Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

July 11, 2022

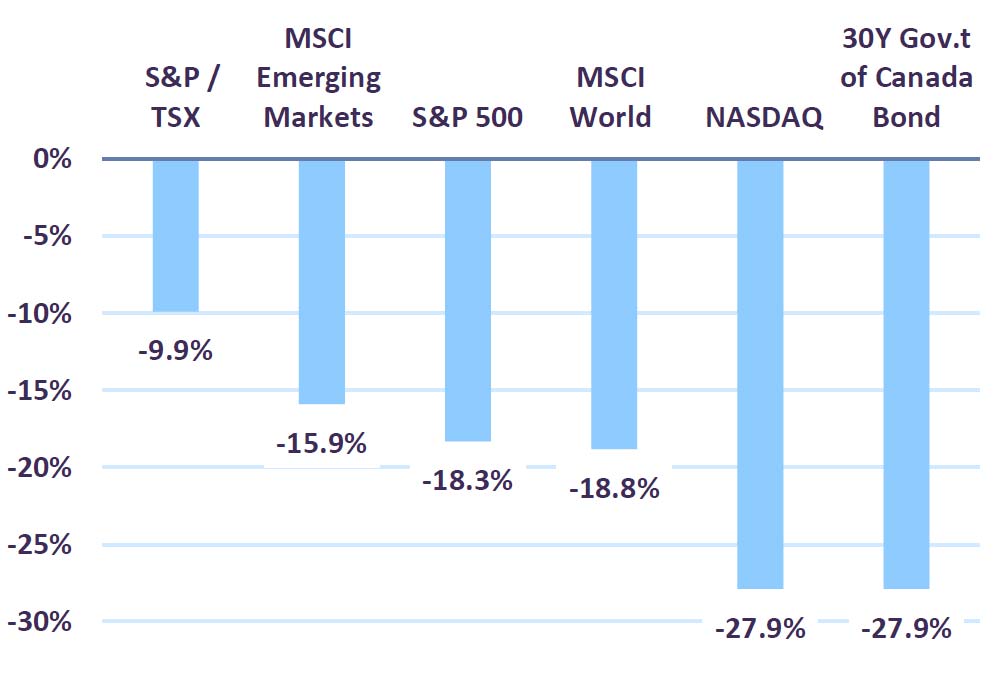

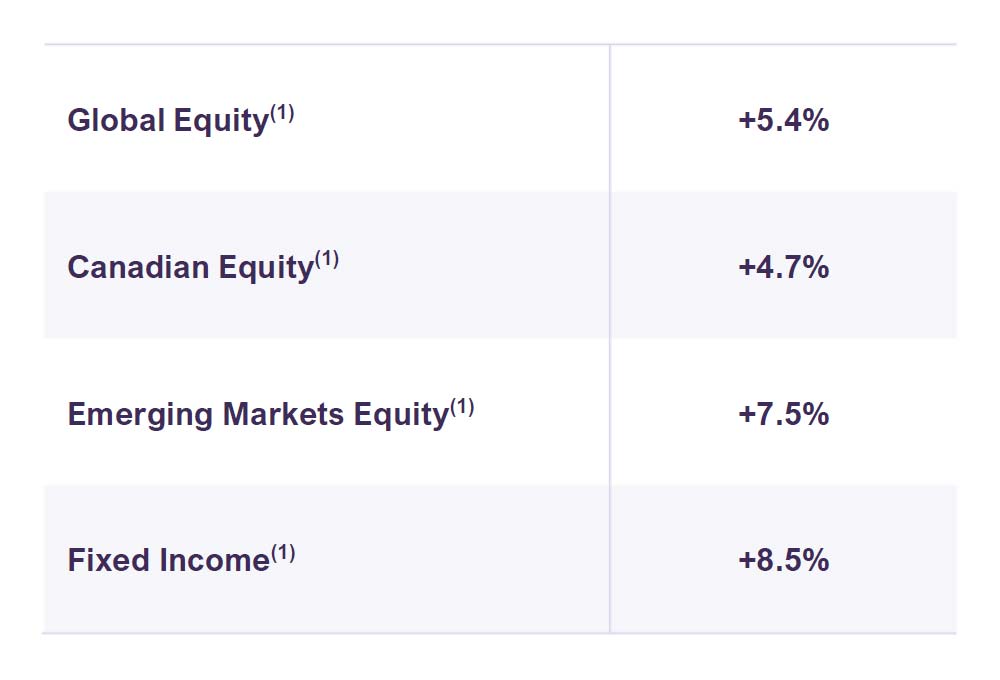

The month of June saw broad-based declines across major asset classes. Rising inflation and the prospect of aggressive rate hikes led investors to price in a higher probability of recession. Year-to-date, the total returns of most equity markets declined by more than 15% and the sharp drop in long-term bonds was on par with that of the NASDAQ (Chart 1). Meanwhile, the bubble in cryptocurrencies appeared to burst as Bitcoin collapsed 40.0% in the month of June and 58.8% year-to-date. Although our portfolios were impacted by the correction, they saw considerably less volatility than market indices (Table 1).

Global central banks are tasked with the challenge to bring inflation down from multi-decade highs. The U.S. Federal Reserve raised its benchmark interest rate by 75 basis points to 1.75% in June, the largest increase since 1994, and signaled more rate hikes were likely required. The S&P 500 has fallen by a median 24% in the twelve U.S. economic contractions following World War II; the S&P 500 dropped 22.9% from its last peak suggesting that markets now appear to reflect a recession scenario. While the global economy is slowing as we expected, we believe it is premature to conclude current events will trigger a broad-based recession.

Total Returns in Canadian dollars

(YTD to June)

Letko Brosseau Returns Relative

to their Benchmarks (YTD to June)

The likelihood and severity of a possible recession differ across economies

As we detail in LBA’s July Economic and Capital Markets Outlook, the balance of risks differs across regions. The economies of Canada and the U.S. are in a better position to address a cycle of monetary tightening. Both countries are important producers of natural resources with reasonable debt levels. At the consumer level, excess savings accumulated during the pandemic continue to offset gradually rising debt servicing costs and higher living expenses born by consumers. Furthermore, the demand for labour in these countries remains high, incomes are rising, and unemployment rates are at multi-decade lows. The situation in Europe is more challenging due to the continent’s dependence on Russian energy imports and the cost-of-living squeeze on consumers from surging energy and utility bills. The prospect of a recession in emerging market countries varies. India is expected to maintain its strong growth momentum and China’s fiscal and monetary policy stimulus together with a lifting of its strict COVID restrictions are showing signs of boosting activity. Near-term growth prospects are less positive for Brazil and South Africa, while Russia is expected to be mired in a multi-year recession. On balance, we expect global real GDP to decelerate from 6.1% in 2021 to 2.9% in 2022 and 2.6% in 2023.

Letko Brosseau equity portfolios offer value and growth opportunities

As global investors seeking to buy companies with solid fundamentals and strong long-term growth prospects, the recent declines offered us an opportunity to initiate new positions and increase our allocation to companies trading below our assessment of fair value. Since the beginning of the year, we reduced our exposure to the energy and materials sectors, realizing important profits, and reallocated this capital to well-valued companies that are leaders in their industry. Some examples of recent purchases include:

- Maple Leaf Foods is one of Canada’s largest food producers, operating in two divisions – meat protein (95% of the company’s revenue) and plant-based protein. A market leader in branded processed meats and fresh pork and chicken, the company has a growing presence in the U.S., led by its strong RWA (raised without antibiotics) offering. Maple Leaf is on track to open a new poultry processing facility this year which will enable it to meet the growing demand from its retail customers for value-added chicken. The commissioning of this new facility will be followed by the closure of three older, less efficient plants which together will support continued margin expansion at the company. While recent results have suffered due to widespread supply chain disruptions and impacts from Omicron, we expect margins will recover and, in fact, continue to expand, supported by the new poultry processing facility. Maple Leaf Foods’ shares trade at an attractive 12x 2023 forecast earnings and pay a 3.2% dividend yield.

- Alphabet is a leading technology holding company whose main assets include Google Services, Google Cloud, and a diverse collection of high-potential early-stage technology companies. Alphabet offers consistent long-term structural growth in its core businesses driven by increased adoption of the cloud and continued online advertising (Google Search, Google Maps, YouTube, etc.). These core high-quality businesses are then leveraged to support other high-potential initiatives such as autonomous driving (Waymo), drone-delivery (Wing), and improving human health (Verily). We believe Alphabet offers a unique combination of proven structural growth with meaningful upside opportunities and is forecasted to grow sales at over 10% per year. The company trades at an attractive 16x 2023 forecast earnings net of cash.

- Power Grid, India’s largest electric power transmission company, operates approximately 90% of the country’s interstate/inter-regional networks and transmits more than 40% of the power generated in the country. India has one of the lowest per capita electricity consumption rates in the world, just 28% of China’s and 6% of the US’ level. The company has undertaken several key infrastructure projects such as upgrading the national grid and building a smart network. Well-positioned to benefit from India’s long term renewable strategy and infrastructure demand, we expect Power Grid to steadily grow earnings by a 5% compound annual growth rate over the next three years. Valuation is currently at 10x 2023 forecast earnings and the company pays a 6% dividend yield.

Though we do not discount the potential for continued volatility as we progress through this period of uncertainty, we believe the investment landscape presents interesting opportunities. Our equity portfolios are attractively valued at 9.2x forward earnings, 5.6x cash flow and offer a 3.4% dividend yield.

Concluding Thoughts

We are confident that our portfolios remain well-positioned to weather the challenges from a slowing economy and rising interest rates. The strategy to maintain credit quality high and duration low has substantially limited the impact of higher rates on our bond portfolios. Equity holdings have benefited from exposure to commodities and defensive sectors, while our avoidance of overvalued technology stocks has shielded the portfolios from the large declines experienced in this segment of the market. Recent volatility provided an opportunity to invest in well-capitalized companies with strong growth prospects. We will continue to monitor the market for possible dislocations from fair value, searching for long-term investment opportunities. We believe our portfolios can navigate growth headwinds and capture secular trends, while still offering reasonable value.

Legal notes

(1) Performance results reflect the reinvestment of dividends, income and other earnings and are presented net of all foreign withholding taxes. Reclaimable withholding tax refunds are recognized when received. The benchmark is fully invested and its returns include the reinvestment of dividends, income and other earnings and are presented net of withholding taxes. Performance results are presented before management and custodial fees but after trading commissions.

Composites and benchmarks information:

- Global Equity: LBA Global Equity (Canadian Bias) Composite. The benchmark is 2% FTSE Canada 91 Day T-Bill Total Return Index, 34% S&P/TSX Composite Total Return Capped Index and 64% MSCI All Country World Total Return Net Index.

- Canadian Equity: LBA Canadian Equity Composite. The benchmark is 2% FTSE Canada 91 Day T-Bill Total Return Index and 98% S&P/TSX Composite Total Return Capped Index.

- Emerging Markets Equity: LBA Emerging Markets Composite. The benchmark is 5% Deutsche Bank Fed Funds Effective Rate Total Return Index and 95% MSCI Emerging Markets Total Return Net Index.

- Fixed Income: LBA Canadian Fixed Income Composite. The benchmark is 5% FTSE Canada 91 Day T-Bill Total Return Index and 95% FTSE Canada Universe Bond Total Return Index.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN