Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

November 2025

The beginning of the fourth quarter saw continued strength across global equity markets, with major indices reaching new all-time highs amid continued investor optimism and resilient corporate earnings. Equities have delivered strong double-digit returns year-to-date, with the S&P 500 up 14.5% (total return in Canadian dollar terms), the MSCI ACWI +18.0%, the MSCI EAFE +23.4%, the MSCI Emerging Markets +29.4% and the S&P/TSX +25.1%.

U.S. equity valuations in particular have become stretched, and earnings growth expectations appear increasingly ambitious relative to moderate economic activity. We remain cautious in light of increasing signs of market exuberance and are maintaining a cash cushion within our portfolios, which would allow us to deploy capital selectively should attractive opportunities present themselves.

What’s Driving Gold Prices to Record Levels as Stocks Reach All-Time Highs?

While equity markets have advanced on optimism surrounding earnings growth and policy easing, other asset classes have also rallied, most notably gold, where the drivers reflect caution rather than confidence.

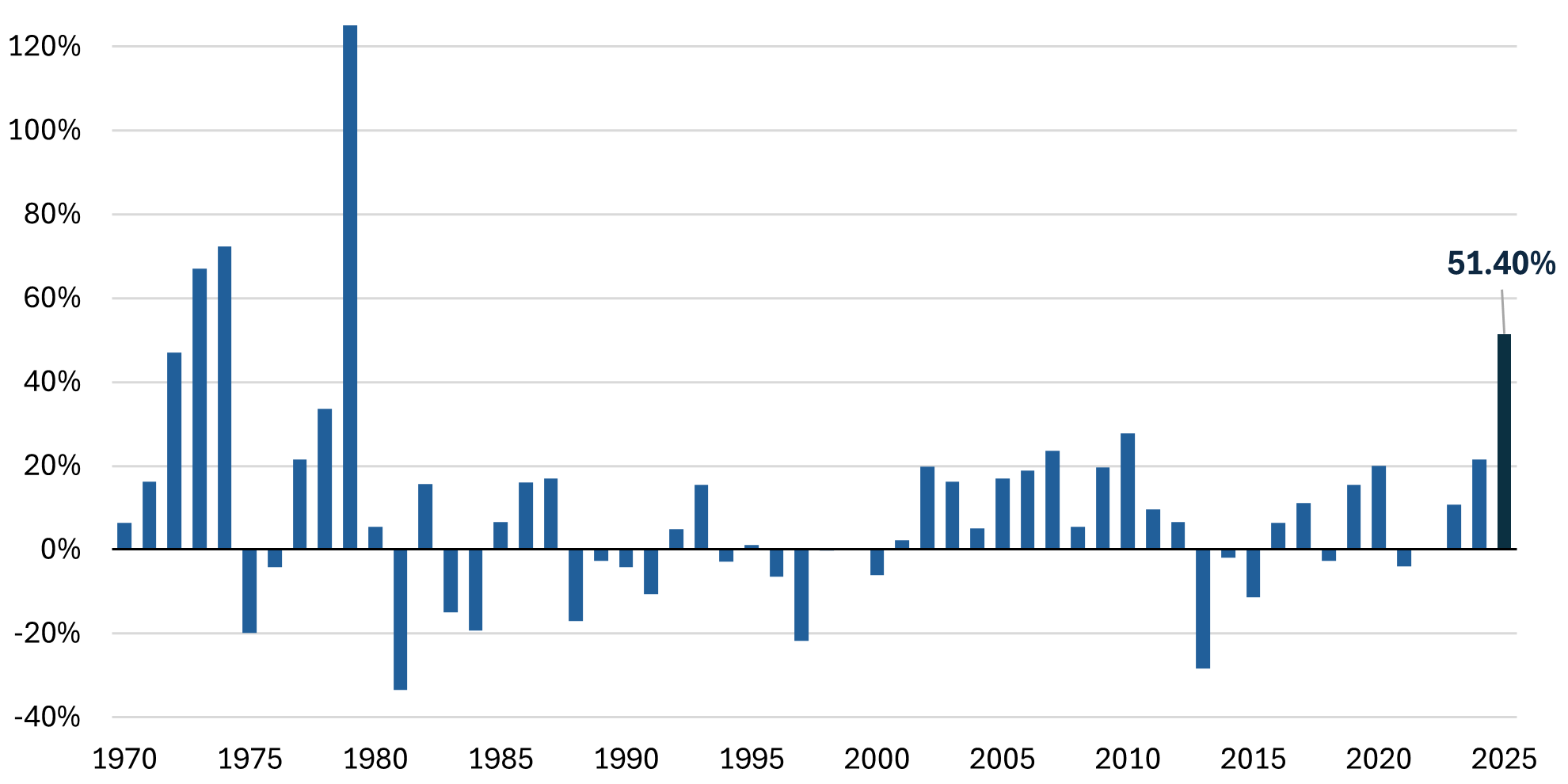

Gold prices have reached record levels, largely driven by heightened fears surrounding economic and geopolitical uncertainty (Chart 1). The last comparable surge occurred in 1979 during the “Great Inflation,” a period when global inflationary pressures were high and investors sought tangible stores of value.

The current spike in gold prices has partly been driven by central bank purchases. Global monetary authorities, particularly in emerging markets, have played a key role in supporting demand through continued accumulation of gold reserves. The largest buyers over the past year have included China, Poland, and Turkey, whose central banks have sought to diversify reserves and reduce reliance on the U.S. dollar. The rally has also been supported by an influx of investors seeking haven assets that serve as alternatives to U.S. Treasuries.

Gold spot price annual return, 1970-2025

Gold is difficult to value given the absence of income or cash flows. Its price is largely determined by various factors including supply and demand, sentiment, and macroeconomic expectations rather than fundamentals alone. As such, we do not seek to own gold as a commodity directly. Our approach is rooted in fundamental analysis and long-term ownership of productive assets, companies that generate earnings, reinvest in growth, and create enduring value for shareholders. Within this framework, we assess opportunities in gold mining equities separately, as these represent ownership in operating businesses rather than exposure to the commodity itself.

Gold Mining Equities: Balancing Opportunity and Risk

Gold mining companies have historically traded above their underlying valuations and have often not met our required return thresholds. The industry tends to trade at rich valuations as it provides liquid, leveraged exposure to the commodity and represents one of the few investable alternatives to ETFs and physical gold. The sector has also benefited from a scarcity premium, with limited listed producers available for capital to flow into during periods of rising gold prices. When assessed on a net asset value basis, share prices have frequently implied discount rates below 5%, well under our required rate of return. In effect, investors have generally been willing to pay high prices for gold miners, effectively accepting lower potential returns despite the considerable risks associated with the business. In our view, these levels do not adequately reflect the volatility of the gold price, the operational and jurisdictional risks inherent to mining, or the capital intensity required to sustain production.

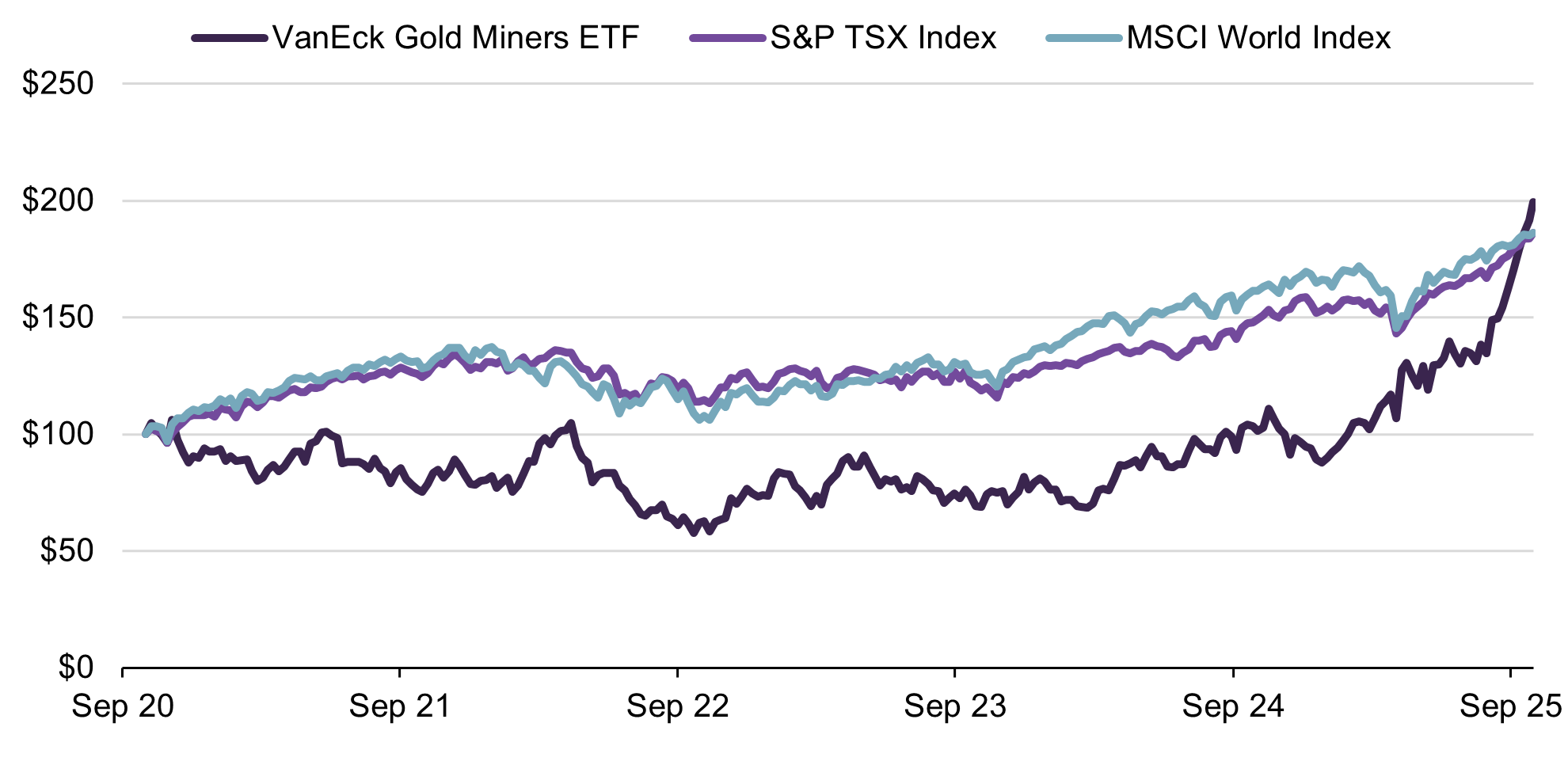

Historically, the gold mining industry has not delivered consistent, sustainable returns relative to the broader market. The sector’s track record has been constrained by poor capital allocation and high reinvestment needs to maintain or grow production. Over the past 15 years, gold mining equities have underperformed major indices, with the recent outperformance largely reflecting the sharp rise in gold prices rather than broad-based improvements in profitability (Chart 2). Moreover, gold producers tend to exhibit elevated share price volatility, driven by the cyclicality of their cash flows and the speculative nature of gold price expectations.

Performance of Gold Miners ETF and Selected Equity Indices over 5 Years (Indexed)

In line with our investment philosophy, we continue to focus on underlying business fundamentals rather than commodity price momentum to achieve our targeted returns. This disciplined approach has led us to prioritize other areas of the market that, in our view, offer stronger valuation support, more predictable earnings growth, and greater long-term potential for value creation.

As a result, we have generally found more attractive opportunities elsewhere from both a valuation and risk-adjusted return perspective. When we have invested in gold mining companies, our approach has been highly selective and fundamentally driven, focusing on businesses with a clear pathway to operational improvement and value creation independent of changes in the gold price.

Current holdings include Barrick Gold and Regis Resources, which we view as sound operators that are cost-efficient, well-capitalized, and disciplined in capital allocation. The investment case for these companies is grounded in long-term business quality rather than speculative exposure to the commodity.

Concluding Thoughts

The current environment underscores the importance of maintaining discipline amid strong market performance. While certain asset classes have benefited from short-term momentum, we continue to emphasize investments supported by tangible cash flows, sound balance sheets, and clear long-term value creation. Our focus remains on identifying opportunities where fundamentals and valuation are aligned, ensuring portfolios are positioned to deliver value across various market cycles.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN