Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

August 6, 2021

Global equity markets have recorded double-digit total returns year-to-date to July 31st. The S&P 500 Index is up 15.6% in Canadian dollar terms, the S&P TSX is ahead 18.2% and the MSCI World Index has risen 12.8%. Our equity portfolios have delivered even better returns, outperforming their benchmark indexes over the same period. This was made possible by progress in vaccination rates across the developed world and by record amounts of stimulus equivalent to around one third of global GDP.

In recent weeks, however, sectors such as energy, materials and financials have seen a pullback amid concerns that the economic recovery may stall as COVID-19 cases have increased. The resurgence in cases is driven mainly by the reopening and the higher transmissibility of the Delta variant. While these factors are likely to lead to a rise in cases, the relationship with hospitalizations and deaths is weakening significantly due to progress with vaccinations. In fact, current leading vaccines appear effective against the Delta variant. Two doses of the Pfizer vaccine have shown to be 88% protective against symptomatic disease and around 95% protective against hospitalizations. Two doses of the AstraZeneca vaccine confer 67% protection against symptomatic disease and over 90% protection against hospitalizations. As expected, populations with higher vaccination levels are better protected against the coming wave of infections. To quote the Unites States Centers for Disease Control and Prevention director Rochelle Walensky, “this is becoming a pandemic of the unvaccinated”.

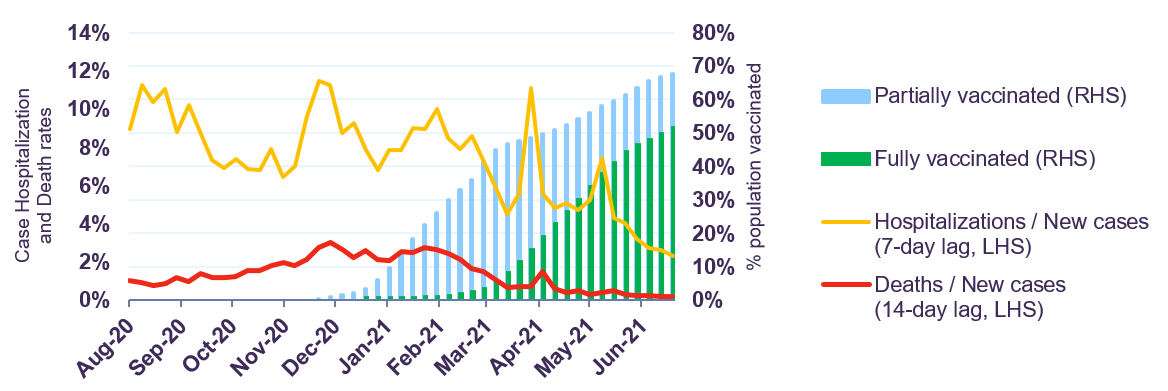

The United Kingdom offers a useful case study. The U.K. saw a sharp drop in COVID-19 case hospitalization and mortality rates beginning in March/April as a significant portion of the population became vaccinated (Chart 1). In the months prior to large-scale vaccination, the ratio of deaths per newly diagnosed cases ranged from 1.5%-3%. Today, with close to 70% of the U.K. population having received at least one dose, and more than half with two doses, the ratio of deaths per new cases is down to 0.2%. Similarly, the percentage of hospitalizations per newly diagnosed cases, which was around 7%-11% prior to vaccination, is now 2.3% and trending lower.

It is important to note that diagnosed cases are only a subset of total infections. Many infections, especially asymptomatic and mildly symptomatic, go untested and uncounted. Hence, the actual rates of hospitalization and mortality are significantly lower than published values. Given significant improvements in health outcomes, the U.K.’s healthcare system can tolerate a much higher infection rate without being overwhelmed. New cases per day shot up to about 52,000 in mid-July, close to the previous peak of roughly 65,000, but the rate of hospitalization and death has remained very low due to the high level of vaccination.

The U.K. COVID case study

The link between COVID-19 infections and hospitalizations or deaths is weakening, but is not fully broken yet. Has it weakened enough at current vaccination levels to allow for a full reopening? The U.K. experiment offers preliminary signs of a positive answer. Since the recent peak of nearly 52,000 new cases, the case count has been declining rapidly. Meanwhile, the removal of mitigation measures continues. This coming wave may present the last significant test to reopening in developed countries, where high quality vaccines are widely available.

We continue to believe that the global economic recovery remains broadly on track. Emerging markets are facing a more challenging environment, but as vaccines become more widely available and further waves of infection are overcome, we should see similar improvements over the next year or two.

The IMF forecasts the world economy to expand by 6.0% in 2021 and by 4.4% in 2022 in real terms. To put things in perspective, this is the equivalent of adding $15.5 trillion or nine and a half Canadas to the world economy over the next 2 years. We believe this environment is very positive for equities. As shown in Table 1, our equity portfolios are expected to grow their revenues and profits faster than the market over the next two years, while still trading at very reasonable valuations of 10.7 times 2022 earnings for Canadian equities and 13.4 times for international equities.

Projected key metrics of companies in

LBA equity portfolios and their benchmark indexes

Sources: Bloomberg consensus estimates and LBA calculations, Letko Brosseau Canadian Equity Fund, Letko Brosseau International Equity Fund.

Our equity strategy has outperformed the markets as the recovery from the pandemic has gathered pace. We are more exposed to sectors that are benefitting from the cyclical upswing, and our portfolio companies have solid growth prospects. Importantly, we have avoided overpaying for growth, and continue to emphasize good value.

We believe equity markets still offer investors choice and opportunity for rewarding returns in the medium term.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN