Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

December 10, 2021

Global financial markets experienced some turmoil over the last two weeks, driven by the emergence of Omicron, a new variant of Covid-19. This, combined with expectations that central banks may begin to raise interest rates sooner than many expected, put pressure on equity markets. Nonetheless, year-to-date returns to end-November remain strong: the total return of the S&P 500 Index (in Canadian dollars) is 24.0%, the S&P/TSX is up 21.4% and the MSCI World Index has risen 17.6%. Our strategies have outperformed their benchmarks over the same period, and we believe our portfolios are well positioned to create good value over the longer term.

Is Omicron going to derail the recovery?

With over 50 mutations, the Omicron variant has raised concerns within the scientific community. The implications of these mutations remain uncertain in terms of impact on the severity of disease, prior immunity and transmissibility. However, not all mutations are harmful. Some have no impact on the virus, some can be counterproductive, and it may depend on the local environment where it is spreading.

Further study may indicate a reduction of protection against infection conferred by vaccination due to potentially lower antibody activity. However, as was the case with the Alpha and Delta variants, protection against severe disease could remain very high due to the activity of T-cells in the immune response. Vaccines should maintain some degree of efficacy against this variant, especially in terms of hospitalizations and death. Antibody treatments like sotrovimab, which was developed by GlaxoSmithKline and Vir Biotechnology, have been shown to retain activity against key mutations of Omicron in pre-clinical studies. Oral antivirals from Merck and Pfizer are expected to be effective given their mechanism of action. Existing testing platforms, including rapid antigen tests, do not appear to be impacted by the mutations. Overall, the toolkit of countermeasures developed over the past 21 months remains powerful. While uncertainty remains around the profile of the new variant, we expect that the transition from a pandemic to an endemic phase of the virus, allowing for a return to normality, will broadly continue in the months ahead.

Our investment strategy remains on track

Despite the recent short-term volatility observed in financial markets, we continue to believe our investment strategy remains on track to create long-lasting value. As we discussed in last month’s update, our portfolios trade at reasonable multiples of earnings, cash flows and book value. We are exposed to sectors offering a natural hedge against inflation (commodities) and those which tend to do well in rising rate environments (financials). We are limiting exposure to fixed income-like sectors such as utilities and real estate. We are also avoiding high valuation stocks, which have historically shown to be more vulnerable to rising interest rates.

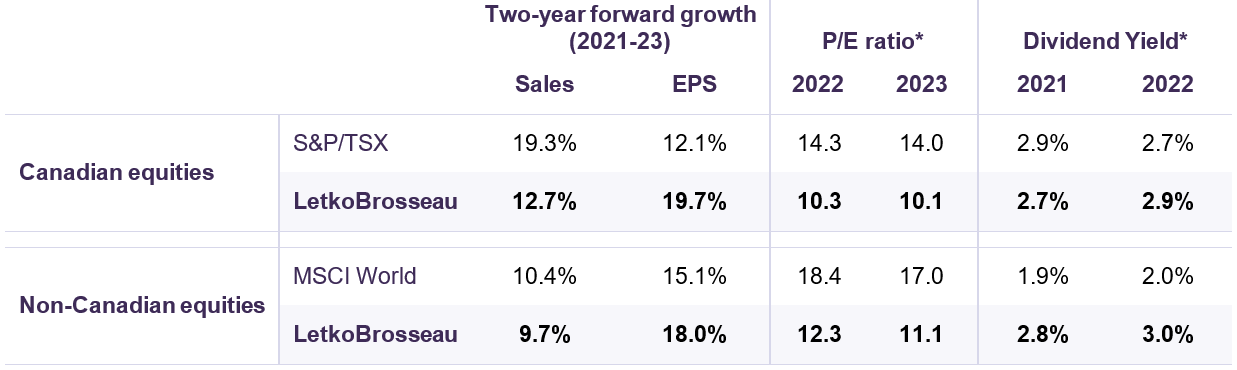

We are optimistic with respect to the solid operating performance of our companies. During the third quarter, 60% of our Canadian investments and 86% of our international holdings beat consensus earnings estimates and, on average, earnings came in 21% (Canadian) and 23% (international) above consensus. For the portfolio as a whole, profits were up 180% year-on-year to September for our Canadian companies and up 100% for our international companies over the same period. Looking out over the next 24 months, earnings growth should temper as the global economy moves from the rebound stage to the sustaining stage of the cycle. Our Canadian equity portfolios are expected to grow profits by a cumulative 19.7% while our international portfolios should see a similar increase in earnings (Table 1).

Projected key metrics of companies in LetkoBrosseau equity portfolios vs. benchmark indexes

*Based on equity prices as of November 30, 2021.

Sources: FactSet (www.factset.com) financial data and analytics consensus estimates and LBA calculations, Letko Brosseau Canadian Equity Fund, Letko Brosseau International Equity Fund

We continue to be very disciplined about the price we pay for every investment we make. We focus on intrinsic value and avoid situations that could result in a permanent impairment of capital. As a result, our Canadian and International portfolios trade at around a 30% discount to their equity benchmarks and offer good value at 10.3x and 12.3x estimated 2022 earnings respectively. If the earnings growth forecasts shown in Table 1 are realized and the P/E multiples remain constant, our equity portfolios could deliver an approximate 12% total return per annum over the next two years. For balanced portfolios, considering our very modest return expectations for fixed income, we expect that returns in the range of 6%-8% are feasible.

On balance, we believe the global economy is likely to manage through the Omicron variant. We encourage patience in the face of volatility, and a focus on the long-term reward potential.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN