Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

- Trillions of dollars have been injected into the economy, preventing a full-scale financial crisis. This stimulus, along with progress on treatments and a vaccine, suggests the worst of the pandemic’s economic impact may be over.

- Economic green shoots have begun to appear. We expect the recession to trough in Q2. Given the scope of global stimulus, 2021 could be a dynamic year.

- In aggregate, the IMF forecasts that the global economy will contract by 4.9% in 2020 and increase by 5.4% in 2021, a path consistent with our U-shaped recovery scenario.

- Global stock markets rebounded in the second quarter, in reaction to developments on the healthcare front, an easing of lockdowns around the world, and the massive stimulus.

- Our portfolio’s cash reserves are being deployed progressively as we capitalize on market opportunities to add quality companies at discounted valuations.

- With bond yields at all-time lows, our fixed income portfolio is steering clear of overvalued longer-term instruments.

- We are confident that the portfolio’s medium-term potential for value creation remains substantial. Patience will be rewarded as we embark on the road to recovery.

Summary

About six months have passed since COVID-19 first appeared and began to spread. In response, governments worldwide have made massive efforts to slow the advance of the virus by enforcing containment and mitigation measures while the scientific community works on a vaccine. With cities in full or partial lockdown and entire industries shuttered, the economic consequences of these policies have been severe. Millions of people have lost their jobs and countless small- and medium-sized enterprises are no longer generating enough cash to pay their bills. The global economy is currently facing its deepest recession since the Great Depression of the 1930s.

Governments and central banks have poured trillions of dollars into the economy to quash credit- and funding-related problems, preventing a full-scale financial crisis. In addition to this massive stimulus, progress towards potential treatments and the development of a vaccine suggests that the worst of the pandemic’s economic impact may be behind us. Cities are gradually reopening, and the easing of physical isolation measures offers the prospect of recovery. Thanks to these positive developments, stock markets have bounced off their lows. By the close of the second quarter, the S&P 500 was up 20% since end-March.

Data are beginning to show that economic green shoots are developing worldwide. This is consistent with our base case scenario that activity will trough in the second quarter. We expect a gradual improvement this year and sustained upside in the latter half of 2021, with the recovery resembling a U-shape. Indeed, given the scope of the stimulus that has been deployed globally, 2021 could be a dynamic year.

We are mindful that uncertainties remain regarding a second wave of transmissions, as well as stresses caused by social or geopolitical disruptions. Our portfolio’s cash reserves are therefore being deployed in a progressive manner in the short-term, though we are confident that the portfolio’s medium-term potential for value creation remains substantial.

Green shoots are appearing worldwide

The slowdown in the spread of the virus has allowed governments around the world to ease physical isolation measures. Cities are reopening and factories are operating again. As we try to analyze how the global economy will progress in this environment, we are paying careful attention to how the situation is evolving in China. Given that the Chinese economy was the first to reopen and has been in recovery for several months, it offers a good roadmap for the rest of the world.

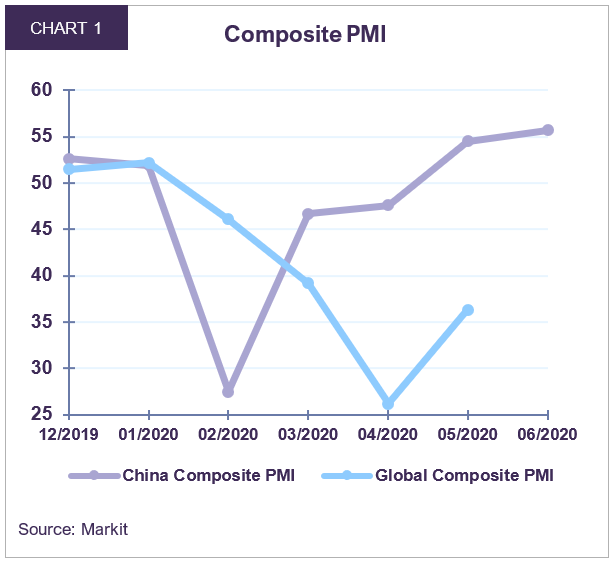

In the first quarter, activity in China was severely impacted by a full-scale lockdown. Real GDP growth declined 6.8% year-on-year, after having recorded a 6.1% increase in 2019. In February, industrial production contracted by 13.5% year-over-year, while the Composite Purchasing Managers’ Index (PMI) hit a low of 27.5 (Chart 1). That same month, passenger car sales declined by 81.6% year-over-year to just 224,000 units, and home sales decreased by close to 100%. In March, total retail sales registered a 15.8% decline on a year-over-year basis, as higher unemployment negatively impacted consumer spending.

As China’s economy gradually reopened, the recovery was swift and sharp. The PMI returned to above 50 in May and now sits at 55.7 at the end of June while industrial production is up 4.4% year-over-year as of May. In May, 2.19 million cars were sold in the country, a rate similar to the number of cars sold before the virus hit, while home sales were up 12.2% year-over-year. However, the turnaround has been uneven. Certain sectors of activity like air travel, hospitality and construction remain severely impacted and are likely to lag, which will weigh on economic growth for some time.

While the contraction in the first quarter was severe, the IMF expects the Chinese economy to grow by 1.0% in 2020. With the worst of the decline already behind it, China is expected to continue to expand over the next several quarters.

China’s recovery appears to be in line with our U-shaped economic growth scenario highlighted in our April Economic and Capital Markets Outlook: gradual improvement in 2020 and sustained upside in the latter half of 2021. Our base case remains that this will also apply to developed markets.

In the U.S., 22 million jobs were lost between February and April, and real GDP is anticipated to have declined by 10% in Q2 against a year ago. As we look forward, we see tentative signs that the U.S. will follow a path similar to China. Factories are restarting production lines, the PMI went up from 27.0 in April to 46.8 in June and industrial production is rebounding. There were 7.5 million jobs created in May and June, and consumer confidence is rising. An elevated saving rate of 23% at the end of May will allow consumer spending to boost growth as retail stores continue to reopen. Already, annualized vehicle sales surged from 8.6 million in April to 12.2 million in May.

While the timeline and trajectory for the recovery remains uncertain and depends largely on developments on the healthcare front, we believe that the U.S. economy is on track to return to its trend rate of growth in the second half of 2021. We forecast U.S. real GDP to contract by 8% in 2020, but increase by 4.5% in 2021.

Early indicators seem to support that the Canadian and European economies will follow along the same lines. In June, the manufacturing PMI rebounded to 47.8 in Canada and to 47.4 in Europe, from 33.0 and 33.4 respectively in April. Consumer and business confidence are also improving and informal indicators such as restaurant bookings and car traffic are showing signs of a pick-up. The Bank of Canada expects economic activity in the country to start picking up in the 3rd quarter, while the European Central Bank (ECB) forecasts a strong rebound on the continent in 2021.

We expect real GDP in Canada to decline by 8.5% in 2020 and rise by 4.5-5.0% in 2021. In Europe, real GDP growth is expected to fall 10.2% in 2020, before rebounding to 6% in 2021. While emerging market activity is projected to fall 3% in 2020, the IMF expects the region to lead the pick-up in world output in 2021, with real GDP growth of 5.9%.

Overall, the IMF forecasts that the global economy will contract by 4.9% in 2020 and increase by 5.4% in 2021, a path consistent with our U-shaped recovery base case.

Massive monetary and fiscal stimulus to hasten a global recovery

In March, when uncertainty was at its peak, credit spreads widened to levels not seen since 2008-09. The destabilization to funding markets put companies reliant on credit in a very difficult position. During the financial crisis, a debate on the negative consequences of stimulus measures delayed their implementation and resulted in a credit crunch that significantly deepened the recession. Learning from their mistake, authorities in both developed and emerging markets were quick to cut interest rates and introduce measures to channel funding to any entity in need. For example, the U.S. Federal Reserve created tools to help different segments of the markets, including small- and medium-sized enterprises, to ensure credit remained available.

From the beginning of February to the end of June, global central banks injected more than $11 trillion into the financial system. Their balance sheets are expected to continue to increase significantly over the next several months. At the beginning of June, the ECB announced an expansion of its Quantitative Easing (QE) program by €600 bn to €1.35 trillion, while the Fed and the Bank of Japan (BoJ) have announced that their QE programs are unlimited. By year-end, the Fed’s balance sheet is anticipated to reach more than $10 trillion, up from $4.2 trillion in December 2019, and the increase will represent close to 30% of U.S. GDP. These measures succeeded in restoring smooth functioning to credit markets and potentially averted an even worse economic and financial contraction.

In addition to monetary stimulus, governments have rapidly deployed fiscal measures, ranging from industry relief (for example to airlines), to mailing cheques to households. This additional spending represented more than $13.5 trillion as at the end of June. In just four months, global monetary and fiscal stimulus totaled $25 trillion, the equivalent of 29% of global GDP (Table 1).

Looking forward, additional government stimulus in the form of infrastructure spending may be used to stimulate job creation at a time when unemployment rates remain elevated. In the U.S., a stimulus bill worth anywhere between $1-3 trillion is widely expected, while in Europe, the European Commission already unveiled a €750 billion package to help member countries recover. The size and extent of this stimulus is truly unprecedented. Given that these measures typically take between 6 and 18 months to work through an economy, the recovery in 2021 may be dynamic.

Potential risks to the recovery

The evolution of the virus and the consequent cautious worldwide reopening, China’s recent economic trajectory and the massive stimulus underway are all factors which support our base case scenario for a U-shaped recovery. There are, however, a few risks which we continue to monitor.

First, a stronger second wave of the virus could bring back some lockdown measures and damage a nascent recovery. At this stage, we are confident that governments are ready for such an outcome given their experience in coping with the first wave. Improved testing capacity, the setup of contact tracing infrastructure, the broader use of masks, and general acceptance of physical distancing measures all suggest that we are learning to better cope with the virus. Along these lines, some lesser equipped emerging market countries are yet to bring the first wave of the virus under control. With surging cases in major economies such as India and Brazil, challenges in the emerging world may weigh on the global recovery going forward.

We estimate that the timeline for herd immunity, and therefore for the pandemic to be over, remains a year away. Given what is known of the virus to date, 70% or more of the population needs to be immunized to achieve herd immunity. In June, it is estimated that approximately 5% of the U.S. population had been infected, 15 times less than required. But there are small studies indicating that there may be a significant portion of the population that is less susceptible to infection due to cross-immunity from other coronaviruses. If that is the case, herd immunity could be achieved at lower infection levels. Moreover, there are large-scale phase 2 and 3 trials planned during this summer for two promising vaccine candidates, offering hope that a vaccine may be available in less than 12 months.

Second, a resurgence of tensions between the U.S. and China, over Hong Kong or other geopolitical sources of conflict, could once again destabilize global trade. The signing of a Phase One trade deal seemed to diffuse the trade war, however the pandemic has made it difficult for the two countries to abide by the terms of the contract which called for increased trade volumes. Although tensions have resurfaced, we continue to believe that a broad community of interest favours a long-term compromise, especially at a time when the two countries face a common predicament in the global pandemic.

Third, political developments in the U.S., including social unrest and the potential election in November of a Democratic administration, could spark uncertainty as to the direction of the economy going forward. High levels of unemployment are typically associated with discontent, although how this may translate into a more lasting impact on the economy is far from clear. We expect every effort will be made to deal with social problems, just as fiscal and monetary interventions have tried to deal with the economic problems.

While we will keep an eye on the evolution of these risks, we remain of the view that once the pandemic passes, significant pent-up demand will provide the foundation for strong global economic growth going forward.

Markets are beginning to rebound

Global stock markets rebounded in the second quarter, in reaction to positive developments on the healthcare front, an easing of lockdowns around the world, and the massive stimulus implemented by both governments and central banks. The S&P 500 (in $CAD) increased by 15%, S&P/TSX 16%, DAX 22%, Nikkei 13%, MSCI World 14% and MSCI Emerging Markets 13%.

At the end of Q2, the S&P 500 traded at 24.9 times estimated 2020 earnings and 19.4 times estimated 2021 earnings, well above long-term fair valuation levels of 15x. Large cap technology stocks, such as Amazon, Microsoft, Netflix and Apple have outperformed the broad market this year and trade at expensive multiples (from 29 times to 144 times price-to-earnings). We remain concerned that overpaying for companies generally leads to subpar returns over time, as multiples eventually converge towards their long-term averages. In contrast, sectors at the forefront of the pandemic have lagged the broad indexes, and current valuations reflect excessive pessimism with regards to their future potential.

Turning to fixed income markets, over 90% of global sovereign bonds issued by developed countries now trade below 1%, with 20% trading at negative levels. Long-term yields in most developed economies have hit all-time lows. We acknowledge that it may take some time for interest rates to adjust higher, in line with economic growth and inflation. However, we choose not to speculate on this timeline. We believe investing in such instruments offers poor prospects for return over the long term and presents an additional risk of losing capital if rates were to rise more quickly.

Fixed income investors should be wary of the longer-term impacts of pandemic-related stimulus measures. An explosion in government deficits will lead to massive funding needs, which may put upward pressure on rates. In the U.S. alone, the fiscal deficit is expected to reach close to 20% of GDP in 2020 (Chart 2). This implies that the U.S. Treasury will need to issue more than $3.8 trillion in new bonds in the market. It may be difficult for this increased supply of bonds to be absorbed by financial markets should investors shun investments that offer meagre return potential.

Our portfolios remain positioned to offer significant value creation in the medium-term. On balance, the equity portfolio trades at 12.8 times forward earnings, 1.4 times sales, and offers a 4% dividend yield. Our fixed income portfolio is steering clear of extremely overvalued longer-term instruments. We are investing surplus cash in a progressive manner, capitalizing on market opportunities to acquire quality companies at discounted valuations. We are confident that patience will be greatly rewarded as we embark on the road to recovery.

All dollar references in the text are U.S. dollar unless otherwise indicated.

This document has been prepared by Letko, Brosseau & Associates Inc. for informational purposes only and is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented hereunder is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that is it accurate, complete and current at all times.

Where the information contained in this document has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice. Past performance is not a guarantee of future returns.

This document may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN