Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio update

April 9, 2021

There has been a decided shift in the bond market in recent months. Investors have begun to focus on the strength of the economic recovery even as central banks press ahead with bond purchases. As a result, longer-term interest rates have more than doubled, returning to pre-pandemic levels. This may signal trouble for high multiple equities, which rely on ultra-low interest rates to justify their hefty premiums. Our portfolios have avoided the risks inherent in both long-term bonds and expensively valued equities, and we believe this will continue to pay off.

Will bond market tremors cause aftershocks in high valuation stocks?

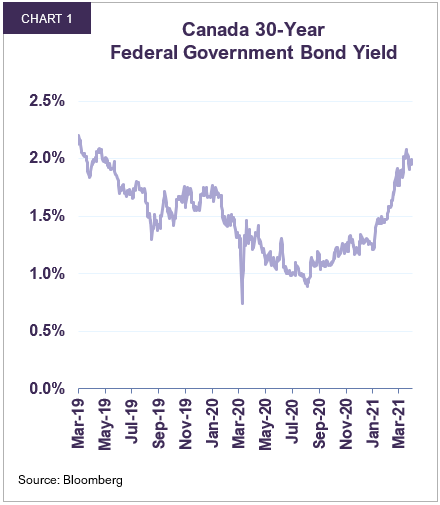

Interest rates worldwide cratered to historic lows in 2020 as central banks embarked on an exceptional stimulus program in response to the pandemic. Following the lead of other central banks, the Bank of Canada cut its policy rate to near zero and purchased bonds in the secondary market. The yield on the 30-year Federal government bond dropped below 1% for the first time ever in March and again in June (Chart 1). In the meantime, digital economy stocks saw their share prices soar, both because they benefitted directly from the pandemic via increased demand for their products and services, and as falling rates led to higher premiums for their shares.

Beginning in the summer of last year, however, investors’ mindset began to change. With global economic data showing decided improvement and vaccine trials demonstrating promising results, investors began to discount an end to the pandemic. A mindset change also occurred at the policy level: economists, governments and policy makers shifted away from fiscal conservatism, embracing instead the use of budget deficits to boost growth. Biden’s $1.9 trillion stimulus program, which comes on the back of $900 billion approved by Trump last December – and this on on top of $2.8 trillion injected in March/April 2020 – fits with a new orthodoxy of borrowing at current low interest rates to support economic activity.

With government spending on the rise and so much money being printed by central banks, inflation concerns are now coming to the fore. This new dynamic has pushed interest rates higher. The 30-year Federal bond yield has risen from 0.9% in August 2020 to 2% at end-March, the same level as April 2019 (Chart 1). The impact on bond prices has been significant: the return on the 30-year bond during the last 7 months was –22%.

A secondary impact of the steepening of the yield curve is the effect on high multiple stocks. We have written at length in the past year how falling bond yields have juiced P/E multiples, particularly in the tech sector. Stocks that derive more of their economic value from future earnings, cash flows, and investments are also more affected by a fall in interest rates. Declining interest (or discount) rates – the rate at which future cash flows are discounted in order to arrive at their current value – inflates today’s values. Put simply, in a world where interest rates are close to 0%, a dollar tomorrow is worth very close to a dollar today. A rise in interest rates has the opposite effect.

If interest rates are no longer falling, and indeed begin to reflect expectations for higher inflation and higher debt levels, this might spell even bigger trouble for high multiple stocks than investors realize. The reason is that ultra- low interest rates may not fully explain the elevated premiums investors have been willing to pay. Is “irrational exuberance” therefore partly responsible for the abnormally high valuations present in some NASDAQ stocks? We wonder the following: what will happen if investors realize (1) the era of falling bond yields is coming to an end and (2) numerous reasonably-valued firms tied to the economic cycle will see earnings growth strengthen as stimulus kicks in and the world economy expands this year and next, narrowing or possibly reversing the earnings growth gap relative to growth stocks?

Letko Brosseau equity portfolios offer value and growth opportunities

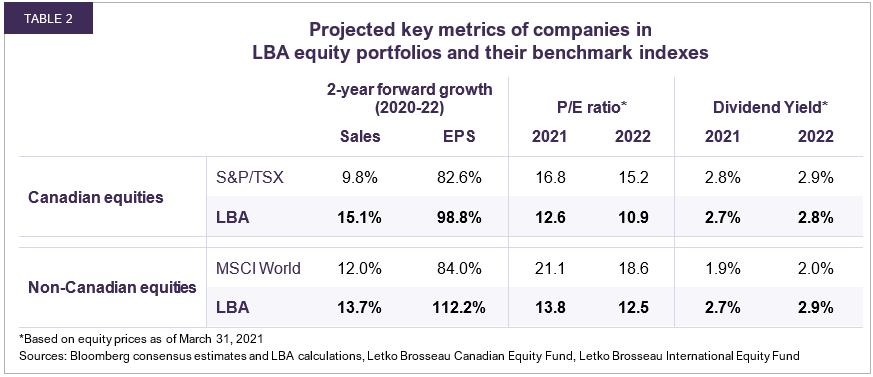

Despite expectations of a faster rise in revenue and earnings than the indexes, our equity portfolios continue to trade at notable discounts to the benchmarks (Table 2).

Our Canadian Equity, International Equity and Emerging Markets portfolios are diversified and structured with well-valued companies that are world leaders in their industry with a compelling growth profile, including:

- Linamar, a global manufacturer of highly engineered auto parts and industrial equipment, is expected to see a 30% increase in revenues and a 65% increase in profits over the next 2 years. The longer-term growth prospects are compelling: auto manufacturers outsource 40% of car parts, leaving a large addressable market for lower-cost and efficient specialty players such as Linamar. In addition, the company is well positioned for the rise of electric vehicles and its Skyjack division stands to benefit from the Biden Administration’s infrastructure spending program. Despite this very strong growth profile, an excellent balance sheet with no net debt and strong cash flows, Linamar’s shares are trading only at 10X expected 2022 earnings.

- Skyworks, a leader in the design and manufacture of Radio Frequency Analog semiconductors, is powering the 5G revolution. The company’s products enable all wireless connections, from Bluetooth to cellular, but the introduction of advanced 5G networks has the potential to substantially increase revenues. We believe that demand for connected devices will multiply due to the Internet of Things and 5G, creating a long tailwind for Skyworks. We expect the company’s revenues to rise by 40% over the next two years. Skyworks has a pristine balance sheet (no debt) and trades at suitable 18X P/E 2022 despite its exciting growth prospects.

- Sinopharm is the largest drug distributor in China with annual revenues approaching $80 billion and an estimated nationwide market share of 18%. The company is also the biggest operator of pharmacies in China. We expect Sinopharm’s earnings to rise by 40% over the next two years, but we also see a long runway of growth ahead. It stands to benefit from market consolidation under the Chinese government’s goal of providing an efficient and safe platform for the delivery of drugs from manufacturers to consumers. Sinopharm trades at a very attractive valuation of less than 6X estimated 2022 earnings, while paying a dividend yield of 5.2%.

We have protected our portfolios from excessive valuations present in long-term bonds and high multiple stocks for some time. Governments continue to press ahead with more fiscal stimulus at a time when central banks admit they are willing to let inflation run a little higher than their usual target of 2%. We believe that maintaining a short duration in our bond portfolios is the best strategy in the current environment. Yields could move further upward which could cause great losses for holders of long instruments. In our view, our equity portfolios offer an interesting opportunity for a diversified exposure to well-valued companies with a strong earnings growth profile. Long-term investors should continue to reap the rewards for their patience.

All dollar references in the text are U.S. dollar unless otherwise indicated.

A list of all purchases and sales made during the past year can be provided on request. The transactions mentioned do not represent all the securities bought or sold in the portfolios during the quarter. It should not be assumed that an investment in these securities was or will be profitable.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN