Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

September 8, 2021

Global equity markets hit new highs in August as companies continued to report strong earnings. The total return for the S&P 500 Index is 20.6% in Canadian dollar terms, the S&P/TSX is ahead 20.2% and the MSCI World Index has risen 17.0% year-to-date. Our portfolios are participating fully in the strong rebound in economic activity post-COVID, having climbed more than benchmark indexes over the same period.

Global fiscal stimulus has been a significant factor behind the recovery. Most government spending to date has come in the form of relief to businesses and households. Looking ahead, however, governments are budgeting massive sums in infrastructure improvements to modernize their economies.

The U.S. is leading the way with the Senate recently having passed a $1 trillion bill to invest in long life productive assets such as roads and bridges, clean energy, public transit, high-speed internet, and water infrastructure over the coming years. This should enhance the competitiveness and sustainability of American capital assets over the long term, while creating jobs to promote the economic recovery in the short to medium term. There is no shortage of demand for infrastructure investment, both in other developed economies and emerging markets. We believe this will create a multi-year tailwind for industries directly and indirectly exposed to infrastructure spending, and we have positioned our equity portfolios to benefit from this.

Transitioning to a greener future requires massive infrastructure investment

Rising penetration of electric vehicles and sources of renewable energy will entail a substantial overhaul of the electrical grid. Electricity generated from coal-fired plants will be replaced by solar and wind, requiring significant investments in power generation, transmission, and distribution networks. The U.S. aims to increase its wind and solar capacity by a factor of 2.5 and 5 respectively by 2030. Our research suggests that complete electrification of the energy system, i.e., replacing all internal combustion engines with electric motors and switching away from fossil fuels in heating and industrial processes to achieve net zero emissions, would lead to a doubling of U.S. electricity demand by 2050. This would be a boon for the utility industry where demand has grown under 1% annually over the past 20 years.

We also see tremendous runway for electricity demand from emerging markets over the coming decades. India, where 18% of the world’s population resides, today consumes barely one-tenth the electricity of Canada’s average on a per capita basis. India aims to increase its installed capacity of wind and solar power by five times its current level and more than double its consumption of natural gas by 2030. The country will also need massive investment in water infrastructure, given that nearly one-third of Indians do not have access to basic sanitation facilities, while just 56% of people living in rural areas can access safely managed drinking water.

Our portfolios’ direct and indirect exposure to infrastructure is noteworthy

Upgrading the world’s power and water systems on the path to a cleaner future is only one part of the infrastructure story. Spending on public transit systems, high-speed communication networks, roads and bridges will also play an important role. We believe our equity portfolio is well positioned to capture the long-term growth in demand for infrastructure from many angles. First, we have substantial indirect exposure through companies producing building materials such as steel, cement, copper, and zinc. For example, the portfolio owns shares in Holcim, the world’s largest cement and concrete producer and a supplier of resilient, durable, and affordable inputs for global infrastructure development. Holcim is also a global leader in the production of low-carbon cement and concrete as well as recycled construction materials.

Second, we have direct exposure to airports, ports, hospitals, data providers and utilities that will benefit from the long-term secular growth in infrastructure. Energias de Portgual SA (EDP) is a global utility involved in renewable power generation and distribution to more than 11 million customers in Portugal, Spain, and Brazil. EDP will spend €24 billion over the next five years to achieve carbon neutrality by 2030, at which point renewables will account for all of its production. The company is also pursuing other clean technology investments, such as adding over 400 megawatts of battery storage in the U.S. to help integrate renewables into the traditional grid system.

In sum, we calculate that our direct exposure to infrastructure amounts to approximately 20% for non-Canadian equities and for Canadian equities respectively.

Going forward, the way we source our energy needs, deliver healthcare, communicate, travel and work will change increasingly. Developing countries, home to 85% of the world’s population, are pursuing their long-term march toward improving the lives and fulfilling basic unmet needs of their citizens. We believe global infrastructure development remains in a long-term uptrend and is fertile ground for promising investment opportunities.

Letko Brosseau launches new investment strategy targeting global infrastructure

As interest rates have declined to ever-lower levels, there has been a large increase in demand from investors for direct infrastructure investing. This is understandable as these assets are long life, stable with predictable cash flows, and provide a hedge against inflation. However, many infrastructure investment vehicles are private, opaque, illiquid, and charge high fees.

We have invested in publicly traded global infrastructure assets since inception, and these holdings have been integrated into our balanced and equity portfolios using the same low fee schedule. Since January 1, 1988, we calculate that we have generated C$6.5 billion in cumulative gains from infrastructure investments around the world.1 This is equivalent to a 13.8% annualized return over 33 years.2

In response to investor demand, we are launching a new specialty strategy dedicated solely to infrastructure. This strategy will be offered as a pooled fund. We believe it delivers a distinctive value proposition based on the following features:

- Unconstrained vehicle with the flexibility to invest in the most attractive opportunities around the world, including emerging markets,

- Public market security holdings offering full transparency and liquidity to investors,

- Diversification across countries and type of infrastructure.

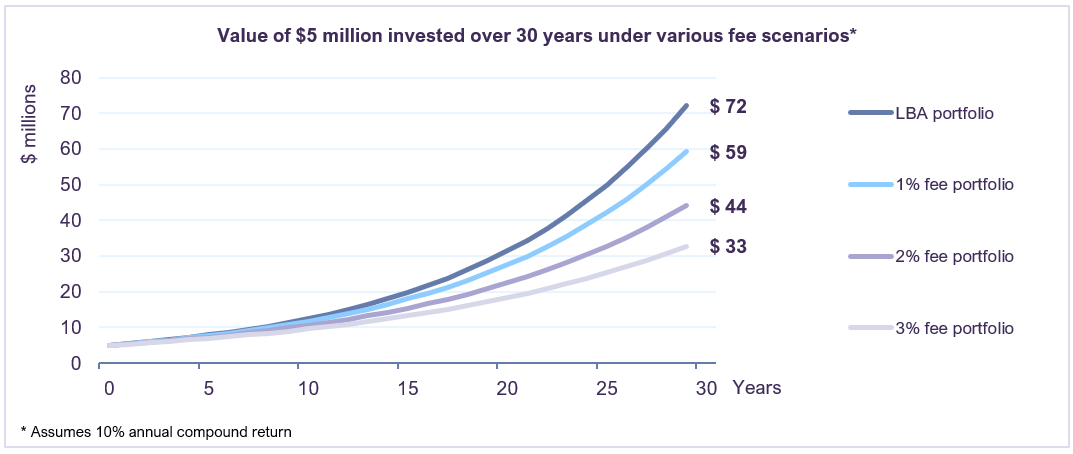

Our global infrastructure strategy will be managed by our experienced investment team and offered at the same low fee level. An extremely important, yet underappreciated, factor in investment decision-making is the long-term effect of paying reasonable fees. Assuming all strategies earn the same return, i.e., 10% compounded annually over 30 years (the useful life of an infrastructure asset), the impact of a 100-300 basis point (bp) fee differential on the value of an investment is substantial. For example, $5 million invested at Letko Brosseau would be worth $72 million after 30 years using our sliding scale fee schedule.3 In contrast, the same portfolio generating the same return would be valued at only $44 million with a 2% fee, which is typical for infrastructure funds. Investors who avoid paying excessive fees on asset management have 64% more capital at the end of the investing period.

For more information on our new dedicated Infrastructure Strategy and its suitability in meeting your investing needs, contact your Account Representative.

1 Represents the net gains on Canadian and non-Canadian infrastructure equities for all mandates under management from January 1, 1988 to May 31, 2021. Infrastructure includes airports, hospitals, oil and gas storage and transportation, ports, toll roads, railways, real estate, telecommunications and utilities.

2 The return is gross of fees and is derived from a carve-out of total firm assets made up of infrastructure equities for the period of January 1, 1988 to May 31, 2021. It does not represent the return of an infrastructure mandate and the choice of securities and their returns could have been different if managed in an infrastructure mandate.

3 0.825 bp on the first $1 million, 0.50 bp on the next $2 million, and 0.25 bp on amounts above $3 million. For example, the Letko Brosseau management fee on a $5 million investment is 0.465 bp.

A list of all purchases and sales made during the past year can be provided on request. The transactions mentioned do not represent all the securities bought or sold in the portfolios during the quarter.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN