Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

September 2023

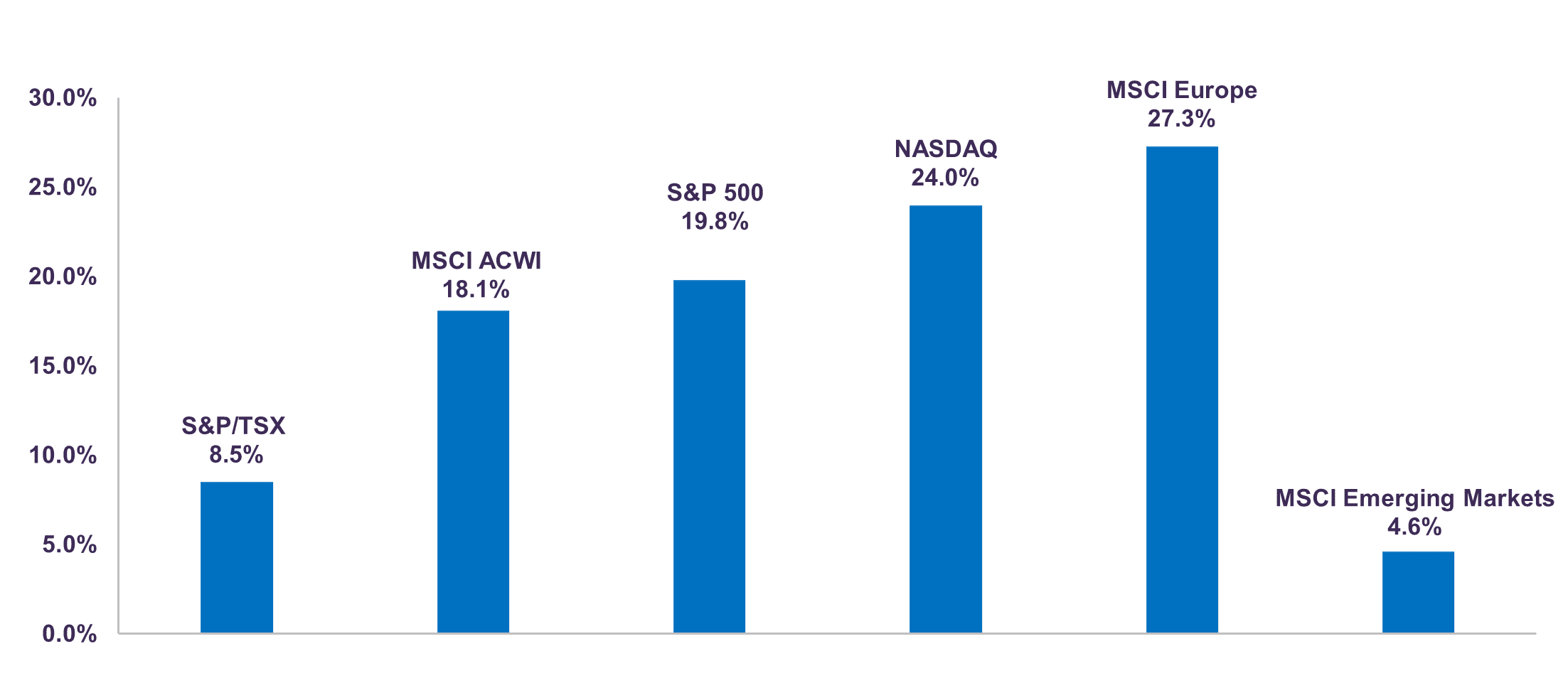

Global equity markets experienced some volatility in August, driven in part by the uncertainty surrounding further interest rate hikes in developed markets and concerns over economic weakness in China. Nevertheless, markets are up nicely year-to-date with the S&P 500 returning 18.6% (total return in C$), while the S&P/TSX rose 6.9%, MSCI Europe 13.0%, MSCI ACWI 14.6% and MSCI Emerging Markets 4.4%. Our Canadian, international and emerging markets portfolios are in line with their respective benchmarks this year, and well ahead over the last twelve months.

Importance of Remaining Invested

As highlighted in our August 2022 Portfolio Update, we believe an investor faces great risk when attempting to time short-term market movements. Looking back just one year ago, inflation levels were near 40-year highs with many experts calling a recession a foregone conclusion. Volatility also spiked many times during the following months, notably in March with the failure of two U.S. regional banks and the acquisition of struggling Credit Suisse by UBS. In fact, investors who relied on forecasts of an imminent recession and decided to sell stocks around the time last year’s letter was published missed out, either partially or entirely, on the period of substantial gains that followed (Graph 1). While we cannot predict what lies ahead, we continue to stress the importance of remaining invested even through periods of uncertainty. The process of selling risky investments and temporarily shifting to cash ultimately entails two very difficult decisions: when to sell and when to re-enter the market. These decisions are almost impossible to time perfectly and, most often, when the investor feels comfortable re-entering the market after selling, a significant portion of the losses have already been recovered. Those who remain disciplined in challenging periods and maintain a long-term focus have a much greater chance of achieving their investment goals.

12- month Total Return of Market Indices (in C$)

A Consistent Investment Strategy

Amidst an ever-changing market environment, we continuously adjust our portfolios based on a risk-reward framework, evaluating the merits of each investment. Furthermore, we evaluate the attractiveness of these investments based on an approach that avoids overpaying for securities trading at excessive valuations, thereby reducing the risk of a permanent impairment of capital. We also favour the stocks of companies operated by management teams that are prudent allocators of capital and share our focus on the medium- to long-term over shorter-term gyrations.

Our investment in Linamar is a leading example of how a consistent and long-term strategy can benefit shareholders. A global manufacturer of automotive parts and agricultural equipment based in Guelph, Ontario, Linamar is operated by an experienced management team that has weathered challenging industry cycles. Despite a rather turbulent macroeconomic environment in the previous decade, the company has delivered double-digit annualized sales and earnings per share growth. Moreover, it has generated cumulative free cash flows that approach its total market capitalization. Said differently, over the past ten years, Linamar has generated enough cash from its operations, net of capital expenditures, to buy back all its outstanding shares at its current price level. Looking forward, we believe it is well-positioned to grow its electric vehicle offering with the recently completed acquisition of three battery enclosure factories. We anticipate Linamar will continue to deliver both growth and attractive returns to shareholders over the medium- to long-term, while currently trading at a compelling 7.2 times forward earnings. As investors in the company for the last 18 years, we made over $315 million in gains for our clients.1

Conclusion

We will continue to monitor fixed income and equity markets for possible dislocations from fair value, searching for long-term investment opportunities. Within our fixed-income portfolios, over the last decade we maintained little to no exposure to bonds with maturities above 10 years, judging that the prospects offered by fixed-income instruments were extremely unattractive given their low yield and high sensitivity to interest rate increases. Recently, we have begun to gradually increase the duration of our bond portfolios by purchasing high-quality 5- to 10-year government bonds. Our equity portfolios are attractively valued at 10.3 times forward earnings and offer a 3.6% dividend yield. We are confident our equity and fixed-income portfolios remain well-positioned to weather the challenges of a slowing economy and will continue to contribute to the preservation and growth of your capital.

[1] Represents the net gains on our investment in Linamar Corp. for all mandates under management from September 1, 2005 to August 31, 2023.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN