Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Aging populations, unmet medical needs, and emerging market growth offer opportunities in the healthcare industry. Opportunities that can be seized by both companies with meaningful research and development spending, and those facilitating access to existing technologies.

The Healthcare Industry: Opportunities and Challenges

The healthcare industry helps us stay alive and well. It strives to maintain or improve health through diagnosis, treatment, and prevention. The industry represents over USD 8 trillion in market value1 for publicly listed companies. It is divided across three major sectors: biopharma, healthcare services, and healthcare equipment.

Biopharma, the sector that produces pharmaceutical drugs, represents more than half of the market value at $4,268 bn. Healthcare services, which includes health plan providers, patient care, and healthcare distributors, represent a quarter of the market value at $2,049 bn. The remaining 23% ($1,861bn) is covered by healthcare equipment, such as medical devices and supplies2.

Opportunities in the healthcare industry focus on two factors: broad secular trends (for example, an aging population and emerging market penetration), and unmet needs in specific diseases (such as Alzheimer’s, cancer, and obesity). The first benefits existing healthcare technologies and services regardless of innovation. The second is open to companies with meaningful research and development (R&D) spending. We believe that innovative healthcare technologies will continue to be rewarded.

Nevertheless, there are challenges to the healthcare industry. These include idiosyncratic R&D risks

and affordability.

How LBA Invests in Healthcare

Letko Brosseau’s healthcare investment strategy is informed by the importance of the United States (both in terms of health spending and R&D), demographic and health trends, advances in medical science, and valuation.

The United States is of systemic importance as nearly all large healthcare companies or products are exposed to the American market. They derive a disproportionate amount of profit in the country due to higher prices. The United States spends nearly 18% of its Gross Domestic Product (GDP) on healthcare. This makes it a clear outlier among developed countries, which average 8.8% according to the Organisation for Economic Co-operation and Development (OECD)3. Moreover, with about ten thousand individuals turning sixty-five daily in the United States, further spending increases are projected. The American healthcare market is under pressure to reduce spending and flatten the cost curve; a goal that is shared by other countries. Healthcare budgets are being pressured in developed economies, and this cost consciousness is catching on in emerging markets.

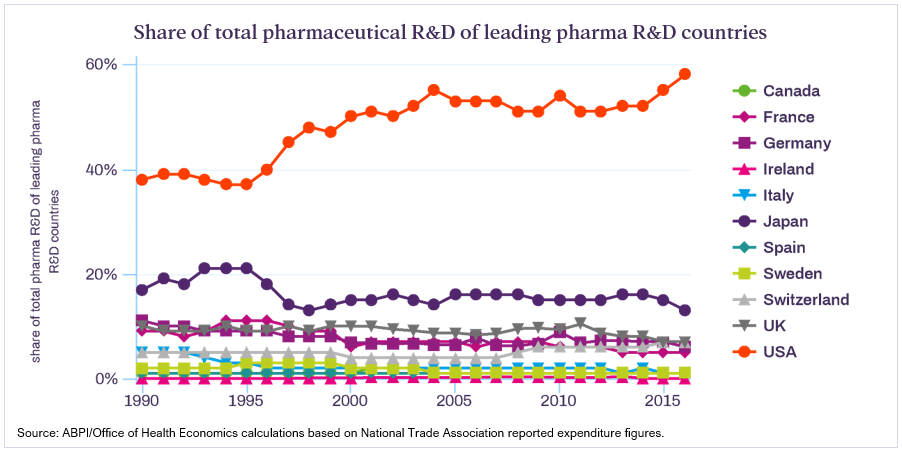

High healthcare spending in the United States nourishes a robust domestic healthcare sector. Nearly 60% of global R&D spending in the healthcare industry takes place in the country. The result is a local ecosystem that promotes the development of world-class healthcare hubs that stimulate innovation, notably around Boston and in California, which leads to discoveries and patents. These hubs provide high-quality and high-paying jobs that attract international talent. The ecosystem reinforces itself through a virtuous cycle of R&D spending, innovation, and marketable patents.

Demographic and health trends are creating a stronger demand for the healthcare industry. Populations in developing markets are aging due to higher living standards and medical advances. Older populations have specific health challenges, such as increased incidences of cancers or neurological or cognitive disorders, wear and tear issues, and a more intense use of healthcare resources to monitor chronic afflictions. Furthermore, the major secular health trend shaping many developed and developing markets is unprecedented rates of obesity. Obesity tends to fast-track ailments usually seen in older populations and intensifies the use of healthcare resources at a younger age.

Advances in medical science lead to improvements in health and longevity. These advances largely depend on R&D. The companies in our portfolio spend a combined $50 bn per year on R&D, which allows them to make advances in the treatment of diseases and focus on fulfilling unmet needs. For example, spinal muscular atrophy (SMA) is a neuromuscular disorder that had no treatment only five years ago. In 2016, Spinraza, developed by Biogen, was approved by the US Federal Drug Administration, becoming the first approved drug to treat SMA. Roche is soon likely to have an oral drug, Risdiplam, approved to treat SMA. Both companies are part of the LBA healthcare portfolio. With sufficient R&D, science moves quickly, and unmet needs can be filled.

Furthermore, recent advances have deepened our understanding of biology and expanded our clinical abilities. For example, immuno-oncology harnesses the body’s immune system to fight cancer. Gene therapy allows the correction of defects in the genetic code that cause disease. New imaging and diagnostic techniques are being developed and their costs are coming down – a genome sequence cost $10 million in 2008 compared to about $1,000 today, a 10,000-fold decrease in price.

Finally, an appropriate valuation is our fourth focus. It is necessary for all investments, in conjunction with one or more of the preceding elements. Once we have narrowed our search, we look to pay a fair price. We want to ensure we do not overpay for the future earnings of companies as any premium will probably have to be given back to the market over time.

Holdings

LBA’s current holdings in the healthcare industry are spread across biopharmaceuticals and healthcare services. The companies were selected using the criteria above. We believe this discipline is a recipe for profitable healthcare investing. The portfolio is well diversified. Our holdings consist of market leaders in oncology, diagnostics, immunology, virology, neurology, vaccines, and diabetes. These fields benefit both from secular trends and disease-specific unmet needs.

Abbvie is a biopharma company. It is best known as the maker of Humira, a drug used in several immunological indications and considered one of the most successful drugs of all time.

Biogen is a mid-sized biopharma company specializing in neuroscience. Approximately 65% of revenues are derived from its multiple sclerosis drug franchise and drug royalties.

Gilead Sciences is dedicated to developing innovative medicines for life-threatening illnesses. It is known for its HIV franchise and its involvement in the treatment of hepatitis C.

GlaxoSmithKline (GSK) is a diversified biopharma company that researches, develops, and manufactures general medicine, vaccines, and over-the-counter consumer healthcare products.

Merck is a biopharma company that develops medicines and vaccines. It produced Keytruda, an immuno-oncology drug that has been approved for fifteen different cancer indications.

Pfizer has a diversified business base that includes stable asset classes such as medicines, vaccines, and sterile injectables (administered intravenously).

Roche is a global leader in oncology and multiple sclerosis treatments with numerous blockbuster drugs on the market, such as Perjeta, and a rich pipeline of new therapeutics.

Sanofi has diversified revenue sources across diabetes and rare diseases treatments, vaccines, consumer over-the-counter healthcare products, and immunology.

Tenet Healthcare owns and operates hospitals and ambulatory centres in the United States that provide outpatient surgeries, emergency care, and imaging.

1 – Source: FactSet financial data and analytics.

2 – Source: FactSet financial data and analytics.

3 – OECD (2020), Health spending (indicator); https://data.oecd.org/healthres/health-spending.htm.

_______________________________________________________________________________

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that is it accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN