Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Overview:

- In light of the rapid spread of COVID-19, we have revised our base case economic forecast for 2020. We expect a sharp decline in global activity during the first half of this year followed by a rebound before the second half of 2021.

- Global fiscal and monetary authorities are taking timely and decisive action to lessen the extent of the fallout and forestall a credit crisis and an even worse economic scenario.

- Advancements on the health care front may offer the potential for a milder recession to play out. We are watching these developments closely.

- Bond yields have plunged to historic lows and credit spreads have widened. Our investments are concentrated in high quality government securities.

- Equity, bond and commodity markets have experienced extremely disruptive trading activity. Some share prices reflect very adverse market dynamics rather than sustainable economic value.

- We continue to assess the investment potential of marquee companies whose shares prices have suffered heavily.

We have made some purchases, but it may still be early to deploy cash more extensively. - Our advice is to avoid a panic sale. History will show that extreme market disruptions such as this one may offer once in a decade opportunities.

Global economic growth was primed to accelerate in 2020, following a period of softer activity brought on by the U.S.-China trade conflict. The signing of a Phase One trade deal between the two countries triggered an improvement in consumer and business sentiment and global economic indicators showed signs of a rebound. The rapid spread of COVID-19 has since ground activity to a halt, prompting a massive revision to economic forecasts for the year. Governments around the world have enacted strict containment measures, including border closures and full lockdowns, to minimize contagion and avoid overwhelming health care systems. The consequences, while positive on the health care front, will be severe for the world economy.

With global recession inevitable, fiscal and monetary authorities worldwide are taking pre-emptive action, deploying the tools necessary to support businesses and households. Aside from any major breakthroughs on the treatment front, the success of these initiatives will likely determine the extent of the economic decline the world is about to face.

Considering these exceptional circumstances and the level of uncertainty surrounding the outcome, we have highlighted three potential scenarios for the world economy. Our base case forecast calls for a steep recession, but government intervention will prevent funding and/or credit-related pressures from causing a more extensive contraction. Our estimate of how long this recession lasts is tied to our virus model – we expect the economic impact of COVID-19 to be front-loaded, with sharp declines in activity observed during the first half of 2020. Beyond this, our forecast is for a strong rebound by the second half of 2021.

On the portfolio side, our advice is to avoid a panic sale. As in every past recession and financial crisis, including the 2008-09 Great Recession, the mistake is to sell once financial markets have begun to price in the worst possible outcome. Although it is impossible to determine the extent of any further decline in equity prices, or to pinpoint the exact timing for shares to begin recovering, the world will get through this period of difficulty. The virus will eventually run its course and companies will survive. When we look back, we will be astonished at the low levels at which share prices were trading.

The pandemic’s side effects destabilize the global economy

On March 17th, upon publication of our report entitled LBA update: answers to your pressing questions, there were 198,238 confirmed cases of COVID-19 in the world. Five days later, on March 22nd, there were 337,469 cases, a 70% increase. Without major mitigation measures, the rate of acceleration was projected to rise. We have since seen an increase in containment measures worldwide. The widespread adoption of physical distancing techniques – self-isolations, quarantines, school closures, public event cancellations and travel restrictions – has gained momentum. Originally limited to virus “hot spots” and later deployed at regional levels, these containment strategies have progressed to nationwide efforts.

How effective these measures will be and whether they will prove sufficient is yet to be determined. Because of the lagged effect between their implementation and the impact on new cases, we will have better insight over the next few weeks. Meanwhile, we believe governments and society will continue to take the necessary steps to slow the spread of the virus to a level which buys us time to develop a vaccine and maintain the stability of health care systems. Unfortunately, this requires economic sacrifice.

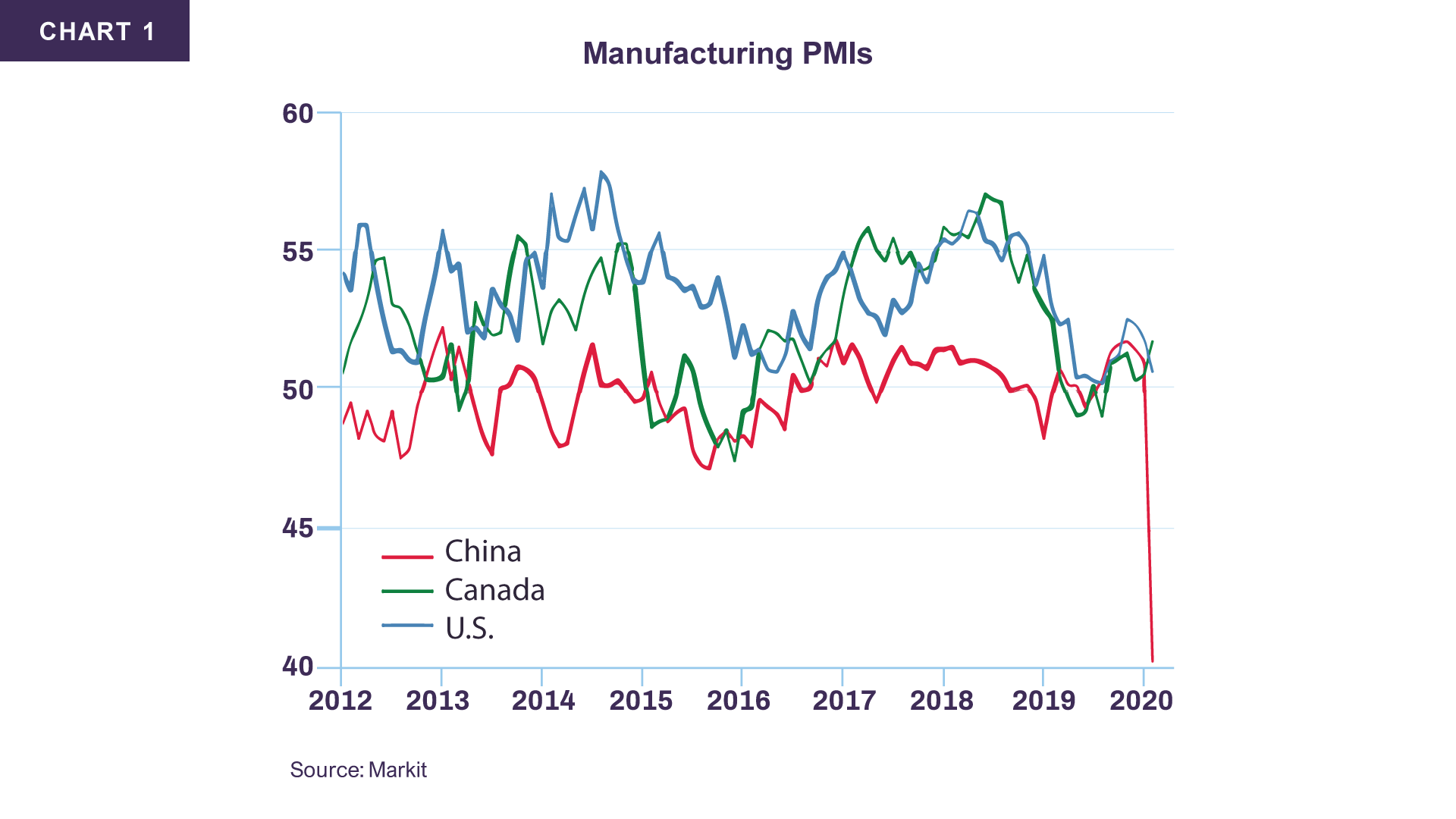

The extent of economic curtailment is still uncertain and subject to experimentation. In China, where the outbreak started, the spread of the virus is appearing to slow thanks to draconian actions. This has come with a cost of acute economic consequences. By locking down 60 million people and implementing strict quarantine and travel restrictions for hundreds of millions more, activity has, for all intents and purposes, almost stopped. According to the China Passenger Car Association (CPCA), the country’s passenger car sales dropped 80% year over year in February. Elsewhere in the transportation industry, rail passenger traffic collapsed 87% in February. Over this period, the Manufacturing Purchasing Managers’ Index (PMI), a gauge of expected activity, plunged (Chart 1). Many factories remain closed or are operating below full capacity. The situation in China clearly illustrates the real economic costs required to limit the virus’ progression.

Over the last several weeks, governments around the world have introduced similar measures which are inevitably going to cause similar economic pain. Several countries have announced a state of emergency and implemented mass quarantines. A third of the United States is now under lockdown. Leading economic indicators are beginning to show that these emergency measures are taking their toll. In the U.S., unemployment claims suggest that nearly 10 million jobs have been lost and the March unemployment rate recorded its largest one-month increase since 1975. Elsewhere, consumer confidence in Germany plunged by 67% heading into April, nearing 2008 lows. These early signs support the view that the global economy is headed toward a sharp recession.

Fiscal and monetary prescriptions

Fiscal and monetary authorities are fully aware of the risks and have, accordingly, begun to take timely and decisive action to enact extraordinary stimulus measures. In the U.S., the Federal Reserve slashed interest rates to 0-0.25% while also relaunching a bond-buying program (quantitative easing or QE), this time with no limits. It also created facilities, with the help of the government, to directly provide funding to companies so that they are better able to maintain business operations and avoid solvency issues. Finally, to ensure the world is awash in dollars, the Fed opened swap lines to the entire G10 and several large emerging economies. The message is clear: it will use the full range of available tools to support households, businesses, the entire domestic economy and even foreign economies during this challenging time.

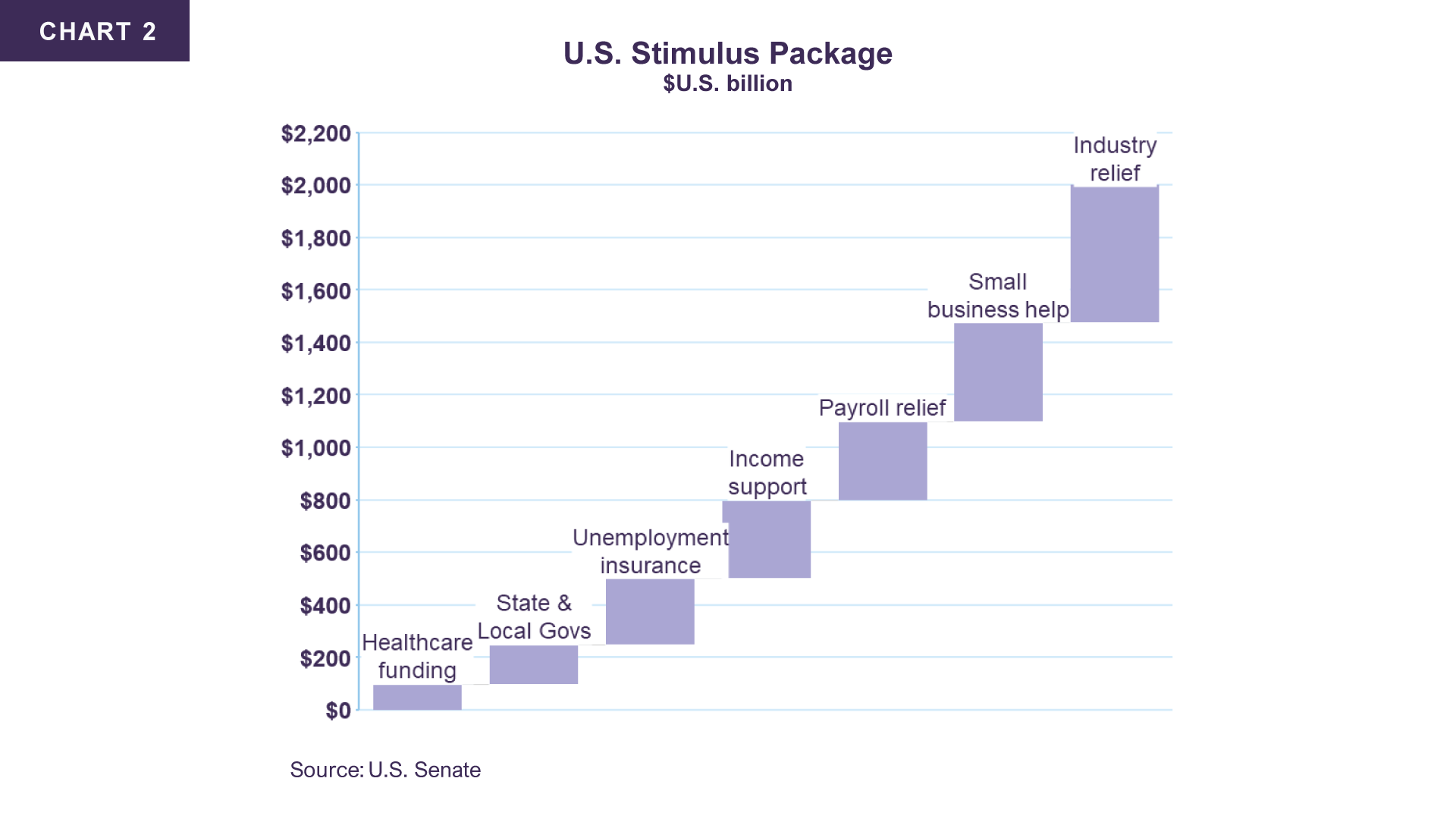

At the fiscal level, the U.S. government is readying its largest-ever stimulus package, providing roughly $2 trillion of support to alleviate funding pressures on households and businesses, as well as state and local governments (Chart 2). From tax cuts to interest and debt holidays, and from bailing out industries to directly sending cheques in the mail to every American, the measures are unprecedented.

The response by global monetary and fiscal authorities is significant and, importantly, early. The Bank of Canada cut rates to 0.25% and announced that it will buy up to C$5 billion of Government of Canada guaranteed bonds per week, its first attempt at QE. Simultaneously, the Housing Agency will purchase C$150 billion of mortgages, as it did in 2008. Meanwhile, the federal government unveiled upwards of C$70 billion in direct support to Canadian workers and businesses.

In Europe, the ECB will increase the size of its current quantitative easing program by €120 billion over the next nine months and offer long-term financing to banks at a cost as low as -0.75%. It also unveiled a Pandemic Emergency Purchase Programme (PEPP) where it will buy an additional €750 billion of bonds in the market. At the fiscal level, European governments are enacting various measures ranging from tax cuts to moratoriums on debt payments, including mortgages. The mindset, as in the United States, is simple: do whatever it takes to prevent a funding crisis.

Japan, the U.K. and the vast majority of emerging markets are also jumping onto the stimulus bandwagon. Even supranational agencies are stepping in, with the IMF and World Bank announcing $50 and $14 billion programs respectively.

The fiscal and monetary prescriptions to mitigate the pandemic’s economic fallout may be only the beginning. More will likely come if required. Additional measures are already being contemplated to provide an extra jolt to the economy during the recovery phase.

Estimating the damage

At this point, the duration and severity of the virus’s impact remain unclear, even if one factors in the mitigating effects from stimulus measures. Given the uncertainty both on the health care and policy response fronts, we foresee three possible paths for the forthcoming recession.

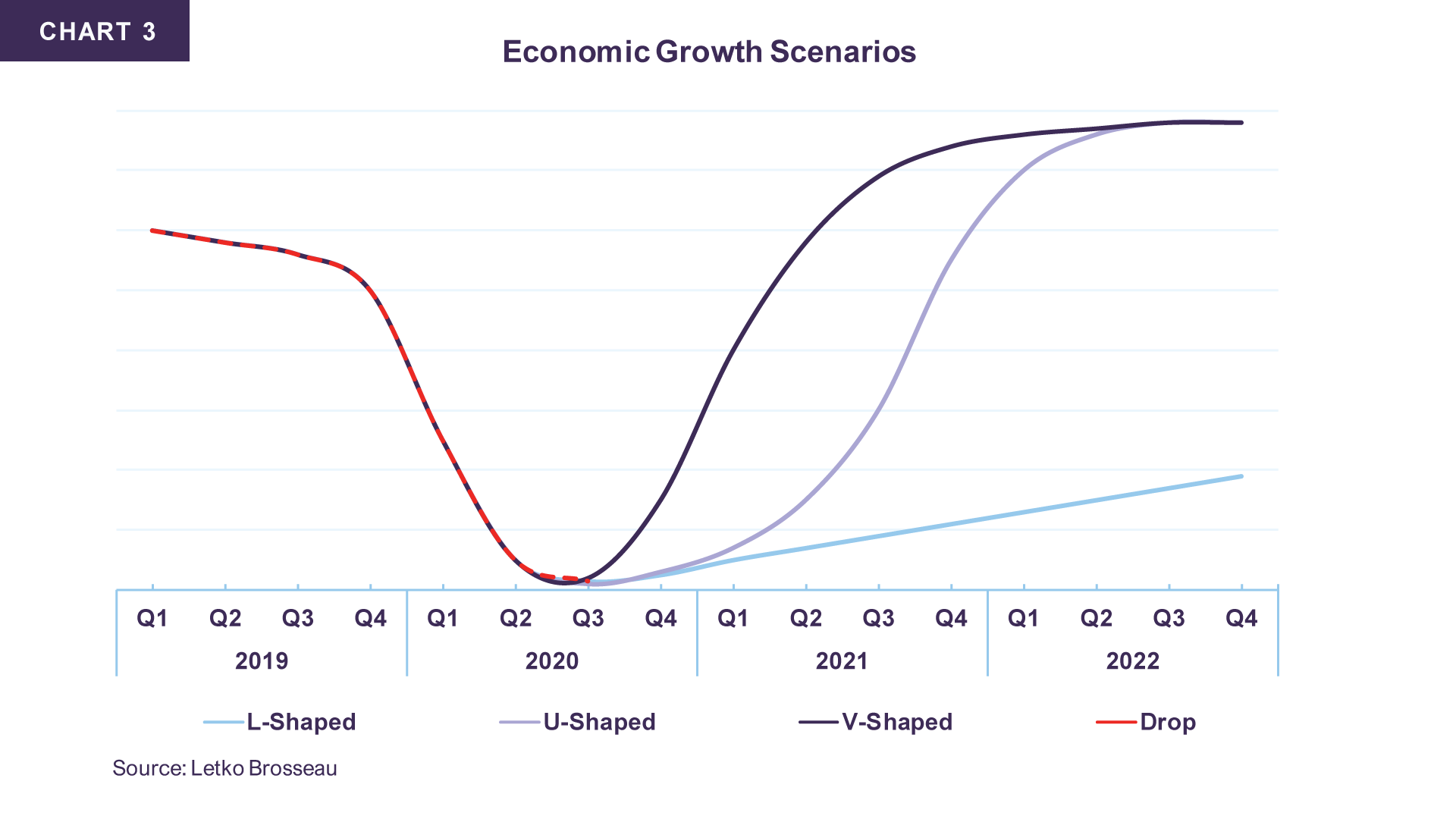

- In our “L-shaped” scenario, the stimulus measures fall short of containing funding or credit issues and the recession plays out in a particularly severe way. As growth contracts, the income of both businesses and households suffers, which unleashes a series of negative secondary impacts. The AARP Public Policy Institute estimates that in the U.S., 53% of households do not have emergency savings and, according to FactSet, 17% of the world’s 45,000 public companies have had to rely on debt to cover interest payments for at least the last three years.From households being unable to make their mortgage payments to companies becoming unable to cover interest on their loans, there is a material risk that credit defaults exacerbate the current downturn. Countries that are reliant on external funding in foreign currency are also at risk due to the lack of liquidity, highlighting the precariousness of their finances. In this scenario, real GDP contracts sharply in both 2020 and 2021, taking several years to return to trend growth (Chart 3).

- In our “U-shaped” scenario, the use of timely and decisive policies that provide ample liquidity prevent funding problems for businesses and households and the global containment measures buy us time. A financial crisis is avoided, and the recession caused by the virus is steep but over by mid-2021, when the majority of the population will have acquired immunity to the virus either through infection or vaccine. In this scenario, global real GDP growth is sharply negative for 2020 but rebounds in 2021, and activity returns to its normal trend in 2022.

- In our “V-shaped” scenario, positive news on the health care front – whether from the development of an effective therapeutic, a shortened timeline for the availability of a vaccine or increased testing efficiency – bring about a shallower economic contraction lasting one or two quarters. A quicker recovery ensues, and global economic growth expands in 2021. Growth is sharply negative only during Q1-Q3 of this year and starts rebounding before year end, returning to its normal trend in 2021.

As we analyze the probabilities associated with each recession path, we forecast that Scenario 2, a U-shaped recession, is the more likely path. The global economy will experience a sharp recession that will pass once developments occur on the health care front.

While it is too early to make a precise economic forecast, we estimate global economic activity may contract by more than 5% in 2020.

Then, once the population has become immune through infection or vaccination, so-called “herd immunity”, demand and production will return to previous levels, and the rebound could be quite sharp due to pent-up demand.

We judge that “L-shaped” Scenario 1, a prolonged recession/depression, carries a low probability given aggressive policy measures already in place and the potential for more to be announced. We note that the financial sector operates with significantly less leverage than before the 2008-09 financial crisis. In the U.S. banking system, the asset-to-tangible equity ratio currently stands at 11, compared with 20 in 2007. In Europe, the same ratio is 16 vs. 27 compared with the Great Recession.

Importantly, the extraordinary measures being implemented do not put undue strain on the banking sector because it is governments and monetary authorities that are extending their balance sheets to provide all this liquidity. How this will ultimately be repaid is uncertain at this time: the more pressing concern is avoiding a funding crisis that would culminate in a full-blown financial crisis. To that end, authorities are responding quickly, aggressively and with a wide range of tools.

Given our current read of scientific developments, we believe that Scenario 3, the “V-shaped” path, carries a low but incrementally rising probability. Therapeutic drugs are being researched and the results of clinical trials will be released in the weeks ahead, therefore it is impossible to conclude on their efficacy at this time. Meanwhile, a vaccine remains 9-18 months away. This leaves a breakthrough in testing as the more probable route for the realization of our third scenario.

The ability to test and quickly obtain results for COVID-19 is rapidly increasing and, as it keeps expanding, will serve as a key tool to fight this pandemic in a more efficient manner. Countries with very aggressive testing and contact tracing in place, like South Korea, Singapore and Taiwan, were able to contain the first wave of outbreaks within their borders. These are countries whose economies are likely to follow Scenario 3 as their populations are back at work and strict, but focused, curtailment exists only for those infected or at high risk. Although there is evidence of a second wave of virus infections, robust testing and tracking infrastructure means domestic containment is feasible once again. While these countries are ahead of the rest of the world on this front, we expect the developed world to learn and eventually follow suit. We are not there yet, however. Our response should become more refined with each round of outbreak. A major improvement in testing abilities, such as an at-home testing kit that would detect whether the individual already has the antibodies to the virus, will allow people to return to work and facilitate a quicker economic recovery.

Markets catch the virus

As we entered 2020, our equity portfolios were positioned for a reacceleration of global growth. The energy, mining and industrial sectors were expected to benefit from this uptick. Economic data reaffirmed our growth outlook was on track. The U.S. added 546,000 jobs in January and February, global PMIs were ticking upwards, and commodity prices were firming up. The S&P 500 Index rose 4.8%, reaching an all-time high on February 19th.

However, when news from China first emerged about a highly contagious novel coronavirus, we began to revisit these expectations. Our base case economic scenario changed from accelerating growth to a protracted period of economic difficulty and our investment team began to work on re-evaluating the risks to the holdings in the portfolio. The focus was to identify and reduce exposure to companies vulnerable to permanent capital impairment. We therefore raised cash levels in the portfolio.

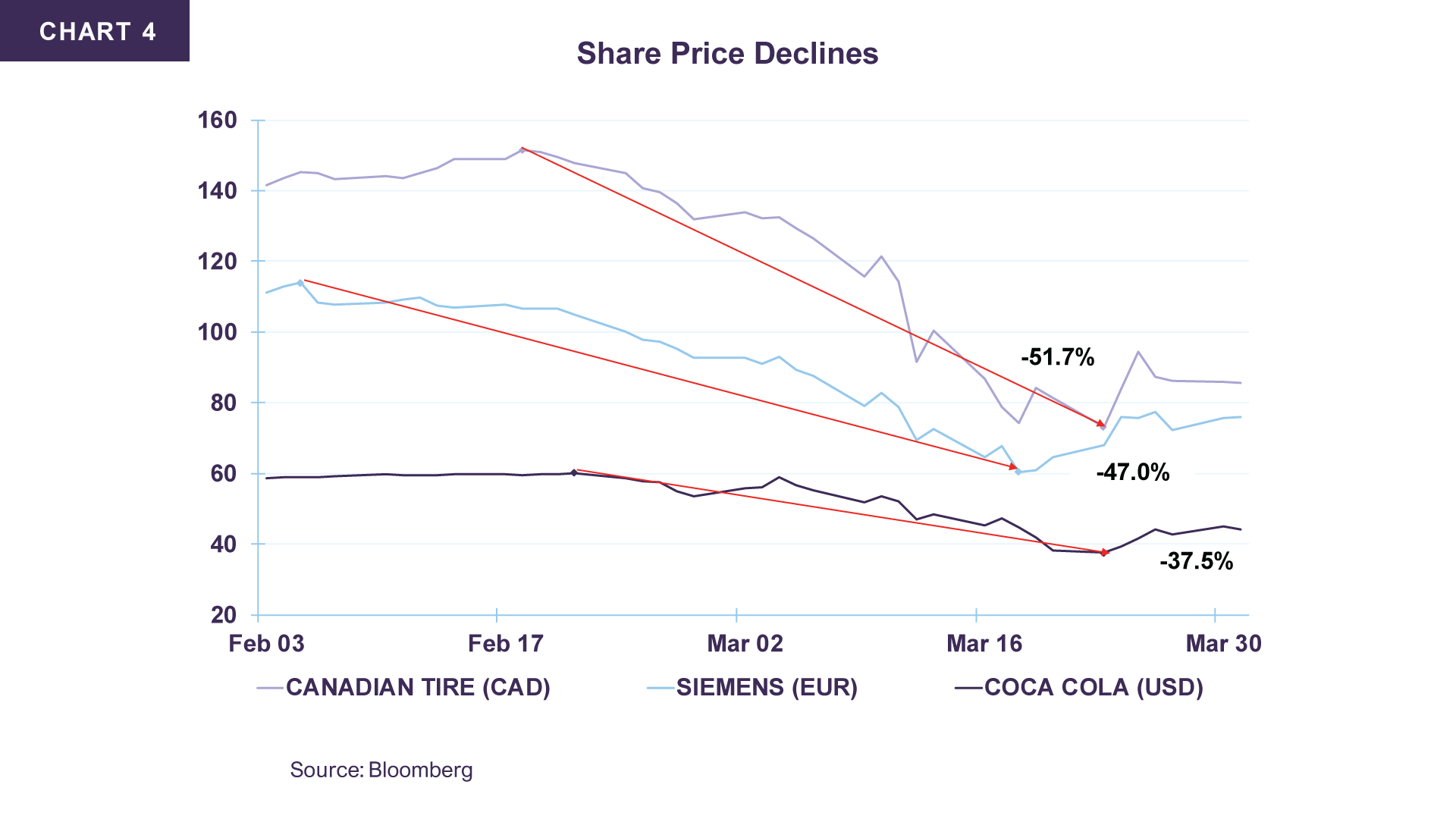

The speed of the market’s decline from its mid-February high was the sharpest ever recorded. The S&P 500 Index corrected –33.9% from peak to trough; the S&P TSX –37.4%; DAX, –38.8%; Nikkei –30.7%; and the MSCI Emerging Markets –31.7%. In addition to travel and commodity stocks, which suffered even more significant pullbacks, other companies also saw precipitous declines in their share prices: Coca-Cola fell from $60.13 to $37.56, Canadian Tire C$151.44 to C$73.14, and Siemens €114 to €60.45 (Graph 4).

It is difficult to say how much lower prices will go from here or when they will begin a sustained rebound, but we do observe that significant bad news has already been priced in. Our equity portfolio now trades at a price-to-book value of 0.7-0.9 times or 20% cheaper than the low point seen during the Great Recession in March 2009.

Meanwhile, bond yields have fallen to new lows. The 10- and 30-year Canadian government bond yield ended the quarter at 0.69% and 1.31% respectively, up slightly from the historical lows set earlier in March. Given poor economic prospects and lower than average liquidity, corporate spreads widened substantially. The spread between corporate BBB-rated and Government of Canada 10-year bonds widened from 175 basis points (bps) at end-December 2019 to 335 bps at end-March, a level last seen during the 2008-09 financial crisis. Provincial spreads widened as well, though to a much lesser extent. The spread on 10-year Ontario provincial bonds increased by 53 bps to 114 bps.

Company earnings are very likely to take a big hit this year, but the virus’s impact has an end point. When herd immunity is reached, currently estimated to be 9 to 18 months away, the disease will pass, the economy will begin to bounce back from the shock, and companies will recover from the disruption. The development of treatments and a vaccine, as well as potential breakthroughs on the testing front, would mitigate the fallout. In anticipation, investors will slowly begin to invest in equities and bid prices up again.

The best advice is, therefore, to avoid a panic sale at these levels.

From a portfolio strategy standpoint, we are continuously assessing the investment potential of high-quality companies whose shares prices have suffered heavily. While it may still be early, extreme market disruptions such as this one offer once in a decade opportunities. With moderately high levels of cash on hand, we are confident that patience will be greatly rewarded as we overcome this severe, but temporary, crisis.

All dollar references in the text are U.S. dollar unless otherwise indicated.

This document has been prepared by Letko, Brosseau & Associates Inc. for informational purposes only and is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented hereunder is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that is it accurate, complete and current at all times.

Where the information contained in this document has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice. Past performance is not a guarantee of future returns.

This document may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN