Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Overview:

- Difficult trade negotiations have fueled fears of a global recession. We believe such fears are overblown.

- These same fears have depressed prices of cyclically sensitive stocks while increasing prices for perceived haven assets and inflating long-term bonds.

- Global monetary and fiscal stimulus is providing a timely boost to economic activity. The IMF forecasts global real GDP will grow by 3.2% in 2019 and 3.5% in 2020.

- In the U.S., solid consumer spending is offsetting softness in manufacturing and exports. We forecast real GDP to advance 2.0-2.5% in 2019 and 2020.

- A sluggish energy sector and soft housing market are tempering Canada’s economic activity. Real GDP is expected to expand 1.5% in 2019 and 2020 as a sound labour market and loose policies provide a positive backdrop.

- Europe’s major economies have been hurt by trade weakness and Brexit. We expect the Eurozone to grow at a sluggish yet positive rate of 1.0-1.5% in 2019 and 2020.

- Growth in Emerging Markets has moderated from 2018 levels. Nonetheless, real GDP is forecast to increase by a solid 4.1% in 2019, before rebounding to 4.7% in 2020.

- Our portfolios possess considerable growth potential at very reasonable valuations, offering the prospect of great shareholder returns. Conversely, long-term bonds continue to remain a high-risk investment.

Uncertainty with regards to trade and geopolitical events such as Brexit and protests in Hong Kong, are contributing to speculation that the global economy is sliding into recession. We do not agree with this view. While manufacturing and trade are under pressure globally, other segments of the world economy continue to show signs of robustness. Job and income growth remain healthy, unemployment rates are at their lowest level in decades and gains in wages are accelerating. Overall credit growth is strong.

This “tale of two economies” makes the outlook murkier than usual, especially as it partly results from geopolitical headwinds. Nonetheless, we believe recession fears to be overblown and primarily the result of President Trump’s unpredictable management of trade negotiations with China. Economic fundamentals support continued growth. Inflation is modest, if not missing, interest rates remain very low and policy stimulation is on the rise. Barring no escalation of the trade conflict, we believe global growth will pick up in 2020.

Tale of two economies

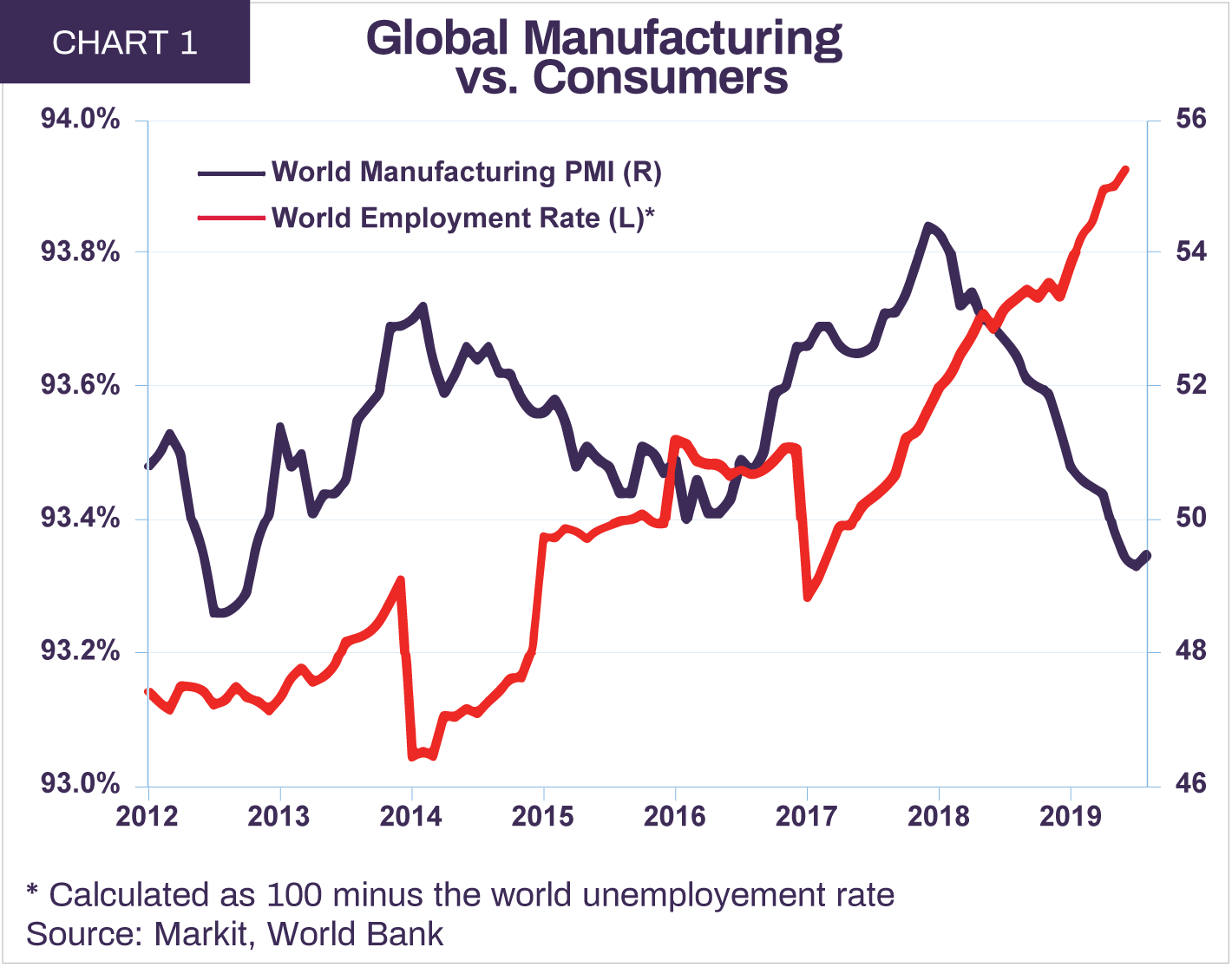

Most major economies are showing a divergence between a slowing manufacturing sector and declining trade volumes versus a robust consumer and solid business investment (Chart 1).

In the United States, real GDP expanded by a moderate 2.3% on a year-on-year basis in Q2.

Trade was weak, given ongoing tariff shocks. Exports declined 1.6% year-on-year in Q2, imports expanded 1.8% and the trade deficit widened by $94 billion to $663 billion over the past year. The malaise caused by the trade war with China, uncertainty over Brexit and the re-negotiation of NAFTA impacted regional trade flows. U.S. exports to China were down 18% and exports to the U.K. and Mexico were each down 4%.

Industrial activity showed signs of sluggishness. The manufacturing ISM index declined to 47.8 in September, a level consistent with contracting activity, and durable goods orders were down 3.0% year-on-year in August.

The weakness in trade and manufacturing was offset by growth in other sectors of the economy. Prospects for the housing sector have improved as mortgage rates declined by an average 100 basis points on the back of the Federal Reserve’s rate cuts. In August, the construction of new homes rebounded to an annualized level of 1.4 million, or 6.6% higher than a year ago, the highest level in 12 years. Meanwhile, credit was readily available and demand remained strong. Consumer borrowing expanded by 4.3% in Q2 while business credit grew 5.1% against a year ago.

Consumer spending continued to be supported by a buoyant job market and wage growth. Hourly earnings were up 3.2% year-on-year in July. High consumer confidence and a healthy saving rate of 8.1% suggest that consumption is likely to contribute positively to growth in the quarters ahead.

Apart from oil & gas investments, which declined 6.1% in Q2, capital spending in all other sectors grew 4.5% year-on-year. Investments in software expanded 9.0% while spending on R&D grew 8.3%.

On balance, we forecast that U.S. real GDP will expand 2.0-2.5% in 2019 and 2020.

In Canada, real GDP grew 1.6% year-on-year in Q2 driven by personal consumption and an improving trade balance. On the trade front, import demand slowed, expanding only 0.3% in the second quarter against a year ago. Meanwhile, exports expanded by 4.0%. This narrowed the trade deficit to $22 billion from $48 billion in Q2 2018.

Consumer spending rose 3.4% in nominal terms during the second quarter as disposable income grew 3.6%, assisted by a 3.0% gain in hourly wages.

Residential investment declined 1.4% in Q2 but is expected to turn positive in the quarters ahead. Canadian mortgage rates have fallen around 50 basis points since the beginning of the year, helping drive an increase in new construction. In the three months to August, the construction of new homes grew 7.4% year-on-year while the sale of existing homes increased 7.1%.

The manufacturing PMI rebounded to 51.0 in September, a sign that the sector is slightly expanding. Non-residential investment contracted 2.7% in Q2 due to a drop in the oil & gas and industrial sectors. Meanwhile, investments in software expanded 5.0% while spending on R&D grew 4.3%. The Bank of Canada estimates that non-oil & gas business spending will improve going forward. We forecast Canadian real GDP to expand around 1.5% in 2019 and 2020.

Economic activity in Europe varied by region with the countries most tied to trade, such as Germany, faring less well than countries more reliant on domestic demand. German real GDP expanded 0.4% year-on-year in Q2 as the country was hit particularly hard by trade uncertainty. Exports account for close to 50% of the country’s total GDP, compared with about 30% for Canada and 10% for the U.S. German exports grew only 1.0% year-on-year in Q2.

Excluding trade, Germany’s economy performed well. Personal consumption expanded 2.9% year-on-year in the second quarter. The unemployment rate remains low at 3.1% and job growth continues to increase at about 1% per year, with strong job gains in construction. As a result, retail sales were up 3.8% in August against a year ago.

Industrial production declined 5.2% year-on-year in July and the manufacturing PMI hit 41.7 in September, showing significant contraction. The impact of trade uncertainty has yet to spread to capital investment which expanded 5.2% year-on-year in Q2 while residential investment grew by a robust 8.3%.

Given the weak level of overall growth, the German government announced its intention to boost fiscal spending if needed. With low government debt of only 66% of GDP and a budget surplus of 1% of GDP, the country has ample room to act. This should support the economy going forward.

The other European country currently facing difficulties is Italy. Since 2010, the country has twice fallen into recession and real GDP has averaged an annual growth of only 0.3%. During Q2 2019, real GDP contracted 0.1% and industrial production was down 1.1% year-on-year.

Unlike other members of the Eurozone, Italy is facing political uncertainty and an inability to stimulate economic growth via government spending. The government is constrained by a 2.1% deficit-to-GDP and a significant level of debt at 151% of GDP. During the second quarter, nominal fiscal spending declined 0.1% year-on-year. The IMF forecasts the country will expand 0.1% in 2019 and 0.8% in 2020.

In contrast, France and Spain are buttressing the Eurozone’s economy. Spain grew 2.3% and France, 1.4% as domestic demand outweighed trade uncertainty and manufacturing weakness.

Overall, real GDP in the Eurozone expanded 1.2% in the second quarter from a year earlier and we expect the economy to grow 1.0-1.5% in 2019 and 2020.

Uncertainty surrounding Brexit continues to plague economic activity in the U.K. Real GDP expanded 1.2% year-on-year in Q2 after growing 1.4% in 2018 and 1.8% in 2017. The IMF expects the country to grow 1.3% in 2019 and 1.4% in 2020.

Trade uncertainty is negatively impacting all major economies of the world with China taking the biggest hit from American protectionist actions. The timing of the recent resurgence of trade tensions was especially inopportune for the country. A Chinese government-led cleanup of unregulated lending by the shadow banking system restrained credit growth and translated into slowing economic activity in 2018.

The first wave of U.S. tariffs was implemented during a time when China was more vulnerable to external shocks. The U.S. subsequently slapped higher tariffs on $200 billion worth of Chinese goods in May. China retaliated shortly thereafter with additional tariffs on $60 billion of American exports (Table 1).

As a result, trade has further depressed economic activity in China. Total exports declined 0.1% while imports declined 6.0% against a year ago in the three months to August. Exports to the U.S. declined 10.2% while imports were down 24.3%. Overall, real GDP expanded by 6.2% in Q2 vs. a year ago, down from 6.7% for the same quarter in 2018.

In response to heightened risks of a slowdown, China suspended its deleveraging of the shadow banking system and has resumed stimulative policies. The government deficit is estimated to reach 5-6% of GDP in 2019. While the Chinese economy has not yet rebounded strongly, it is showing signs of stabilization. The manufacturing PMI crossed above 50 to 51.4 at the end of September and aggregate credit growth remains strong, growing 10.9% year-on-year as of August. We expect real GDP growth of 6.0% in China in 2019 and 5.8% in 2020.

Elsewhere in the Emerging Markets, growth continues to moderate from 2018 levels. India’s real GDP decelerated to 5.0% year-on-year during Q2, the slowest pace of expansion in more than five years. The country’s fiscal and monetary authorities have stepped in and the additional stimulus should kick in during the second half of 2019. The IMF forecasts the Indian economy will grow by 7.0% in 2019 and 7.2% in 2020.

For the economies of Southeast Asia, the pace of expansion remains relatively robust. In the three months to June, real GDP in Indonesia grew by 5.1% year-on-year, the Philippines 5.5% and Malaysia 4.9%. In aggregate, Emerging Markets’ real GDP is expected to grow by 4.1% in 2019 and 4.7% in 2020.

Overall, the IMF estimates that global real GDP will expand by 3.2% in 2019 and 3.5% in 2020.

Why no recession ahead?

The global economy has been buffeted by highly destabilizing events during the recovery from the financial crisis. The potential breakup of the Eurozone, the U.S. government’s near-default on sovereign debt, an oil price shock to the downside, and Brexit each eroded investor confidence and triggered predictions of recession. In the end, global policy easing combined with underlying economic fundamentals supported activity.

At the core of investors’ current concerns is the risk that an escalating trade war tips an already slowing global economy into recession. We acknowledge that increased tensions could negatively impact business spending and, ultimately, job growth. We do not, however, share the pessimism on the outlook for trade negotiations or the world economy.

Though it is difficult to judge the progress of current talks, we believe that both the U.S. President and the Chinese administration have a strong incentive to arrive at a compromise. U.S. rhetoric has become more muted amid some signs of slowdown in industrial activity heading into an election year. China has also reportedly taken some steps to address major trade irritants. They have agreed to stop the forced transfer of technology and scrapped the obligation to set up a joint venture as a condition for foreign investment.

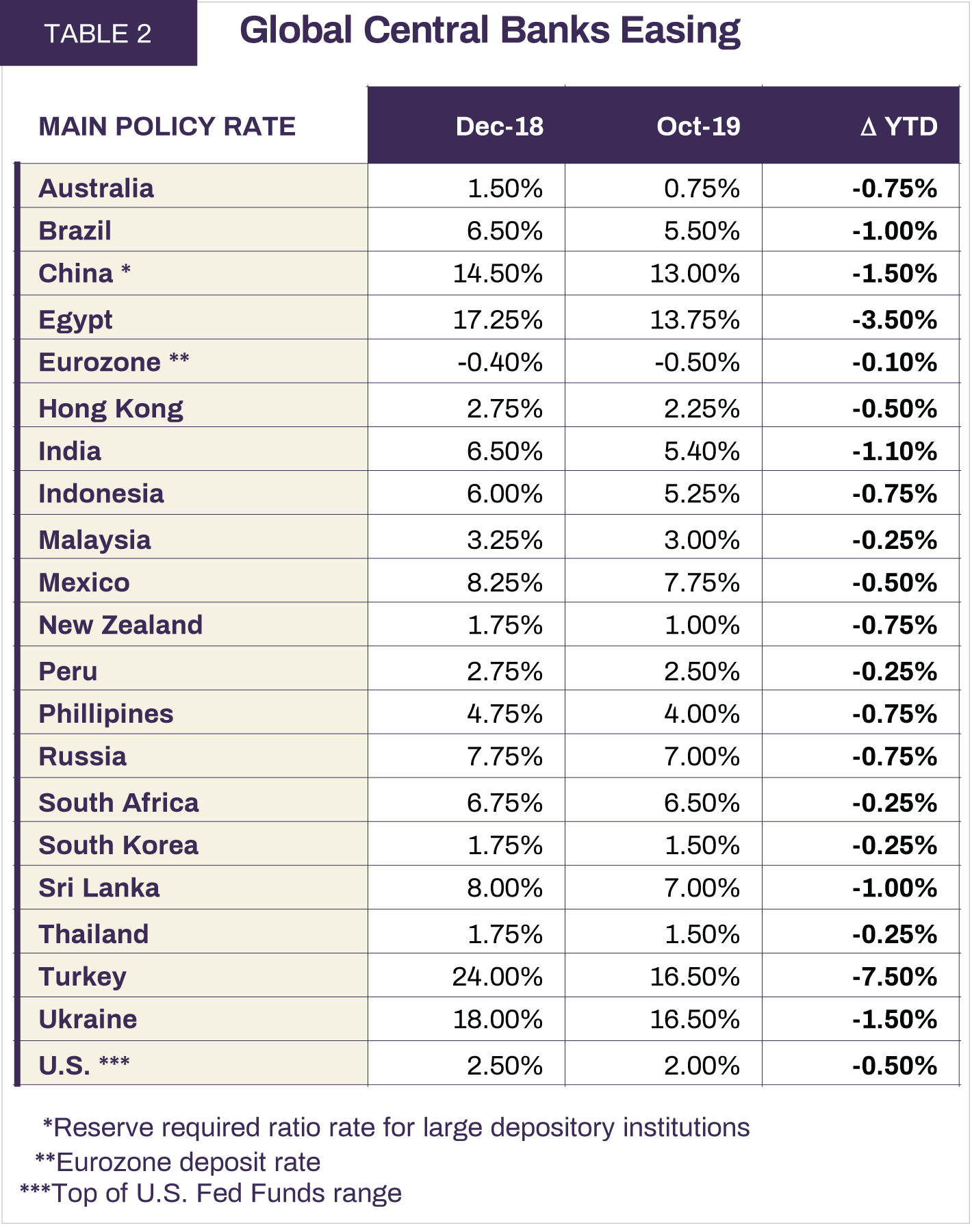

While a deal would remove a major worry for investors, central bank easing and fiscal policy stimulus have already been implemented worldwide in response to slowing growth. In September, the U.S. Federal Reserve cut interest rates by 25 basis points, the second time this year. The ECB also recently cut its deposit rate by 0.1% to -0.5% and will resume a quantitative easing program by purchasing €20 billion of bonds every month starting in November. Elsewhere, China has reduced the bank reserve requirement ratio and many emerging market countries have also slashed interest rates, including Brazil, Egypt, Mexico, India, Indonesia, Peru, the Philippines and Thailand. At last count, 47 central banks cut interest rates this year (Table 2).

The push to stimulate growth is also helped by loose fiscal policies. Across the developed and developing world, governments are tolerating higher budget deficits as low interest rates serve to contain debt service costs. This global coordination of monetary and fiscal policies is providing an important boost to activity while acting as a mitigating factor to the uncertainty caused by trade.

Cyclically sensitive stocks have the potential to deliver substantial returns

Most global equity markets are up substantially year-to-date. The total return for the MSCI Index was 14.2% in Canadian dollar terms, S&P 500 17.0%, S&P/TSX 19.1%, FTSE 7.0%, MSCI Europe 10.7% and the MSCI Emerging Markets Index 3.1%.

Though the U.S. stock market has reached all-time highs, cyclically sensitive sectors have lagged through 2019. We believe that an extreme level of negative sentiment is priced into sectors such as energy, mining, auto and forest products. If recession fears recede as we expect, these sectors could provide very strong returns over the next year. Overall, our equity portfolios trade at less than 11x 2020 earnings and pays a 3.7% dividend yield.

Investors’ demand for haven assets also had a significant impact on the level of interest rates. Interest rates hit a trough in August before rebounding by quarter-end.

In Canada, the 10-year Federal bond yield moved from 1.47% to 1.36% during Q3 while the 30-year yield declined 16 basis points to 1.53%.

These extremely low yields suggest that bonds continue to be reacting to speculative rather than fundamental factors. History suggests such speculative excesses tend to end badly. At the peak of the dot.com bubble, the P/E ratio of the S&P/TSX reached 62x. Today the equivalent “P/E” on a 30-year bond yield is 65x.

While timing is always a challenge in investing, we believe patience has always been greatly rewarded. Stock prices may be volatile over shorter periods, but they inevitably converge toward their intrinsic values over longer horizons. Based on our fundamental analysis, the companies in our portfolios have exciting growth potential, are very reasonably priced and offer the prospect for great shareholder return. In contrast, long-term bonds remain a very expensive and unappealing investment.

Legal notes

All dollar references in the text are U.S. dollar unless otherwise indicated.

This document has been prepared by Letko, Brosseau & Associates Inc. for informational purposes only and is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Where the information contained in this document has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice. Past performance is not a guarantee of future returns.

This document may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN