Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

December 9, 2022

Equity markets increased sharply in the past two months as inflation has shown signs of a downward trend. While fears of persistently high inflation and the impact of aggressive monetary tightening may be beginning to abate, we cannot ignore the potential for further market volatility as price pressures remain above trend, the global economy adjusts to a slower growth path and the full effects of rate hikes are felt in 2023.

Our strategy continues to favour companies with strong balance sheets that trade at attractive valuations, while avoiding securities that are priced well above their fundamental value and are sensitive to rising interest rates. On a relative basis, our core portfolios have done well to preserve capital during periods of heightened volatility and have also benefitted from the recent rally. Year-to-date returns for our equity, balanced and fixed income portfolios are well ahead of their benchmarks.

Staying the Course

Concerns surrounding the impacts of inflation, a possible recession, and geopolitical conflict weighed on financial markets throughout most of this year. Investors appeared to have swung from periods of panic to euphoria based on economic data releases and anticipated action from central banks. In the first nine months of the year, the S&P 500 index shed nearly one-quarter of its value. In October and November, US stock prices were up 13.8%. If inflation proves to be stickier than the market anticipates, there will likely be further rate hikes and pessimism could return. We believe the greatest risk to an investor is attempting to time short-term market movements. In our August Portfolio Update, we highlighted the importance of patience in investing. Investors who decide to sell their diversified portfolio of quality securities and temporarily shift to cash typically do so when pessimism is greatest, and only buy back after assets have rallied and their sense of optimism is firmly grounded. Those who remain disciplined in challenging periods and maintain a long-term focus have a much greater chance of achieving their investment goals. An often-overlooked risk to a long-term investor is missing the subsequent advance following a temporary market downtown.

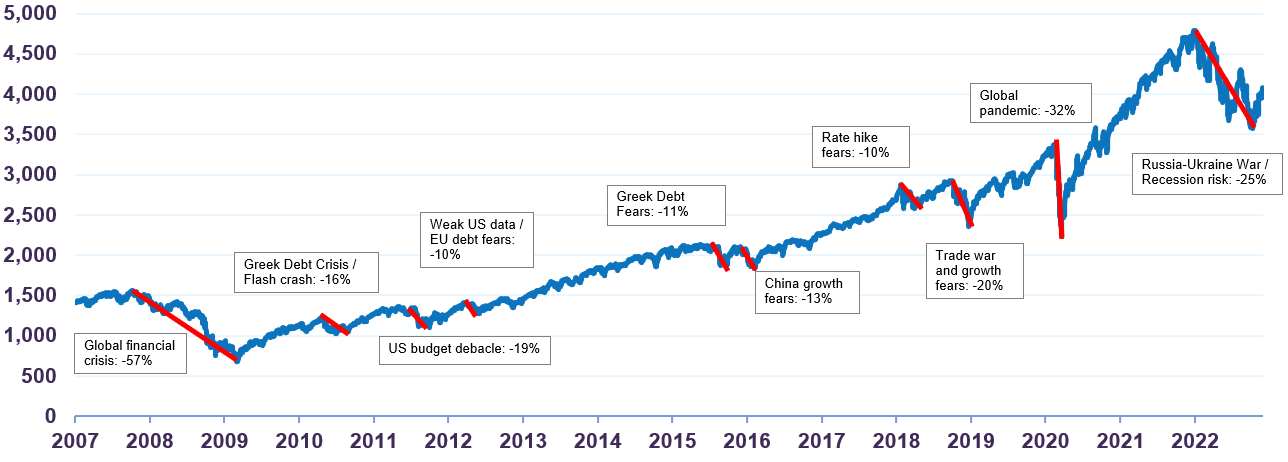

In the following graph, we chart the performance of the S&P 500 index since 2007, highlighting periods when the index declined by 10% or more from its peak. Each correction reflected the leading concern at that point in time and predictions on when or how the economic disruption would end were bleak.

S&P 500 Corrections of 10% or more

Source: Standard & Poor’s, Letko Brosseau.

The common denominator amongst these crises and corrections was that they led to dislocations between share prices and underlying value which, invariably, were temporary in nature. Macroeconomic concerns should therefore be less important to a long-term investor than whether their portfolio holds quality investments at attractive valuations.

Market leading companies continue to offer attractive return potential

Our investment strategy involves analyzing structural and demographic trends in the industries we invest in, and determining the companies best positioned to benefit from these trends over the long term. During the year, we took advantage of short-term price weakness and increased our positions in Siemens AG and CAE Inc., two market-leading companies in the industrials sector.

Siemens AG, a holding in our global equity portfolio, is actively supporting manufacturers across the world as they implement greater automation in their production processes. Challenges in the supply chain and labour markets have pushed manufacturers in various industries to consider automation as a long-term solution, and we are confident in Siemens’ ability to benefit from this trend.

CAE Inc., a holding in our Canadian equity portfolio, is a manufacturer of simulation technologies and is positioned to benefit from increasing demand for its products. The company has a globally diversified client base and operates the world’s largest civil aviation training network. As the middle class within emerging markets continues to grow, we believe this will increase the demand for air travel and, to meet this new demand, an influx of new pilots will need to be trained.

Concluding Thoughts

Patience in the face of volatility will continue to benefit investors over the long term. The longer the time frame, the greater the likelihood of a positive outcome. Our investment strategy to maintain credit quality high and duration low has substantially limited the impact of higher rates on our bond portfolios. For equities, we continue to monitor the market for possible dislocations from fair value, searching for long-term investment opportunities. In the current environment, we would like to assure you that our equity portfolios are well diversified by geography and industry, trade at a very reasonable valuation of 10.1 times estimated 2022 earnings and are supported by an attractive 3.6% dividend yield.

Highlighting the Success of the Letko Brosseau Emerging Markets Strategy

Propelled by favourable demographics and rising incomes, emerging markets are growing at twice the rate of their developed market counterparts. The Letko Brosseau Emerging Markets Equity Fund offers exposure to compelling investment opportunities in these developing economies. The global equity portfolios under our discretionary management include a meaningful allocation to emerging markets. We are proud to announce that the RBC Investor & Treasury Services Pooled Fund Survey, an independent survey of funds available to Canadian institutional investors, ranked our Emerging Markets Equity Fund in the first percentile for each of Q3 2022, 1-year, 2-year, 3-year and 10-year performance periods, among a pool of 30 other emerging market funds.1 We attribute this success to our active investment strategy. By emphasizing careful analysis of companies, exercising price-discipline and diversifying across a wide range of emerging market geographies, we are confident our portfolio will continue to benefit from this exposure.

1 The RBC Investor & Treasury Services’ Q3 2022 Pooled Fund Survey can be accessed via the following link.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN