Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

February 8, 2022

Global equity markets began the new year with price declines. During the month of January, the S&P 500 (Canadian dollars) fell 4.9%, the S&P/TSX decreased by 0.6% and the MSCI World Index dropped by 5%. Market volatility was mainly triggered by a perception that central bank policy rates will rise at a faster pace than originally expected. Our portfolios performed significantly better than market benchmarks and ended the month in positive territory.

Now that we are in the second year of recovery from the pandemic, monetary policy is beginning to normalise. Due to supply side disruptions, strong demand and a labour shortage, inflation has risen putting more pressure on central banks to tighten monetary policy. The forward market is pricing six to seven quarter-percentage point Federal Reserve rate hikes over the next two years, a gradual approach to raising rates. Given that the fair value of common stocks is derived from discounting future expected cash flows, rising interest rates are particularly negative for companies generating little or no profits and trading at high multiples of earnings and cash flows. We have written extensively on this subject and invite you to revisit “The illustrious history of growth through value investing” for a comprehensive review of this important concept.

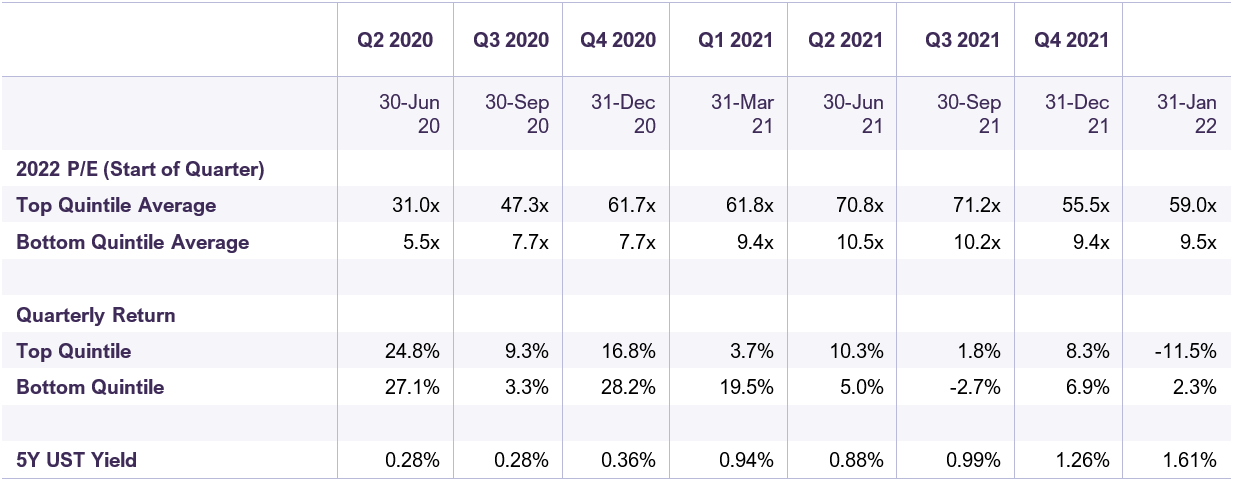

The shift towards a more restrictive monetary policy was not felt uniformly across all equities. Those trading at high multiples were impacted more negatively. As shown in Table 1, share prices for the most expensively valued stock quintile in the S&P 500 (trading at an average 59 times earnings) decreased by 11.5% during the month of January. Netflix, for example, which traded at 46 times earnings at the end of 2021, decreased by 29% in the first month of the year. At the opposite end of the spectrum, share prices for the least expensive stock quintile increased by 2.3%.

Breakdown of S&P 500 Index Valuation and Quarterly Returns by Quintile

*Based on equity prices as of January 31, 2022.

Sources: FactSet (www.factset.com) financial data and analytics consensus estimates and LBA calculations

Our portfolios are highly diversified, by industry and geography, and exhibit value characteristics similar to the bottom quintile valuations, trading at 11.5 times earnings, 6.8 times cash flows and paying a 3% dividend yield. We have carefully avoided speculative companies trading at lofty valuations. We are confident that your capital is well positioned for growth over the medium- and long-term while offering protection from interest rate increases.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN