Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

July 2023

- The world economy has remained resilient despite tighter monetary policy and persistent inflation. The IMF forecasts global real GDP growth of 2.8% in 2023 and 3.0% in 2024.

- We believe unemployment will trend higher, tempering U.S. economic activity by year-end. We forecast U.S. real GDP to grow in a range of 0.5-1.5% in 2023.

- Accumulated savings should provide a buffer for Canadian households against high borrowing costs and a weakening labour market. Our outlook is for Canada’s real GDP growth rate to moderate to 0.5-1.5% in 2023.

- The Eurozone economy slipped into recession territory in Q1 and will remain under pressure from rising living costs and restrictive financial conditions.

- China is on an improving trajectory following an abandonment of zero-COVID policy measures. The IMF anticipates real GDP in China will expand by 5.2% in 2023 compared to 3.2% a year prior.

- Outlooks vary across emerging economies but, on balance, the region is expected to avoid a broad-based downturn. The IMF forecasts emerging markets will advance by 3.9% in 2023.

- Inflationary pressures show clear signs of abating. We believe central banks are nearing the end of this current rate hiking cycle.

- Given our base case forecast for slower yet still positive global growth, we expect our equity holdings to provide meaningful returns over the medium term. We continue to favour equities over bonds.

Summary

Forecasts of an imminent recession are difficult to reconcile with recent economic developments. Despite strong headwinds related to restrictive monetary policy and persistent inflation, the global economy has remained resilient.

Excess savings and robust labour markets continue to provide a key offset to current challenges in the U.S. and Canada. To-date, Europe has defied expectations. Spillovers from the war in Ukraine have not plunged the region into a severe downturn, though the Eurozone contracted slightly in the fourth quarter of last year and the first quarter of this year. Elsewhere, the outlook for emerging markets has improved following China’s exit from its zero-COVID policy.

With inflation cooling globally, we believe that most major central banks are nearing the end of this current rate hiking cycle. The economy continues to adjust to the impact of cumulative tightening, and we anticipate weaker aggregate activity in the months ahead. However, we caution against adopting an overly pessimistic view. Slowing economic growth is an intended consequence of monetary tightening and an essential development for inflation to return to its target.

Our base case is for global growth to slow, though certain regions remain at high risk of recession. The IMF forecasts global real GDP growth of 2.8% in 2023 and 3.0% in 2024, compared to the long-term average of 3.4%.

U.S. economy resilient but slowing

U.S. real GDP expanded 0.5% quarter-on-quarter in Q1. Consumer spending increased 1.0%, while government expenditures (+1.2%) and non-residential business investment (+0.2%) also made positive contributions to growth. In annual terms, real aggregate output rose 1.8% against a year ago.

Recent indicators confirm the resilience of the U.S. economy, but also suggest activity will decelerate as the year progresses. Businesses created 339,000 jobs in May. Over the last three months, however, job gains averaged 283,000 compared to just under 400,000 per month in 2022. Meanwhile, in June, new applications for unemployment benefits rose to their highest level since 2021. On the wage front, average hourly earnings increased by 4.3% year-on-year in the same period. Since reaching a high of 5.9% in March of last year, income growth has steadily decelerated. Trends in employment and compensation suggest U.S. labour demand is past its peak.

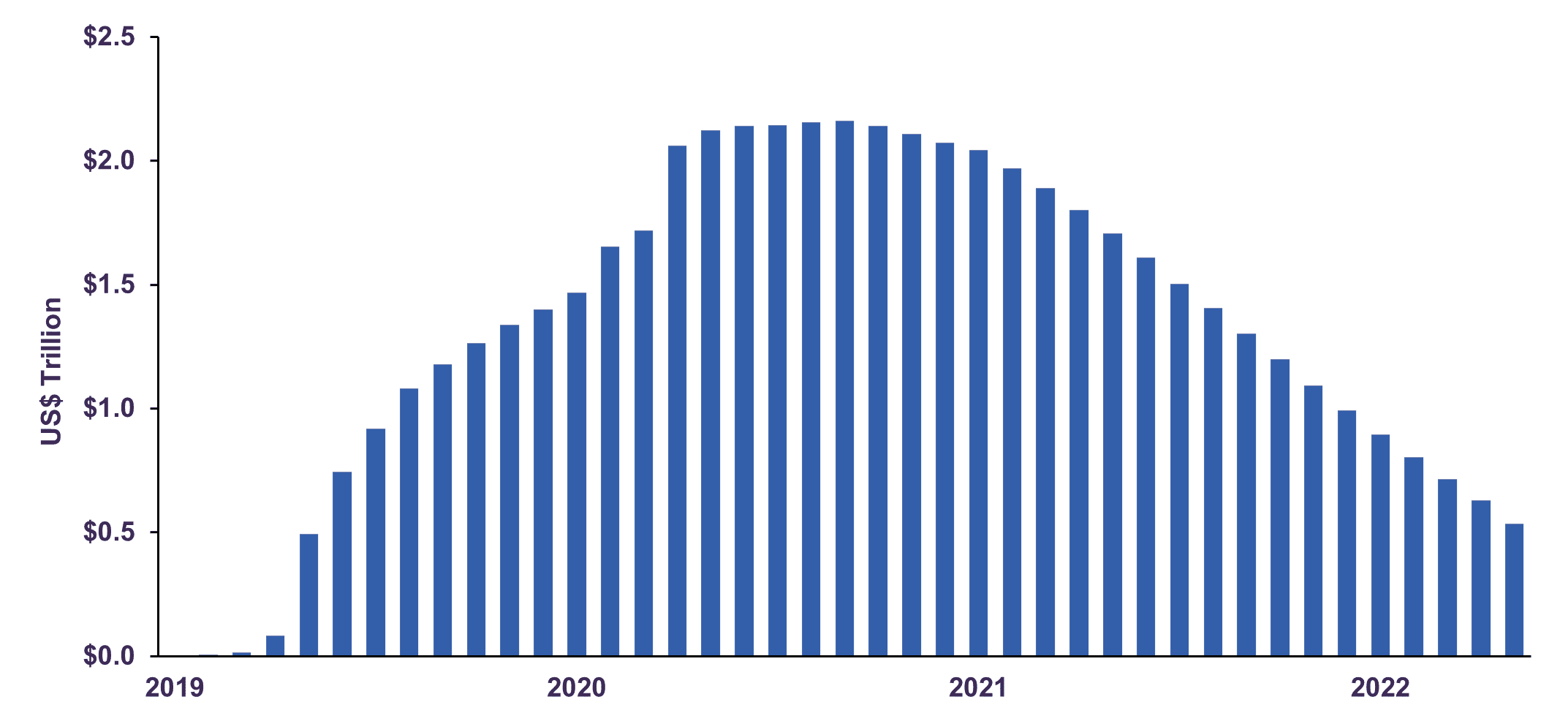

In response to persistent inflation and lagging earnings, households have increasingly drawn on savings to sustain spending. Excess consumer savings have declined by one-third year-to-date. Nonetheless, despite recent drawdowns, households still hold a large amount of surplus cash in their bank accounts (Chart 1).

Given the lagged impact of tighter lending standards, and the household sector’s reliance on savings to cope with higher costs, we expect consumer spending – the main driver of the economy – to moderate in the months ahead. We also anticipate labour market conditions will soften, leading to an uptick in unemployment by year-end. Consequently, we forecast the U.S. economy will slow through 2023, with real GDP growing in the range of 0.5-1.5%.

Excess U.S. personal savings

Source: U.S Bureau of Economic Analysis, Piper Sandler & Co.

Solid growth in Canada despite rate hikes

In Canada, real GDP advanced 0.8% quarter-on-quarter in Q1, and 2.2% against a year ago. Household expenditures grew 1.4%, reflecting robust spending on both goods (+1.5%) and services (+1.3%).

Against a backdrop of higher consumer expenditures, the household savings rate declined to 2.9% in Q1 from 5.8% at year-end. Despite the drop, the savings rate remained above its pre-pandemic level, indicating that consumers have yet to draw on cash balances amassed during the pandemic. Canadian households possess an estimated C$300 billion (13% of GDP) in excess savings, a key offset to current headwinds.

After eight consecutive months of job gains, the Canadian labour market shed 17,000 positions in May. These job losses nudged the unemployment rate up to 5.2% from 5%. Wage growth appeared to stall in the same period, albeit at an elevated level: average hourly earnings grew 5.1% compared to 5.2% a month prior. Indeed, a record proportion of Canadian small- and medium-sized enterprises reported to the Canadian Federation of Independent Business that wage costs are causing them difficulties. We anticipate that the labour market is likely to soften further in the months ahead.

Elsewhere, the effects of sharp rate hikes since March 2022 are becoming more apparent. Activity has visibly deteriorated in the housing market. Residential investment declined 3.9% quarter-on-quarter in Q1, its fourth consecutive quarterly contraction. Malaise in the sector was widespread as new construction

(-6.0%), renovations (-2.1%), and resale activity (-1.5%) all fell amid higher borrowing costs. Housing will continue to exert a drag on Canada’s near-term growth prospects.

We expect broader activity to become more affected by restrictive financial conditions and weakening employment trends in the months ahead, though accumulated savings should provide a buffer for households. Our forecast is for Canada’s real GDP growth rate to moderate to 0.5-1.5% in 2023, down from 3.4% a year ago.

Europe fares better than expected

Following two quarters of negative growth, the Eurozone slipped into recession in the beginning of the year. Real GDP declined by 0.1% quarter-on-quarter in Q1 2023 and Q4 2022. Consumer spending across the region fell 0.3% in the first quarter, as the rising cost of living weighed on households. Meanwhile, public spending shrank 1.6% as stimulus measures meant to offset the impact of high energy prices expired.

Russia’s invasion of Ukraine exacerbated a cost-of-living crisis in the Eurozone last year, yet the region’s economy exceeded widely-held views for a more pessimistic outcome. Conditions are not uniformly recessionary across the Euro Area. In the first quarter, while real GDP in Germany (-0.3%) and the Netherlands (-0.3%) contracted, the economies of France (+0.2%), Italy (+0.6%) and Spain (+0.6%) all experienced expansions. In addition, the European Union – which includes eight more countries than the Eurozone – recorded a 0.1% quarter-on-quarter increase in real output during the first three months of the year.

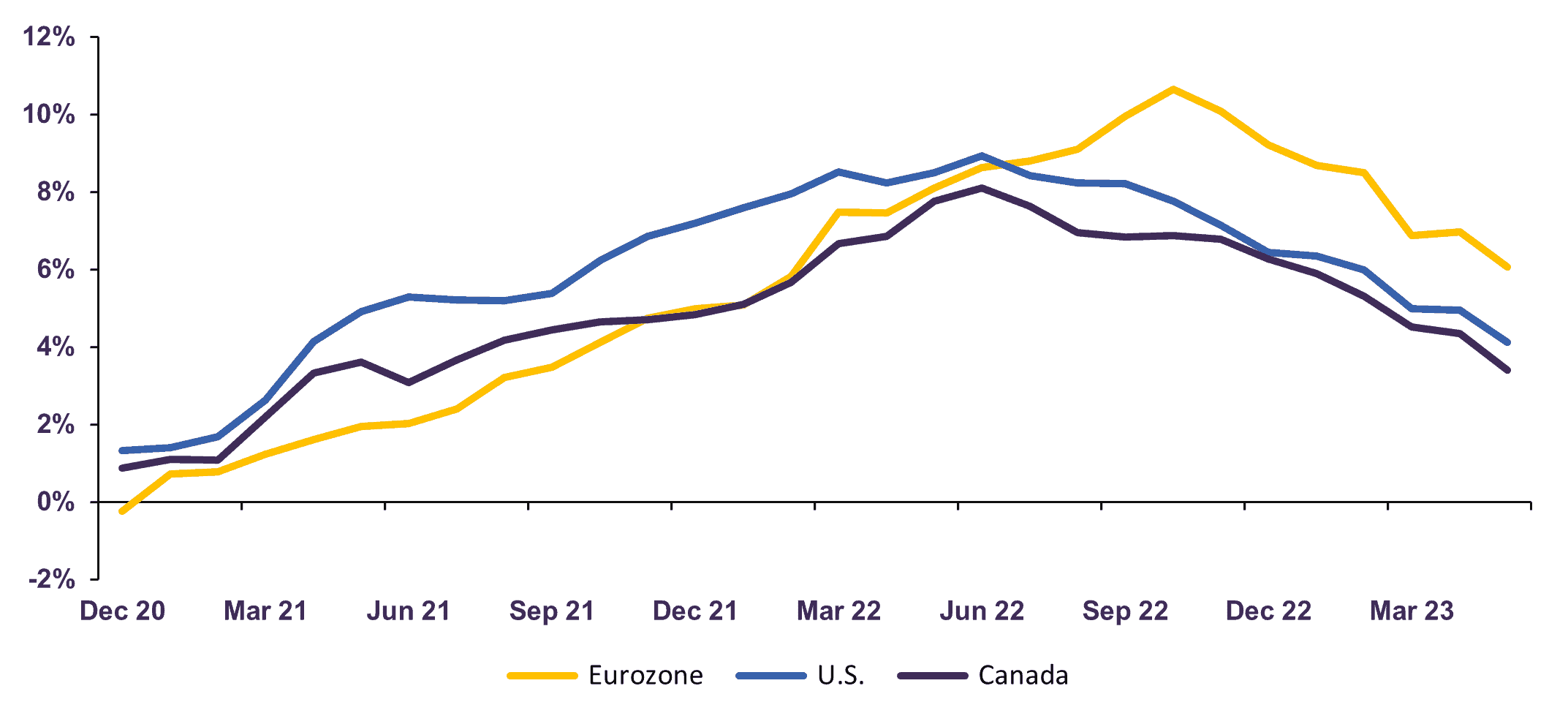

Headline inflation has slowed considerably since the peak of Europe’s energy crisis last year (Chart 2). However, the Euro Area’s shift from a slight expansion to a mild contraction has not coincided with a meaningful deceleration in core inflation. Given that households will likely remain under pressure from rising living costs and further policy rate increases for some time, there is a high likelihood that more economies within the Euro Area fall into recession as the year progresses.

Headline inflation

% year-on-year

Source: U.S Bureau of Labour Statistics, Eurostat, Statistics Canada

Mixed prospects in emerging markets

China is on an improving trajectory following its abandonment of zero-COVID policy measures. In the first quarter, real GDP grew 4.5% year-on-year as the service sector staged an impressive rebound of 5.4% against a year ago. Although more recent data from April and May are inflated by a positive base effect – the annual comparison corresponds with the Shanghai lockdown of 2022 – most indicators of activity are encouraging.

Retail sales registered a fifth consecutive sequential improvement in May, expanding 0.4% month-on-month. Through the first five months of the year, retail expenditures have risen 9.3% against a year ago. Demand-side data suggest consumers are converting pent-up demand into purchases. On the supply-side, the May Caixin China Services PMI signaled a fifth straight month of expansion in service sector activity.

Slowing global demand for Chinese exports and depressed real estate activity present headwinds to growth. However, we believe the ongoing consumption-driven recovery should provide an effective offset to these challenges. The IMF anticipates real GDP in China will advance by 5.2% in 2023 compared to 3.2% last year.

In India, real GDP advanced 6.1% year-on-year in Q1 driven by strong private spending and investment. Over the course of the last year, the Reserve Bank of India lifted rates by 250 basis points before signaling a pause in April. Policy rates are now at pre-pandemic levels. In contrast to many of its emerging market peers, India’s growth prospects appear unhampered by restrictive monetary policy. Real GDP is expected to rise 5.9% in 2023, per IMF estimates, the fastest growth among major economies.

Prospects are less robust elsewhere. In Brazil, the lagged impact of a protracted monetary tightening cycle is expected to weigh more heavily on real activity. However, the economy has remained resilient to date. Real GDP in Q1 grew 4.0% year-on-year, underpinned by household spending growth. The IMF forecasts real GDP growth in Brazil will moderate to 0.9% year-on-year in 2023. Meanwhile, activity in Mexico is also expected to decelerate as the U.S., Mexico’s largest trading partner, slows further. Real GDP in Mexico is expected to increase by 1.8% in 2023.

Tighter financial conditions and slowing developed market growth present dual challenges for emerging markets. However, the region is forecast to avoid a broad-based downturn due to varying outlooks across economies. The IMF anticipates emerging markets will advance by 3.9% in 2023, practically unchanged from the 4.0% rate of expansion a year prior.

Inflation is moderating

Headline inflation around the world shows clear signs of abating. U.S. consumer price inflation declined to 4.0% year-on-year in May, the slowest rate of price growth since March 2021. The CPI decelerated to a multi-month low of 3.4% in Canada and inflation in the Eurozone has declined by more than 300 basis points year-to-date.

Meanwhile, core inflation (consumer prices excluding food and energy) is also moderating on a sustainable basis in most major economies. Core CPI in the U.S. declined to 5.3% in May, the slowest rate of price growth since Q4 2021. Similarly in Canada, core inflation reached a 16-month low of 3.9% in May and, in Europe, it has receded from a record high rate of 5.7% in March to 5.4% at present.

We see increasing evidence that economies are going through the necessary adjustments to allow core inflation to return to central bank targets.

In the U.S., real hourly compensation declined 2.6% year-on-year in the first quarter, a sign that wage pressures are easing. With unemployment rising in Canada, we anticipate a similar dynamic will unfold in the months ahead. In our assessment, receding demand-side price pressures suggest the Federal Reserve and Bank of Canada are both near the end of their respective tightening cycles.

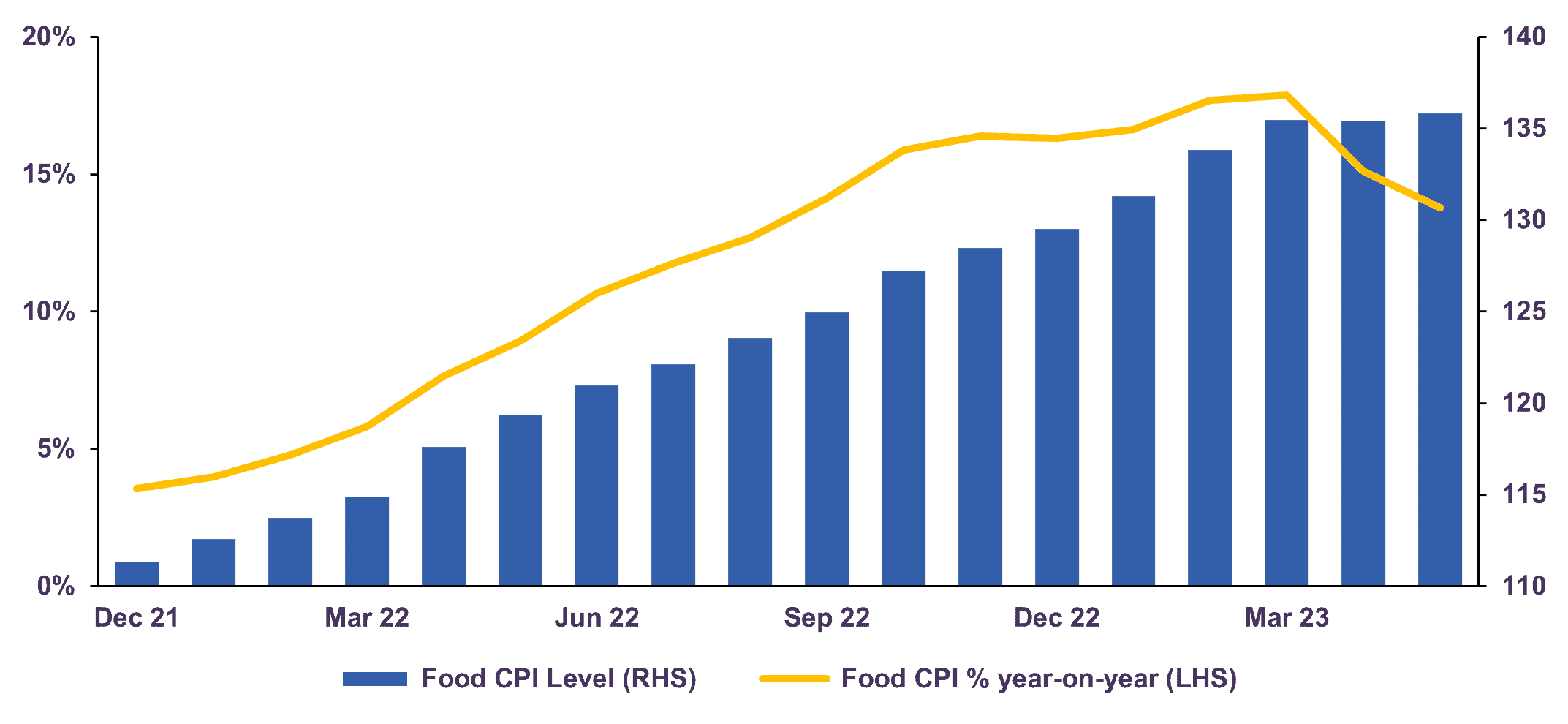

In contrast, the European Central Bank faces a more complex challenge. Natural gas prices are significantly lower than at the peak of the recent energy crisis yet remain well above pre-Ukraine invasion levels. Food inflation is running in the mid-teens and presents a meaningful upside risk to the headline rate (Chart 3). Meanwhile, Eurozone unemployment recorded a low of 6.5% in May and annual wage growth remains close to the decade-high set in Q4 2022. These dynamics suggest the ECB will have to continue raising rates for some time to restrict demand enough to prevent a self-reinforcing spiral of wage and price growth.

Eurozone food inflation

Source: Eurostat.

Stocks rise as monetary tightening cycle nears an end

Markets rallied in the second quarter, overcoming concerns of financial system instability and debt ceiling anxieties. The year-to-date total return of the S&P 500 was 14.2% (in Canadian dollar terms), while the S&P/TSX (5.7%), MSCI Europe (11.3%), MSCI ACWI (11.3%), and MSCI Emerging Markets (2.4%) all closed the first half of the year in positive territory.

The Federal Reserve’s decision to hold interest rates unchanged and signs of receding price pressures bolstered equity markets toward the end of the quarter. The S&P 500 rose more than 8% in Q2 (more than 6% in Canadian dollar terms), while the VIX Index – a popular measure of U.S. stock market volatility – fell to its lowest level since the start of the pandemic.

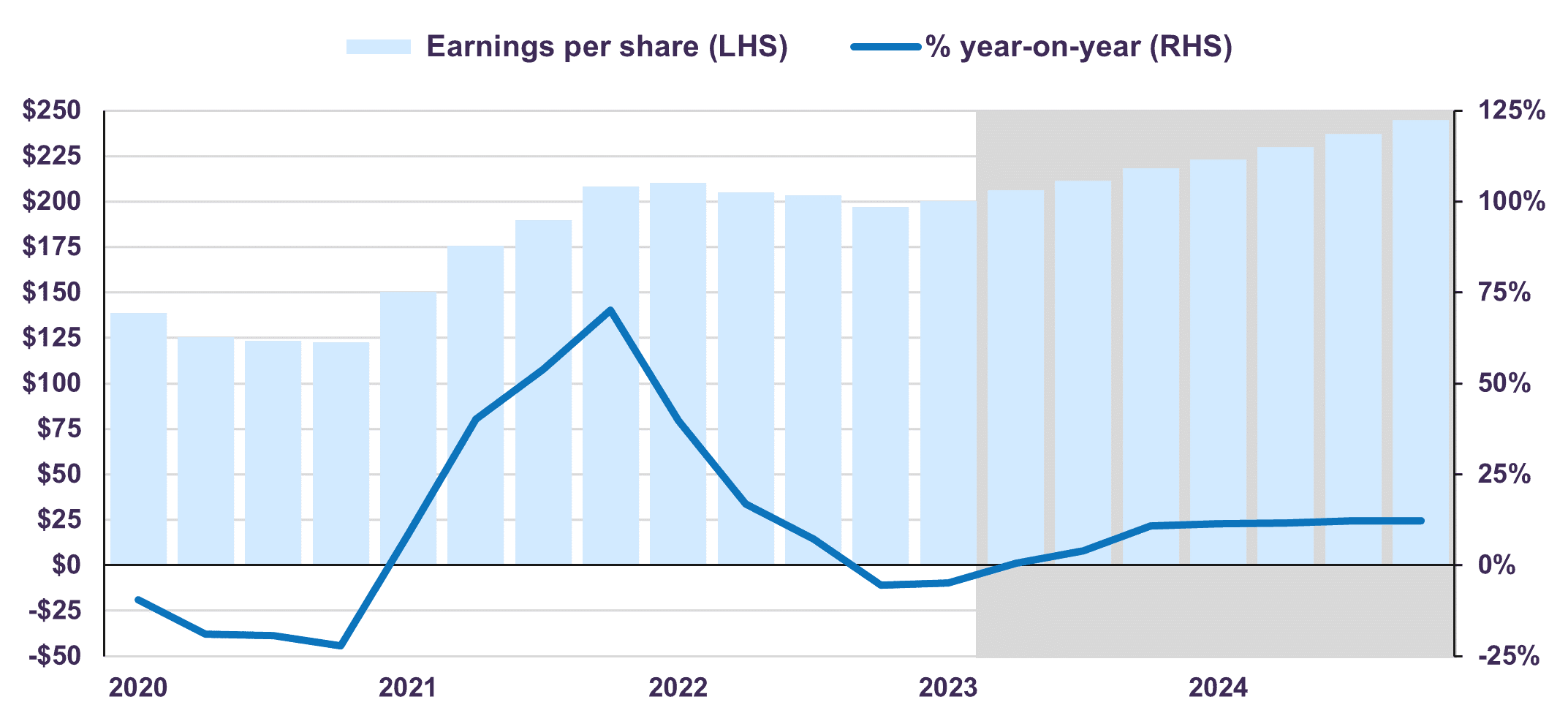

Better-than-expected earnings help explain some of the positive sentiment surrounding equities. Although Q1 profits declined 4.8% on average compared to a year ago, 78% of S&P 500 companies outperformed consensus earnings forecasts for the quarter. Analysts’ more pessimistic forecasts still have not materialized: at the end of Q2, more companies in the S&P 500 saw upward revisions to earnings estimates for 2023 than downgrades. Overall, S&P 500 operating earnings per share are forecasted to improve in the second half of this year and next (Chart 4).

Company fundamentals have thus far remained resilient, but we anticipate a challenging period of adjustment ahead. Indeed, pressure on profitability should intensify as elevated labour costs and decelerating economic activity are likely to limit companies’ pricing power. In turn, profit margins should continue to compress in the short-term.

Looking beyond near-term challenges, we view the risk/reward prospects of equities as attractive. While the S&P 500 currently trades at 20.4 times 2023 estimated earnings, 36% above its long-term average of 15x, valuations are not uniformly expensive. The S&P 500 Value Index trades at a more reasonable 17.7 times 2023 earnings, significantly lower than the P/E multiple of 23 for the S&P 500 Growth Index. Meanwhile, our global equity portfolio trades at around a 33% discount to its equity benchmark and offers good value at 11.5 estimated 2023 earnings.

While equities have surprised to the upside year-to-date, fixed income assets delivered a paltry 2.5% despite the higher level of interest rates. At present, 10-year and 30-year Government of Canada bonds yield 3.3% and 3.1% respectively, which remains below our fair value level of 4.5%, based on long-term real GDP and inflation. We have recently taken advantage of the rise in interest rates to modestly extend the duration of our portfolios and to increase our weight in good quality higher-yielding corporate bonds. However, our broad-based strategy for fixed income remains unchanged: we are avoiding exposure to instruments with a term above 10 years and the bond portfolio is well below benchmark duration.

Given our base case forecast for slower yet still positive global growth in 2023 and 2024, we expect our equity holdings to provide meaningful returns over the next 3-5-year horizon. We continue to favour equities over bonds within balanced portfolios and do not advocate any major shifts in asset mix.

S&P 500 operating earnings per share

Source: Standard and Poor’s, shaded for forecasts by S&P.

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN