Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

2023-24 Highlights

January 2024

As we begin a new year, many of us take a moment to look back on past events and set goals for the future. Following this tradition, we would like to outline a few notable achievements from 2023 and promising developments for our firm in the year ahead.

A look back at the market in 2023

Stock markets ended the year on a strong note, notwithstanding periods of intense volatility. The S&P 500 returned 22.9% (in Canadian dollars), S&P/TSX 11.8%, MSCI Europe 17.8%, MSCI All Country World Index (ACWI) 18.9% and MSCI Emerging Markets 6.9%. In fixed income markets, the 10-year Federal bond yield surged 120 basis points between May and October, reaching a 16-year high of 4.3%, before drifting down to levels prevailing at the start of the year. The Canadian 10-year yield was 3.1% at end-December 2023, virtually unchanged from end-December 2022.

Investor sentiment swung from negative to positive throughout 2023 as inflation and monetary policy dominated the discourse. We remained patient in challenging periods, trusting that our equity portfolios, which consist of well-financed quality companies with strong management teams, could weather short-term headwinds.

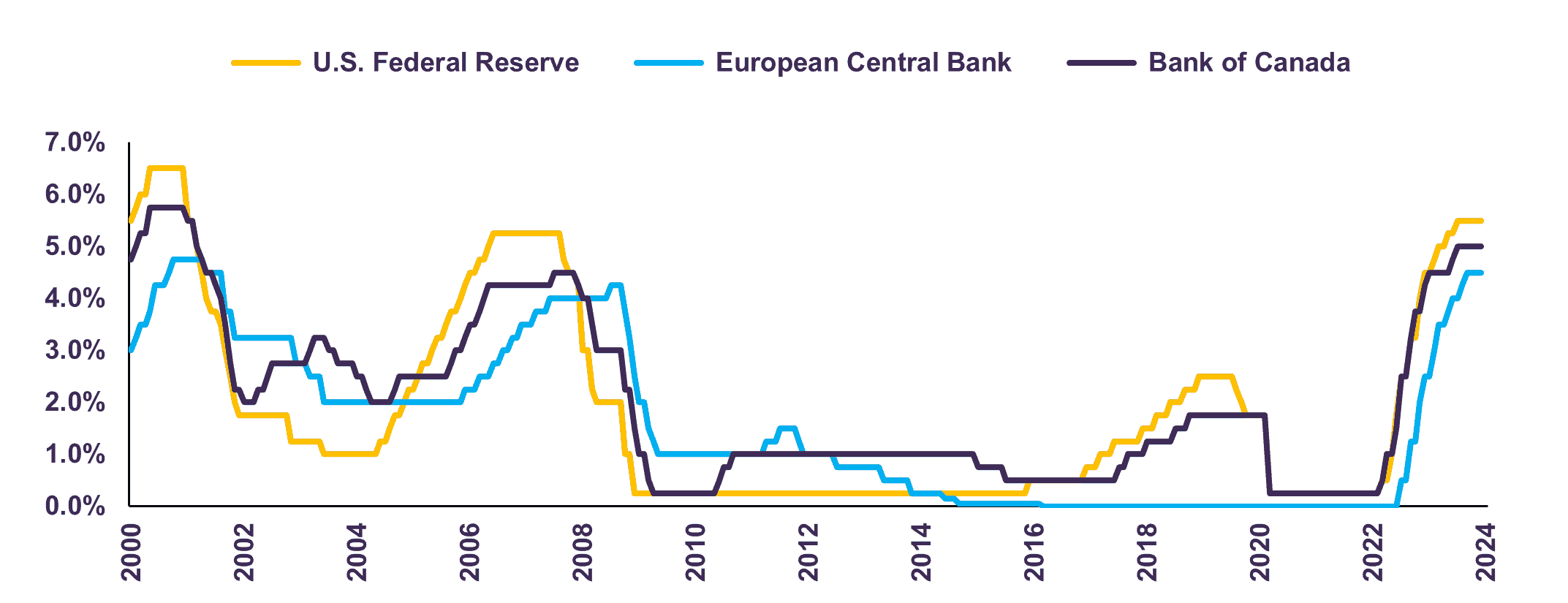

Central banks in much of the developed world continued to hike rates in an effort to tame rising inflation. In Canada and the U.S., policy rates rose from near-zero levels in March 2022 to 5% and above, the fastest rate of monetary tightening in decades (Chart 1).

Central Bank Policy Rates

The market consensus at the beginning of the year was that the global economy would tip into recession in 2023. We did not subscribe to this pessimistic forecast. We were of the view that, while prospects varied by region, on balance global growth would remain positive.

We anticipated that inflation would temper, labour markets would remain resilient, and excess savings accumulated post-pandemic would provide consumers with a cushion against higher costs. Ultimately, the global economy unfolded as we expected. By year-end, the inflation rate in most developed countries had eased to around 3% or lower. The IMF is now forecasting that real GDP expanded 3.0% in 2023.

The adjustment to higher interest rates has not been smooth. In March, two mid-sized U.S. regional banks collapsed, and a struggling Credit Suisse was acquired by UBS. As fears of contagion in the global banking sector began to spread in early spring, we concluded that the handful of bank failures was isolated to their own poor management and that the global financial sector was on a solid footing.

Our investment strategies performed well during the year. The decision to keep a notable overweight position in equities versus fixed income in our balanced portfolios contributed positively to performance. Moreover, the gains in our equity portfolios were diversified across companies and sectors, whereas the performance of passive indices was driven by only a handful of names.

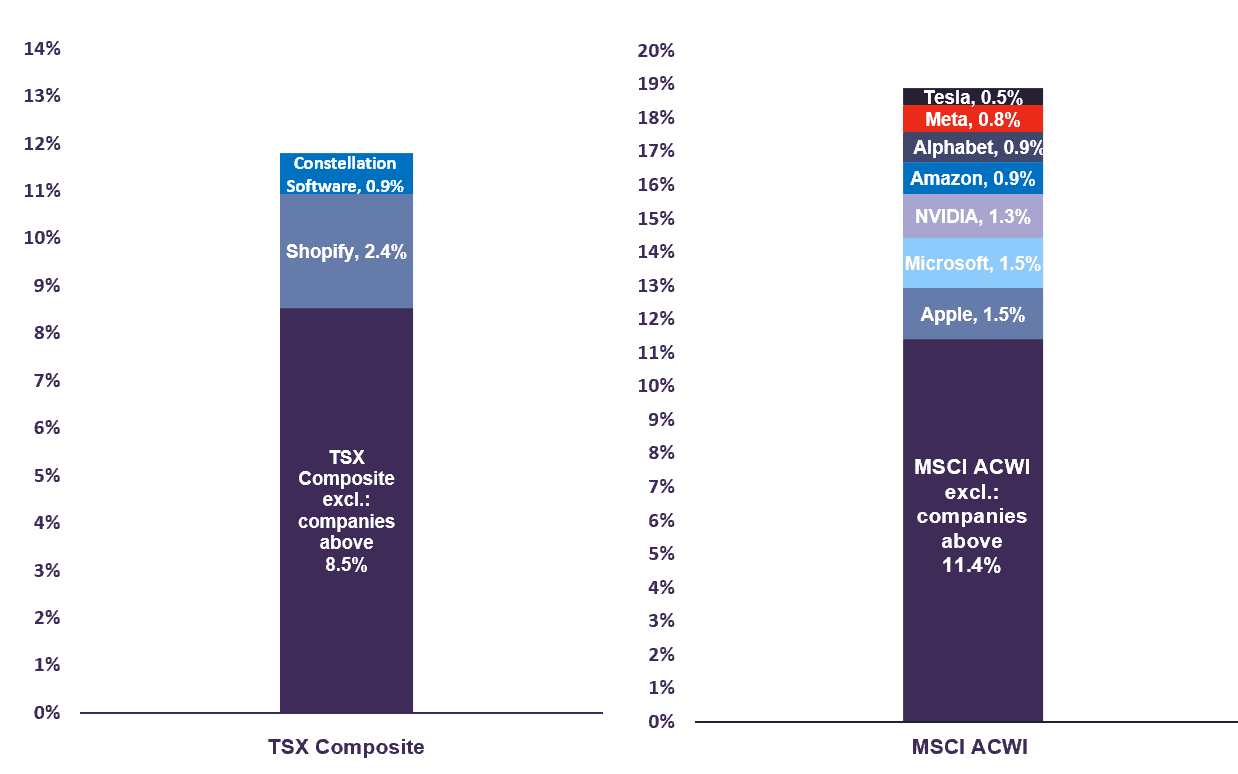

Shopify and Constellation Software, two Canadian technology companies, contributed 20% and 7% of the S&P/TSX return, respectively. The performance of the MSCI All Country World Index (ACWI), a global stock market benchmark, was even more concentrated. The seven largest companies, known as the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla), contributed 40% of the index’s return (Chart 2).

These companies, which corrected sharply in 2022 as rising interest rates caused their valuations to compress, experienced a rebound this year due to the excitement around generative artificial intelligence (AI).

Contribution to the Total Return of the Index in 2023 (in C$)

Source: Bloomberg, Letko Brosseau.

In our November Portfolio Update we underscored how this surge in a handful of companies has pushed valuations higher and increased the level of concentration in large technology-related firms. The S&P 500 is trading at an elevated 19.7 times estimated earnings for 2024, 31% above its long-term average of 15 times. By the close of 2023, these seven companies represented a remarkable 31% of the S&P 500 – surging from 21% at the end of 2022 – and traded at a weighted average multiple of 28 times 2024 earnings. In contrast, the index’s valuation demonstrates a more reasonable price-to-earnings ratio of 17.5x when excluding these seven stocks. It’s noteworthy that if all companies in the index were equally weighted, the S&P 500 would have seen a rise of 11.6% (price return in U.S. dollars) rather than the 24.2% recorded during the year.

In our assessment, the significant differentiation in valuations—where some parts of the market are highly valued while others remain reasonably priced—presents compelling opportunities for investors who prioritize price sensitivity and have a longer investment horizon. We own many attractively valued companies such as Celestica, Samsung, Meta and Alphabet that will benefit from the expansion of generative AI. Nevertheless, our portfolios remain well diversified with growth driven by a variety of technological, demographic and economic trends. We see significant value in our equity portfolio, trading at a price-to-earnings ratio of 11.1x with earnings expected to grow at roughly twice the index, per outside estimates.

Regarding fixed income, in the last couple of years, we lengthened the duration of our portfolios and increased our holdings in high-quality corporate bonds. These strategic changes yielded significant rewards and our fixed income portfolio delivered 5.9% in 2023. Our overarching strategy remains unchanged; we are maintaining a lower duration than the index and continue to avoid bonds with a term above ten years. In our view, longer-dated Canadian bonds are still expensive. We estimate the fair value of the 10-year Canadian government bond yield to be around 4-4.5%, compared to its current yield of 3.1%.

2023 Highlights at Letko Brosseau

In keeping with our objective to provide our clients with an informed perspective on our portfolio strategy and other financial market topics, we continued to release our monthly “Portfolio Update” letters and quarterly “Economic and Capital Markets Outlook” publications in both digital and print versions.

In addition, we published a new research note in December as part of our Net Zero Research Series: Part 2: Electricity Generation.

This paper takes a deep dive into electricity generation, the world’s biggest source of GHG emissions. We investigate the fundamental requirements for electricity generation and its associated emissions, the technologies that exist today to reduce these emissions, as well as the solutions required to reduce them to net-zero by 2050.

During the year, we engaged Navigator, an independent market research and public affairs firm, to conduct a survey among our clients. We would like to express our gratitude for your participation in this inaugural client perception survey. Your input is invaluable and will greatly assist us in understanding our clients’ needs and enhancing our services.

On the staffing front, we were pleased to welcome David Newman, our new Regional Head for Ontario and Manitoba. Based in our Toronto office, David will be responsible for business development, client services and talent management in Central Canada.

A look forward to 2024

The cumulative impact of monetary tightening remains the main factor behind a weaker global economic outlook entering 2024. Inflation has eased and policymakers in much of the developed world are signaling that rate hikes may be at an end. As we detail in our latest Economic and Capital Markets Outlook, the risk of recession is highest in the Eurozone, whereas growth in Canada and the U.S. is expected to moderate to 0.5-1.5% in 2024. Elsewhere, emerging markets are expected to advance by 4.0% in 2024, according to the IMF. On balance, the IMF anticipates global real GDP growth of about 2.9% in 2024, a slightly slower expansion than its projection of 3.0% for 2023.

We remain committed to our approach of looking beyond short-term forecasts, emphasizing a medium-to-long-term focus. Our equity holdings, trading at attractive valuations and supported by a 3.4% dividend yield, should offer meaningful value creation over the next 3-5-year horizon. We continue to favour equities over bonds within balanced portfolios and do not advocate any major shifts in asset mix at this time.

On the client services front, we are pleased to announce that in 2024 we will be giving clients the ability to access their statements directly through our secure portal. We encourage all clients to consider switching to digital statements in order to cut down on paper waste. If you have not already activated your access to the portal, we invite you to contact your account representative. The majority of our clients access the online platform on a regular basis.

Turning to our business initiatives, we are progressing with the international launch of our emerging markets strategy. Last year, we undertook a partnership with Arrow Partners, a New-York based third-party marketing firm, to coordinate the penetration of the U.S. institutional market. Consistent with this approach, this year we established a new partnership with Candoris, a Netherlands-based firm, to market our EM strategy to European clients. Over the years, this strategy has delivered value to our clients. In fact, the RBC Investor & Treasury Services Pooled Fund Survey, an independent survey of funds available to Canadian institutional investors, ranked our Emerging Markets Equity Fund in the first percentile for the 2-year, 3-year, 5-year and 10-year performance periods ending Q3 2023, among a large pool of other Canadian-domiciled funds.

Finally, 2024 brings a notable change to the internal structure of Letko, Brosseau & Associates Inc. To ensure a smooth evolution in the governance of the company, Peter Letko, the company’s co-founder and Senior Vice President, is transitioning to the role of Senior Advisor effective January. Mr. Letko will take a step back from the firm’s day-to-day operational activities to focus on overseeing our investment strategies, undertaking special projects and fulfilling his duties on our Board of Directors.

Stéphane Lebrun and Rohit Khuller, Vice Presidents of Investment Management, will remain responsible for formulating the investment strategy and directing the investment team’s operations. Our investment team consists of twenty professionals who cover all industries and geographies. They are dedicated full-time to portfolio analysis and investment management. The more senior members of the team are responsible for specific strategies such as Canadian Equity, Global Equity, Emerging Markets Equity, fixed income, and other specialty mandates.

Since 1988, our investment process has yielded compound returns of 11.3% for all assets under management, compared with 8.0% for the benchmark, and equity returns of 13.2%, outperforming the benchmark of 8.1%.1 Over that time, more than $35.9 billion in cumulative gains have been generated for our clients.2 We are confident that our investment approach, which emphasizes companies chosen for their strong business franchises, top management, growth characteristics and sensible valuations, will continue to generate value over the long term.

We thank you for entrusting us with the responsibility of investing on your behalf.

All of us at Letko Brosseau wish you and your families joy, good health and prosperity in the new year.

Daniel Brosseau

PRESIDENT

Peter Letko

SENIOR ADVISOR

David Després

VICE PRESIDENT –

INVESTMENT SERVICES

Stéphane Lebrun

VICE PRESIDENT –

INVESTMENT MANAGEMENT

Rohit Khuller

VICE PRESIDENT –

INVESTMENT MANAGEMENT

Isabelle Godin

VICE PRESIDENT – OPERATIONS AND CFO

2. Represents the net gains on all assets for all mandates under management from January 1, 1988 to December 31, 2023.

Images used under license from Shutterstock.com

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN