Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

March 2024

The U.S. economy’s resilience and the prospect of future central bank rate cuts recently propelled the S&P 500 Index above 5,000 to new historic highs. Global equities are in a general uptrend since last quarter as inflation in developed markets continues to fall closer to the 2% target and labour markets remain strong. Equity markets also received a boost from Nvidia, now the third-largest company in the U.S. and the perceived main beneficiary of generative AI. Nvidia, along with a few other large capitalization companies, has contributed to increased benchmark concentration, crowding, and expensive index valuations. Our portfolios remain well-diversified, valuation sensitive, and balanced to an array of secular drivers.

Benefiting From AI in Underappreciated Companies

While we continually strive to expose our portfolios to exciting secular tailwinds, we are also mindful of what we pay to gain such exposure. In many cases, companies benefiting from exciting trends tend to trade at elevated multiples subjecting investors to the risk of derating if expectations are not met. Our focus is on investing in companies with attractive valuations and realistic growth expectations, carefully avoiding those with share prices inflated by optimism or contingent on elevated growth rates for long time periods.

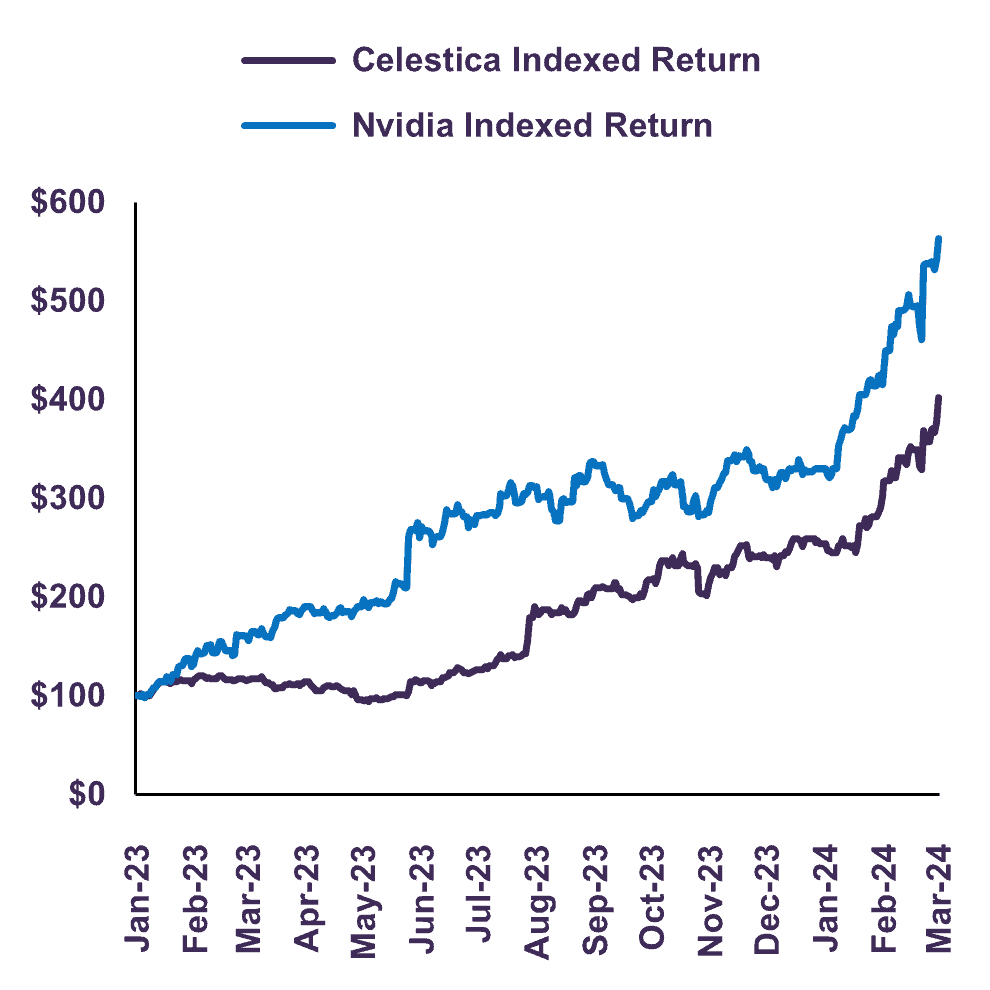

Most recently, this approach has allowed us to benefit from the current increase in artificial intelligence capital expenditure spending without exposing the portfolio to excess risk. Since the start of 2023, Celestica, Meta, Samsung and Alphabet generated over 574 million in gains for our portfolios. Of this, Celestica’s gains exceeded 300 million as their shares were up over 400% during the period. Nevertheless, Nvidia, the biggest benefactor of the AI frenzy, delivered over 500% during the same period (Chart 1). The company added over $250 billion in market cap in a single day in February, the largest one-day gain in history. Its $2 trillion valuation is now roughly equal to the entire Canadian economy, as measured by GDP.

$100 Invested in Celestica and Nvidia

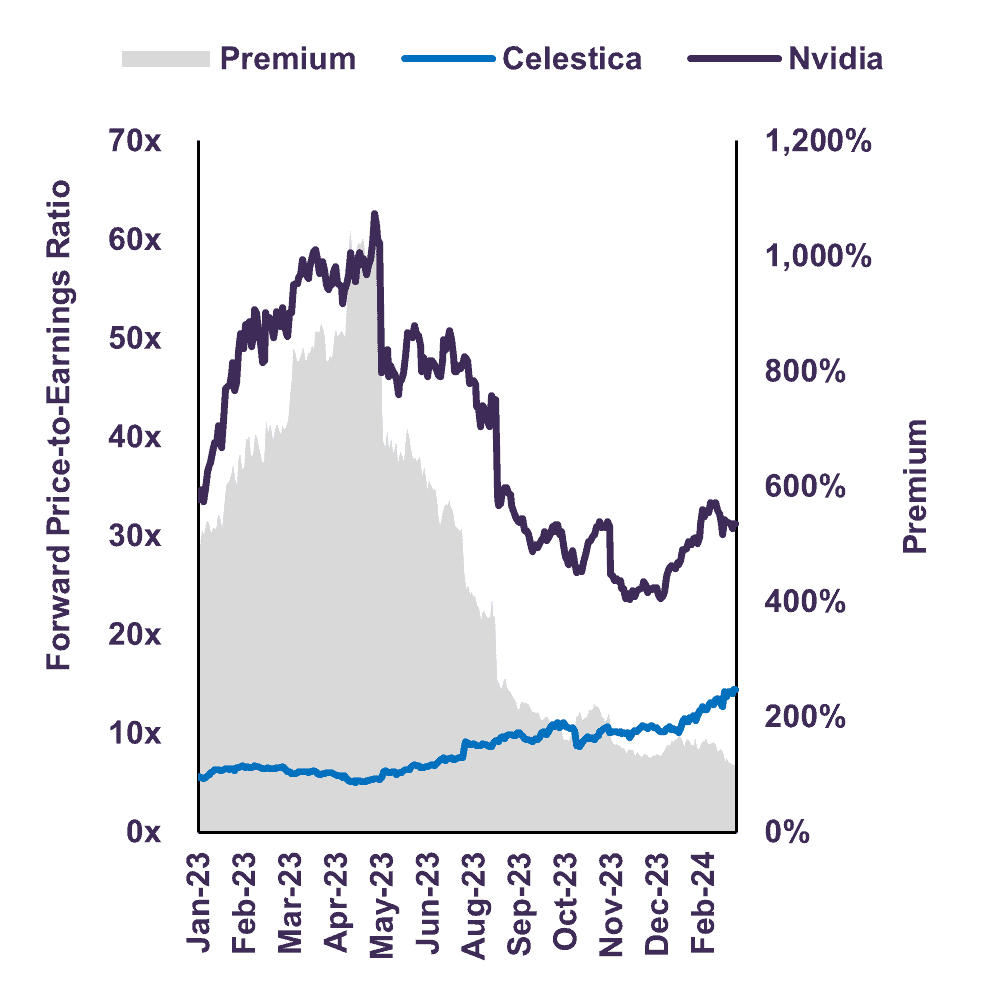

Celestica vs. Nvidia Forward Price-to-Earnings Ratio

To achieve Nvidia’s return, investors paid 34.4 times forward earnings at the beginning of 2023 while we paid 5.5x for Celestica. In other words, investors in Nvidia paid a 521% valuation premium to the price we paid for Celestica (Chart 2). Indeed, both companies delivered remarkable returns in a relatively short time span, yet Celestica’s upstream exposure in the AI value-chain offered considerable downside protection and with a valuation less contingent on astronomical growth. As one of the largest shareholders in Celestica, our investment is a testament to the possibility of achieving strong risk-adjusted returns through investing judiciously across the AI value chain. Celestica, assisting its customers in building AI-powered servers, provided returns not unlike Nvidia’s, the leading company in AI chips market share, all the while presenting significantly lower valuation risk.

In our view, Celestica was, and continues to be, a better investment from a risk-return perspective. Its growing aerospace and defense, industrial, and healthcare divisions provide exposure to a diversified client base. Meanwhile, it continues to provide eight of the ten largest hyperscalers in the world (companies that operate vast data centres and deliver cloud services at an extensive scale) with the components to build out their massive AI infrastructure. Lower valuations offer better protection against potential future headwinds that may impact the company’s growth. As medium- to long-term investors, this is why we approach Nvidia with caution. Nvidia is an exceptional technological leader that has exhibited significant growth in the short term. However, its market valuation appears to assume it will maintain its position as the primary provider of AI-centric graphic processing units (GPUs) indefinitely. With increasing competition from other chip manufacturers, sustaining current levels of growth and profitability will likely be challenging, potentially affecting the company’s valuation. We will continue to invest judiciously, across the value chain, in areas we think offer the best risk-adjusted returns. In many cases, investing in the most crowded idea typically does not offer the best long-term risk-adjusted return.

Conclusion

Our portfolios are constructed to generate value-added performance over medium- and long-term horizons. Companies trading at stretched valuations often assume ambitious growth prospects, but increased competition or execution errors can weaken their outlook, leading to lower-than-anticipated future profits. As history has demonstrated, many pioneers in industries have faltered and failed to fulfill their initial promise. Companies like Blackberry, Nokia, and Motorola were leaders in the nascent cell phone market in the mid-2000s, but each ultimately stumbled and failed to sustain their promise, resulting in significant losses for their shareholders. Our philosophy lies in avoiding overpriced stocks, while backing companies with strong management, sustainable strategies, and reasonable earnings multiples. Currently, our portfolios are trading at around 11.9 times forward earnings while the S&P 500 Index’s market multiple is 21.2 times, almost twice as high. We believe our approach continues to enrich our portfolios and remains our path forward.

Letko Brosseau Client PortalWe are pleased to announce that your account statements are now available through our secure portal. We encourage all clients to consider switching to digital statements to reduce paper waste. If you have not already activated your access to Letko Brosseau’s portal, we invite you to contact your account representative.

|

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN