Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

August 2024

Despite a broad-based pullback in equity markets in early August on signs of a weakening U.S. economy, global indexes are up year-to-date to August 6th: the S&P 500 +16.0% (total return in C$), the S&P/TSX +6.8%, MSCI ACWI +12.2% and MSCI Emerging Markets +7.3%.

We had warned in prior communications that strong performance in a subset of AI-related companies had led to stretched valuations in some areas of the market. Meanwhile, other sectors such as telecommunications had fallen into disfavour and valuations compressed. In Canada, weakness in telecommunications share prices has raised questions about the sector’s prospects. Despite this, we believe the industry exhibits stable fundamentals and growth potential. A closer evaluation of the telecom sector highlights the importance of diversification and reveals the attractive investment opportunities that shape our equity portfolios.

Highlighting the Canadian Telecom’s Resilience and Value

The telecommunications sector provides essential services to modern society and has historically done so with lower financial volatility, owing to its defensive business model and diversified customer base. Over the years, the industry has made significant investments in expanding its network coverage nationwide. By the end of 2023, the mobile network reached 99.5% of Canadians, and 94.8% of households had access to unlimited high-speed broadband. Today, our coast-to-coast network coverage is ranked #1 among G20 countries for mobile network quality.

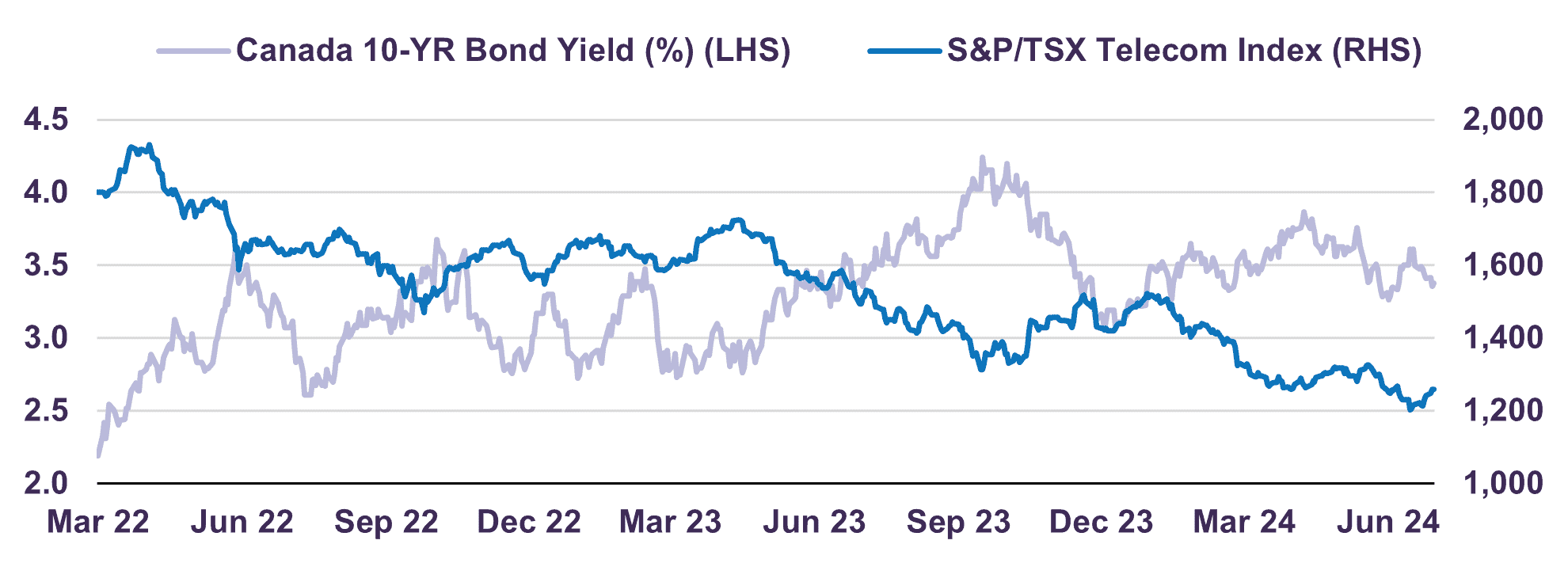

Despite the strengths of the Canadian telecom industry, equity prices of companies in the sector have underperformed over the past two years, though they are up in the first week of August while the S&P/TSX has declined. Since April 2022, the S&P/TSX Telecommunication Services Index has declined by over 30%. This drop coincided with a sharp rise in long-term interest rates, which made the sector’s dividend yield less appealing (Chart 1). Competition has significantly intensified, especially following Quebecor’s acquisition of Freedom Mobile, while regulatory uncertainty has amplified the negative sentiment, putting additional pressure on the industry’s leading companies.

S&P/TSX Telecom Index Decline Amid Rising Interest Rates

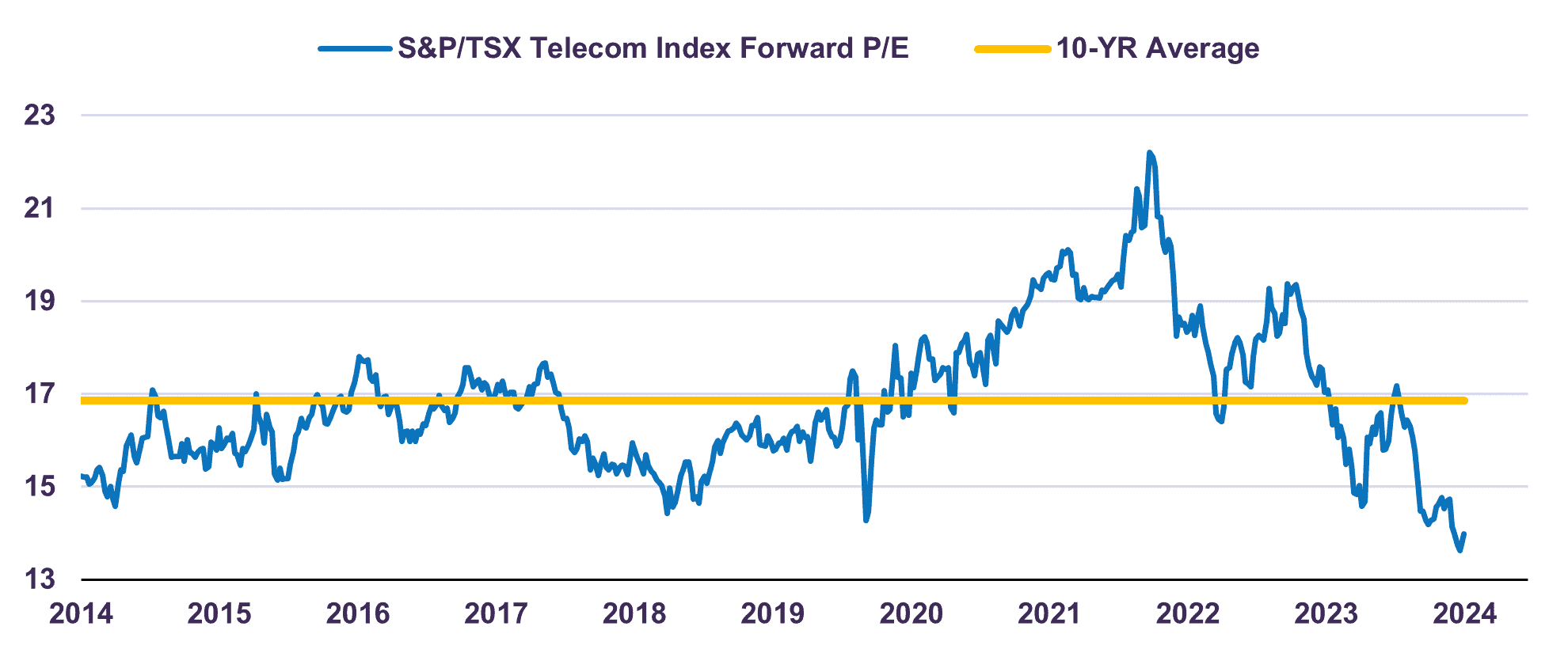

As a result of these concerns, the industry is trading at about 14 times forward P/E, well below its 10-year average of nearly 17 times (Chart 2), marking the sector’s lowest valuation in a decade. We believe that this level reflects an excessively pessimistic scenario. Despite recent challenges, the fundamentals of the Canadian telecom industry have remained relatively stable, with wireless services driving growth. Based on data from the Canadian Radio-television & Telecommunications Commission (CRTC), mobile wireless revenue grew at a compounded annual growth rate (CAGR) of 6.1% since 2021. Telecom companies have reported stable profit figures, only partially influenced by acquisitions, suggesting that profits alone may not be the reason for their weaker share prices. In recent years, the industry has also benefited from high levels of immigration and increased market penetration. By the end of 2023, Canada’s wireless subscribers had grown at a 4.7% CAGR since 2021. Another growth driver is consumers upgrading to higher-tier plans due to increased data use. In Canada, average monthly traffic per data subscriber reached 7.9 GB by the end of 2023, up a notable 40% from 5.7 GB in 2021.

Industry Forward P/E

In addition to growing sustainably, telecom companies demonstrate an ability to respond to tougher economic conditions and adopt defensive strategies when needed, as evidenced by those that have restructured to manage costs and enhance efficiency in recent years. Moreover, after significant investments in 5G and fibre-to-the-home (FTTH) internet, capital expenditures have peaked. We expect the CapEx-to-revenue ratio to decline over the coming years, improving company capitalization.

On average, the telecom companies in our portfolio offer an attractive dividend yield of approximately 6%. In addition, we expect strong free cash flow (FCF) in the coming years, demonstrating financial stability.

| Rogers is expected to lead in FCF growth, driven by the successful acquisition of Shaw and achievement of synergies and achieving de-leveraging targets ahead of plan. | |

| Telus is well-positioned for above-average FCF and dividend growth, due to reduced capital expenditures. The company increased its dividend by 7% last quarter and reaffirmed its target of 7-10% dividend growth for the medium-term. | |

| BCE’s FCF will be hit by a restructuring of 4,800 positions, resulting in one-time severance costs and higher financing expenses, but should recover by 2025-26. | |

| Quebecor is expected to continue its role as a market disruptor and further expand its wireless market share through the acquired Freedom Mobile operations. | |

| With new leadership, Cogeco focuses on cost efficiency and profitability. We anticipate positive FCF growth starting in 2025, due to new strategies. |

With stabilizing long-term rates, attractive valuations, and improving free cash flow, the Canadian telecom industry presents an attractive risk-reward profile. Our investments show resilience and growth potential, which should drive strong share performance.

Conclusion

Prior to the recent volatility in global equity markets, we had begun to realize gains on a number of companies that were approaching their intrinsic value. Therefore, a moderate cash cushion had been built up in our portfolios. While we do not exclude the possibility of further choppiness in the markets, we remain confident your capital is well-positioned to navigate the current environment.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the strategy(ies) may differ materially from those reflected or contemplated in such forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN