Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

October 8, 2021

Global equity markets experienced some volatility in September, driven, in part, by the prospect of a debt default by Evergrande, China’s largest real estate developer. Meanwhile, spiking natural gas prices and reports of energy shortages in Europe sent energy share prices higher. By the end of September, stock market indices were not far from their all-time peaks. Year-to-date, the total return for the S&P 500 Index was 15.3% in Canadian dollars, the S&P/TSX was ahead 17.5% and the MSCI World Index rose 12.4%. Our equity strategies are fully participating in the strong rebound in economic activity, climbing more than benchmark indexes over the same period.

Spillover from highly-indebted Chinese property developers expected to be contained

In an attempt to rein in excessive financial leverage and prevent systemic risks, the Chinese government implemented new financing rules for real estate companies in late 2020. The rules set limits to borrowing if developers exceed specific leverage thresholds. Evergrande highlights the risks the government is trying to address. Evergrande’s troubles began to escalate when it found itself generating insufficient cash flows to service its $300 billion liabilities, and unable to borrow further because it had already breached the government’s debt thresholds. With an estimated 800 projects in 200 cities throughout China, total annual revenues of $80 billion and representing approximately 3% national market share, China’s largest real estate company faced default on its interest payments to domestic and foreign lenders in September. Given that the 2008-09 financial crisis originated from excesses in real estate, it is perhaps not surprising that news of Evergrande’s financial situation led to investor concerns about the Chinese real estate industry as a whole, and the possibility of global contagion.

We believe that the impact of a restructuring of Evergrande’s debt should largely be confined to China. At this juncture, we judge the risk of negative global spillovers to be limited. With the exception of Evergrande, Guangzhou R&F, and a few smaller developers, finances for the rest of China’s real estate industry seem reasonable. Evergrande’s foreign currency-denominated debt amounts to $21 billion, about one-quarter of its total borrowing and is spread amongst large financial institutions, such as Blackrock, Fidelity and UBS, accounting for a tiny fraction of their overall holdings. Moreover, the exposure of Chinese domestic banks to the company is estimated to be 0.3% of total loans, a manageable number for the industry. We expect that the Chinese government will coordinate an orderly restructuring in which existing real estate projects and other assets will be sold to other Chinese developers in exchange for cash to pay down debt. While holders of Evergrande’s debt and equity are likely to lose money, buyers of their apartments should see completion of their property. We do not believe this issue will materially impact China’s growth path (see Economic and Capital Markets Outlook – October 2021). Of note, our portfolios have no direct exposure to Chinese real estate or domestic banks.

Spike in natural gas prices leads to share price rises for selected energy companies

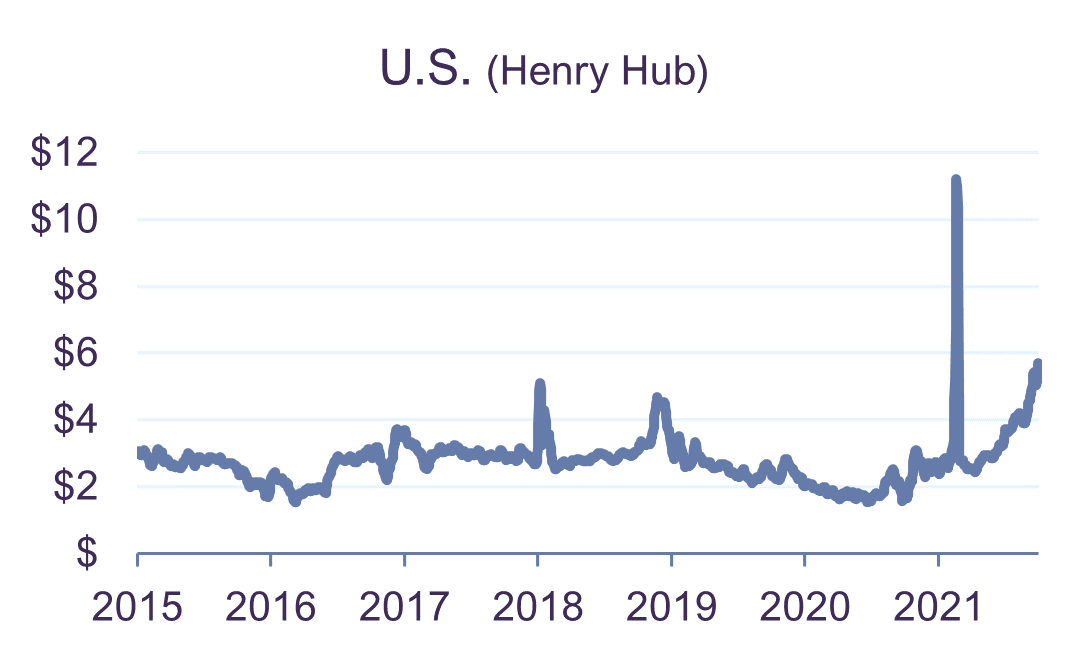

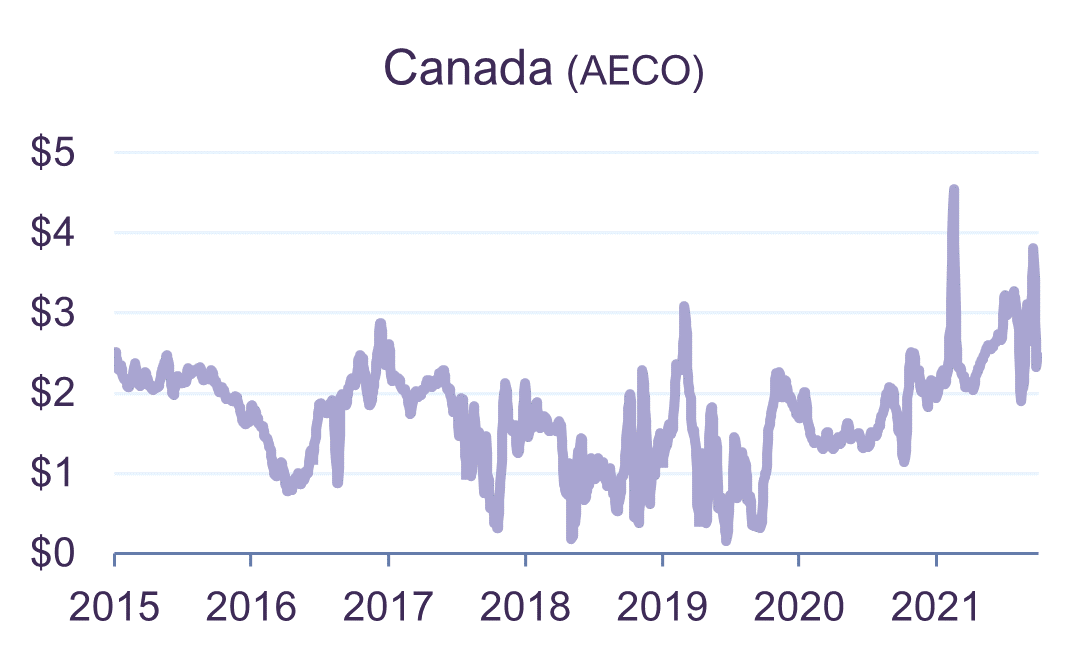

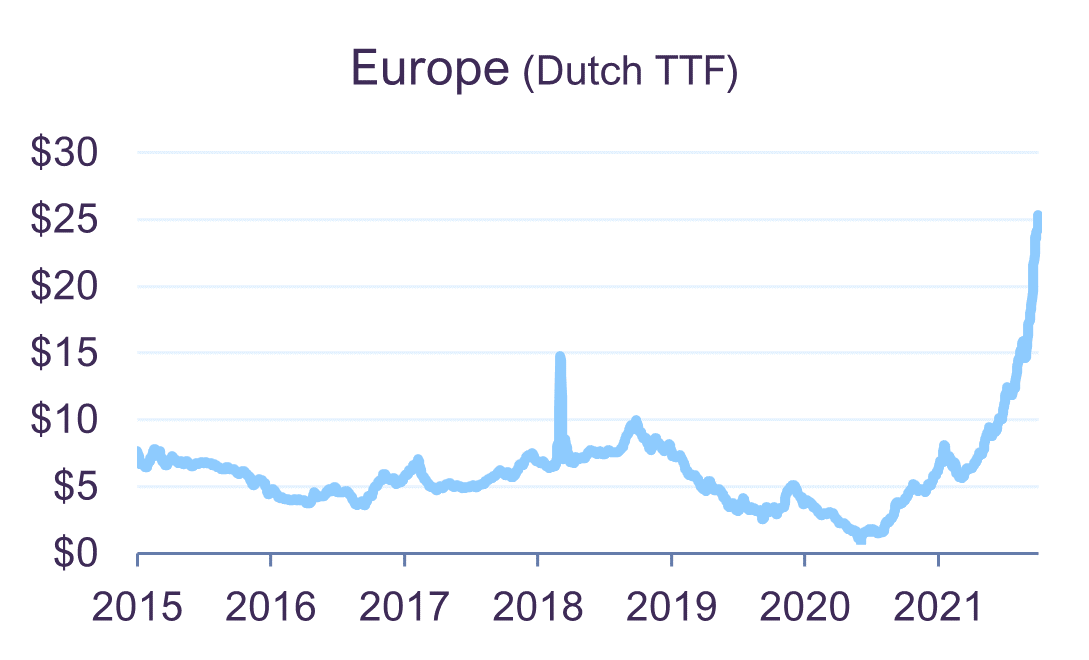

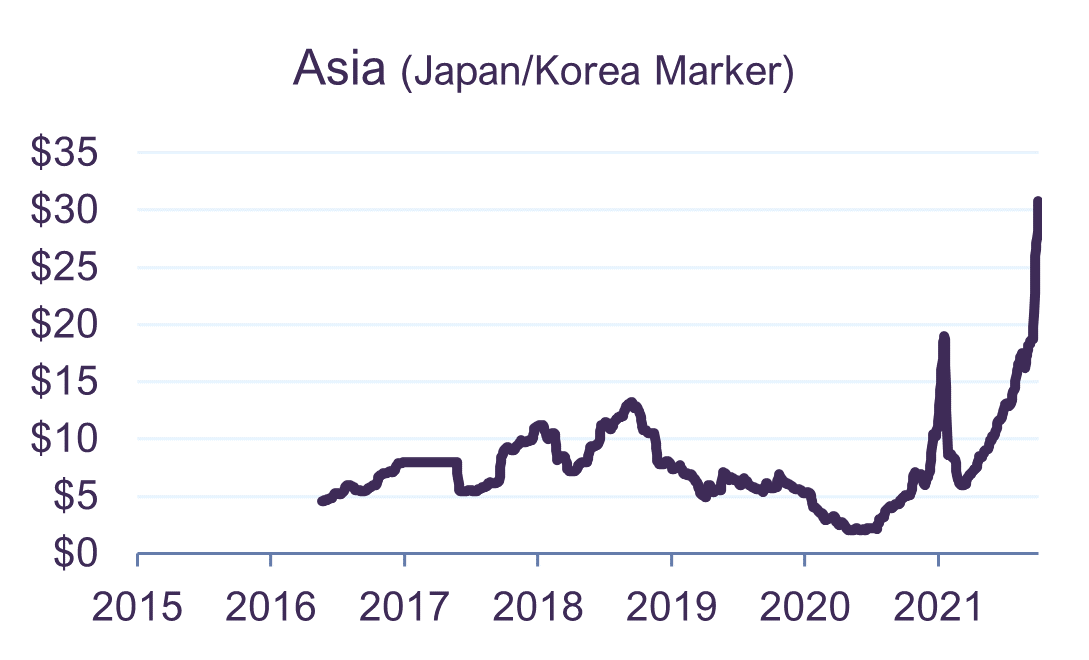

Natural gas prices have surged worldwide since the beginning of the year, hitting record levels in some geographies. Unlike oil, natural gas prices are determined by regional demand and supply. As at end-September, the spot price of natural gas was around $28 per one million British thermal units (mmbtu) in Europe and $34 per mmbtu in Asia, well above the $5-$8 per mmbtu range over the last decade. In the U.S. and Canada, spot prices closed the month at $5.87 and $2.67 per mmbtu respectively, up from $2.36 and $1.95 since the beginning of January (Chart 1).

A confluence of factors lies behind this price spike. The global economic rebound has led to double-digit growth in China’s exports, boosting Chinese domestic electricity demand. Coal prices rose by 66% since the beginning of 2021, making coal-to-gas switching attractive and, in turn, driving demand for natural gas. In Europe, last year’s cold winter season, lower wind output, closure of coal and nuclear power plants and a decline in natural gas imports from Russia together combined to reduce natural gas inventories to 16% below their normal levels. This has led to concerns of shortages ahead of the coming winter and the prospect of higher prices for the commodity.

Regional natural gas spot prices in US$ per mmbtu

Source: FactSet (www.factset.com) financial data and analytics and Bloomberg, shown as a 5-day moving average

In North America, natural gas inventories are 8% below their normal level following a cold winter and hot summer. Given that the U.S. exports almost one-fifth of its natural gas to Asia and Latin America, the American Midwest and West Coast have become increasingly reliant on Canada to supply their energy needs. Rising consumer and industrial demand has therefore driven the Canadian natural gas price benchmark (AECO) higher as well.

The natural gas producers in our Canadian equity portfolio – Birchcliff Energy, Peyto Exploration and Development, Tourmaline Oil and Advantage Energy – have seen their share prices rise two- to three-fold year-to-date to end-September. Some of our international energy companies, such as Devon, Hess, ConocoPhillips, Royal Dutch Shell, Total and Ovintiv, have a significant share of their energy production devoted to natural gas. Overall, we estimate that natural gas accounts for about 40% of the total production of our company holdings in the energy sector, positioning our clients to benefit from the recent rally in the commodity.

Our thesis on gas rests on longer-term fundamental factors. We have long believed that natural gas has a role to play in the transition away from more polluting sources of energy such as thermal coal, and this should lead to an increase in demand for the commodity, particularly in the developing world. We also recognized that over the past few years, North American natural gas prices were too low relative to the cost of production, disincentivizing the industry to increase supply. As a result, we viewed natural gas to be an interesting area for investment, and we focused on the best-in-class producers from an Environmental, Social and Governance (ESG) perspective (see “Doing well while doing good with natural resources” – Letko Brosseau Investor Forum 2021).

The integrated nature of global energy markets highlights how regional demand and supply imbalances can lead to worldwide price dislocations. Also, energy security, reliability and affordability have come to the forefront as important issues for every country. A balanced mix of energy sources requires that renewable power be integrated with both stable and flexible generation, often driven by natural gas. This is indeed food for thought as we transition to a low carbon environment.

In sum, we continue to see a long runway of growth ahead. We believe our portfolios are positioned to capture both cyclical and secular trends, while still offering reasonable value.

All dollar references in the text are U.S. dollars unless otherwise indicated.

A list of all purchases and sales made during the past year can be provided on request. The transactions mentioned do not represent all the securities bought or sold in the portfolios during the quarter.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN