Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

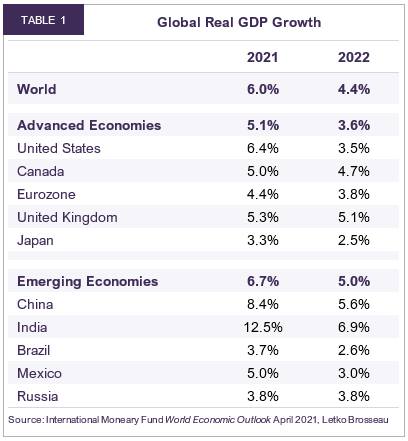

April 2021- The global economic outlook is increasingly positive. The IMF anticipates world real GDP will grow by 6.0% in 2021 while investment banks like Goldman Sachs estimate growth of 6.8%. This represents a multi-decade high.

- S. fiscal and monetary stimulus totals $12.3 trillion, the largest pandemic response effort in the world. With more relief spending on the way, we forecast U.S. real GDP will expand by 6.4% in 2021.

- An improving job market and excess savings should boost consumer spending in Canada during 2021. We expect real GDP to increase 5.0% in the year ahead.

- Eurozone economic activity will benefit from continued stimulus and a strengthening global recovery, and we anticipate output will expand by 4.4% in the year ahead.

- The IMF forecasts emerging markets’ real GDP will increase 6.7% in 2021, with China and India leading the region.

- Global equity markets reached new highs in Q1. Conversely, bond markets began to question the sustainability of historically low rates in the face of record high national deficits and signs of rising inflation.

- We continue to favour stocks over cash and bonds. Our portfolios are invested in companies with sustainable business models offering products and services for which demand is growing. We favour companies with advantages that include proprietary products, dominant market position and low cost structures. We believe these characteristics, when bought at reasonable valuations, is a recipe for investment success.

Summary

Global equity markets climbed to new highs in the first quarter of 2021. Robust income growth, record household net worth and high private savings point to significant support for consumer spending as pandemic constraints subside.

This will create positive spillovers to global manufacturing and trade, which are already benefiting from a solid pick up in investment and business confidence.

The promise of additional monetary and fiscal stimulus further strengthens our conviction that 2021 will be a dynamic year for the global economy. The IMF forecasts that global real GDP growth will accelerate to 6.0% in 2021, a multi-decade high.

U.S. bolstered by stimulus

U.S. real GDP expanded 1.1% quarter-over-quarter in Q4, building on the recovery that began in Q3. Despite renewed restrictions on mobility, consumption grew 0.9% quarter-on-quarter in nominal terms. Government spending played a vital role in offsetting the negative impact of the millions of jobs lost in the first half of 2020.

In January, household disposable incomes soared 14.9% against a year ago, driven by government transfers, which increased a staggering 80.3%. Bolstered by $600 per person stimulus cheques, the U.S. private savings rate jumped to 19.8% from 13.5% a month prior. The outlook for consumer spending over the coming quarters is strongly positive. U.S. private savings are nearly twice pre-pandemic levels and household net worth is at a record-high $130 trillion. Retail sales growth of 6.3% year-on-year in February confirms consumers are converting pent-up demand into purchases.

The labour market is healing. The U.S. economy added 609,000 jobs in March and the unemployment rate decreased to 6.0%. The new round of stimulus approved this March includes a $1,400 cash transfer to most Americans as well as fortified unemployment benefits. This is expected to boost disposable incomes, savings, and net worth even higher.

Residential investment rose 9.8% quarter-on-quarter in Q4 and is now above its pre-pandemic level. While the 30-year mortgage rate climbed 50 basis points (bps) from end-2020 to 3.17% in March, it is still 33 bps lower than a year ago and well below the 20-year average of 5.09%. Home sales registered a strong positive start to the year, with both new and existing home sales in February up 8.2% and 9.1% respectively against a year ago.

Indicators for industrial activity suggest U.S. manufacturing is expanding at a fast pace. The Markit Manufacturing Purchasing Managers’ Index (PMI) came in at 59.1 in March, as solid increases in output and new orders drove the improvement. As of February, durable goods orders and shipments have each posted five increases in as many months. With overall industrial production approaching pre-pandemic levels, U.S. industrial sector growth will continue to boost aggregate activity going forward.

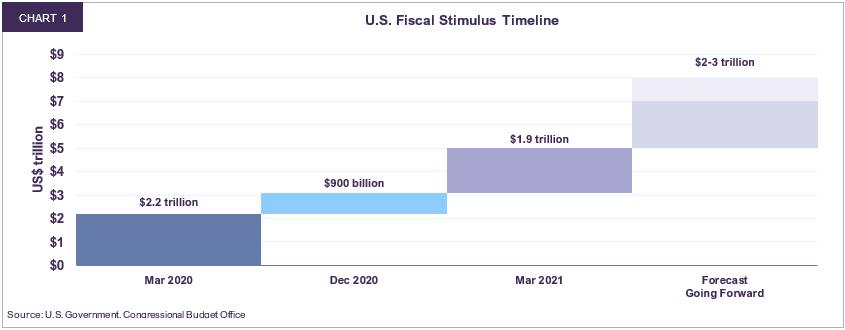

The $1.9 trillion COVID-19 relief bill passed in March marked the third significant U.S. fiscal stimulus package since the beginning of the pandemic. There are already plans for more: the Biden administration proposed a $2 trillion infrastructure package that is widely expected to be the first of two spending measures, which combined will total approximately $3 trillion (Chart 1). With a focus on investment, this upcoming round of stimulus could provide a multi-year boost to activity.

On the monetary policy front, the Federal Reserve remains committed to an accommodative stance and is willing to tolerate higher levels of inflation in order to achieve maximum employment. Chair Powell recently announced that he expects the benchmark interest rate will stay near zero through 2023 and regular monthly bond purchases will continue well into the recovery.

Together, U.S. fiscal and monetary policy measures enacted over the course of just one year total an astounding $12.3 trillion, or 57.4% of GDP. In contrast, stimulus measures during the financial crisis of 2008-09 amounted to $4.9 trillion, or 33% of GDP, and were spread over the course of more than five years.

The U.S. leads much of the world in vaccinating its population. More than 100 million Americans are at least partially vaccinated, and the country is set to achieve large-scale immunization in Q3, in line with our base case scenario first outlined in April 2020. This, together with the massive amount of stimulus in the pipeline, suggests a dynamic recovery is underway. We forecast U.S. real GDP will expand 6.4% in 2021, a multi-decade high.

Canada’s economic recovery on track

The Canadian economy expanded 2.3% quarter-on-quarter in real terms during the last three months of 2020, after registering a record sequential rebound of 8.9% in Q3. Despite weaker consumer spending in the fourth quarter due to renewed social distancing measures, household incomes and savings should provide a meaningful support for consumption in the year ahead.

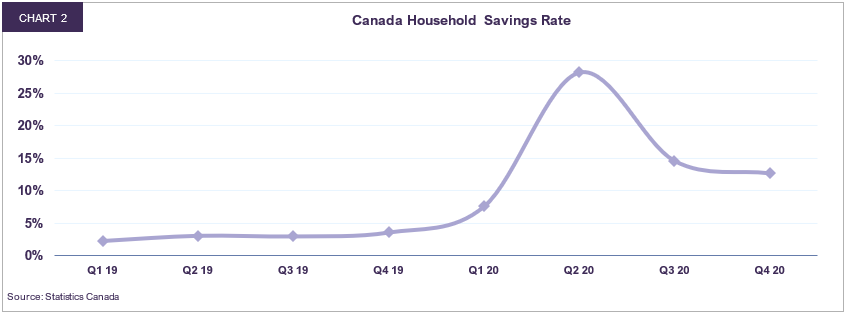

Government financial assistance more than offset the negative impact of job losses during 2020. Transfers to Canadian households increased by an extraordinary C$119 billion relative to 2019 levels, while employment income declined by only C$6 billion year-over-year. In the final three months of 2020, household disposable incomes grew 7.7% compared to last year, and household savings more than tripled from pre-pandemic levels, reaching 12.7% at year-end (Chart 2). An improving job market together with excess savings should boost consumer spending in 2021.

Residential investment increased 6.2% quarter-on-quarter in Q4, driven by new construction and renovation activity. Early indicators show that the housing market’s strength extended into 2021, with home sales up 39.2% and prices up 17.3% against a year ago in February.

Canada’s upcoming 2021 budget will include a new spending package estimated at C$100 billion, or 3-4% of GDP, reaffirming the federal government’s commitment to stimulus spending. Although the details have yet to be finalized, the program will likely consist of near-term pandemic-related relief measures and longer-term investment-focused programs. Further monetary stimulus is also in the pipeline. At its March meeting, the Bank of Canada kept ultra-low policy rates steady and maintained a C$4 billion per week asset purchase program. It also signaled that these measures would remain in place until economic slack is absorbed, and the 2% inflation objective is sustainably achieved, which the Bank of Canada believes will not happen until 2023.

As in the U.S., the Canadian economy will continue to be supported by accommodative fiscal and monetary policy well into the recovery. We forecast real GDP growth to expand by 5.0% in 2021, a 20-year high.

Stimulus key to Europe’s recovery

In the Eurozone, real GDP contracted by 0.7% quarter-on-quarter in Q4 amid new pandemic restrictions. Government programs allowing firms to temporarily reduce workers’ hours while providing employees with income support, tempered the effects of the lockdown on incomes and employment.

Disposable personal incomes increased in the Eurozone’s two largest economies in the fourth quarter, rising 1.1% year-over-year in Germany and 2.0% in France. Meanwhile, the number of employed persons in the Eurozone increased by 561,000 in Q4 from the previous quarter. The Eurozone unemployment rate improved to 8.1% in January compared with 8.7% in August. Germany and the Netherlands recorded the lowest jobless rates of the region’s major economies, at 4.5% and 3.6% respectively. Gradually improving labour markets and a still-elevated household savings rate of 17.4% suggests European consumers will help fuel the recovery as reopening continues.

Renewed lockdown measures at the end of 2020 interrupted a seven-month period of industrial production expansion in the Eurozone, but early indicators point to a strong start to 2021. The Manufacturing PMI reached 62.4 in March, the highest level on record. Looking ahead, the Eurozone is well positioned to benefit from accelerating global growth and trade, given the export-oriented nature of its key manufacturing economies.

Stimulus will play an important role in defining Europe’s post-pandemic outlook. The European Commission estimates that the recently approved €750 billion recovery fund and the European Union’s sizeable €1.1 trillion multi-year budget could create two million jobs by 2022 and add 2% to GDP by 2024. Spending is planned through 2027, indicating a long-term commitment to accommodative fiscal policy. On the monetary policy front, the European Central Bank has spent around €870 billion of its €1.85 trillion Pandemic Emergency Purchase Programme (PEPP), leaving an abundance of firepower still available. Further, the ECB signaled that asset purchases will accelerate over the coming months. Alongside targeted longer-term refinancing operations (TLTROs), which supply long-term financing to banks at -0.5% and are set to continue to June 2022, ultra-accommodative monetary policy will persist well into the recovery.

We expect the Eurozone will expand 4.4% in the year ahead, benefiting from domestic drivers such as vaccination progress, reopening and stimulus, as well as a strengthening global recovery.

Elsewhere, U.K. real GDP grew 1.3% quarter-over-quarter in Q4, the second consecutive quarter of expansion. Government spending increased 6.7% and investment 5.9%, offsetting a 1.7% decline in household consumption. The outlook for U.K. consumers is improving. The unemployment rate was 5.0% in January, only modestly higher than its pre-pandemic level of 4.1%, while the household savings rate surged to 15.6% in Q4, more than double its pre-pandemic level. The IMF forecasts real GDP will increase by 5.3% in 2021.

Positive outlook for emerging markets

China’s real GDP increased 6.5% year-over-year in Q4 and recent economic indicators point to a broadening recovery. Exports surged 60.6% year-over-year through the first two months of 2021, marking eight consecutive months of growth. China’s exports to the U.S. and E.U. soared by 87.3% and 62.6% respectively, while exports to the ASEAN countries were up 53.0%, South Korea 49.0% and Japan 47.9%. All major trade categories saw robust increases, evidence that a global recovery in consumer spending and manufacturing activity is underway. As a result, China’s trade surplus for January and February combined climbed to $103.3 billion, compared with a $7.2 billion deficit recorded one year prior.

A rebound in global activity is greatly benefiting China’s industrial sector. Industrial production increased 35.1% year-over-year in January and February combined. During March, the Manufacturing PMI recorded an eleventh consecutive month in expansion territory. Meanwhile, domestic consumer activity is surging. Passenger vehicle sales jumped by a cumulative 3.2 million in January-February, 74.8% higher than the same time a year prior. Home sales increased 143.5% year-over-year and retail sales climbed 33.8%. This strong start to 2021 is consistent with solid consumer fundamentals: household disposable incomes grew 3.5% in 2020 and the unemployment rate closed the year at 5.2%, unchanged from pre-pandemic levels.

Given the Chinese government’s recently announced targets of real GDP growth above 6% and the creation of 11 million new urban jobs in 2021, fiscal and monetary policy are likely to remain accommodative in the short term. The IMF anticipates real GDP will expand 8.4% year-over-year in 2021, the strongest pace of growth in more than a decade (Table 1).

India emerged from recession in the fourth quarter, with real GDP expanding 0.4% year-over-year. Government spending surged 7.2% in nominal terms over the same period, while investment (5.9%) and household spending (1.0%) also contributed to activity. Leading economic indicators suggest the recovery is gaining momentum. In February, the Services PMI signaled its fifth consecutive month of expansion and the steepest monthly increase in a year, as new order growth and business sentiment reached one-year highs. The Manufacturing PMI for March recorded an eighth-straight month in expansionary territory, driven by strength in output and new orders.

The Reserve Bank of India reiterated that policy rates will remain low at least until growth is on a sustainable track. In addition, the government’s recent budget is set to deliver a public investment package equivalent to 2.5% of GDP, the largest in more than a decade. Against this accommodative backdrop, India’s real GDP is expected to grow 12.5% year-over-year in 2021.

While progress with respect to infection rates, vaccination campaigns and economic reopening varies across countries, in aggregate, a recovery is underway in emerging markets. The IMF forecasts real GDP will expand 6.7% in 2021.

Economic backdrop favours equity tilt

Progress on the vaccination front, more government stimulus, and stronger economic growth boosted investor confidence and propelled global equity markets higher in the first quarter. The S&P 500 Index increased 4.9% year-to-date (total return in Canadian dollars), while the

S&P/TSX (+8.1%), DAX (+3.7%), FTSE 100 (+4.6%), MSCI World (+3.6%), and MSCI Emerging Markets (+1.1%) all recorded gains.

Interestingly, the same factors that led to investor optimism on the outlook for stock markets has more recently stoked concerns about the potential effects of higher inflation and interest rates. Some have begun to question whether rising bond yields risk derailing the stock market rally.

Indeed, some segments of the market are particularly sensitive to the dynamic of rising rates. The U.S. technology sector trades at a P/E multiple of 26.5 times 2021 earnings, a premium to the S&P 500 Index (22.1x) and S&P 500 Index excluding technology (20.9x). Valuations of some digital economy stocks are near levels last seen in the 1990s dot.com bubble. These companies’ values are derived from cash flows expected far into the future. As interest rates rise, their future earnings are discounted more deeply, and become worth less today. It is perhaps no coincidence that the U.S. tech sector underperformed the broader market during Q1 as the U.S. 10-year government bond climbed to a one-year high.

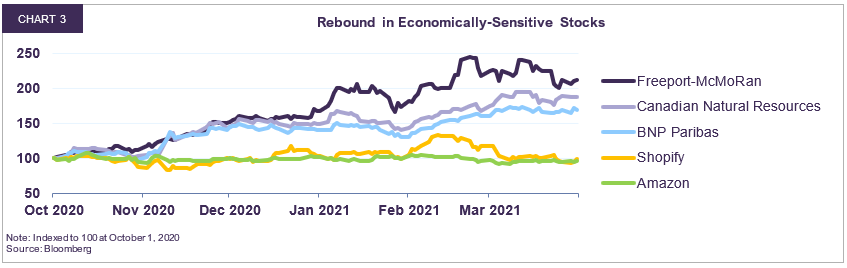

In contrast, companies with ties to the physical economy such as commodities, industrials, financials and transportation, all experienced significant price appreciation in the first quarter (Chart 3). Even oil stocks, a laggard in 2020, saw share prices surge in Q1 as WTI rose to $60, double the level prevailing at end-March 2020. Though the oil industry faces strong headwinds from electric vehicle penetration and a global push for divestment of fossil fuels, our research suggests that the medium-term outlook for the energy sector is more nuanced (see LBA special report: The climate is changing. Electric vehicles are coming. Should we still invest in oil?).

On balance, economically-sensitive sectors still trade at reasonable multiples to earnings and book value and are well-positioned to benefit from a reopening of the global economy. The S&P 500 Value Index trades at 19.2 times P/E and offers considerable upside potential. Companies included in the value benchmark are expected to grow earnings per share by around 75% as global economic activity firms over this year and next.

Fixed income markets, on the other hand, have come under increasing pressure even as central banks have reaffirmed a commitment to keep short-term rates anchored at low levels. Concerns regarding the inflationary impact of cumulative stimulus measures propelled long-term yields back to pre-pandemic levels. The 30-year Canadian government bond yield more than doubled from 0.9% in August 2020 to 2.0% at end-March, generating a loss of 22% in just seven months. Long-term yields are still below 3.5%, the average prevailing over the last two decades. A gradual normalization from current levels, while unlikely to destabilize the recovery, would inflict great financial pain on holders of long instruments and could spell trouble for high-multiple stocks.

We continue to tilt balanced portfolios towards reasonably-valued and well-diversified companies over cash and bonds. Our global equity portfolio trades at 14.6 times 2021 earnings and provides a relatively attractive 2.8% dividend yield. We reiterate our cautious stance on bonds: we hold no securities with maturities above 10 years and the duration of our fixed income portfolio is low. We believe our investment strategy is well-positioned to offer meaningful value creation in the medium-term.

Legal notes

All dollar references in the text are U.S. dollar unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN