Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

May 2024

Despite a slight pullback in the month of April, equities generated strong positive returns year-to-date as market consensus converged on an economic soft-landing scenario and companies reported solid earnings. The total return for the S&P/TSX was 6.1% since the beginning of the year, while the S&P 500 returned 10.5% (in Canadian dollars), the MSCI ACWI 9.0% and the MSCI emerging markets 7.1%. Fixed income investors have been laser focused on the likelihood and timing of rate cuts, and hints that central banks may delay the shift to a more accommodative monetary policy sparked volatility in bond markets. The FTSE Canada Universe Bond Index was down 3.2% year-to-date.

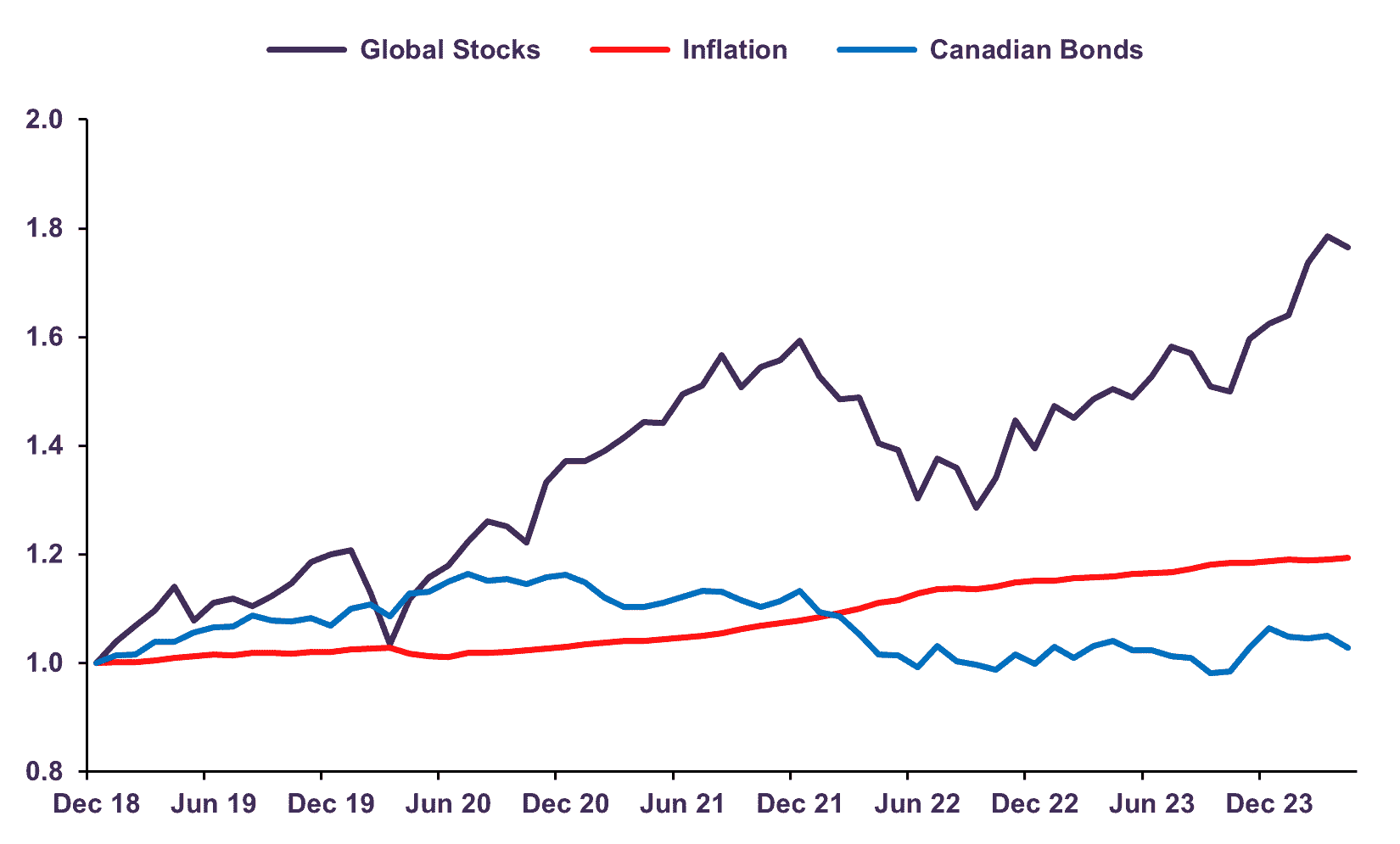

Unlike equity investors, bond investors have not been well rewarded over medium and long-term time frames (Chart 1). We are unsurprised by this outcome. Indeed, we have managed to successfully navigate a tumultuous post-pandemic period in bond markets by ignoring short-term market noise and focusing on the longer horizon, and by making strategic decisions using a risk/reward framework while evaluating the merits of each bond along the yield curve. The result has been an outperformance of our bond portfolios over both short and longer periods.

Value of $1 Invested

Source: Bloomberg, Statistics Canada. Letko Brosseau.

A Strategy to Preserve Capital

We had warned both before and after the pandemic that longer-term bond yields appeared disconnected from economic fundamentals. By steering clear of the excessively valued long-term end of the yield curve, we were well positioned to avoid the majority of the bond market’s sell-off as inflation began to rise and central banks tightened rates. In addition, our strategic asset allocation decision to maintain a very short duration in bonds while favouring attractively valued equity investments benefited the performance of our balanced portfolios.

Over the last two years, we have made tactical adjustments to our fixed income portfolios to capitalize on the opportunities that emerged in the face of changing market fundamentals. First, we increased our exposure to high quality corporate bonds when spreads widened to enticing levels due to speculation the global economy would fall into recession. At the height of concern over global growth, a BAA-rated 5-year corporate bond yielded nearly 5.75%, a 190-basis point spread to a same maturity Canadian government bond. Second, we progressively lengthened the duration of our bond portfolios by adding seven to ten-year government bonds, an area of the yield curve that we had previously shunned, when the 10-year yield spiked to 4% on inflation fears, a level that had not been reached since 2007. We judged this to be an attractive entry point given our estimate of fair value was around 4%-4.5%, based on a view of the economy’s potential real growth rate (around 2%-2.25%) and inflation expectations over the next decade (2%-2.25%). Both decisions – adding corporate bonds and increasing duration – were based on our analysis that investors were mispricing securities due short-term pessimistic views that we did not share.

Our price discipline has remained steadfast amidst the shifting tides of market speculation. This has helped us rank within the first quartile on eVestment among Canadian fixed income (core) strategies, a competitive landscape of 60 firms and 203 strategies, over one, three, and five-year periods¹.

Concluding Thoughts

By strategically positioning our fixed income portfolio and capitalizing on opportunities, we have been able to outperform our bond benchmark all the while mitigating undue risk. Since April 2020, the early stages of the pandemic, our bond strategy has generated a modest positive annualized return of 0.7% while the FTSE Canada Universe Bond Index recorded a -2.2% return². Pension investors and their beneficiaries who sought to immunize their liabilities by investing in long-term bonds have suffered substantial losses over the last four years as the 30-year Canada government bond experienced a 42.5% decline in price over the period.

Within the context of balanced mandates, we remain overweight in equities where the risk to reward relationship has been the greatest. Given our base case forecast for slower yet still positive global growth in 2024 and for improved prospects thereafter, we expect our equity holdings to provide meaningful returns over the next 3-5-year horizon. With a continued emphasis on long-term vision and sustainable growth, we remain confident in our strategy to favour companies with strong fundamentals and attractive valuation.

2. Data is preliminary. The performance numbers are annualized and presented in Canadian dollars and refers to the Letko Brosseau Canadian Fixed Income Composite as of April 30, 2024. This Composite was created in January 1991 and is defined to include all discretionary Canadian dollar based fixed income mandates with asset mix targets for Canadian equities of less than 10%. The Composite assets as of April 30, 2024, were $39.4 million or 0.23% of total assets under management. The benchmark since inception is 5% FTSE Canada 91 Day T-Bill Total Return Index and 95% FTSE Canada Universe Bond Total Return Index. Performance results reflects the reinvestment of dividends, income and other earnings and are presented net of all foreign withholding taxes. Reclaimable withholding tax refunds are recognized when received. The benchmark is fully invested and its returns include the reinvestment of dividends, income and other earnings and are presented net of withholding taxes. Performance results are presented before management fees and custodial fees but after trading commissions.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the strategy(ies) may differ materially from those reflected or contemplated in such forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN