Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

October 2024

Global equity markets reached all-time highs in September after the Federal Reserve cut its policy benchmark, initiating the start of a new easing cycle. Year-to-date, the S&P 500 is up 25.1% (total return in Canadian dollars), while the S&P/TSX rose 17.2%, the MSCI ACWI 21.6%, the MSCI EAFE 15.8%, and the MSCI Emerging Markets 19.7%.

As we explain in detail in our Economic and Capital Markets Outlook, the lagged effects of restrictive monetary policies are leading to a global slowdown, though we ascribe a low risk to a more adverse economic scenario.

Away from the spotlight of market attention, some areas have done quite well. Copper-related stocks, for example, have seen strong performance and we took the opportunity to reduce our exposure. We take this opportunity to take a deeper dive into the mining sector, with a particular focus on copper.

We are optimistic on the medium-term outlook for our mining holdings and are of the view that copper’s role in the global energy transition and electrification of the transportation market underpins the long-term demand for this commodity.

The Role of Copper in the Global Economy and Energy Transition

Copper is a critical commodity widely used in the global economy. It is renowned for its superior conductive properties and is essential for the manufacture of electronic devices, infrastructure construction, electrical wiring, and transportation equipment—segments that account for more than 80% of global copper demand. From a geographic perspective, 50-60% of global copper is consumed in China, where it is used in manufacturing, investments in domestic industrial and civil infrastructure, and real estate.

Over the last few years, copper’s role in electrification and the global energy transition has become a key focus of capital markets. In fact, the copper intensity of an electric vehicle (EV) is estimated to be three to four times higher than that of an average internal combustion vehicle. In addition to EV manufacturing, the shift toward green energy is another catalyst driving the global demand for copper. Specifically, solar and wind generation require two to seven times more copper than fossil fuel power generation. As the world moves to cleaner power generation and electrification of transport, copper demand should naturally rise.

More recently, the rapid growth of data centres, due to expanding AI technologies, has required more power. A rise in power demand should mean an increase in copper consumption, as copper is widely used in power distribution networks. However, this potential power demand increase is tempered by continuing efforts to increase the energy efficiency of data centres. In addition, while copper has superior conductive properties, it still competes with aluminum which, despite being an inferior conductor, becomes more attractive than copper at lower price points in certain electrical applications. Currently, aluminum prices are relatively low compared with copper prices, creating a heightened risk of substitution.

When we think about copper demand going forward, we balance the increasing demand related to electrification and energy transition with a continuing slowdown in Chinese economic growth, which impacts half of global copper demand, and aluminum’s substitution effect.

Balancing these opposing demand forces, we expect the copper market to continue to grow at a 2-2.5% annualized rate in the short to medium term.

Supply Growth and Inventory Trends

According to the International Copper Study Group (ICSG), refined copper supply has steadily increased over the last few years, with refined copper production growth showing a notable uptick of 5.9% in the first seven months of 2024—more than double the growth rates experienced in 2020 to 2023. Looking ahead, copper production is expected to increase by 2.8% in 2024 and 2.2% in 2025.

Despite this, overall copper inventories have remained relatively flat in recent years. We estimate that recent demand growth is increasing in line with the historical average of 2.4%-2.5% annually, keeping pace with production growth.

Copper Price Volatility and Future Growth Outlook

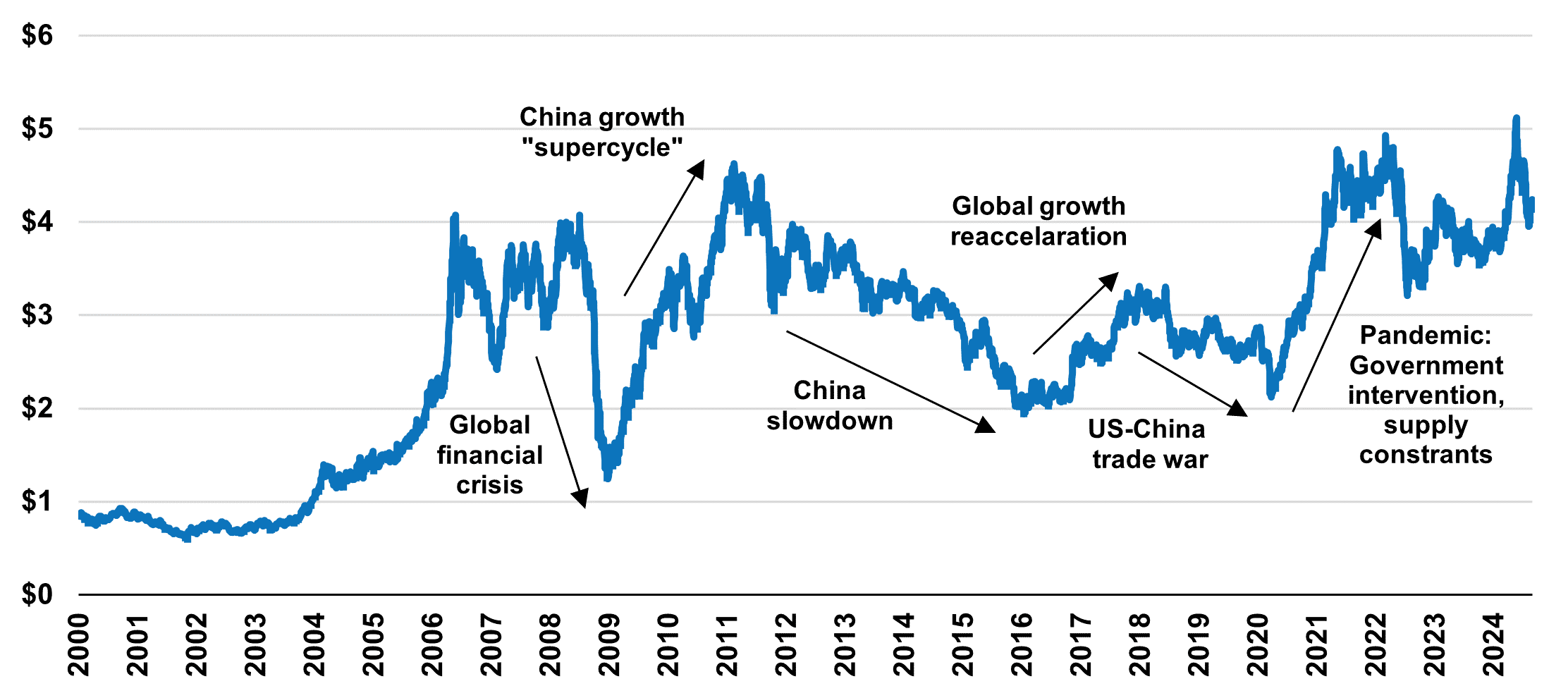

Over the last 10 to 15 years, copper prices were volatile (Chart 1). During the pandemic, the mining industry experienced rapid inflation, and costs at some mining sites increased by 30% to 70%. At the same time, companies observed substantial increases in capital expenditures required to bring new projects on-line. A combination of high operating costs and capital expenditure inflation on the supply side and continuing demand growth resulted in the price of copper remaining at close to historical highs.

Copper Prices in USD/lb (2000-2024)

Going forward, we expect copper demand to continue to grow and the price of the commodity to remain at levels that allow companies to earn a sufficient return on capital on new projects necessary to satisfy the growing demand.

As mining is a cyclical industry, we have carefully adjusted our exposure to select companies as opportunities presented themselves. For example, we increased our exposure to Teck Resources in 2015 and 2020, and to HudBay Minerals as their share prices and valuations fell to multi-year lows.

Share prices of copper producers have increased sharply, reflecting the market’s enthusiasm for the metal playing an important role in electrification and energy transition. For instance, Teck Resources currently trades at a 2025 price-to-earnings multiple of 27 times1. We believe that the current valuation of certain companies reflects a very optimistic outlook for future copper demand. A more conservative scenario could limit the return potential for mining stocks. Consequently, we have recently reduced our exposure to Teck Resources, HudBay Minerals, Lundin Mining, and Ivanhoe Mines.

Concluding Thoughts

We continue to be invested in a select group of mining companies, though with reduced positions, as we recognize their potential as high-quality, low-cost producers capable of delivering sustained long-term value. While we have prudently managed near-term valuation risks, reflecting our disciplined approach to price sensitivity, our medium-term outlook for copper remains optimistic, and we are well-prepared to increase our exposure if prices adjust in the future. As long-term demand may strengthen beyond current projections and supply is likely to remain constrained in the short-term, we see an increased likelihood of commodity prices surpassing existing long-term forecasts. In this environment, we believe our mining holdings are well-positioned to outperform prevailing expectations.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the strategy(ies) may differ materially from those reflected or contemplated in such forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN