Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

October 2021

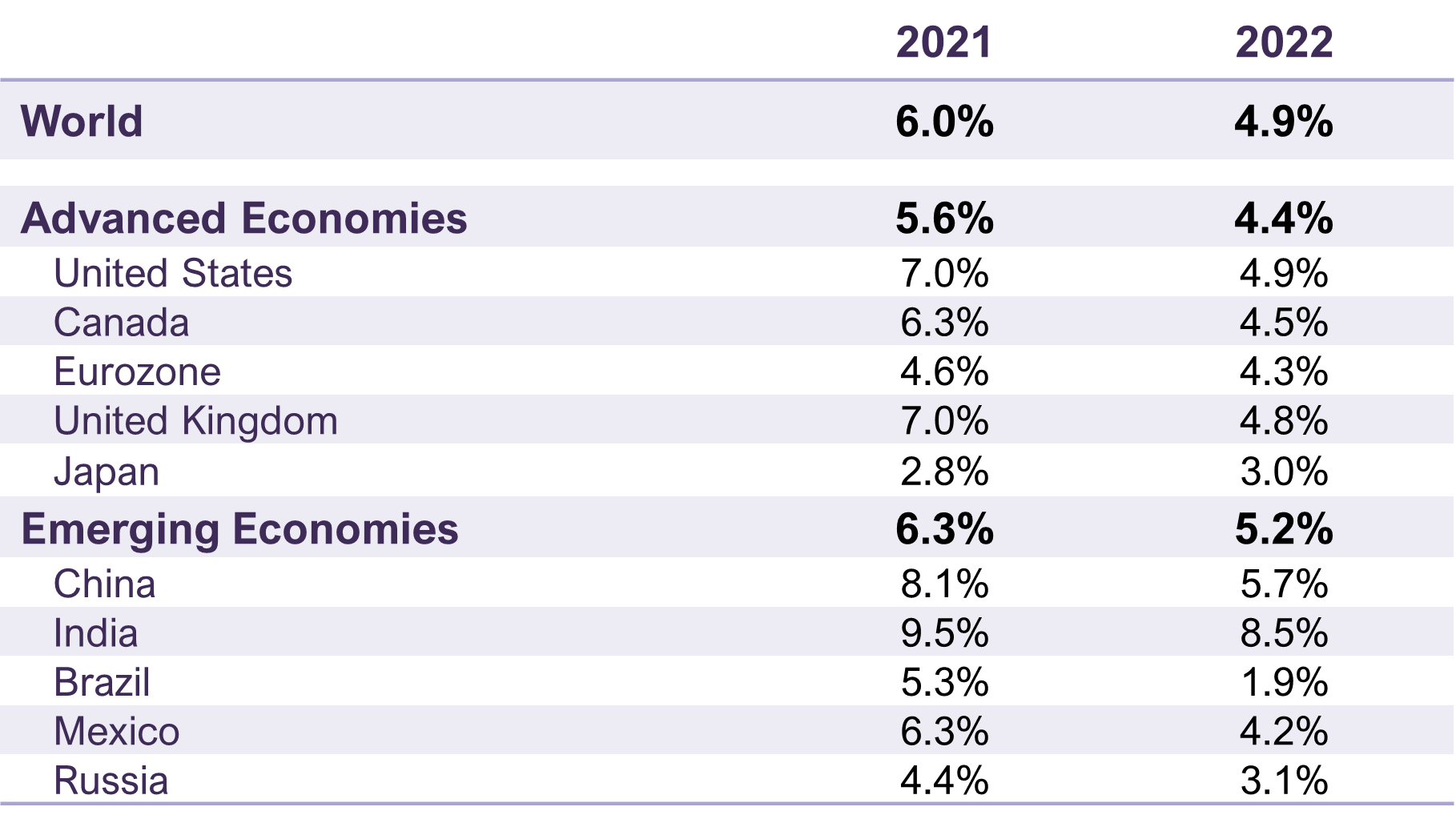

- The economic recovery continues to advance. The IMF expects 4.9% global real GDP growth in 2022, a rate well above the five-year pre-pandemic average of 3.4%.

- The U.S. continues to lead global growth. We forecast its economy will expand by 4.9% in 2022.

- Solid labour markets and household balance sheets point to strong consumer-led growth in Canada. With additional policy support in the pipeline, we expect Canada’s real GDP will increase by 4.5% in 2022.

- The Eurozone economy is poised to grow 4.3% in 2022, driven by robust domestic demand and accommodative monetary and fiscal policies.

- Facing near-term headwinds from variant outbreaks and regulatory uncertainty, Chinese real GDP is nonetheless forecast to rise by a healthy 5.7% in 2022. On balance, emerging market real GDP growth is expected to expand by 5.2% in the year ahead.

- While inflation could trend above the 2% target level in the short to medium term, we ascribe a low risk to systemically higher inflation materializing and derailing the expansion.

- Economic fundamentals support a positive outlook for equities. Valuations are elevated but not uniformly expensive.

- We continue to favour equities over cash and bonds. We believe our portfolios are invested in companies that are well-suited to tolerate higher inflation while offering meaningful value creation in the medium term.

Summary

The global economic recovery is powering ahead. Activity is rebounding impressively and, despite a resurgence in COVID-19 cases, there are many levers for growth. Strong wage gains, elevated private savings and record-high household net worth signal robust consumer demand. Together with the massive amount of monetary and fiscal stimulus already in the pipeline – and more on the way – a long runway of growth lies ahead.

Consistent with this positive outlook, global equity markets reached new highs in the third quarter. We believe this optimism is warranted. While monetary policy is set to gradually normalize, more fiscal stimulus is planned in the medium term. Activity has broadly shown to be resilient to waves of the pandemic and we do not foresee a return of extensive shutdowns. Indeed, 2022 is set to be another year of above-trend global growth. The IMF forecasts global real GDP will expand 4.9% in 2022, a rate that is well above its five-year pre-pandemic average of 3.4%.

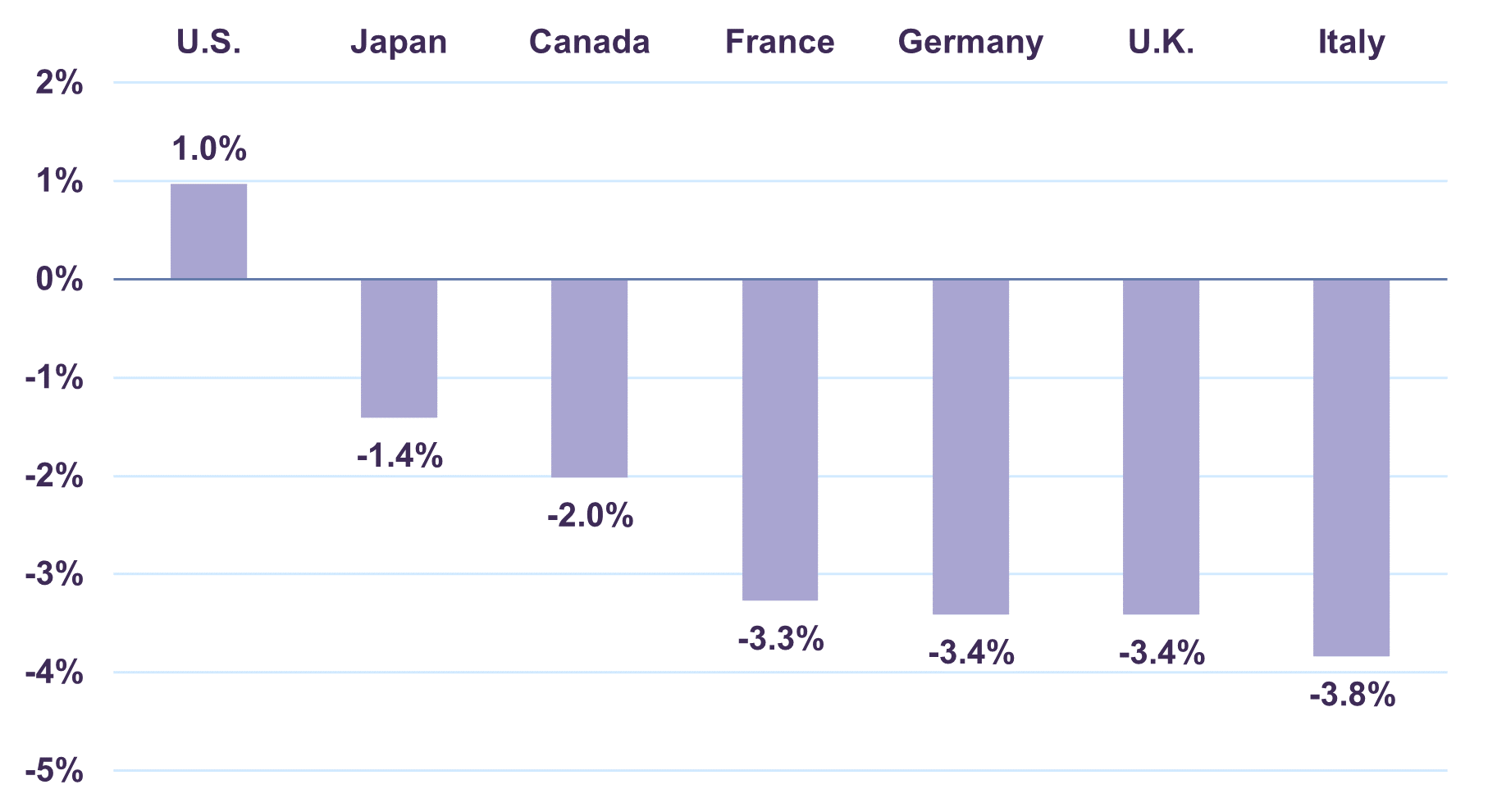

U.S. closes pandemic GDP gap

U.S. real GDP surged 12.2% year-over-year during the second quarter. The country became the first G7 nation to surpass pre-pandemic levels of activity (Chart 1). While the virus still poses a near-term challenge to full normalization, most indications suggest the U.S. will continue to be the global growth leader going forward.

Real GDP % Gap: Q2 2021 vs. Q4 2019

American households are well-positioned to boost growth. Average hourly earnings expanded 4.3% in August against one year ago while aggregate weekly payrolls increased 9.7%. The unemployment rate declined to 5.2% in August, its lowest level since March 2020, as over 500,000 jobs were created in the month alone. With July job openings at a record high of 10.9 million, the prospects for sustained employment growth in the months ahead are robust.

Recent sales data from retail to big-ticket items reflect strong consumer balance sheets. Retail sales surged 15.1% year-over-year in August as consumers were largely undeterred by a resurgence in COVID-19 cases. Restaurant and bar spending (+31.9% year-on-year), purchases of electronics and appliances (+18.1%), as well as still-resilient vehicle sales (+11.0%), all boosted retail activity in August. Record consumer net worth and an estimated $2 trillion in excess private savings suggest consumer spending has more room to run.

Existing home sales decreased 1.5% year-on-year in August as supply remained tight, while median existing home prices rose 14.9%. Housing starts recorded a robust annualized rate of 1.62 million units in August. The long-term outlook for U.S. housing is constructive. As outlined in our July 2021 Outlook, we estimate pent-up demand for housing may equal three to four million homes. Given that the U.S. household debt service ratio for mortgage credit and mortgage delinquencies are at an all-time low, banks are likely to keep credit widely available.

U.S. industrial activity is increasingly positive. Industrial production increased 5.9% against one year ago in August, marking six straight months of rising factory output. Total factory orders surged 16.0%, as durable goods and non-durable goods orders recorded double-digit gains of 18.2% and 13.9% respectively. The Markit Manufacturing Purchasing Managers’ Index (PMI) rose to 60.7 in September, further pointing to a robust outlook for the U.S. industrial complex and business investment over the coming year.

On the fiscal front, the $1 trillion bipartisan infrastructure bill approved by the Senate signals a long-term commitment to accommodative fiscal policy and is the latest in a series of relief packages totalling an aggregate $6 trillion. With another budget bill of up to $3.5 trillion advancing through Congress, the U.S. economy is poised to receive a multi-year boost to growth.

The U.S. is on track to grow 7.0% this year. We expect another year of above-trend growth in 2022, with real GDP forecast to increase by 4.9%.

Canadian economy resilient amid rising cases

Canada’s real GDP contracted 0.3% in Q2 relative to Q1 as pandemic mitigation measures slowed the economy’s momentum. However, overall activity remained resilient. Real GDP expanded 12.7% against one year ago and is only 2% below its pre-pandemic level. Canada’s recovery remains on track and the stage is set for robust consumer-led growth.

The unemployment rate fell to 7.1% in August, the lowest jobless rate recorded since February 2020. Meanwhile, employment rose by 90,000 as the economy gained 69,000 full-time positions. Wage data is also encouraging, with average hourly earnings up 1.25% year-on-year in August. Amid widespread reports of labour shortages, income relief programs are expected to come to an end in the weeks ahead. Solid job market fundamentals, elevated household savings and record-high private net worth further contribute to our constructive outlook for consumer spending.

There is mounting evidence that activity is rebounding with the easing of public health restrictions in the second half of 2021. Retail sales increased 5.3% year-on-year in July. Housing demand was robust, with home sales recording the second strongest August on record as average home prices rose 21.3% versus the prior year. On the industrial front, manufacturing sales surged 24.7% year-on-year in July. Industrial production increased 5.1% year-on-year in the same period, while durable goods orders grew 47.3%. The Markit Manufacturing PMI climbed to 57 in September, signaling a 15th consecutive month of expansion for factory output. Canadian industries are operating at the highest level of production capacity since Q4 2019, a supportive signal for business investment spending going forward.

Fiscal policy will likely remain accommodative. In addition to the roughly C$450 billion in relief spending granted since the beginning of the pandemic, C$78 billion in government support over the next five years is currently being planned to further boost economic activity.

With an entrenched recovery and additional policy support in the pipeline, we forecast Canadian real GDP will expand by a robust 4.5% in 2022.

Consumer-led recovery firms up in the Eurozone

Real output in the Eurozone rose 14.3% year-on-year in Q2, ending five consecutive quarters of contraction. This marked the fastest pace of expansion on record as demand surged amid a reopening of the region’s economies. Real output increased 9.4% against the prior year in Germany, 18.7% in France and 17.3% in Italy. Despite a new wave of infections related to the Delta variant, the Eurozone’s recovery continues to advance.

Consumer services and household spending are key drivers behind the expansion. The Markit Eurozone Services PMI reached a record high 59.8 in July, before moderating to 56.3 in September. Meanwhile, retail sales advanced 3.1% year-on-year in July, marking the fifth consecutive month in positive territory.

Domestic demand is expected to be sustained by improving employment. The number of employed persons rose 2.0%, driven by job gains in four of the bloc’s five largest economies. The Eurozone unemployment rate improved to 7.5% in August, in line with the pre-pandemic level of 7.4%.

While the outlook for consumer services is strengthening, indicators of Euro Area manufacturing activity are mixed. The Eurozone Manufacturing PMI recorded a third consecutive month of slower growth in factory output during September amid rising input costs and supply-chain constraints. Industrial production increased 1.5% month-on-month in June and 7.7% higher than the prior year. Industrial activity appears to be moderating after rebounding impressively through the first half of 2021.

The expiry of pandemic relief measures at year-end, including the short-term working scheme, loan guarantees and small and medium-sized enterprise loan moratoria, do not mark an end to Europe’s stimulus. The €750 billion E.U. recovery fund, equal to about 5.4% of E.U. GDP, will continue to provide payouts to member countries until 2026. Further, the budget and debt constraints of the European Stability and Growth Pact will be suspended through 2022, allowing member countries to gradually reduce fiscal support and avoid a so-called fiscal cliff.

We expect the Eurozone economy will expand by 4.3% in 2022, benefiting from robust domestic demand amid reopening, as well as extended policy support.

In aggregate, developed market economies are forecast to grow by 4.4% in the coming year, a rate more than double the pre-pandemic pace (Table 1).

Global Real GDP Growth (% Y/Y)

Mixed growth picture in emerging markets

China’s real GDP advanced 7.9% year-on-year in the second quarter. After a period of stimulus-fueled growth, activity appears to be moderating to more normal levels. However, a resurgent virus complicates the near-term outlook.

Delta variant outbreaks and government-imposed mobility restrictions weighed on service sector activity and domestic demand in August. The Caixin China Services PMI descended into contractionary territory for the first time since April 2020. Retail sales growth decelerated to 2.5% year-on-year from 8.5% one month earlier and passenger vehicle sales contracted 11.6%. On a year-to-date basis however, retail sales and passenger vehicle sales are 18.1% and 16.2% above 2020 levels respectively. Consumer demand is likely to rebound once pandemic health measures are lifted.

The outlook for China’s real estate market is less constructive. In August, home sales decreased 20% against the prior year and new home prices rose at the slowest annual rate in eight months. Property control measures such as restrictions on home purchases, higher mortgage rates and constraints on property developers’ access to funding, pose near-term challenges to activity but should help foster stability over the long run. A general tightening in regulations for other industries, including internet companies, for-profit education and online gaming, has raised concerns of a crackdown on private enterprise. Shifts in China’s regulatory regime require close monitoring going forward.

Trade activity mitigated weak domestic conditions in August. Exports surged 25.6% year-on-year, marking fourteen consecutive months of growth. China’s exports to the U.S. and E.U. increased by 15.5% and 22.7% respectively, while shipments to Canada advanced 6.3%, confirming the strength of developed market consumer demand. As a result, China’s trade surplus widened to $370 billion during the first eight months of the year, $115 billion above its pre-pandemic 2019 level. Trade will likely continue to be an offset to moderating domestic growth in the months ahead.

It is unlikely China will deploy the same scale of fiscal stimulus as that undertaken in 2020. However, if China’s slowdown intensifies, authorities could accelerate budgeted spending or bring forward next year’s issuance of local government bonds to boost infrastructure investment. On balance, growth remains resilient amid the near-term headwinds of delta variant outbreaks and regulatory uncertainty. The IMF forecasts Chinese real GDP will expand 5.7% in 2022.

In Q2, real GDP in India grew at a record 20.1% versus the prior year despite a second wave of COVID-related regional lockdowns. Key leading indicators suggest the economy’s strong performance carried over into the second half of the year. The Markit India Services PMI increased to 56.7 in August, pointing to the strongest service sector activity since February 2020. Meanwhile, the Markit India Manufacturing PMI remains in expansionary territory and the Reserve Bank of India’s Business Expectations Index has returned to pre-pandemic levels. Recovery is well underway in Asia’s third-largest economy and the IMF forecasts Indian real GDP will expand 8.5% in 2022.

Elsewhere, emerging market recoveries firmed in Q2 after suffering sharp declines last year. Mexican real GDP advanced 19.6% year-on-year and the Brazilian economy expanded 12.4%, both record highs. Growth also surged in Southeast Asia as the economies of the Philippines and Indonesia recorded their strongest rebounds in more than a decade. On balance, the IMF anticipates emerging market real GDP will expand by 5.2% in 2022.

Is inflation a risk to the global recovery?

The global economic recovery is on a promising trajectory and 2022 is shaping up to be another dynamic year for growth. Beyond the challenge of successive waves of COVID-19 variants, a key risk to our outlook is inflation. Most measures of inflation are elevated and, if price rises are systemic rather than transitory, this raises important implications for monetary policy, asset prices and economic growth.

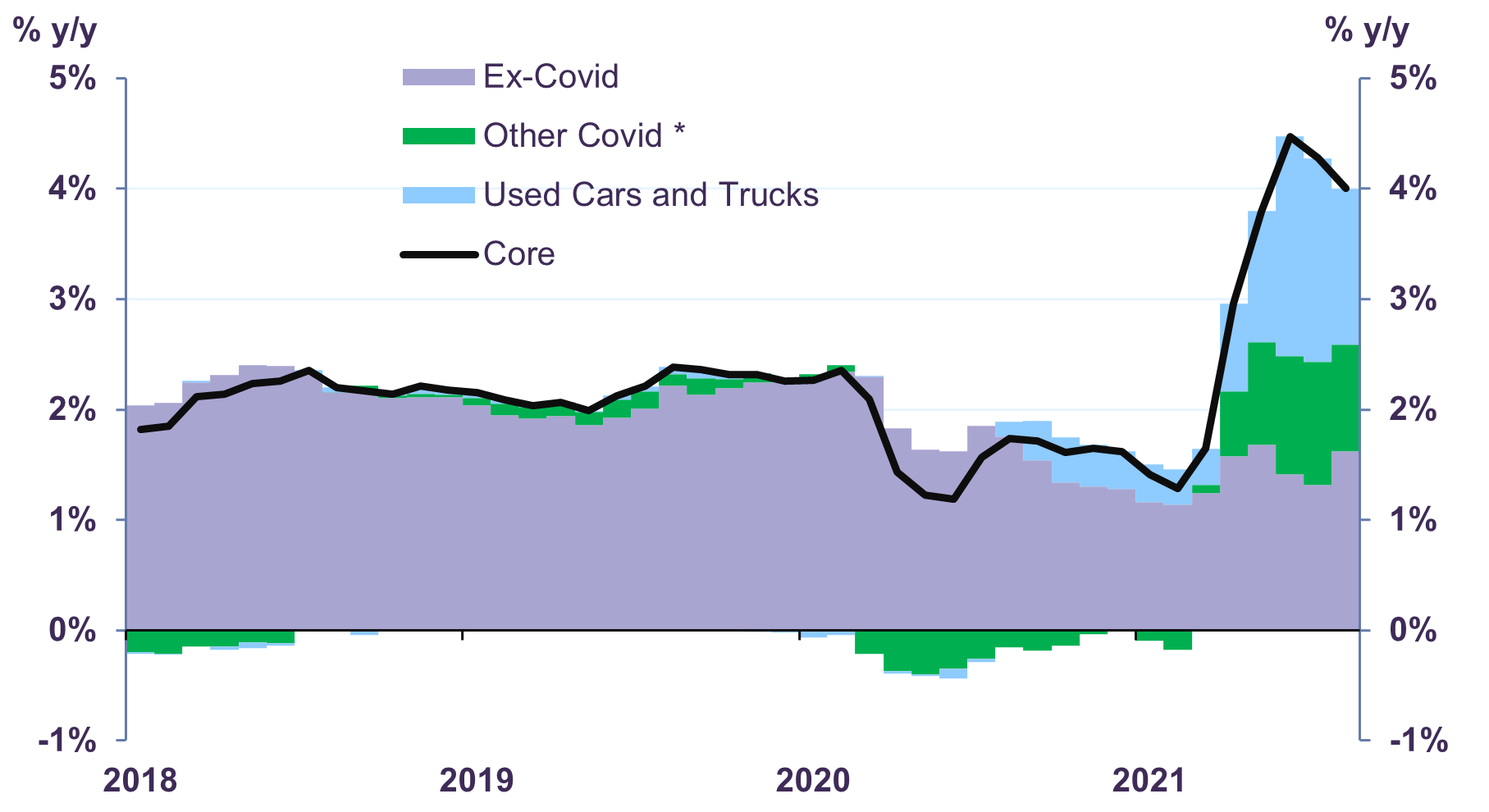

The U.S. Core Consumer Price Index, a measure of inflation that strips out the volatile components of energy and food, increased at an annual rate of 4.0% in August. Core prices are rising at double the Federal Reserve’s objective of 2% and are just shy of a 29-year high. Despite this trend, the Federal Reserve has stated that price pressures will temper due to two effects that will diminish over time. First, supply chain constraints will be resolved as economies fully reopen, and second, prices of certain goods and services which are temporarily distorted by the pandemic will eventually normalize.

We believe runaway inflation is a low risk, though CPI may stay somewhat above the 2% Fed target for some time. An analysis of core CPI shows that a handful of goods and services disrupted by the pandemic are skewing overall prices higher (Chart 2). In the three months to August, used car and truck prices rose at an average annual rate of 39.6%, more than 60 times their long run average. This alone accounted for more than one-third of core price growth. If one excludes used cars/trucks and a small subset of goods and services that were heavily impacted by COVID-19 such as new cars/trucks, car/truck rentals, airfares, lodging and furniture, U.S. core inflation would not have surpassed 2% at any point in the last year.

Breakdown of Core CPI

Source: U.S. Bureau of Labor Statistics, Letko Brosseau

Commodity prices, which surged throughout the latter half of 2020 and first half of 2021, are now moderating. The price of lumber peaked in May at $1,656 per thousand board feet; it has now returned to around $625. Similarly, the price of iron ore is down 52% from its pandemic high. This can also be seen in agricultural goods, as the price of corn is down 29% and soybeans are down 25% from their respective peaks. Labour shortages, another notable price pressure, are also set to abate. The coming months will bring the return of millions of people to the workforce as extraordinary government income support programs expire and immigration normalizes. This should increase the pool of labour and help anchor wage growth.

These factors support the view that global central banks will gradually – rather than aggressively – retract extraordinary stimulus measures. In the U.S., policy rate hikes are not scheduled until 2023. The Fed is still buying bonds to the tune of $120 billion per month, though this level will likely taper in the coming weeks. The Bank of Canada appears to be of the same mindset, leaving its benchmark interest rate unchanged at 0.25%, while reiterating that the pace of its C$2 billion per week bond purchase program will decline as the recovery proceeds. Meanwhile, the European Central Bank (ECB) explicitly stated its intent to modestly scale back its €80 billion monthly bond purchases. However, the ECB will continue asset purchases under its Pandemic Emergency Purchase Program (PEPP) at least until 2022, and reinvestment of maturing securities is scheduled through 2023.

While inflation levels could remain higher in the short to medium term, we are confident that runaway inflation will not materialize and derail the expansion. Given our understanding of the dynamics behind current price pressures, we believe the shift away from extraordinarily accommodative monetary policy will be gradual. Global growth will continue to benefit from both accommodative monetary and fiscal policy well into 2022.

Asset allocation strategy: overweight equities

Global equity markets performed strongly in the third quarter against a backdrop of firming global growth and ample stimulus. The S&P 500 Index advanced 15.3% year-to-date (total return in Canadian dollars), while the S&P/TSX (+17.5%), DAX (+5.6%) and the MSCI World (+12.4%) all recorded gains.

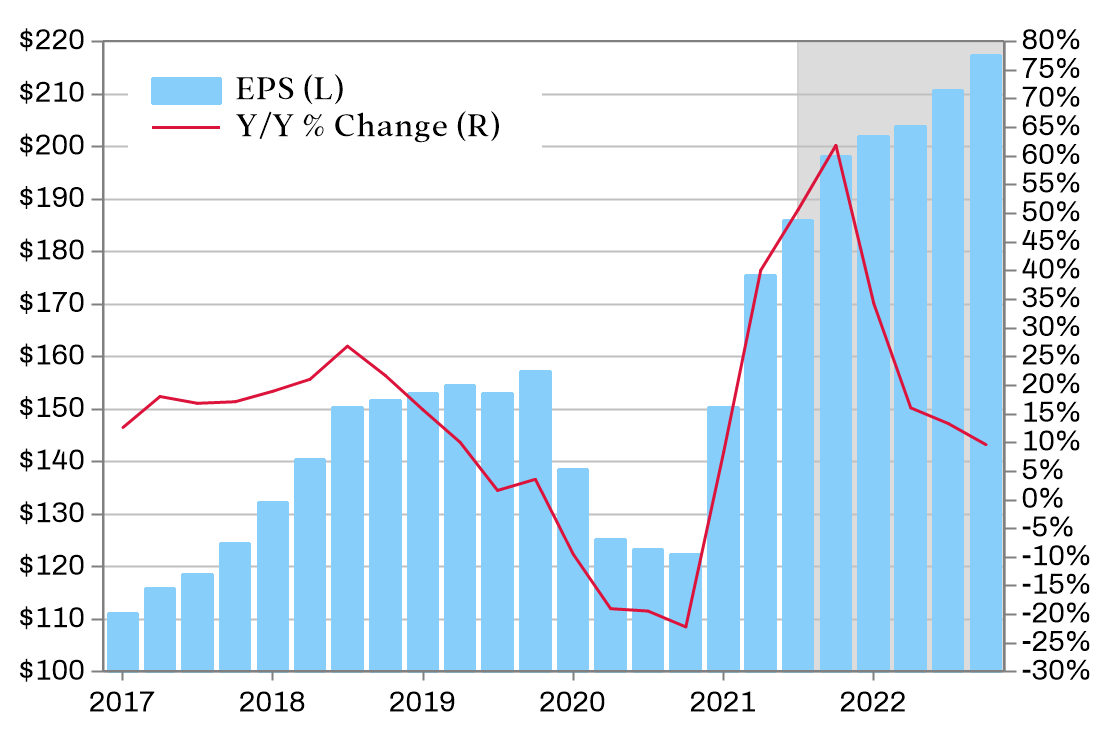

We believe economic fundamentals generally support a positive outlook for equities. S&P 500 earnings are expected to increase 9.7% year-on-year in Q4 2022, following an estimated 62% jump in 2021 (Chart 3). Analysts have been consistently revising estimates of company earnings upwards since the beginning of the year. S&P 500 EPS estimates for 2021 were adjusted higher for 60% of index constituents between January and September.

S&P 500 Operating Earnings per Share

In our opinion, equity markets are correctly reflecting the high likelihood that 2022 will be another year of above-trend global growth. Valuations, while elevated, are not uniformly expensive. The S&P 500 trades at 19.8 times 2022 earnings with a particularly wide dispersion across its constituents. The 2022 P/E multiple for the S&P 500 Value Index is considerably lower at 15.6 compared with the S&P 500 Growth Index at 25.2 times 2022 earnings. Such discrepancies signal both caution and opportunity. Our key investment principle of exercising price sensitivity is especially important in this environment. The Letko Brosseau global equity portfolio is currently valued at a reasonable 11.1 times 2022 earnings and provides a relatively attractive 2.9% dividend yield.

Should inflation remain above the last decade’s average of 1.8% for some time, this could spell trouble for certain stock sectors, as well as long-term bonds. As noted above, central banks appear prepared to accept price increases above 2% in the post-pandemic environment. In our view, our portfolios are well-positioned to tolerate higher inflation. We continue to tilt balanced portfolios towards equities over cash and bonds. Within equities, we have limited exposure to fixed-income-like securities, such as utilities and real estate, and our commodity holdings offer a natural hedge against moderate levels of inflation. Further, we expect our financial holdings to benefit from higher yields.

While we are optimistic about the prospects for equities, we continue to view the risk/return profile of bonds as unattractive. Bond markets have yet to reflect the post-pandemic reality of higher growth and inflation, largely due to the influence of monetary authorities’ extraordinary asset purchase programs. As these purchases are reduced in the months ahead, yields should begin to normalize. Even a gradual increase from current levels would inflict significant losses for holders of long duration instruments. A 30-year Government of Canada bond currently yields 2%. Should rates rise by just 1%, the bond would incur a capital loss of 20%. Capital preservation and low duration remain the focus of our fixed income strategy.

We continue to believe our overall investment strategy is well-positioned to offer meaningful value creation in the medium-term.

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN