Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

November 9, 2022

Capital market volatility continues to be driven by investor sentiment on the future path of interest rates and the possibility of a recession. Most recently, the Bank of Canada and the U.S. Federal Reserve hiked their benchmark interest rates by 50 bps and 75 bps, respectively. In light of economic uncertainty, we are frequently asked whether we believe the global economy will fall into recession and how this impacts the decisions we make at the portfolio level. While both questions are timely, we caution against using a binary recession-no recession framework to make investment decisions.

The global recession question

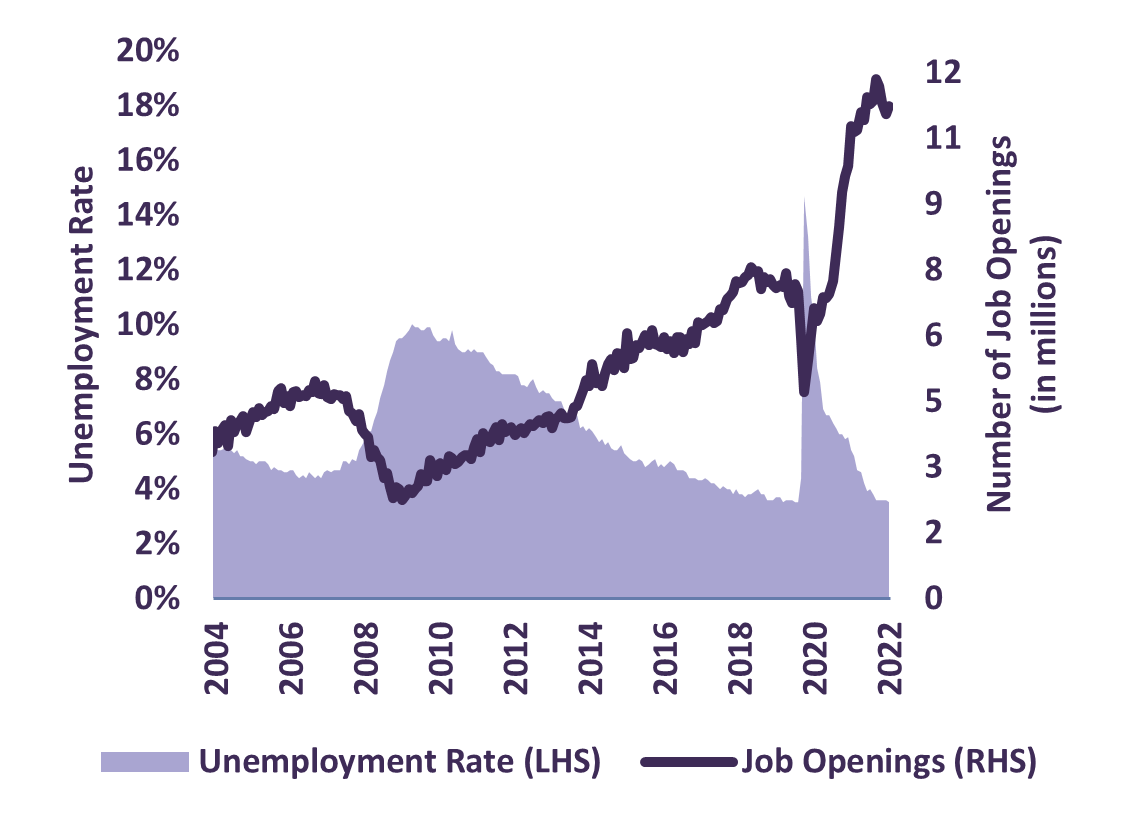

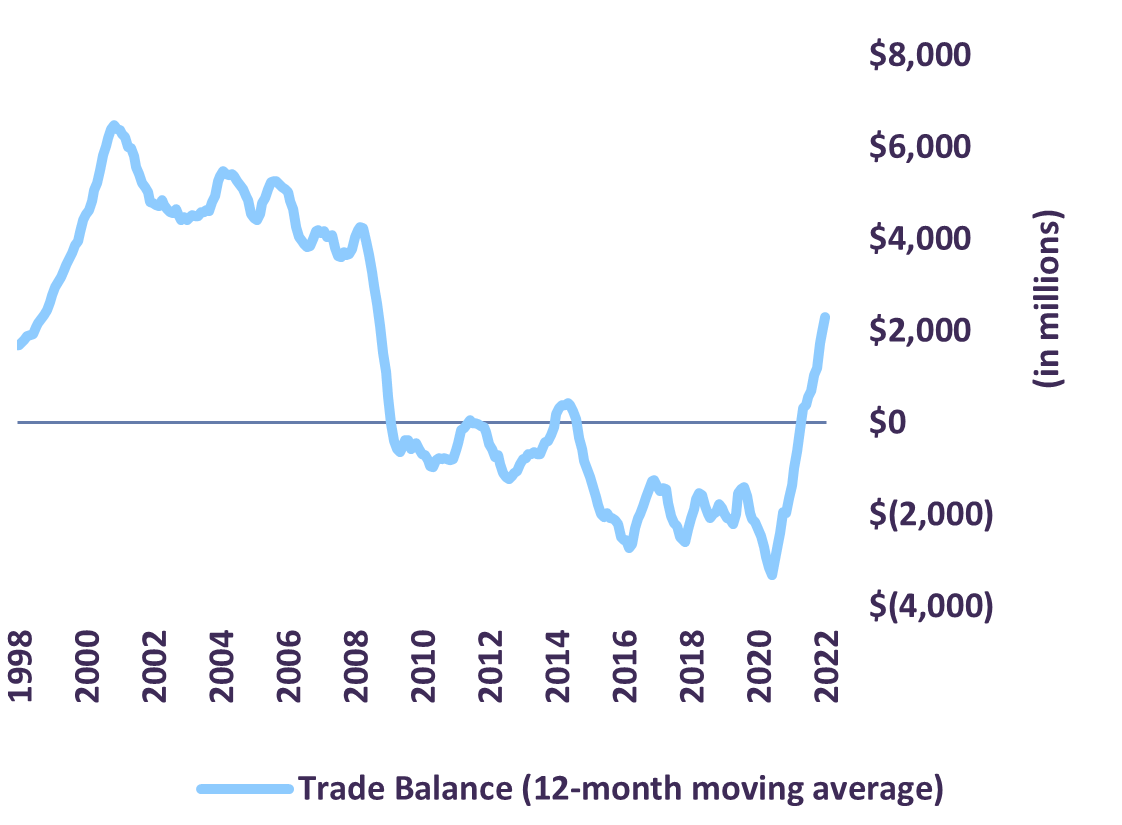

While the debate continues over whether the global economy is heading toward an imminent downturn, we believe it is premature to conclude a synchronized global recession is in the cards. As we detail in our October Economic and Capital Markets Outlook, certain countries or regions are demonstrating resilience to headwinds while others are struggling due to a variety of internal and external factors. A robust labour market helps explain the continued strength in consumer spending in the US: unemployment is at 3.7% and the number of open job positions is approximating historic highs (Chart 1). In Canada, higher commodity prices – a consequence of the war in Ukraine – continue to benefit the country’s natural resources sector and exports. Canada’s trade balance has been in surplus this year, an important support given slowing growth elsewhere in the economy (Chart 2). On balance, global growth is slowing, but the risk of recession varies greatly across regions and countries.

U.S. Unemployment Rate

& Job Openings

Source: U.S. Bureau of Labor Statistics & FRED Economic Data –

St. Louis FED.

Canada

Trade Balance

Source: Statistics Canada. International merchandise trade for all countries and by principal trading partners.

We don’t believe an unduly pessimistic scenario is about to unfold and we think the wisest course of action is to stay the course. Since 1970, the U.S. has experienced eight economic recessions with varying levels of severity and length. Over this period, the S&P 500 Index is up 40 times and its dividends have increased by a factor of 20. Remaining invested through periods of economic uncertainty is crucial to long-term success.

Our focus on longer-term opportunities is not meant to downplay the importance of understanding near-term challenges. We constantly monitor risks and determine if action is necessary. In fact, we actively try to identify which businesses are best positioned to weather and respond to these challenges. We are confident the companies held in our portfolios can navigate current headwinds.

Concluding thoughts

Our investment strategy entails patience in the face of volatility and a high degree of portfolio diversification by industry and geography. Additionally, our equity portfolio trades at a very attractive valuation of 9.2 times estimated 2023 earnings with a dividend yield of 3.6%. As for fixed income, our portfolio is structured to dampen the negative impact of rising interest rates – duration is short and credit quality is high. Though we have not fully shielded our portfolios from the decline in financial asset prices, our equity, balanced and fixed income strategies have remained well ahead of their benchmarks year-to-date. We remain confident that your capital is well positioned for growth over the medium- and long-term.

Legal notes

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN