Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

US tariffs on Canadian trade

February 2025

Canada and the US have been important trading partners for centuries. The relationship is however of unequal importance to both countries. Exports represent 25% of Canada’s GDP, of which 77% goes to the US. Meaning 19% of Canada’s GDP is directed to the US. On the other hand, US exports to Canada represented 1.3% of US GDP in 2023 and total exports accounted for 7.7% of GDP. This highlights the large difference in significance to each country of their trade relationships.

The US government has introduced tariffs on some of its imports. Tariffs are charged to the importer when they purchase goods from abroad. Contracts normally provide that if tariffs are imposed or when there is no contract, the importer needs to pay them, the seller’s price is not changed. Like a sales tax, tariffs are a tax on the purchaser not the seller. Evidently, tariffs increase the cost to the importer which might lead them to reduce consumption, seek alternate sources or negotiate price reductions. But alternate sources are not always available, and the seller may have other clients to whom they can sell if their current buyer does not want to pay.

The US government has announced not only tariffs on Canadian imports but those of Mexico and China. We estimate that the impact of full 25% tariffs on all goods from Canada and Mexico and another 10% tariffs on China would add between 0.5% and 1.5% to prices in the US. For Canada, the Bank of Canada has estimated that full tariffs would reduce GDP by 2.5% if applied for a full year, possibly leading to a recession but motivating Canada to reconfigure itself and disengage somewhat from the US. This considers the possible absorption of part of the tariffs by Canadian exporters and a reduction in demand for Canadian products. If the tariffs are less, have exceptions, take time to be implemented, or are of limited duration, the impacts would be diminished. Government support programs for businesses and individuals could also cushion the impact on the economy and facilitate required changes.

The US has pointed to illegal immigrants and fentanyl entering the US from Canada as the reason to impose the tariffs but there may be other reasons.

The US has highlighted the trade imbalance between the countries as a possible justification. In free markets, trade surpluses are normally dealt with through currency appreciations and not tariffs, a method used back in the 19th century. Canada’s supply management systems for milk, chickens, turkeys, and hatching eggs have also long been trade irritants.

Commentators have raised non-trade related reasons for the tariffs. Amongst these is the goal of the current US government to reduce income taxes by reducing the cost of government and, importantly, increasing other revenues, tariffs being the principal alternate source. A desire to absorb Canada into the US by increasing the economic cost of not being a US state and thus the benefit of joining the US has been evoked. This may seem extreme but should not be dismissed lightly because it has long been an ambition of the US to extend its territory going back to its founding. Benjamin Franklin was sent to Canada to specifically assess the possibility.

We do not yet know how this trade dispute ultimately gets resolved as it depends on its impact and the real reason the tariffs are being introduced. Some of these seem less likely. Illegal immigration and fentanyl are the least probable as less than 1% of both enter the US through Canada.

The current US administration has frequently referenced the later part of the 19th century when discussing tariffs. They were the principal source of government income at that time. Income taxes became entrenched as late as 1913 through the 16th amendment. The desire to reduce income taxes requires finding new revenue sources and tariffs may be part of the answer, particularly since they are well hidden from the general population. If the objective is to change the revenue mix, then there might not be much to be done, and some form of the tariffs will stay. Economists point to an uncomfortable truth however: the domestic impact of tariffs tends to fall the hardest on the poorest households and increases income disparities. Their ability to positively impact economic development has also been questioned.

The US has indicated their intent to put tariffs on European imports as well. Virtually all nations exporting to the US will be affected. This is consistent with an objective of developing a new substantial revenue source for the US government. When these tariffs are applied equally to Canada and its competitors, their ultimate impact might not be that significant as it would not affect Canada’s competitiveness relative to other countries. The effect on the US would be to increase the cost of imported products creating some modest inflation and a slight loss of international competitiveness.

Canada currently imports $425 billion of goods from the US amount and exports $565 billion. Oil and gas represent the largest export, $165 billion or 29%. The US is self sufficient in oil and gas, which means that the oil and gas imported from Canada allows the US to export an equivalent quantity at a profit. Not only is importing Canadian oil financially beneficial but there is also an operational imperative. The US refineries that receive the Canadian oil are specially configured to upgrade that oil and could not process other oils without substantial investment and time.

Excluding oil and gas, Canada has a $25 billion trade deficit with the US. There are good economic and physical reasons for almost every exchange of goods between the two countries. In the auto industry, the manufacturing processes are so integrated that certain components cross the border more than half a dozen times. Industry participants have indicated that tariffs would quickly stop production lines and cause massive layoffs on both sides of the border.

It will not be easy for US manufacturers to untangle all of this, and it will also affect their profitability. Over and above the tariffs, efficiencies will be lost. USMCA embodies this high level of integration. The fact that little was changed the last time the US renegotiated USMCA testifies to its success. We suspect the same will be true next time.

We do not yet know what the US objective really is but if it is to reduce income taxes and make up some of the reduction with tariffs, then the Canadian government would probably be best served by facilitating a reconfiguration of the Canadian economy to increase its ability to trade internationally and reduce its dependence on exports to the US. This would mean reducing inter provincial trade barriers and investing in infrastructure such as developing alternate export routes for Canadian oil and gas and other products. These have been awaiting resolution for many years. Encouraging more investment and ceasing to subsidize the outflow of Canadian savings from Canada as our Invest in Canada campaign has advocated would also be helpful. Stimulating innovation and supporting domestic enterprise would be money well spent.

Trade reconfigurations are always disruptive in the short term and some disruptions could have such a serious impact on the US economy that they will have to be mitigated. But we must not lose sight that Canada is the largest democratic country in the world by land mass. It is rife with resources that others need and want. The country has a talented and well-educated labor force, and sound governmental and legal systems. These are strengths, not weaknesses. Companies can and do adapt. The value of these characteristics will not be lost upon investors.

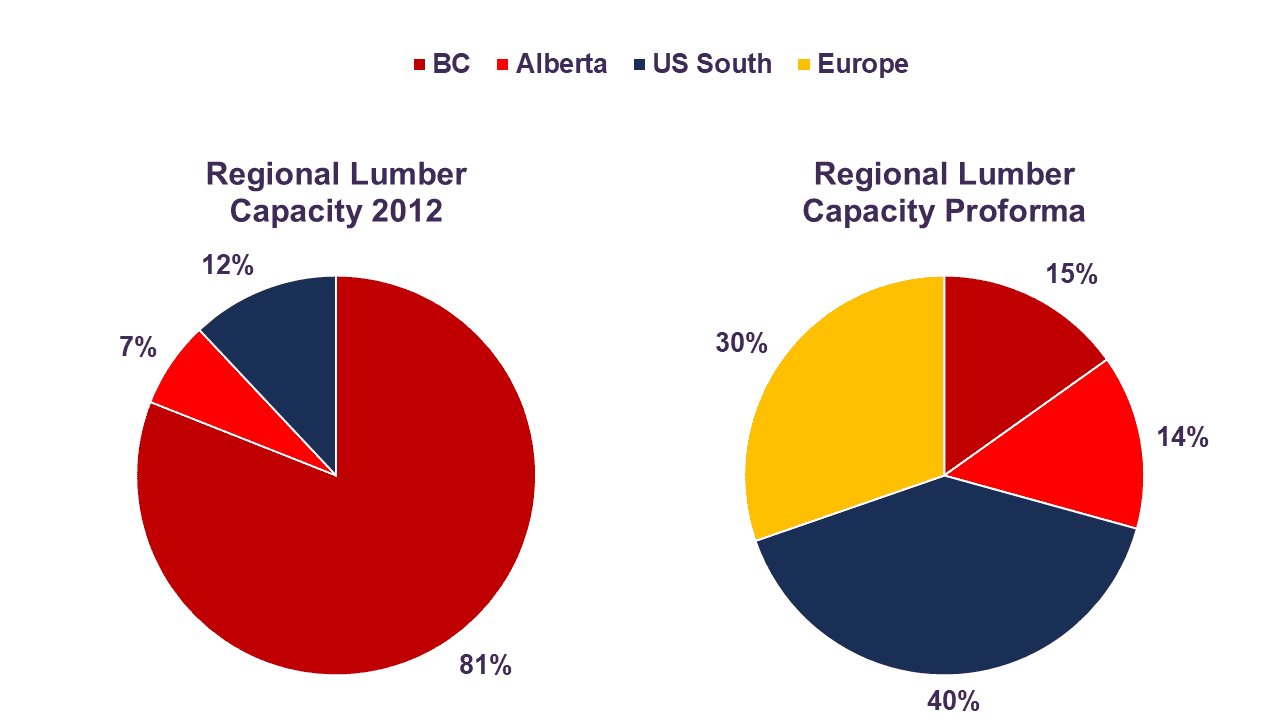

Canfor production capacity change since 2012

It is important to review security holdings when disruptive events occur, assess their consequences, and act, if necessary, but it is equally important to keep a medium-, long-term view. Where we are allowed, our holdings are not limited to companies based in Canada and exporting to the U.S. We participate in many different trends globally, including information technology, financial services, infrastructure investments, healthcare innovation and so on.

With this in mind, we have reviewed our Canadian, US, and international holdings. We have raised portfolio cash over the last few months from companies trading at high valuations. The securities we continue to hold are well supported by sales, earnings, assets, cash flows, and dividends. They trade at very low valuations: 10 times earnings, 5 times cash flows, 3.6% dividend yield, and have very favorable long-term growth prospects. Most of our Canadian holdings either have little US exposure, have US production, can move production to the US, or have access to alternate markets.

In too many cases, once the decision has been made to sell down equity positions in a portfolio and the choice has been reinforced by a subsequent market decline, the decision to re-enter the market is hard to make and often too late. Overall results end up having been hurt. More important is to hold a portfolio of securities that are well valued, can withstand the difficult period, and keep an eye out for opportunities the economic stresses may present.

Churchill said: “Never let a good crisis go to waste”. We may have the chance to redeploy our cash in the coming months as the market may overreact and present interesting opportunities. Long required changes in Canada may finally be made.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to

provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein

are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment

in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates

indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc.

cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from

sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in

relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute

our judgment as of this date and are subject to change without notice.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies,

tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on

such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forwardlooking

terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,”

or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to,

among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other

factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ

materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on

these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN