Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

April 2024

- The lagged effect of monetary tightening remains the main factor behind our call for slower growth in the year ahead. We forecast global real GDP to advance 2.8% in 2024.

- We believe softer labour market dynamics will temper U.S. economic activity by year-end. Our outlook is for U.S. real GDP growth to moderate to around 1.0-1.5% in 2024.

- Excess savings of more than C$300 billion (13% of GDP) should provide a buffer for Canadian households against tight financial conditions and higher unemployment in the coming months. Consequently, we forecast Canadian real GDP growth to decelerate to 0.5-1.0% in 2024.

- The Eurozone economy stagnated over the last several quarters. Prospects remain poor given lingering inflation risks and restrictive financial conditions.

- China’s struggling property market continues to present a headwind to growth. The IMF forecasts real GDP growth in China will moderate to 4.6% year-on-year in 2024.

- Outlooks vary across emerging economies but, on balance, activity in the region is forecast to remain broadly stable. The IMF anticipates real GDP growth of 4.1% in 2024.

- A backdrop of strong estimated earnings growth and attractive valuations supports our view that our equity holdings will offer meaningful value creation over the medium term.

- While we remain active in the management of our fixed income holdings, we do not believe that fixed income prospects are higher than those of equities. We continue to favour a well-diversified and reasonably valued portfolio of equities over bonds.

Summary

Consensus forecasts of a sharp economic downturn did not materialize in 2023. Instead, global real GDP advanced by a healthy 3.1%. Entering the second quarter of 2024, broad-based macroeconomic resilience and steady progress on inflation continue to bolster the likelihood of a soft landing.

Inflation is converging toward target levels in most large economies. The prospect of central bank rate cuts is now on the horizon. However, we caution against overlooking the lagged effect of monetary tightening that occurred during 2022-23. We expect growth to trend lower and unemployment to move higher in 2024 as the impact of higher interest rates is fully reflected in economic conditions.

The IMF projects that global real GDP growth will remain constant at 3.1% in 2024. Our own forecast is for softer growth in the U.S. and Canada and for activity to remain stagnant in Europe. On balance, we anticipate global real GDP to advance 2.8% in 2024 (Table 1).

Global Real GDP Growth Forecast

| 2023 | 2024 | |

| World | 3.1% | 2.8% |

| Advanced Economies | 1.6% | 1.1% |

| United States | 2.5% | 1.0-1.5%* |

| Canada | 1.1% | 0.5-1.0%* |

| Eurozone | 0.4% | 0.25% |

| United Kingdom | 0.5% | 0.6% |

| Japan | 1.9% | 0.9% |

| Emerging Economies | 4.1% | 4.1% |

| China | 5.2% | 4.6% |

| India | 6.7% | 6.5% |

| Brazil | 3.1% | 1.7% |

| Mexico | 3.4% | 2.7% |

Lagged impact of tight monetary policy impacting U.S. growth

The U.S. economy remained robust in Q4 2023. Real GDP increased by 0.8% quarter-on-quarter, a moderate deceleration from the 1.2% expansion registered in the previous three months. Household spending, the economy’s main driver, grew 0.8% quarter-on-quarter, reflecting sound consumer demand for both goods (+0.7%) and services (+0.8%). On the year, real GDP advanced 2.5%.

The fundamentals of consumption are becoming less supportive. While the unemployment rate has remained below its pre-pandemic level of 4% for some time, hiring has slowed markedly. In the first two months of 2024, job gains averaged 252,000 per month, down from an average of 385,000 last year. In the same period, job openings fell by 130,000.

Slowing wage growth also signals that the U.S. job market is rebalancing to pre-pandemic norms. Average hourly earnings rose 4.3% year-on-year in February, a slight moderation from the 4.5% average annual rate of increase in 2023. Meanwhile, the combination of weaker income growth, elevated prices and high borrowing costs have caused households to become increasingly reliant on accumulated savings to sustain spending. Since Q1 2023, excess consumer savings have fallen by more than $500 billion. American households have much less surplus cash to spend compared to the same time last year.

Consumers should benefit from improving purchasing power in the near term as wage growth remains above inflation, but softer labour market dynamics and a dwindling stockpile of excess savings ultimately point to a gradual slowdown in household spending. We forecast nominal consumer spending to ease to 3.0-4.0% in 2024, down from 6.0% last year.

While private spending will remain the main driver of the U.S. economy’s expansion, fiscal policy will also make a positive contribution to growth. We anticipate an increase in government spending of around 7.0% year-on-year. Fiscal support could even surprise to the upside if draft spending packages are approved.

Elsewhere, the near-term outlook for domestic investment is tempered by a combination of higher mortgage costs weighing on residential investment, and weaker profit growth limiting business capital spending. In the medium-term, however, surging AI-related investments bode well for growth.

We expect the U.S. economy to advance 3.5-4.0% in nominal annual terms in 2024. Inflation is on a slowing trajectory and the GDP deflator – a broad measure of the prices of goods and services produced in the U.S. – is likely to fall to 2.5% this year from 3.7% in 2023. Consequently, we forecast U.S. real GDP growth of around 1.0-1.5% in 2024.

Bank of Canada expected to cut rates

In Canada, real GDP increased by 0.2% quarter-on-quarter in Q4. Expansions in consumer spending and exports were partially offset by continued declines in housing and business investment. On the year, real GDP growth slowed to 1.1% in 2023 from 3.4% the previous year.

The Bank of Canada’s steep rate hiking cycle has cooled the economy over the past several months and there is increasing evidence that inflation is on a downward track. In February, headline inflation fell to an eight-month low of 2.8% year-on-year from 3.4% at year-end. On a three-month annualized basis – a measure that reflects the underlying trend – inflation moderated to just 1.8% in the same period, less than the central bank’s 2% target.

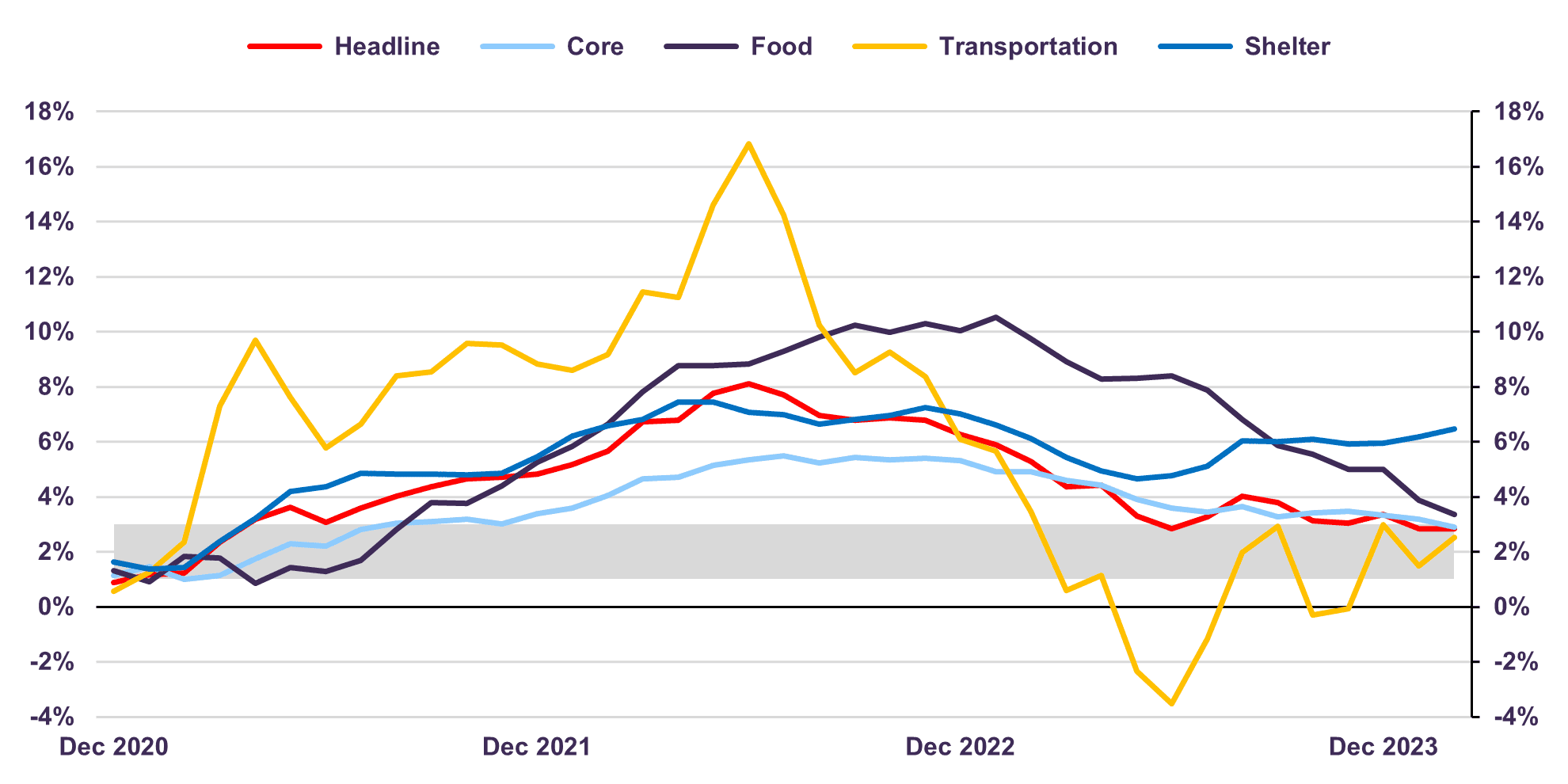

The largest contributors to Canada’s inflation rate are in a downtrend, except for housing (Chart 1). Shelter costs rose 6.5% year-on-year in February against a backdrop of high mortgage interest rates and strong population growth. Looking ahead, the cyclical impact of higher interest rates on housing will dissipate as the Bank of Canada transitions to easier policy, but robust demographics suggest shelter inflation may take some time before returning to its long-term average of about 3%.

Canadian Inflation

% year-on-year

Excluding shelter inflation, we believe the necessary adjustments are underway to keep inflationary pressures subdued on a sustained basis. Although the economy added 41,000 new jobs in February, the employment rate fell for a fifth consecutive month as labour supply grew faster than labour demand. In the same period, average hourly earnings growth slowed to 5.0% year-on-year from 5.4% at end-2023. Looking ahead, we anticipate wage growth will continue to moderate alongside gradually loosening labour market conditions.

The combination of high interest rates and weaker employment trends will exert more of a drag on activity in the coming months. However, Canadian households possess an important offset to navigate these headwinds. Accumulated savings currently total more than C$300 billion, around 13% of GDP. This savings cushion will continue to provide a buffer for households against high debt service costs, as well as a critical support in the case of unemployment.

Meanwhile, it is worth noting that high interest rates do not affect all Canadians equally. While the total interest costs paid by debtholders has increased by C$70 billion since 2020, the total interest income earned by savers over this period grew by C$55 billion. In other words, the net cost to Canadians was C$15 billion, (<1% of GDP). Some households have experienced difficulties meeting higher debt payments over this period, but this has not been a major source of stress for the aggregate economy. Credit losses remain low by historical standards and, in our assessment, Canadian banks have built sufficient capital reserves to absorb higher loan delinquencies.

We anticipate another year of below-trend growth for the Canadian economy in 2024. We forecast Canadian real GDP growth to slow to 0.5-1.0% compared to the long-term average growth rate of 2.0%.

Stagnant activity, stubborn inflation in the Eurozone

The Eurozone economy stagnated in the fourth quarter following a 0.1% contraction in real GDP in Q3. On an annual basis, the economy grew a meager 0.4% last year. Indeed, the region recorded only one quarter of growth in 2023.

While headline inflation in the Eurozone has fallen from above 10% in 2022 to just 2.6% at present, services inflation – which has a strong link to domestic wage pressures – appears to be more entrenched. In February, service sector prices rose 4.0% year-on-year, equivalent to the rate of increase recorded in each of the previous three months. Given services account for 45% of Eurozone headline CPI, concern about the upside risk to inflation posed by service sector price pressures is growing.

The ECB’s monetary tightening campaign has seemingly had little impact on a hot jobs market. Union-negotiated wages, which cover a large portion of Eurozone workers, rose 4.5% year-on-year in Q4, exceeding the 3% rate judged by the ECB to be consistent with target inflation. Meanwhile, the unemployment rate in the Eurozone edged down to a new record-low of 6.4% in January.

Job market pressures could delay the ECB’s transition to less restrictive monetary policy despite the region’s ongoing economic downturn. In our assessment, economic prospects remain poor in the Eurozone.

Fiscal and monetary stimulus key to China’s outlook

The Chinese economy expanded 5.2% year-on-year in 2023. While growth improved in annual terms, the data benefitted from a low base of comparison as lockdowns suppressed activity for several months in 2022. Looking ahead, the path to repeating the government’s 5% economic growth target in 2024 appears challenging.

Consumer spending emerged as the key engine of growth last year following the reopening of China’s economy. Retail sales surged 7.2% year-on-year in 2023 and spending on services soared 20.4% as the sector benefitted from a significant amount of pent-up demand. Following a year of robust catch-up growth, consumer spending is likely to downshift in 2024. Indeed, through the first two months of the year, retail sales grew 5.5% in annual terms, down from 7.4% year-on-year recorded in December 2023.

Elsewhere, China’s struggling property market continues to present a major headwind to growth. Annual real estate investment sank 9.6% in 2023, which marked a second consecutive year of contraction. The government plans to spend RMB 1 trillion on urban redevelopment projects, affordable housing construction and public infrastructure in 2024, which should help manage the slowdown of housing-related activities. However, at just 8-9% of annual real estate investment, policy support measures announced thus far are unlikely to engineer a turnaround in China’s real estate market. The fundamentals of housing demand in China are in a structural slowdown, as noted in our October 2023 Economic and Capital Market Outlook. We expect that this sector will remain a drag on growth for some time.

Softer household consumption and lingering property market troubles point to slower growth in the year ahead for China. However, there are numerous indications that policy is becoming more supportive. A newly announced RMB 1 trillion in special treasury bonds is a key signal of the government’s intent to step up stimulus. Last used during the pandemic, these bonds will likely finance additional infrastructure investment – an important offset to declining real estate investment. On the monetary policy front, the People’s Bank of China cut reserve ratio requirements (RRR) by 50 basis points in February, an action that will provide a further RMB 1 trillion in long-term capital to the economy.

The IMF forecasts real GDP growth in China will moderate to 4.6% year-on-year in 2024, though much will ultimately depend on the magnitude of fiscal and monetary stimulus delivered in the year ahead.

Emerging market growth to remain stable

In India, real GDP advanced 8.4% year-on-year in Q4 2023. This marked the fastest rate of expansion in the last six quarters, lifting growth for the full year to 6.7%. India’s composite PMI is deeply in expansionary territory, reaching 60.6 in February, confirming momentum has successfully carried over from the previous year. The IMF’s forecast is for India’s real GDP to advance by 6.5% in 2024, the highest rate of growth among major economies.

Outlooks in other large emerging markets are generally constructive. Real GDP in Mexico advanced 3.4% year-on-year in 2023. Despite maintaining a record high central bank policy rate of 11.25% throughout 2023, domestic demand has fared well to date. Meanwhile, booming exports to the U.S., Mexico’s largest trading partner, have also been a key support to growth. Real GDP in Mexico is expected to expand by 2.7% in 2024 per IMF estimates. In Brazil, the benchmark interest rate has been falling since August 2023. Real GDP is forecast to moderate to 1.7% in the year ahead, but less restrictive financial conditions should help smooth the economy’s deceleration.

Emerging markets remain subject to significant external pressures, including tight global financial conditions, slowing growth in developed markets and increased currency volatility. The region has navigated these headwinds well and is set to benefit from sustained central bank rate cuts in the year ahead. In aggregate terms, emerging market growth is forecast to remain broadly stable. The IMF anticipates real GDP growth of 4.1% in 2024.

Equity markets hit new highs in Q1

U.S. economic resilience and the prospect of future central bank rate cuts underscored the strong performance of equity markets in the first quarter. The S&P 500 gained 13.5% (total return in Canadian dollars), while the S&P/TSX (6.6%), MSCI World (+11.7%) and MSCI Emerging Markets (+5.1%) all ended Q1 in positive territory.

The S&P 500 has risen for five consecutive months, eclipsing the 5,000 mark and setting record highs. But as we have highlighted in recent publications, most of the rise in U.S. and global equity markets has been driven by Nvidia and a handful of large cap technology or tech-related companies that have benefitted from generative AI exuberance. In our assessment, this small subset of companies trading at excessive valuations are contributing to index concentration and necessitate a degree of caution.

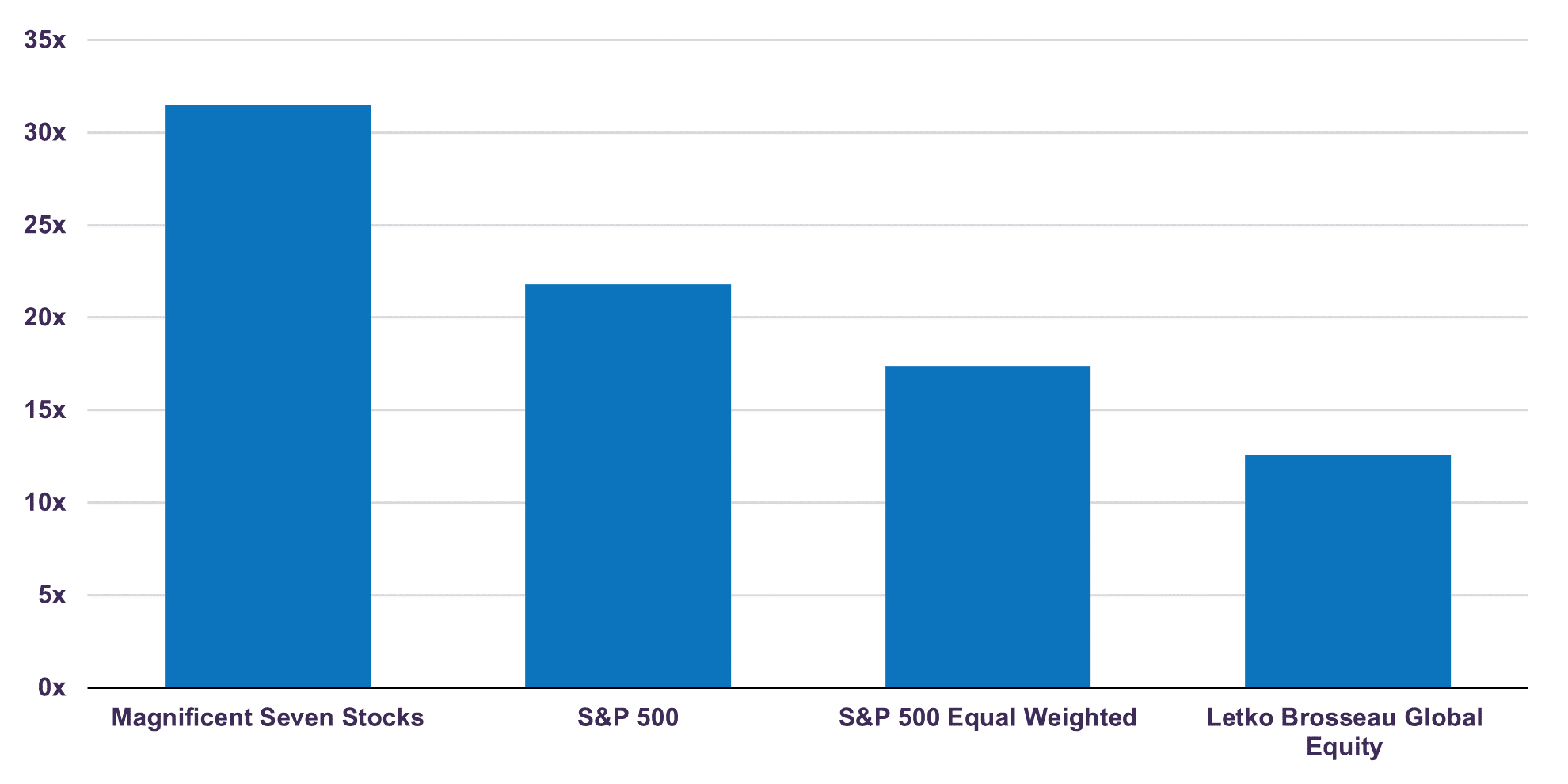

The S&P 500 forward price/earnings ratio is 21.8 times 2024 estimated earnings, a 45% premium to its long-term average of 15 times. However, this lofty valuation is very much a function of the significant multiple expansion in the aforementioned mega-cap companies. The S&P 500 equal-weighted index, which is rebalanced quarterly to assign the same weight to each company, currently sits at 17.4x. Valuations are not uniformly expensive, and we believe opportunities still exist for discerning longer-term oriented investors who keep a careful eye on earnings potential and place an emphasis on price discipline.

While our equity portfolios have delivered strong absolute returns over the previous twelve months, they remain attractive from a valuation perspective. Our global equity portfolio trades at only 12.6 times forward earnings (Chart 2).

Forward Price-to-Earnings Ratio

Furthermore, despite trading at a steep discount to the benchmark, our portfolio holdings exhibit higher forecasted earnings growth and provide an attractive dividend yield of 3.3% according to Bloomberg consensus estimates. While an expected slowdown in economic growth may weigh on company profitability in the near-term, our equity holdings are well-positioned to remain resilient despite more challenging fundamentals. We are confident in the ability of our portfolios to provide meaningful value creation over the next 3-5 years.

Adding value through a risk/reward approach

The Bank of Canada has held its key interest rate at 5% since July 2023, and there is a growing sense of optimism that lower interest rates are on the horizon. Indeed, while expectations of an interest rate cut did not materialize in March, the market consensus is now forecasting a 75% probability of a first cut in June. This policy rate backdrop begs the question: what is an appropriate duration strategy at this juncture?

Our fixed income investment decisions are based on our assessment of fair value along the yield curve. Over the past two years, we doubled the duration of our bond portfolios by acquiring high-quality medium-term government bonds. We determined that 5–10-year bonds were attractively priced when yields spiked above our fair value estimates of 3.5-4.0%. In contrast, we did not judge the risk/return profile of longer dated instruments to be attractive.

The 30-year Canadian federal bond yield peaked at 4.0%, below our fair value estimate of 4.5%. Longer-dated instruments not only carried increased additional interest rate risk, but they also offered less yield given the inversion of the yield curve during this period. Currently, the 30-year federal bond is yielding 3.3% and we continue to believe that its interest-rate risk is not sufficiently rewarded to prompt a move into this instrument. As a result, we continue to avoid exposure to fixed income securities with a term above 10 years and have focused our purchases in the 5-10-year maturities.

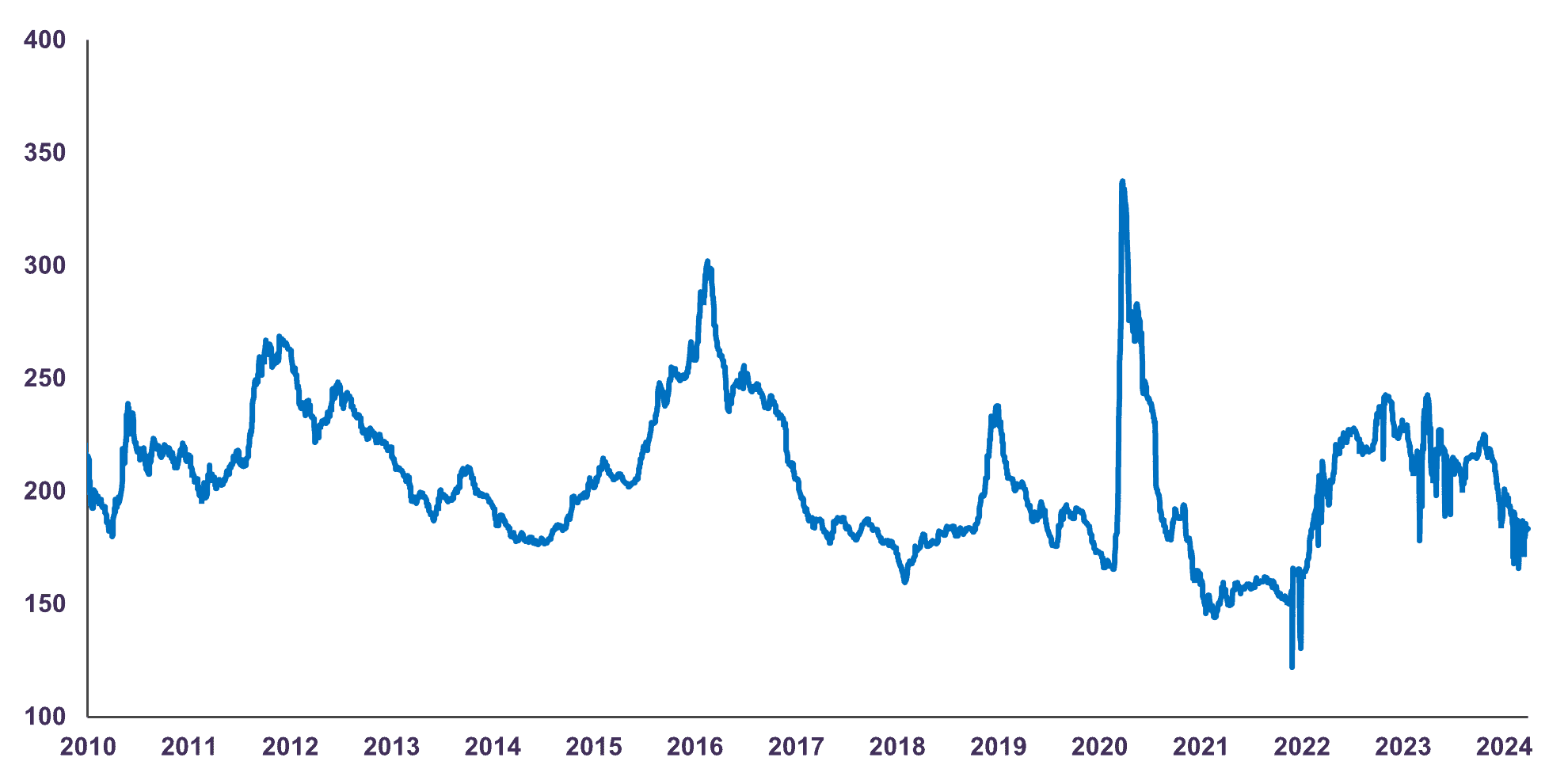

Another opportunity where we saw potential to add value in our fixed income portfolios during 2022 and 2023 was by increasing exposure to high-quality corporate bonds. As market participants feared that the global economy would enter a recession, corporate bond spreads widened to levels only experienced during downturns (Chart 3).

Canada 10-year Corporate BBB Spread (bps)

Given our positive medium-term outlook for the economy, we believed too much pessimism had been priced in. Our analysis of the credit risk of specific issuers led us to conclude that the risk/reward profile of these bonds was quite compelling. These strategic decisions – extending duration but avoiding instruments with a term above 10 years and increasing exposure to high-quality corporate bonds – continue to generate value for our fixed income portfolios.

On balance, we remain of the view that carefully selected stocks will outperform cash and bonds over the medium-term. While we remain active in the management of our fixed income holdings, we do not believe that fixed income prospects are higher than those of equities. We do not advocate for any material changes in asset allocation at this time.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN