Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

May 9, 2022

Global equity markets declined in April as multiple factors weighed on investor sentiment. Surging inflation, tighter monetary policy, ongoing risks stemming from the war in Ukraine and renewed pandemic-induced lockdowns in China are contributing to concerns that the risk of a global recession is rising. Year-to-date, the total return in Canadian dollars for all major indices was negative: the S&P 500 dropped 11.9%, the S&P/TSX declined 1.3%, the MSCI World lost 12.0% and the MSCI Emerging Markets index fell 11.1%. Certain industries experienced significant drops, with the technology-heavy NASDAQ down 19.3% in Canadian dollars year-to-date. Within our balanced strategy, we attribute the merits of our investment discipline as a major reason for the outperformance relative to benchmark. This discipline allowed us to avoid excessively-valued stocks that are overly reliant on uncertain future cash flows. It also allowed us to minimize the impact of rising interest rates which caused significant price declines in these stocks as well as long-term bonds.

Global economy will likely avoid recession in 2022

Most indicators of activity signaled another year of above-trend economic growth prior to the outbreak of the war in Ukraine. Following Russia’s invasion, disruptions to key commodities, namely energy products and agricultural goods, are complicating the inflation picture and weighing on global growth prospects.

As noted in last month’s report, the threat to the physical flow of energy products represents a principal risk to Europe’s economic activity given its reliance on imports of oil and gas from Russia. For instance, Russia recently cut off its supply of natural gas to Poland and Bulgaria. In addition, renewed lockdowns in China’s major cities, aimed at limiting the spread of COVID-19, will impact the economic output of the world’s second-largest economy. The lockdowns are forcing some large manufacturing hubs to halt their operations, causing further disruption to supply chains and world trade. The Chinese government is already easing monetary policy and increasing infrastructure spending to mitigate against slowing activity. As cases continue to rise and disruptions intensify, Chinese authorities will have to weigh the benefits of their zero-tolerance containment strategy against the risk of recession and social unrest. We forecast that while the lockdowns will lower China’s GDP growth by 1-2% in the second quarter, economic activity should normalize in the second half of the year and the country should avoid a pronounced downturn.

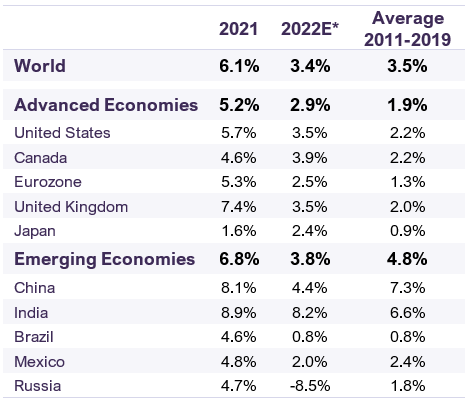

Given current headwinds to growth, we have revised downwards our 2022 economic forecast by 1% to 3.4%. Global real GDP growth is expected to temper to the average level seen during 2011-2019 (Table 1). As noted in our Economic and Capital Markets Outlook – April 2022, while inflation could persist at above-trend levels for some time, we are confident that the risk of runaway inflation is low. In turn, we foresee a gradual, rather than abrupt, normalization of monetary policy in advanced economies. The outlook in most parts of the world remains positive as major developed and developing countries have strong labour markets and sufficient growth momentum to absorb the headwinds from geopolitical risk and inflation.

Global Real GDP Growth (% Y/Y)

Source: IMF World Economic Outlook (April 2022) and Letko Brosseau

Managing portfolio risk while positioning for longer-term opportunity

We have written at length about the impact that ultra-low interest rates have on inflating the prices of certain assets. Exceptional monetary policy measures over the past decade, amplified by stimulus injected during the pandemic, led to record-high bond valuations. In addition, the use of low discount rates to value company earnings expected long into the future was a major reason for some stocks reaching excessively high multiples. As interest rates began to rise in the past year, these effects began to reverse.

The recent selloff in Netflix is a case in point. In our June 2020 Portfolio Update, we highlighted that the company was trading at a P/E multiple of 54 times 2021 estimated earnings per share or the equivalent of 54 years of profit. We questioned the reasonableness of this valuation in the face of rising competition from Amazon, Disney and HBO, among others. We also explained that its lofty valuation left the company vulnerable to an earnings disappointment and how rising interest rates could have a deflating effect on its P/E multiple. Fast forward to today, the company recently announced that it expects to lose two million global subscribers in the current quarter, and the share price is down 66.7% year-to-date. In the Canadian equity market, similar examples of companies having experienced speculative price runs are Shopify and Canopy Growth. Both companies saw their stock prices rise to record levels before collapsing and destroying billions of dollars in value due to factors such as slower revenue growth forecasts and the impact of rising interest rates on their valuations. Shopify and Canopy Growth have lost 72.7% and 89.1% of their market value since their recent peaks in November 2021 and February 2021, respectively.

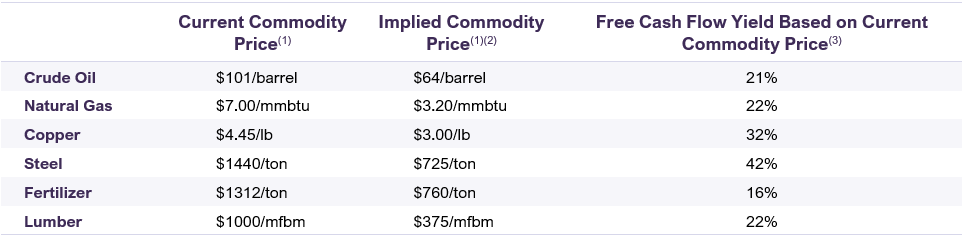

Our portfolios’ exposure to commodity companies has been a positive offset to stock price volatility in other sectors. Agriculture, energy, and industrial metal prices spiked at the outset of Russia’s invasion of Ukraine in late February and are now stabilizing, albeit at prices above pre-conflict levels. We have trimmed exposures at a profit on many of our commodity holdings in order to manage the risk to our portfolios, though we believe these companies still offer potential upside. Our analysis suggests that our commodity holdings trade at a discount to current elevated commodity prices. For instance, our portfolio’s oil companies’ valuations imply an oil price of $64 per barrel of West Texas Intermediate (WTI) while the current spot price is around $101 per barrel. In addition, these companies are generating high levels of cash which could be used to further enhance value by paying down debt, investing in new projects, making acquisitions or paying special dividends (Table 2).

(2) The implied commodity price is calculated using a weighted average methodology for all LBA portfolio holdings with exposure to each listed commodity.

(3) The free cash flow yield measures the free cash flow per share all LBA commodity holdings are expected to earn against their market value per share using a weighted average methodology.

Concluding Thoughts

We are presently navigating an uncertain environment, but we believe it is premature to forecast an imminent recession. As we manage the risk in our portfolios, we think it wise to avoid hasty actions based on short-term predictions of market movements. In our view, our portfolios are less exposed to the impact of rising rates and offer some protection from geopolitical risk, while trading at a reasonable valuation of around 10.5x estimated 2022 earnings. We have avoided overpriced assets, many of which have run into trouble over the last several months. Our equity portfolios include sectors that offer a natural hedge against inflation and are less vulnerable to rising interest rates, while our bond portfolios are constructed to mitigate the impact of central bank policy rate hikes.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN