in private equity and venture capital firms. As interest rates rose and private borrowing became more costly, these customers increasingly withdrew their cash deposits to meet funding needs. On the asset side, SVB’s large unhedged long duration fixed income exposure meant that when the bank had to sell assets to fund withdrawals, it faced extensive losses from which it could not recover.

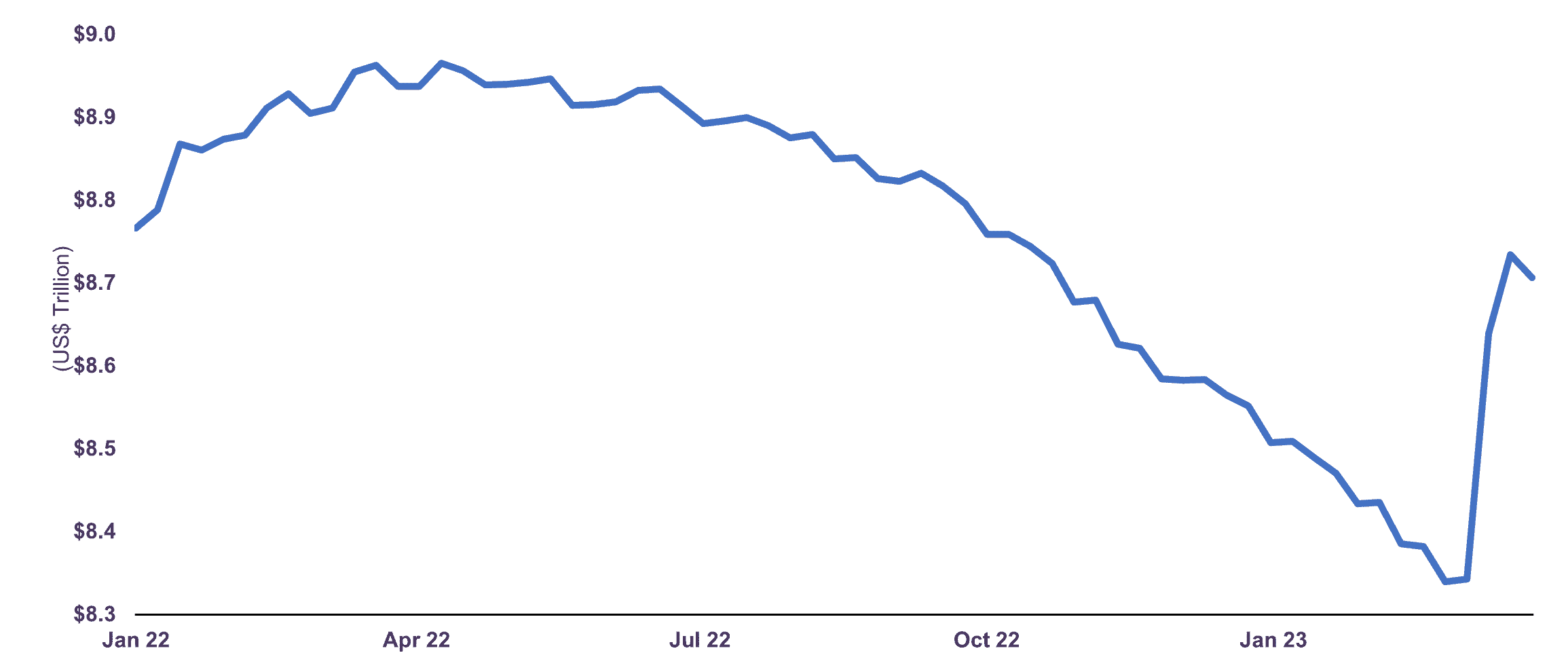

While the situation remains fluid, we note that the government’s intervention has been quick and decisive. The Federal Deposit Insurance Corporation and state regulator in California took control of SVB, guaranteeing all deposits, and the bank’s assets were subsequently sold to First Citizens. Meanwhile, the U.S. Federal Reserve put in place a new U.S. Treasury Department-backed credit facility to help other banks meet deposit withdrawals. Under this measure, banks can borrow against collateral at par value, a key support for banks that have suffered losses on interest rate-sensitive assets in their portfolios. Already, more than $350 billion worth of emergency liquidity has been injected into the financial system, in effect undoing four months of quantitative tightening (Chart 1).

U.S. policymakers have taken important steps to shore up the financial system and, at present, the situation appears contained. SVB is not considered a systemically important bank; it accounted for less than 1% of all banking assets in the U.S. While banks will likely become more conservative in their lending practices, and this may lead to an overall tightening in credit conditions, we believe the U.S. banking system is on a solid footing. Large U.S. banks are well-capitalized and are backed by a strong regulatory risk management framework.

Total assets of the Federal Reserve

Source: U.S Federal Reserve

U.S. economic growth is slowing

The U.S. economy remained resilient in Q4 2022. Real GDP increased by 0.7% quarter-on-quarter, a marginal deceleration from the 0.8% expansion registered in the previous three months. In annual terms, the economy grew by 2.1% in 2022 as consumer spending and business investment offset decreases in government spending and residential investment.

Recent data suggest that the fundamentals of consumption – the economy’s main driver – remain supportive. Despite some high-profile mass layoffs in the technology sector, on a year-to-date basis U.S. employers have already hired 815,000 people. As of February, there were approximately two open jobs per unemployed American versus the pre-pandemic norm of one-to-one, a figure that suggests firms in aggregate have not cut back on their hiring intentions.

Household balance sheets also help explain the resilience in consumer spending. Excess savings – the amount accumulated above pre-pandemic savings trends – still represent more than 5% of GDP. Meanwhile, consumer interest payments have risen in nominal terms since the Federal Reserve began raising rates but, as a share of income, interest payments are low by historical standards.

Consumer spending on goods and services has held up, with the exception of interest rate-sensitive areas such as housing and autos. However, spending will likely moderate as the lagged impact of the Federal Reserve’s rate hikes take effect. We expect firms’ hiring to slow, layoffs to rise, and by end-2023 unemployment will begin to trend upwards from near all-time lows. Tighter monetary policy will provide another headwind to consumption at the margin, though accumulated savings should continue to provide a buffer for households.

Our forecast is for the U.S. economy to continue to slow through 2023. We anticipate real GDP growth in the range of 0-1%.

Canada not immune to slowdown

The Canadian economy appeared to stall in Q4 as real GDP was unchanged against the previous quarter. Quarterly contractions in residential and business investment broadly offset growth in household spending, government expenditures and net exports. On the year, real GDP advanced 3.8%.

Consumption rose 4.8% year-on-year in 2022 as service sector spending (+8.7%) rebounded with the end of pandemic-era restrictions. However, other components of private spending indicate that households pared back purchases elsewhere in response to persistent inflation and higher financing costs. Household spending on goods rose just 0.6% against a year ago, and durable goods expenditure – which includes new and used automobiles, furniture, and appliances – declined 2.0%.

Sustained labour market strength and a large stockpile of household savings have underpinned the gradual adjustment of private spending to date. Full-time employment reached a record high in February and at 6.0%, the household savings rate is well above its 2019 level of 2.8%.

We anticipate a slowdown in the labour market in the months ahead. However, excess savings of more than C$300 billion (13% of GDP) should help Canadian households weather a period of higher unemployment, tighter financial conditions, and still-high inflation. Consequently, we forecast Canadian real GDP growth to moderate to 0.5-1.5% in 2023.

Europe vulnerable to recession

The Eurozone economy fared well relative to expectations that record-high energy prices and supply shortages would tip the region into a sharp downturn. Euro Area real GDP expanded 3.5% year-on-year in 2022. Despite the acute headwinds faced by energy-intensive companies, the region’s industrial output managed to rise 0.7% on an annual basis.

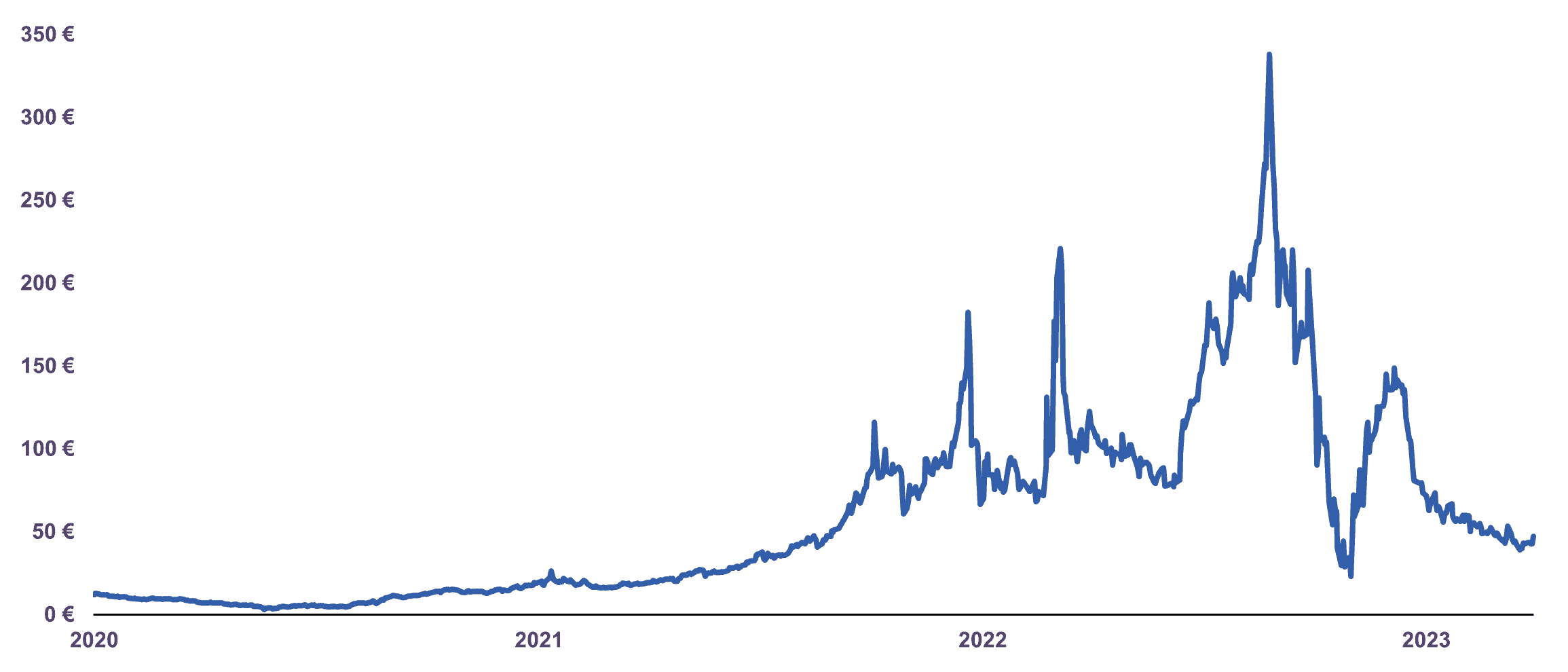

European natural gas prices have dropped 86% from their peak level in August 2022 (Chart 2). Meanwhile, Euro Area natural gas demand fell in 2022 by an unprecedented 13%. While uncharacteristically warm winter temperatures kept heating demand low, industrial curtailments and government emergency measures also contributed to lower energy usage in the region.

Extreme energy price pressures appear to have subsided. Yet while prices are significantly lower than at the peak of the energy crisis, they remain elevated compared to pre-war levels – a trend we expect to persist going forward. In our assessment, this dynamic heightens the risk of entrenched inflation and weighs heavily on the outlook for Eurozone business and consumer activity. Given that further policy rate increases are likely in the pipeline, there is a high probability that the Eurozone enters recession in 2023.

Europe natural gas price benchmark*

(€ per MWh)

*Dutch TTF

Source: Bloomberg

China reopening leading to strong rebound

In the previous issue of our Economic and Capital Markets Outlook letter, we noted that recent adjustments to China’s COVID response indicated the country had pivoted toward reopening. Since then, authorities have completely abandoned China’s Zero-COVID strategy. For the first time in three years, the world’s second largest economy is operating unimpeded by public health measures.

Early indicators of activity paint an encouraging picture. In January, both industrial output and service sector activity returned to growth according to Purchasing Managers Indices published by the National Bureau of Statistics. Meanwhile, in the same period, China’s Composite PMI indicated that the economy recorded its largest expansion in seven months.

The outlook for consumer spending in the coming quarters is positive. Over the course of 2022, Chinese households accumulated excess savings worth more than 4% of GDP. Retail sales growth of 3.5% year-on-year in the first two months of 2023 indicate consumers are beginning to convert pent-up demand into purchases.

While real estate activity remains depressed, the rapid relaxation of strict “Zero-COVID” restrictions has set the stage for a meaningful economic rebound in the year ahead. The IMF forecasts China’s real GDP to grow by 5.2% in 2023, a marked improvement from the 3.0% expansion recorded in 2022.

Mixed outlook for other emerging market economies

In India, real GDP grew 4.4% against a year ago in the fourth quarter. This compared to a growth rate of 6.3% in Q3. Amid persistent inflation, higher borrowing costs are tempering consumption and investment spending. According to the IMF, growth is forecast to decelerate from 6.8% year-on-year in real terms in 2022 to 6.1% in 2023.

Outlooks vary in other major emerging markets. Despite tighter financial conditions and austere fiscal policy, real GDP in Mexico advanced 3.1% year-on-year in 2022. Domestic demand has fared well to date and the continued resilience of the U.S., Mexico’s largest trading partner, has also proven to be a key support to growth. Real GDP in Mexico is expected to expand by 1.7% in the year ahead. Meanwhile, real GDP growth in Brazil is expected to slow to 1.2% in 2023 as the lagged impact of protracted monetary tightening weighs more heavily on real activity.

Emerging markets remain subject to significant external pressures, including tighter global financial conditions and increased currency volatility. However, improving activity in China will provide a partial offset to cooling external demand, particularly for commodity exporters. While growth is expected to slow in most major emerging economies in the year ahead, regional growth is forecast to remain broadly stable due to China’s anticipated rebound. The IMF projects emerging market real GDP will grow by 4.0% in 2023.

The balance of economic data suggests that global economic growth is decelerating. The IMF forecasts world output will expand by 2.9% year-on-year in 2023 in real terms.

Inflation trending lower but still above 2% official target

While core inflation has likely peaked in most major economies, it remains well above target rates. Uncertainty regarding how long it will take for inflation to sustainably return to near 2% levels has caused interest rate expectations to become more hawkish since the start of the year.

Core consumer price inflation in the U.S. declined for a fifth consecutive month to 5.5% year-on-year in February. This marked the slowest rate of price growth since December 2021. In the same period, three-month annualized inflation – a measure that reflects the underlying trend – moderated to 3.4%. At present, most goods categories within core CPI are experiencing disinflation, driven largely by the normalization of supply chain conditions.

While recent supply-side trends in U.S. inflation are constructive, demand-side pressures remain an area of concern. Wage and employment data remain robust, an important predictor for consumer spending. In February, average hourly earnings accelerated by 4.6% year-on-year. This compares to a pre-pandemic average growth rate of 2.5%. The continued strength of the U.S. job market increases the likelihood of additional interest rate increases in the months ahead.

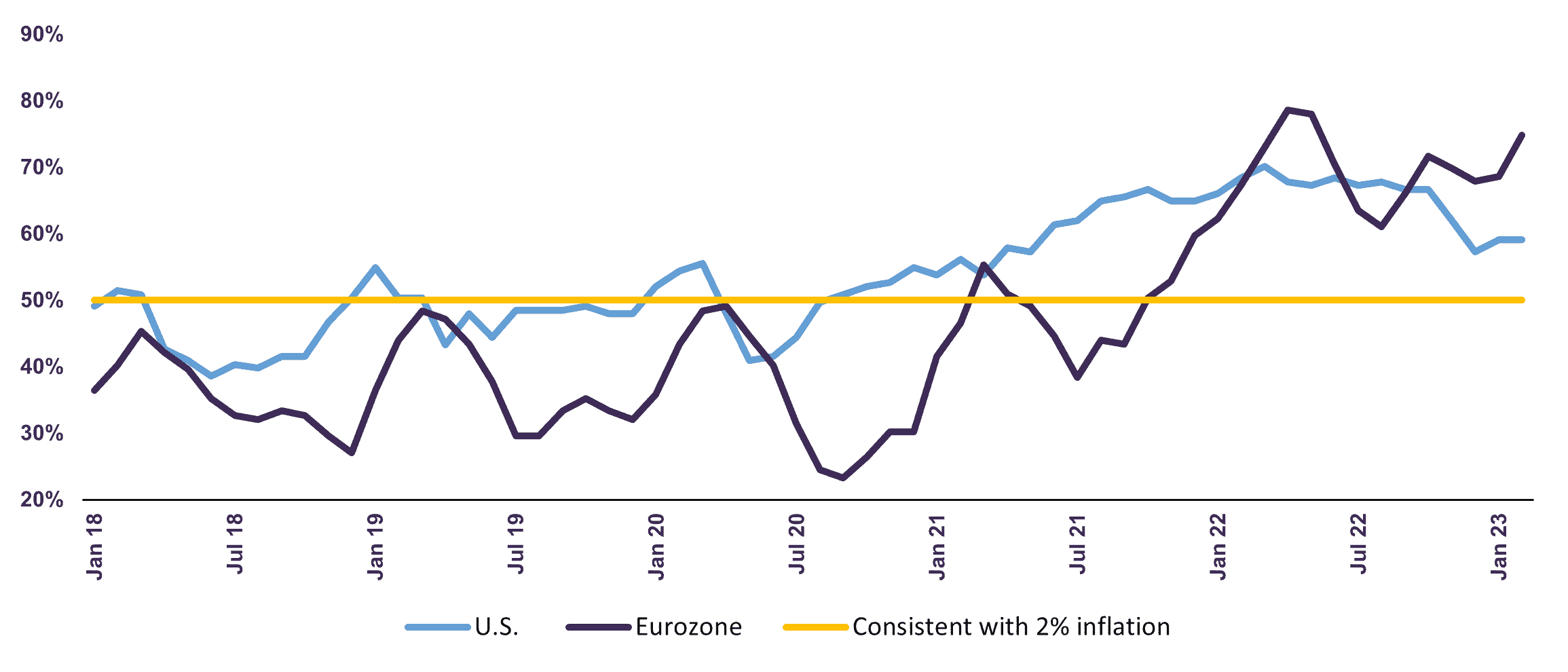

Elsewhere, the European Central Bank faces a similar challenge. Inflation and wage growth peaked in 2022 but have since remained elevated. The region faces challenging underlying dynamics as natural gas prices are more than double 2019 levels. Further, compared to the U.S., inflationary pressures are more broadly dispersed across CPI subcategories (Chart 3).

Ultimately, wage pressures will likely be alleviated through higher unemployment – an expected outcome from the monetary tightening of the past two years. While present conditions create the scope for further interest rate increases, we believe we are nearing the terminal point of the current global tightening cycle. Monetary policy usually impacts the economy with a 12–18-month lag. In the U.S., the Federal Reserve only ended its quantitative easing program and began raising interest rates from 0% in March 2022, a year ago. As the impact of these measures begin to weigh more on economic conditions, we anticipate demand-driven disinflation in the coming months.

Share of price categories for which month-on-month inflation*

is above 2% annualized

*3-month average

Source: U.S Bureau of Labour Statistics, Eurostat

Markets oscillate amid heightened uncertainty

Financial markets were choppy throughout the first quarter, ultimately closing in positive territory. The S&P 500 was up 7.4% (total return in C$), while the S&P/TSX rose 4.6%, MSCI Europe 10.7%, MSCI ACWI 7.2% and MSCI Emerging Markets 3.8%.

Equity market volatility continues to be driven by investor sentiment on the future path of interest rates and the possibility of a recession. While we expect the global economy faces a challenging period of adjustment in the quarters ahead, we do not believe an unduly pessimistic scenario is about to unfold. We believe the best course of action is to remain invested through this period of economic uncertainty.

During times of heightened recession fears, investors often forget that a sell decision is actually a two-step decision; choosing the right time to divest, and the right time to re-enter the market. Timing both decisions correctly on a consistent basis is extremely difficult, if not nearly impossible. Since 1970, the U.S. has experienced eight recessions of varying severity and length. Over this same period, the S&P 500 Index is up more than 40 times, while its dividends have increased by a factor of twenty. In our experience, staying the course through times of uncertainty is critical to long-term investment success.

However, our emphasis on long-term value creation is not meant to downplay the importance of remaining vigilant regarding near-term challenges. We constantly monitor a myriad of risks, and continuously assess their potential to significantly impair the value of our holdings. It is the potential for permanent loss of capital – rather than a temporary dislocation of financial market prices from their underlying values – that should be the main factor in determining whether portfolio action is warranted. During periods of volatility, we tend to take the long view, which also entails determining whether market distortions present investment opportunities.

A recent example that illustrates our approach was our decision to increase our positions in a select group of European companies between the spring and fall of 2022. At the time, investor sentiment on Europe’s situation was extremely negative and the prevailing view was that the ongoing energy crisis would send the region into a sharp downturn. In our assessment, Europe was indeed at a higher risk of recession, however growth outlooks differed significantly by country and sector. Ultimately, we believed the investment landscape presented interesting opportunities at compelling valuations. Many of these companies have seen their share prices increase significantly since then, and we have realized profits on a handful of our European holdings.

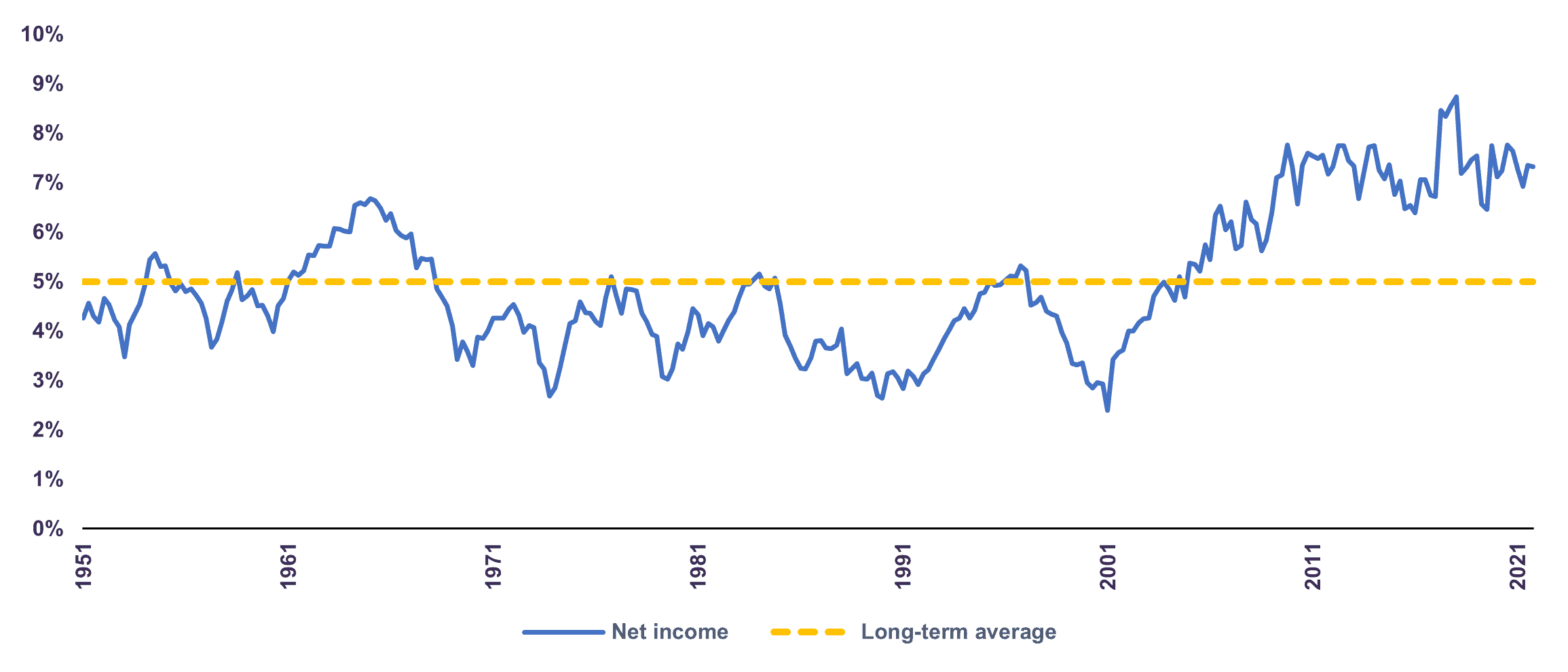

Looking ahead, we continue to view the risk/reward prospects of equities as attractive. In the near-term, companies will face a challenging earnings environment, characterized by slowing global demand and elevated input prices. Corporate margins are historically high after a period where companies have been able to pass on price increases to end customers. The net income margin of all non-financial firms in the U.S. was 7.3% as of the end of Q3 2022 compared with a long-term average of 5% (Chart 4). On the other hand, P/E multiples no longer appear stretched. We believe opportunities still exist for discerning longer-term oriented investors who keep a careful eye on earnings potential and reasonable valuations.

U.S nonfinancial corporations’ margins

Source: U.S Bureau of Economic Analysis

Overall, our holdings are well diversified by sector and geography, with a sizeable allocation to less economically sensitive industries such as utilities, consumer staples, telecommunications and healthcare. The expected return from the companies in our portfolio is less dependent on future margin expansion than the rest of the market and, from a valuation standpoint, our global equity portfolio trades at a compelling 11 times 2023 earnings and provides an attractive 3.3% dividend yield.

As for fixed income, we continue to focus on capital preservation and minimize risks in our bond holdings by prioritizing quality and avoiding long duration securities. As outlined in A strategy that pays off: maximizing returns through a risk/reward approach, a note we highly encourage you to read, this strategy has served us well, leading to meaningful outperformance versus our benchmark over 1, 2 and 5 year investment horizons.

Overall, we do not advocate any changes in asset allocation strategy and are maintaining a tilt towards equities over cash and bonds within balanced portfolios. We believe patience in the face of volatility will be rewarded in the medium term.

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN