Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Introduction

In 2020, we witnessed several taxation changes often related to the COVID-19 pandemic, as governments implemented new permanent or temporary measures to assist Canadian taxpayers.

This bulletin summarizes information and some changes that may be of interest for your 2020 and 2021 tax planning. It provides general information that we deem important. Please consult with professional advisors (accountant, tax specialist, etc.) to find out how this information applies to your personal circumstances or to learn about other measures that may be relevant.

Personal Taxation

Registered Retirement Savings Plan (RRSP)

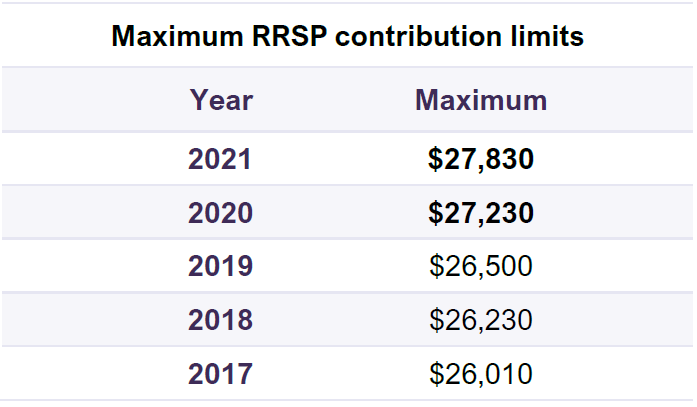

The amount that an individual may contribute to an RRSP is subject to an annual limit since 1991. Generally, this limit is the sum of the previous years’ unused contribution room, plus the lesser of the two following amounts: 18% of earned income in the previous year or the annual limit ($27,230 for 2020 and $27,830 for 2021). This contribution room is reduced by the pension adjustment (PA), which factors in the contributions to a registered pension plan (RPP) or a deferred profit sharing plan (DPSP) during the preceding tax year.

To know the exact amount of your deductible contributions for 2020, just log in to “My Account for Individuals” on the Canada Revenue Agency (CRA) website or check your most recent federal Notice of Assessment.

The contribution deadline for the 2020 tax year is March 1, 2021.

Tax-Free Savings Account (TFSA)

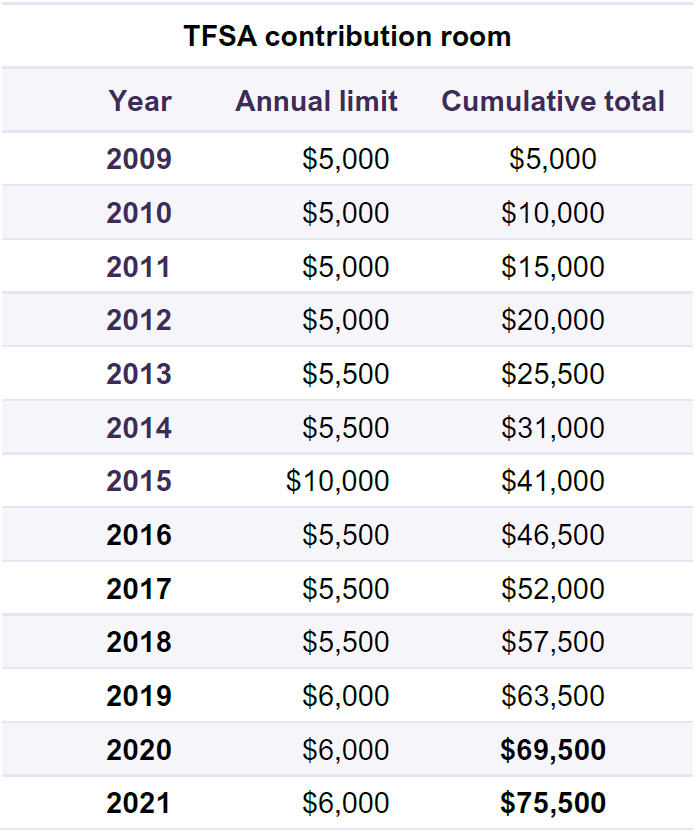

The TFSA was introduced in 2009. To be eligible, an individual must be 18 or older and a Canadian resident. From the eligibility date, the contribution room accumulates every year. Therefore, any unused contribution room may be carried forward indefinitely to future years.

The maximum cumulative contribution room is $69,500 for 2020 and $75,500 for 2021. However, an individual who makes a withdrawal in any given year can contribute an equivalent amount the very next year. It is important to maintain a record of the TFSA deposits and withdrawals. The exact amount of your current cumulative room can also be found in “My Account for Individuals” on the CRA website.

Finally, contrary to the RRSP, contributions to a TFSA are not deductible for income tax purposes. Therefore, withdrawals are not taxable and must not be included in the individual’s taxable income. The main benefit of the TFSA is that the investments within it grow on a tax-free basis.

Registered Retirement Income Fund (RRIF)

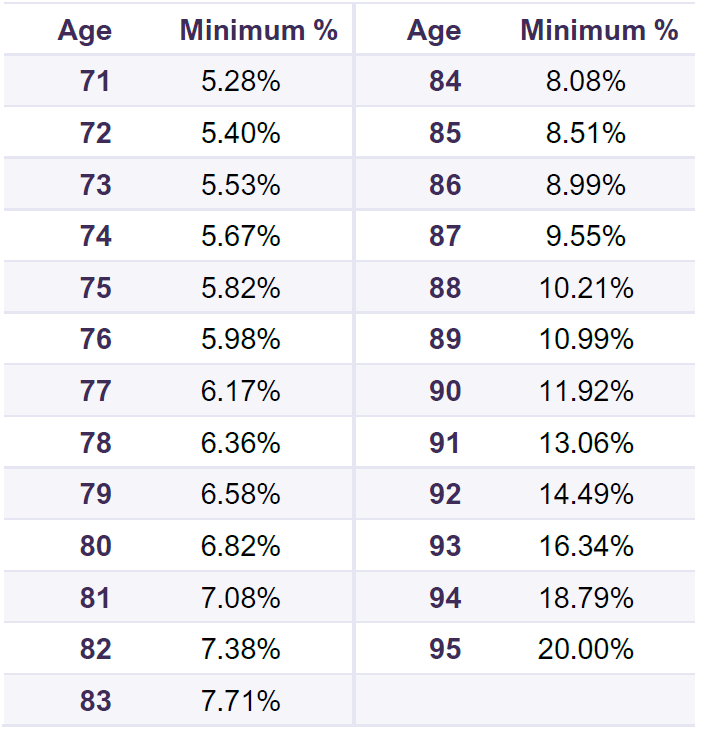

RRSP holders must convert their plan to a RRIF in the year they turn 71. Usually, the financial institution where the plan is held will contact the individual. No minimum withdrawal is required in the calendar year of the conversion. However, minimum withdrawals must be made starting the following year. As shown in the table below, the minimum amount is a percentage of the value of the RRIF on January 1st, based on the age of the holder:

The minimum amount remains at 20% once the individual reaches age 95.

This table does not take into account the special measure under which the required minimum withdrawal has been reduced by 25% for the year 2020 in the wake of the COVID-19 pandemic.

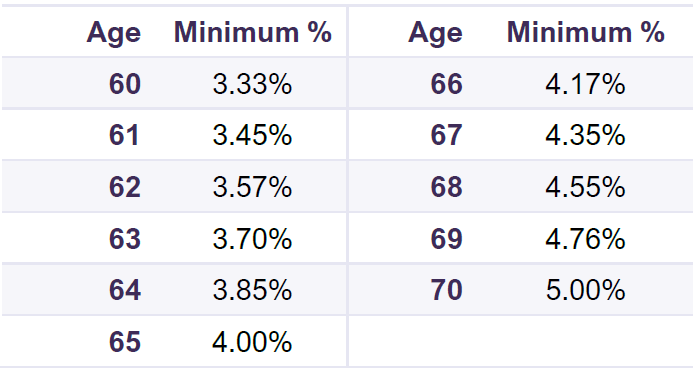

The minimum withdrawal amount is taxable, but no income tax withholding is required. However, income tax must be withheld at source on withdrawals in excess of the minimum. There is no maximum withdrawal for RRIFs. Finally, the minimum withdrawal can be based on the younger spouse’s age, and individuals may convert their RRSP to a RRIF before they turn 71. In these cases, the required minimum withdrawal is applied based on the table below:

These minimum withdrawal percentages also apply to life income funds (LIFs). However, contrary to the RRIF, the LIF has a maximum annual withdrawal limit.

Home Buyers’ Plan (HBP)

Generally, the HBP allows first-time homebuyers to withdraw up to $35,000 (since 2019) tax-free from their RRSP to buy or build a qualifying home. To be eligible, the individual and his/her spouse or common-law partner must not have owned a home used as a principal residence at any time during the previous five years (including the current year).

The amounts withdrawn under this plan must be repaid to an RRSP over a period not exceeding 15 years beginning two years after the withdrawal.

In 2020, the rules have been eased to allow separated spouses or common-law partners to purchase the other’s interest in the home or acquire a new residence. Thus, separated spouses or common-law partners can once again be considered first-time homebuyers and access the HBP if they:

- Live separate and apart from their spouse or common-law partner for at least 90 days;

- Live separate and apart from their spouse or common-law partner at the time of the withdrawal and began to live separate and apart in the year of the withdrawal or in the four preceding years.

Also, the acquired residence must not be owned by the buyer’s new spouse or common-law partner. Finally, if the buyer has already accessed the HBP, the amount withdrawn must have been fully repaid.

Homebuyers who accessed the program can find out the amount to be repaid by logging in to “My Account for Individuals” on the CRA website.

You will find further information about this plan through this link to the CRA website.

Prescribed Rate

Canada’s prescribed interest rate, which is subject to revision every quarter, dropped from 2% to 1% in July 2020. It remains at 1% in the fourth quarter of 2020 and the first quarter of 2021.

The prescribed rate is used for some taxable benefits, to bypass the attribution rules applicable between related persons, such as spouses and minor children. For example, it is used when there is a significant difference in the value of the spouses’ non-registered portfolios and one of the spouses pays higher income tax on investment income. A prescribed rate loan can be made to the spouse in the lower tax bracket as part of an income-splitting strategy.

Reporting the Sale of a Principal Residence

An individual may benefit from an income tax exemption on the capital gain realized on the sale of a principal residence. A tax measure provides for an exemption on all or part of the gain if the property sold was the principal residence of the individual. It should be noted that this capital gain exemption can only be applied to the disposition of one property per family unit per year.

To better enforce this rule, since 2016, the CRA requires that taxpayers report the sale of their principal residence on their tax return, whether the capital gain is partly or fully tax exempt. Therefore, it is important to report the sale of a principal residence in 2020.

Foreign Property

CRA Form T1135 must be filed by any taxpayers who, at any time during the year, own foreign property worth more than $100,000. The value must be calculated on the adjusted cost base rather than the fair market value.

Foreign property includes:

- Amounts deposited with financial institutions

- Shares of non-resident corporations (including U.S.)

- Debt securities issued by a non-resident

- Interest in a non-resident trust

- Real estate

- Other property, except for personal-use property

Answers to frequently asked questions:

- Shares of listed foreign corporations are considered as foreign property even when held with a Canadian broker. However, if they are held in a registered plan (RRSP, RRIF, LIRA, LIF, TFSA, RESP or RDSP), you do not have to include them in Form T1135.

- Units or shares of Canadian mutual fund trusts (such as Letko Brosseau Funds) do not have to be included in Form T1135 even if the mutual fund holds many foreign securities.

- A condominium in Florida mainly used for personal use (and not used for rental purposes with the reasonable hope of making a profit) is not part of foreign property subject to Form T1135.

If you hold investments considered as foreign property in your Letko Brosseau portfolio, all the information required to complete Form T1135 will be included in your tax summaries.

It is not easy to determine which foreign property must be included in calculating the value. The CRA’s FAQ on Form T1135 contains much detail on what should be included or not.

Deductible Financial Expenses

Like the interest paid to earn an income, fees paid for the management of non-registered investments may be treated as tax-deductible financial expenses. Details of the fees paid during the year for your Letko Brosseau account will be included in your tax summaries.

The deduction may be applied differently under federal and provincial income tax, depending on your province of residence. Do not hesitate to discuss this matter with your accountant.

Home Office – Work from Home

In 2020, working from home became more common due to the lockdowns put in place to contain the pandemic.

For that reason, the federal government has introduced in December a temporary flat rate method that simplifies the claim for a home office expense deduction. This method can only be used for the 2020 tax year. The objective is to allow taxpayers who meet the eligibility criteria to claim a deduction based on the hours they worked from home without being required to track their expenses in detail. You can use this method:

- If you worked more than 50% of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic.

- You can claim $2 for each day you worked from home during that period, and $2 for any additional days you worked at home in 2020 due to the COVID-19 pandemic, up to a maximum of $400 (200 work days).

The federal government has issued an information sheet that helps to determine taxpayers’ eligibility.

Individuals who want to claim more than $400 for home office expenses must use the detailed method to calculate their expenses, as explained on the CRA’s website: Home office expenses for employees.

Conclusion

In Canada, taxation is primarily the federal government’s responsibility, and most tax measures are announced in the annual budget. Generally, the provinces incorporate these tax measures in their own budgets, although some differences may exist between the provinces. Exceptionally, the last federal budget was tabled more than 18 months ago due to the pandemic. However, in 2020, Ottawa has implemented programs and measures to help Canadian individuals and businesses cope with the problems caused by the COVID-19 pandemic.

It will be interesting to see whether the governments will maintain some of these programs in 2021.

Please consult with your accountant or tax specialist to determine if a specific measure applies to your situation.

Legal notes

The information contained herein is provided for informational purposes only, is subject to change and is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Where the information contained in this document has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but Letko, Brosseau & Associates Inc. has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN