Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

July 2025

Recent market performance has been shaped by uncertainty around tariff policy and rising geopolitical tensions. While trade concerns appeared to peak in April, subsequent developments—including a 90-day pause on reciprocal tariffs, the resumption of bilateral negotiations, and a recent court ruling suggesting potential limits to executive trade authority—have contributed to a modest stabilization in investor sentiment.

As of June 30th, global equity markets had rebounded to levels near where the year began. Year-to-date total returns for the S&P 500 were 0.8% (in Canadian dollars terms), while the S&P/TSX rose by 10.2%, the MSCI ACWI 4.4%, the MSCI EAFE 13.3%, and the MSCI Emerging Markets 9.4%. The outlook beyond the July 9 reciprocal tariff deadline remains uncertain. However, as outlined in our Q3 Economic and Capital Markets Outlook we do not foresee a broad-based recession at this stage. We expect economic activity to remain subdued and volatility elevated in the second half of the year.

Most major economies possess significant policy tools to cushion potential tariff-related shocks. In Canada, the central bank’s benchmark interest rate stands at 2.75%, well above pre-pandemic levels, offering room for further monetary easing beyond the 225 basis points cut since mid-2024. On the fiscal front, Canada’s deficit stands at 2% of GDP (including both the federal and provincial government budget balance)—among the lowest in the G7 economies—offering scope to increase spending if needed. For instance, a rise in the deficit toward the G7 average of 4.6% could largely offset the economic drag of U.S. tariffs. Increased defense spending, which also supports investment in infrastructure, power, and supply chains, is one example of how targeted fiscal measures can bolster economic resilience.

A New Era of Defence and Trade Policy

While the U.S. administration has reached new trade agreements with several partners in recent weeks, tariffs continue to remain a central component of the U.S. policy agenda. Additional developments are expected as negotiations unfold through the second half of the year. Notably, Canada has recently announced plans to rescind its digital services tax to facilitate broader trade discussions with the United States.

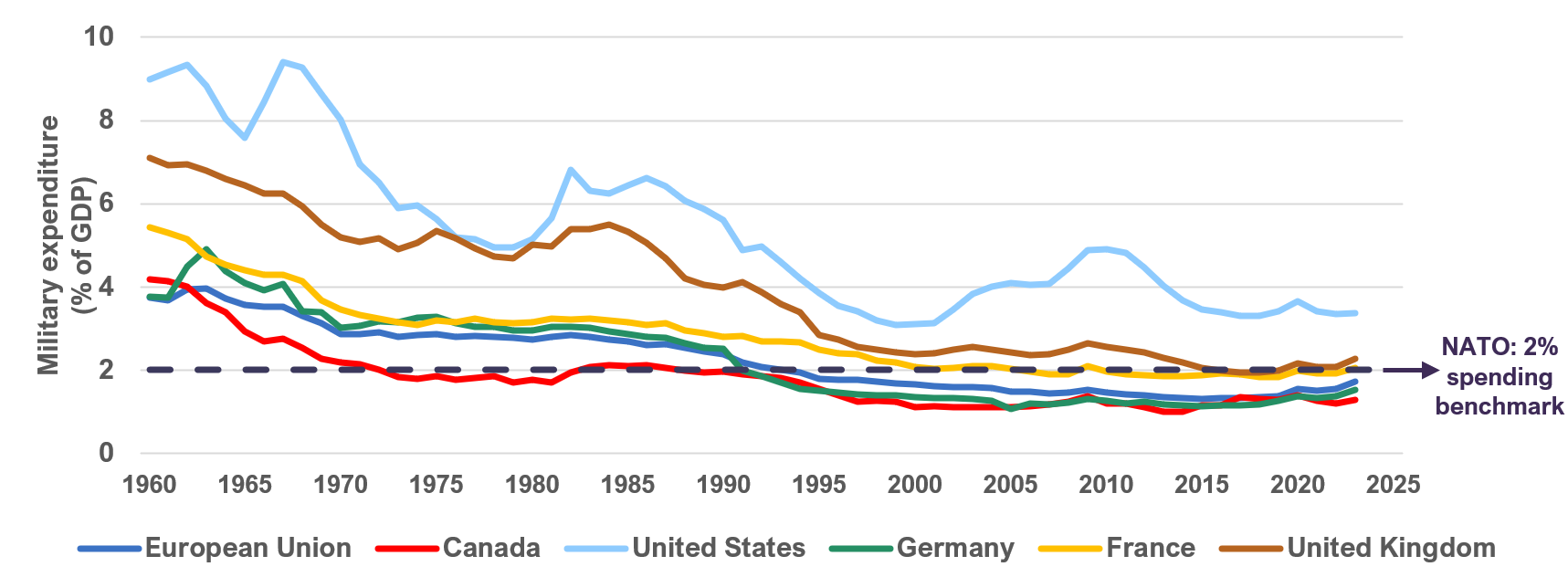

Meanwhile, geopolitical tensions have continued to escalate. Against this backdrop, NATO members have pledged to increase defence spending to 5% of GDP annually by 2035, while Canada has committed to meeting the 2% threshold by 2026—marking the highest levels of defence spending since the Cold War (Chart 1). These increases in defence budgets are expected to extend well beyond conventional military spending and support investment in sectors tied to infrastructure, power, supply chains, and cybersecurity. As a result, these policy shifts may create opportunities for a broader set of companies contributing to these capabilities, beyond traditional defence contractors.

Military Expenditure as a % of GDP (1960-2023)

While investors appear to have jumped onto the defense bandwagon—with the S&P Aerospace & Defense subsector trading at a forward price-to-earnings multiple of 30.4x, well above its historical average of 21.8x—we believe there are still opportunities to prudently maintain exposure where defense-related revenue growth is less widely recognized. For example, Bombardier and CAE, both long-standing positions in the portfolio, are expected to see increased demand from growing defence-related investment.

Bombardier, a global leader in business aviation, also manufactures specialized defence aircrafts—including the Global 6500 Surveillance jet. Though Bombardier’s current defence revenue is modest, management aims to grow this segment substantially, targeting between US$1 and US$1.5 billion of revenue by 2030. Bombardier continues to leverage its substantial asset base to grow revenues with limited incremental capital spending, supporting higher margins and stronger cash generation. The company trades at a reasonable price-to-earnings multiple of 13x and price-to-free-cash-flow multiple of 11x based on our 2026 estimates.

CAE Inc., a global leader in simulation-based training as well as operational support for both civil aviation and defence markets, is similarly well-positioned. As military fleets expand across aircraft, ships, and vehicles, the demand for advanced training and simulation is expected to rise, supporting CAE’s long-term growth prospects. With a strong backlog, rising margins, and a strategic role in new defence initiatives, CAE is expected to outpace broader defence market growth. CAE is particularly well-positioned domestically, having recently been named Canada’s Top Defence Company by Canadian Defence Review magazine. The company trades at an enterprise value-to-EBITDA multiple of 12x based on our forecast for next year, in line with other leading aerospace and defense companies.

Concluding Thoughts

The first half of 2025 has underscored the need for discipline amid shifting trade dynamics, policy uncertainty, and renewed geopolitical tensions. The latter reminds us that defence spending will likely benefit from a long runway of government support, providing various industries and companies with a secular earnings tailwind. We maintain portfolio exposure in this area with a focus on price-sensitivity.

Overall, while equity markets have rebounded from April lows, we remain attentive to areas of elevated valuation and potential volatility. Moreover, with a moderate cash position in our portfolios, we are maintaining a degree of flexibility in the event of market dislocations. Our strategy positions us to navigate a potentially more volatile period for equities.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN