Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

July 2023

Equity markets ended a volatile first half of the year in positive territory, with the S&P 500 up 14.2% (total return in C$), the S&P/TSX 5.7%, MSCI Europe 11.3%, MSCI ACWI 11.3% and MSCI Emerging Markets 2.4%. Year-to-date, our equity portfolios’ performance is running slightly behind its respective Canadian and international equity benchmarks but well ahead in emerging markets, and in all mandates over the previous twelve months. The rally in the major global indices has largely been fueled by a rebound in a handful of expensive technology companies. In contrast, gains in our portfolios have been well spread across various industries and geographies, and our equity holdings continue to trade at very reasonable valuations.

As we detail in our July Economic and Capital Markets Outlook, we should continue to see slower yet still positive global growth as the world economy adjusts to tighter monetary policy and higher inflation. Nevertheless, with inflation pressures continuing to decline globally, we believe that most major central banks are nearing the end of the current rate-hiking cycle. We continue to view the medium-term risk/reward prospects of equities as attractive both in absolute terms and relative to fixed income instruments.

Concentration Risk in Underlying Equity Indices

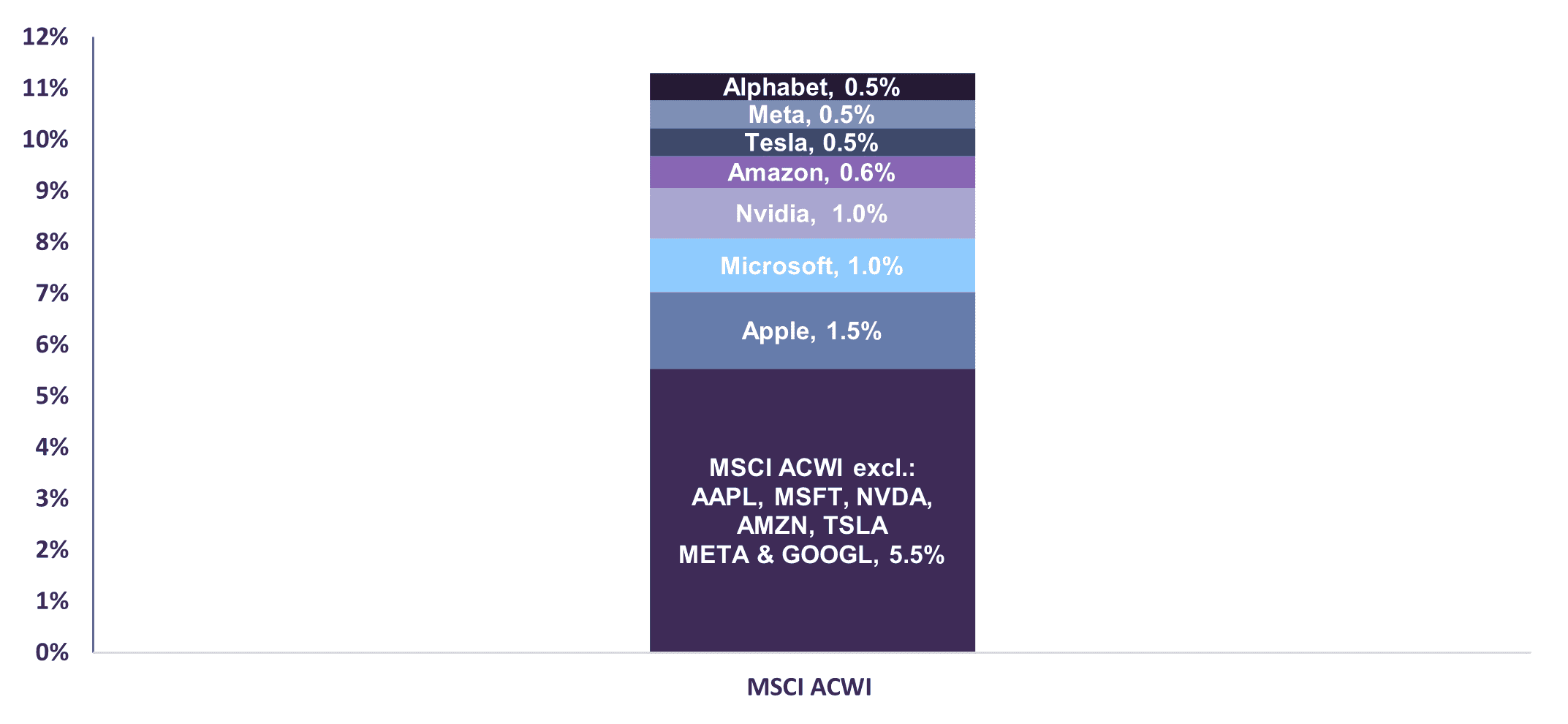

Passive investing has gained enormous popularity in the past couple of decades. However, a risk that is often overlooked when investing in funds that track an index is that it may leave one vulnerable to the idiosyncrasies or weaknesses of that index. For instance, while the returns for U.S. and global equity indices have hit double-digits during the first half of this year, the performance has mostly been driven by a handful of companies. Apple, Microsoft, Nvidia, Amazon, Tesla, Meta and Alphabet alone generated over 50% of the year-to-date return of the MSCI All Country World Index (ACWI), an index made up of over 2,800 companies (Graph 1).

Contribution to the Year-to-Date Total Return of the Index (in C$)

Based on equity prices as of June 30th, 2023, in Canadian Dollars.

Sources: Bloomberg, Letko Brosseau

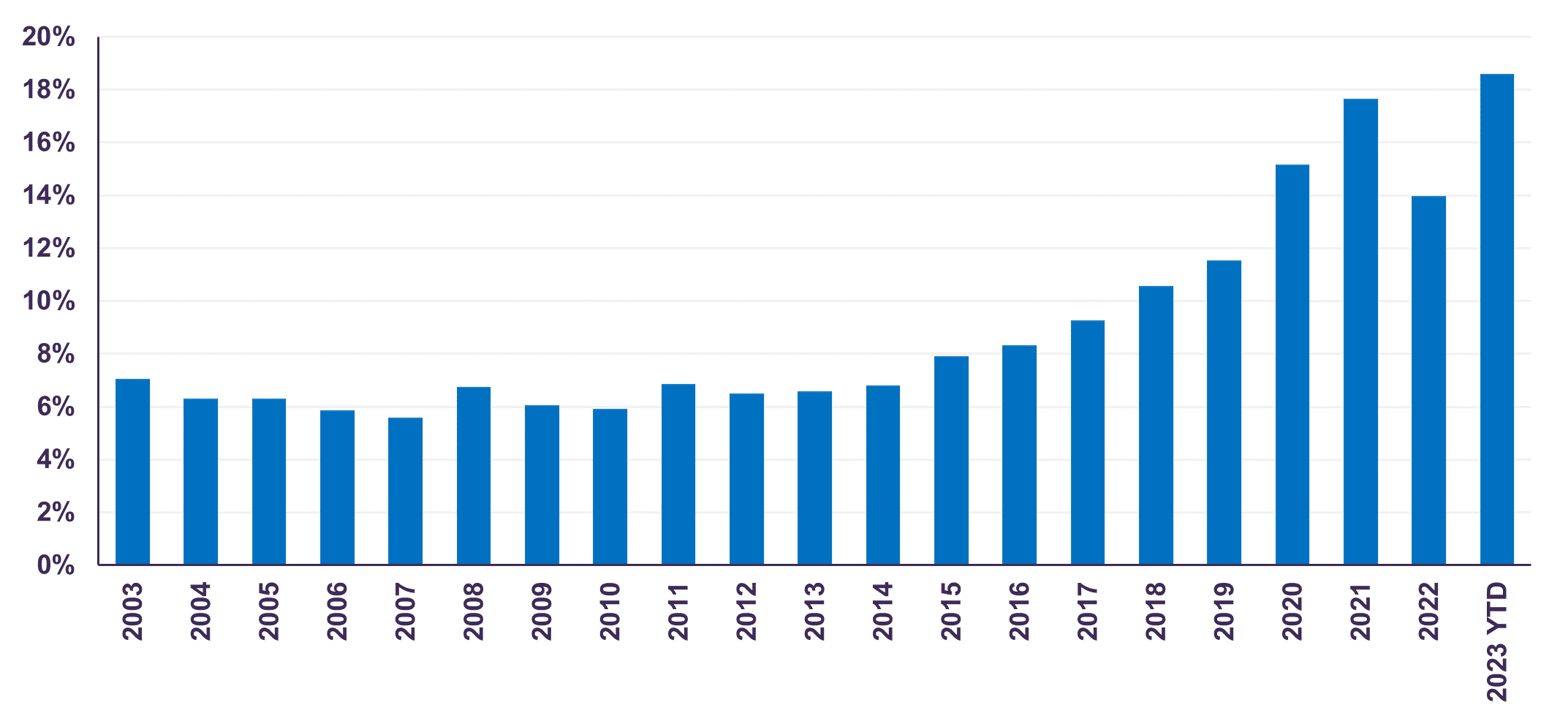

As these companies have grown, so too has their weight in the ACWI. In fact, the diversification of the underlying market has reached its lowest point in decades, meaning a small number of companies now make up a significant portion of the index (Graph 2).

MSCI ACWI

Weight of the 10 Largest Constituents in the Index

Based on equity prices at year-end and as of June 30th, 2023, in Canadian Dollars.

Sources: Bloomberg, Letko Brosseau

Investing in Generative Artificial Intelligence (AI)

A catalyst for the recent outperformance of tech companies, many of which are highlighted above, is the development of generative artificial intelligence (AI). Generative AI has experienced an unprecedented surge in popularity since the launch of OpenAI’s ChatGPT in November 2022, attracting an astounding user base of over 100 million within a matter of days.

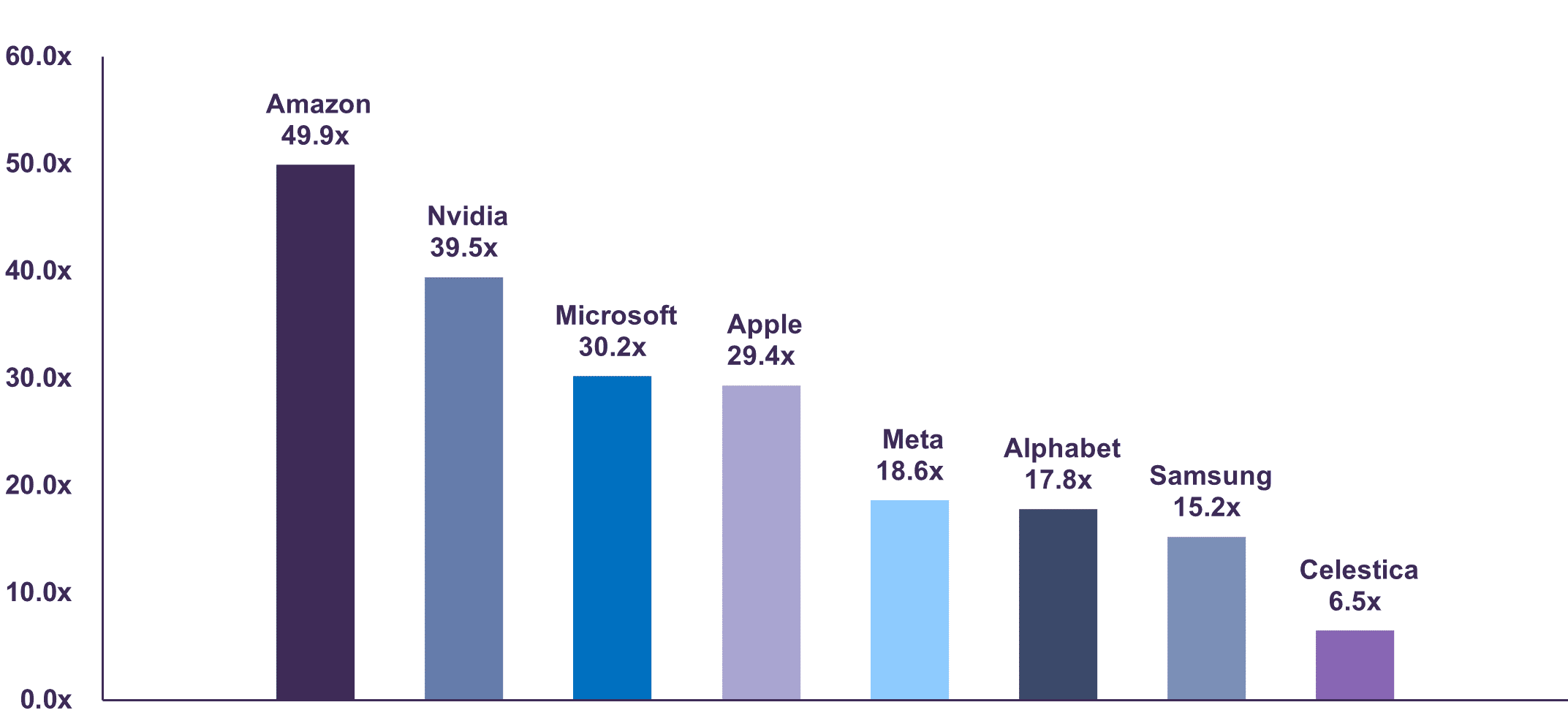

While we do view the applications of generative AI as legitimately enabling an increase in productivity across various fields (software development, call centres, marketing agencies, etc.), opportunities for investment in the space should be examined independently and with realistic expectations of future cash flows. At Letko Brosseau, we invest in exciting technological trends while minimizing our exposure to companies trading at lofty valuations and often relying on unsustainable growth rate assumptions. We estimate that several of our portfolio holdings, such as Samsung, Alphabet, Meta and Celestica, are poised to benefit and lead in the new era of AI. Of note, these companies currently trade at reasonable multiples (Graph 3).

Forward Price-to-Earnings Ratio

Based on equity prices as of June 30th, 2023, in Canadian Dollars. The companies’ forward price-to-earnings ratio has been adjusted to exclude their cash holdings.

Sources: Factset (www.factset.com) financial data and analytics, Letko Brosseau

Samsung, the world’s largest memory chip maker, produces high-performance DRAM (Dynamic Random Access Memory) modules that are used extensively within graphical processing units (GPUs), the main infrastructure to power AI models. Similarly, Alphabet and Meta continue to develop unique processing units to power their own proprietary large language models.

These companies are not only creating the necessary infrastructure for AI, the “picks and shovels” per se, but Alphabet and Meta additionally have vast collections of proprietary data to feed into their models and leverage the benefits within their existing ecosystems. Celestica is expected to see strong demand from their hyperscaler customers (companies that operate vast data centres and provide cloud services at an extensive scale) and sees generative AI as a tailwind within their compute and networking product lines. The company has strategically positioned itself to be a key partner to eight of the ten largest hyperscalers globally, helping them build out their data centre infrastructure throughout this next wave of innovation. We remain extremely optimistic about the future innovations of our tech holdings and their contributions to the world of AI.

Great new technologies are often accompanied by great exuberance. Thus far, Nvidia has been the biggest benefactor of the AI frenzy, returning 182.8% year-to-date (total return in C$). The company currently trades at a remarkable 39.5 times forward earnings (ex-cash) and an enterprise value-to-sales multiple of 19.2. Furthermore, it produces industry-leading GPUs along with an AI-centred architecture called CUDA. Nvidia is currently priced to be the sole provider of AI-centred GPUs going forward, which we view as highly unlikely. Advanced Micro Devices, another leading chip manufacturer, has promising AI developments spanning their CPU, GPU and networking product lines. Moreover, we view Alphabet and Meta’s hardware developments within AI compute and accelerators as extremely promising as well. While Nvidia is an incredible technological leader, its market valuation reflects abundant optimism regarding its growth trajectory. History has shown time and again that such valuation bubbles rarely persist.

Conclusion

As active discretionary managers, we are not required to mimic the index. Indeed, we always seek to construct well-diversified portfolios of attractive companies in the broader economy, trading at or below our assessment of their true value. We avoid any undue concentration of exposure to a certain group of companies or sectors, and this approach mitigates the risk that a sudden downturn in one or a few companies can have a disproportionately negative impact on the entire portfolio. This strategy has also been shown to protect against asset bubbles and overvaluation. We believe our equity holdings, trading at an attractive valuation of 11.5 times forward earnings and supported by a 3.4% dividend yield, should offer meaningful value creation over the next 3-5-year horizon. We continue to favour equities over bonds within balanced portfolios and do not advocate any major shifts in asset mix. We are confident this disciplined investment strategy will contribute to the preservation and growth of your capital.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN