Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

October 2025

Global equity markets continued to hit new highs in September, supported by resilient corporate earnings and central bank rate cuts. Year-to-date, stocks have delivered strong double-digit returns, with the S&P 500 up 11.1% (total return in Canadian dollar terms), the MSCI ACWI 14.6%, the MSCI EAFE 21.1%, the MSCI Emerging Markets 23.4% and the S&P/TSX 23.7%.

Looking ahead, we anticipate another year of positive, albeit subdued, growth for the global economy. As highlighted in our latest Q4 Economic and Capital Markets Outlook, our base case forecast calls for global real GDP to advance by 3.1% in 2026. Accommodative monetary and expansionary fiscal policies should provide further support, helping to offset trade-related pressures.

Against this backdrop, equity valuations have moved higher and, in several segments, appear stretched. Earnings growth expectations have also become increasingly ambitious relative to moderate economic activity. This divergence underscores the importance of maintaining price discipline and focusing on companies where fundamentals and reasonable valuations continue to align.

While we remain cautious in light of increasing signs of market exuberance, we believe that opportunities continue to exist. Maintaining a moderate level of cash within our portfolios allows us to deploy capital selectively as opportunities arise.

Staying the Course Amid Elevated Markets

The strong advance of global equities over the last three quarters has been striking, particularly given disruptions from trade policy concerns and geopolitical tensions. While investor optimism has underpinned recent market strength, it has also driven valuations in certain segments to levels that appear elevated relative to fundamentals.

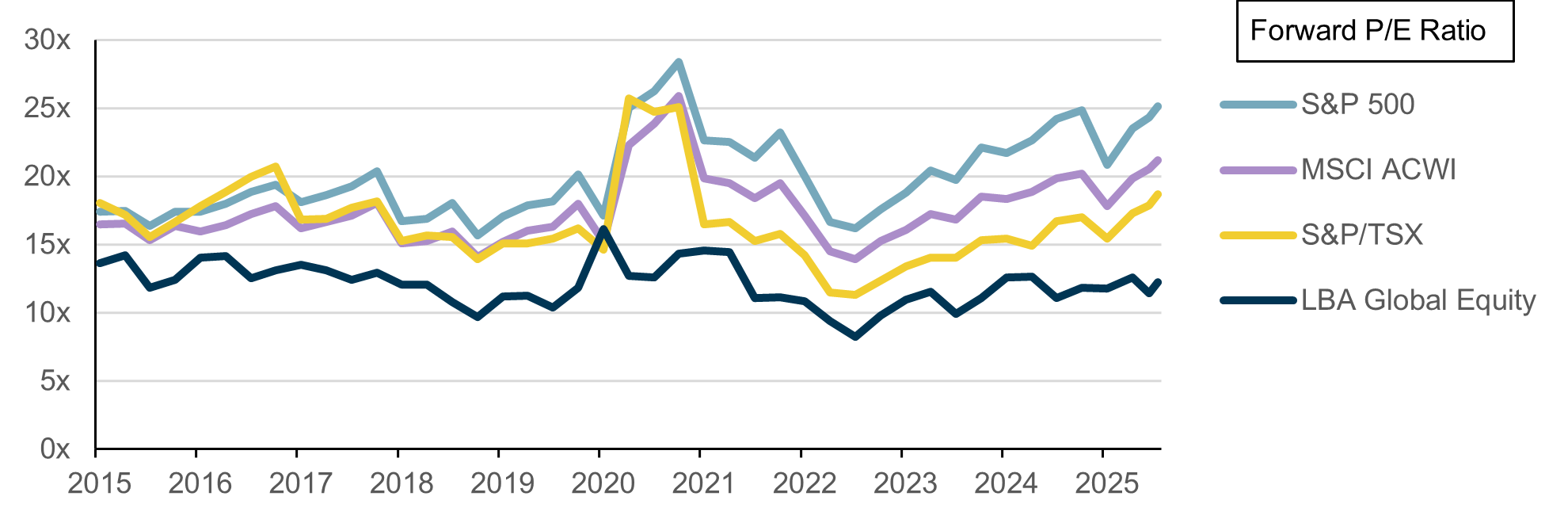

In comparison, LetkoBrosseau’s global equity portfolios remain attractively valued on an absolute and relative basis (Chart 1). The current forward price-to-earnings ratio for our equity portfolios stands at 12.2x, compared with 21.2x for the MSCI ACWI. Lower valuations provide a margin of safety and help protect against downside risk, while preserving upside potential as earnings and investment theses materialize.

LBA Global Equity Portfolio Trades at a Discount to Major Indices

Our disciplined approach to portfolio construction and focus on price sensitivity allows us to uncover opportunities, even in an environment marked by elevated valuations. Barry Callebaut, a recent addition to our global equity and balanced portfolios, is a case in point.

Recent Addition: Barry Callebaut

Barry Callebaut is the world’s largest producer of cocoa and chocolate products, with approximately 20% global market share. The company operates 60 factories and serves customers across 140 countries, including many of the leading global consumer brands.

In recent years, results were pressured by a five-fold increase in cocoa prices, which increased inventory costs, strained cash flow and dampened customer demand. The company was also negatively impacted by higher leverage and increased hedging costs. At the time, shares were trading at 13x forward earnings, compared to a 10-year historical average of 22x.

We initiated a position in July in Barry Callebaut, a company we view as a high-quality long-term operator whose shares had become undervalued following the sharp rise in cocoa prices. The sell-off provided an attractive entry point into a market leader well positioned to benefit from what we anticipate will be a normalization of cocoa pricing and the execution of its “BC Next Level” transformation program, aimed at streamlining operations, strengthening food safety and enhancing service to customers.

Longer term, structural outsourcing trends in chocolate manufacturing, alongside growing consumer demand for premium and differentiated chocolate offerings, provide an additional tailwind for growth. With its scale, integrated supply chain and cost-plus pricing model, Barry Callebaut is positioned to remain a preferred partner for global consumer companies. This investment represents an opportunity to own a market leader with clear recovery potential and durable long-term growth drivers.

Concluding Thoughts

Our investment approach focuses on owning businesses with solid fundamentals that are reasonably priced. In our view, the best-suited strategy for the current environment is an active approach that emphasizes price sensitivity, careful stock selection and a moderate cash reserve. The addition of Barry Callebaut underscores this approach, demonstrating how value can still be found even as segments of the market trade at higher levels.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN