Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

November 2023

Global equity markets experienced volatility in October primarily due to heightened geopolitical tension and slowing global growth. Year-to-date, the S&P 500 returned 13.4% (in Canadian dollars), S&P/TSX 0.1%, MSCI Europe 7.1%, MSCI All Country World Index (ACWI) 9.4% and MSCI Emerging Markets 0.3%.

As we detail in our October Economic and Capital Markets Outlook, restrictive monetary policy typically takes 12 to 18 months to be fully reflected in economic conditions. Given the steep rise in central bank policy rates since March 2022, we anticipate weaker growth for most major economies in 2024. On the other hand, inflation continues to trend downward, lessening the risk of additional rate hikes. We believe that major shifts in asset allocation are not warranted at this juncture, though we have been making gradual changes to our fixed income and equity holdings. Our strategy continues to favour companies with strong balance sheets that trade at attractive valuations while avoiding securities that are priced well above their fundamental value.

Rising Concentration of Index Returns

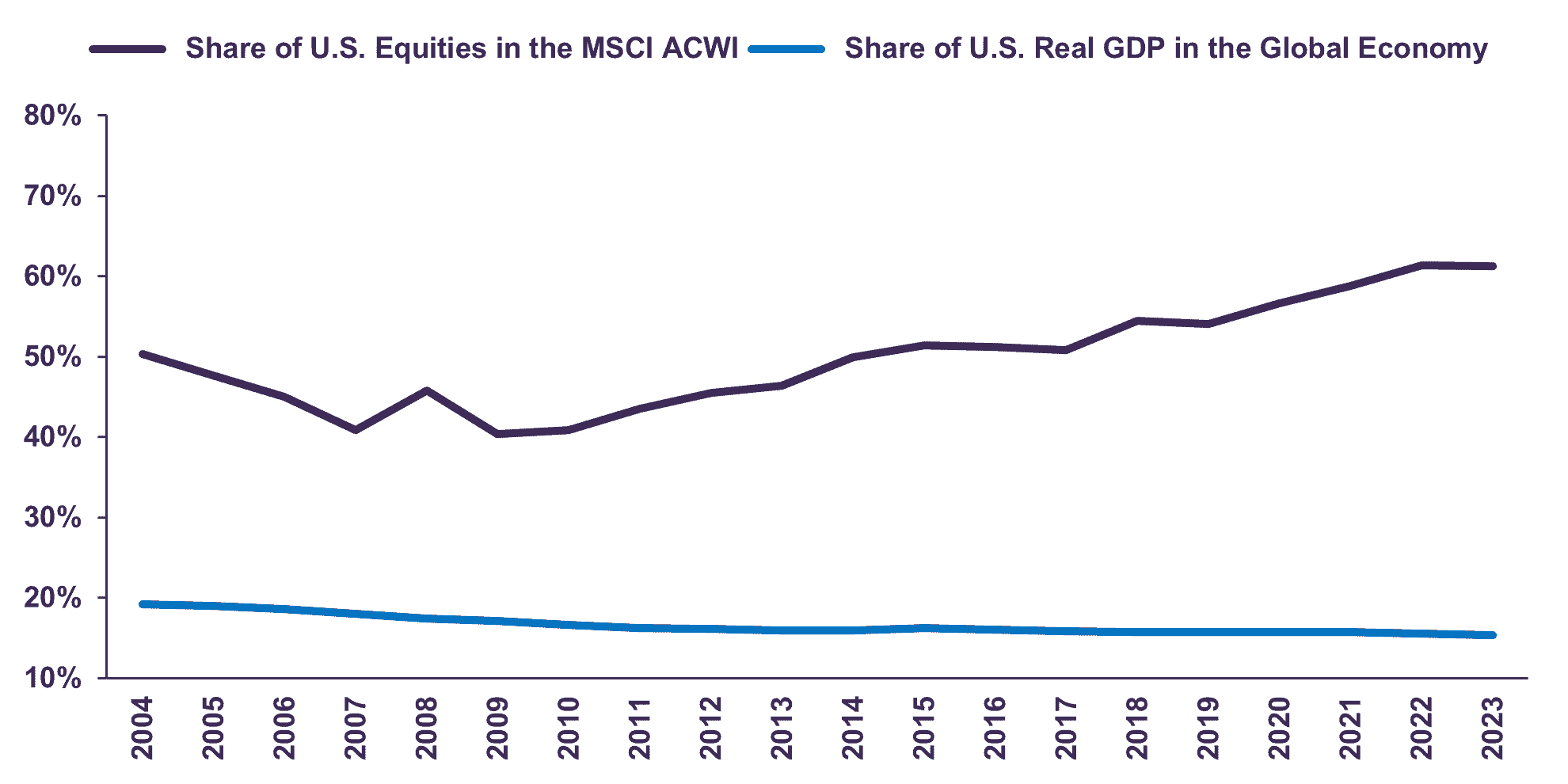

In our July Portfolio Update Letter, we highlighted how passive investing may leave one vulnerable to the idiosyncrasies or weaknesses of that index. Since the beginning of the year, the rise in U.S. and global stock markets has been driven almost entirely by a small number of technology – or tech-related – companies. In the MSCI All Country World Index (ACWI), an index of almost 3,000 large and midsized global companies, the seven largest companies, known as the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla), currently make up over 16.8% of the index. Diversification has also worsened on a geographic basis: U.S. companies account for 61.3% of the ACWI compared to 50.4% almost two decades ago while the country’s share of the global economy has declined from 19.3% to 15.4% over the same period (Graph 1).

U.S. Equity Concentration

Differing from the Benchmark Index

Unlike passive investing, where the underlying companies comprise a higher weight in the index after periods of strong performance, our active approach entails managing company and sector concentration risk by reallocating capital to areas where we believe there are better opportunities. Since the beginning of the year, we have taken advantage of price strength in companies such as Celestica, Teck Resources and Bombardier, among others, and have sold nearly $1 billion worth of stocks across all portfolios. Approximately half of the proceeds have been reallocated to the shares of new and existing portfolio companies where, in our view, valuations were more attractive. Consequently, our equity portfolio trades at a discount to market indexes: the forward price-to-earnings ratio of our portfolio is 9.7x compared to 14.9x and 17.4x for the MSCI ACWI and S&P 500, respectively. We have minimized idiosyncratic company and sector-level risk by investing in a diversified set of companies across developed and emerging markets. Said differently, we are much less exposed to the impact on the overall portfolio of a small number of expensively-valued U.S. technology and tech-related companies.

The excess capital from our year-to-date equity sales has been directed into money market securities, or in the case of balanced portfolios, a combination of money market and high-quality medium-term bond securities. We plan to gradually allocate the available cash to more lucrative opportunities as they arise. We also remain active in the management of our fixed income portfolios, where we have been progressively extending duration by purchasing 5- to 10-year Canadian government bonds. In addition, we opportunistically increased the proportion invested in corporate bonds issued by stable companies such as Bell, Royal Bank and Manulife in order to pick up yield. The yield-to-maturity of our bond portfolio is 5.1%.

Conclusion

We understand that exposure to short-term market volatility driven by changes in investor sentiment can be an uncomfortable experience. While there is the temptation to take drastic action in the face of uncertainty, we believe a more prudent strategy is to carefully weigh risks and opportunities over a longer timeframe. We remain committed to staying invested in companies that we believe can navigate short-term challenges while delivering solid performance over the medium and long term. At the same time, we take active decisions for the portfolios as opportunities unfold. Our cash position has risen modestly as we sold or trimmed some of our strongly performing equity holdings. We have tactically adjusted our fixed income portfolio throughout the year to enhance yield. At present, our equity portfolios boast strong diversification across sectors and geographies, an attractive forward price-to-earnings multiple, and a solid dividend yield of 3.9%. In our view, this disciplined investment approach will contribute to both the preservation and growth of your capital over time.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN