Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Portfolio Update

August 2025

Improved investor sentiment and stronger-than-expected corporate earnings propelled global equity markets to new highs in July. This followed a sell-off in April triggered by the “Liberation Day” tariff announcements, after which a series of pauses in reciprocal tariffs and resumption of bilateral negotiations unfolded. Most recently, several trade announcements ahead of the August 1st deadline temporarily eased trade tensions.

As of July 31st, the total return of the S&P 500 Index since April’s market bottom (in Canadian dollar terms) was 24.5%. Year-to-date, all major equity index returns were in positive territory. The S&P/500 advanced by 4.4%, S&P/TSX 12.0%, MSCI ACWI 7.2%, MSCI EAFE 13.2% and MSCI Emerging Markets 13.0%. In an environment characterized by elevated valuations in certain segments, persistent trade uncertainty and heightened geopolitical risks, we continue to favour a selective and disciplined approach.

We remain focused on high-quality businesses trading at attractive valuations. Regional diversification also plays a key role—not only in mitigating risk, but in accessing underrepresented segments of the global economy. Emerging markets stand out in this regard. These markets have outperformed U.S. equities year-to-date, yet still remain supported by favourable fundamentals and compelling valuation levels, reinforcing the merits of maintaining exposure to a broad and diversified investment universe.

Uncovering Opportunities Within Emerging Markets

Emerging markets continue to represent a significant source of long-term potential, both as a standalone asset class and as a complement within diversified global portfolios. This region accounts for more than 80% of the world’s population and has contributed to over 60% of global GDP over the past decade, yet represents roughly 28% of global stock market capitalization and trades at a 35% discount to the developed markets. This divergence offers a compelling opportunity for long-term investors.

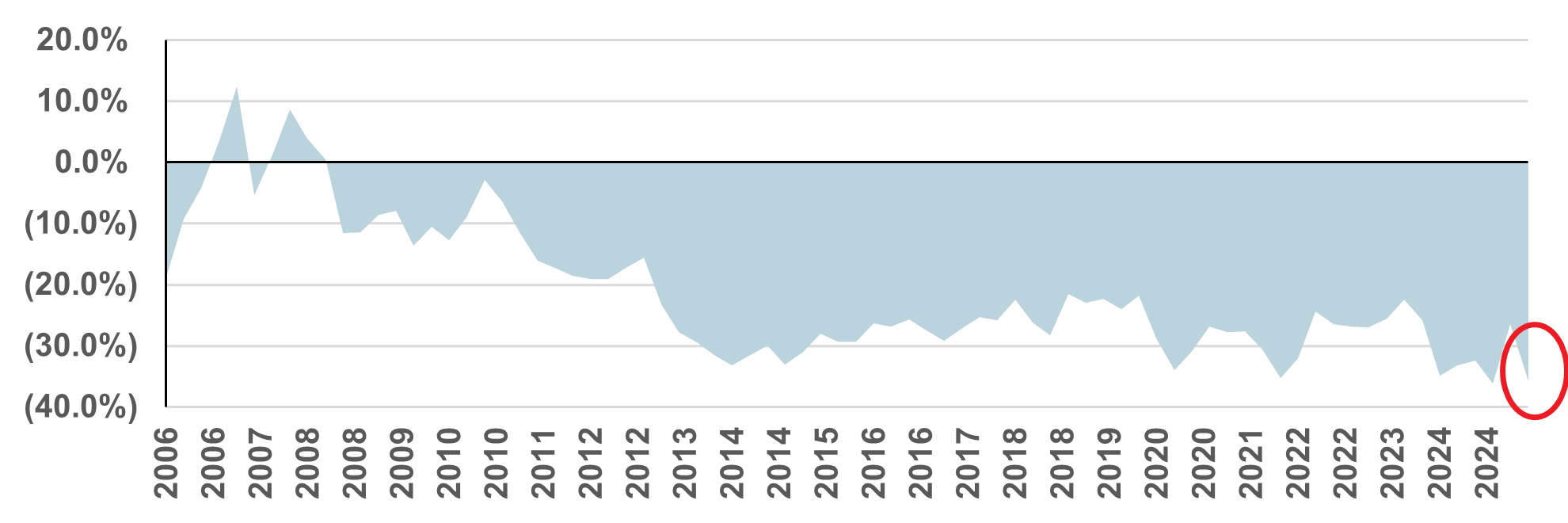

Valuations in emerging market equities remain particularly attractive. As of July 31st, the MSCI Emerging Markets Index trades at 12.0 times forward earnings compared to over 18.5 times for the MSCI World Index, a significant valuation gap (Chart 1). However, investing in these markets requires careful stock selection given the elevated volatility and structural inefficiencies inherent in these regions.

MSCI EM Discount Relative to MSCI World (P/E Ratio Comparison)

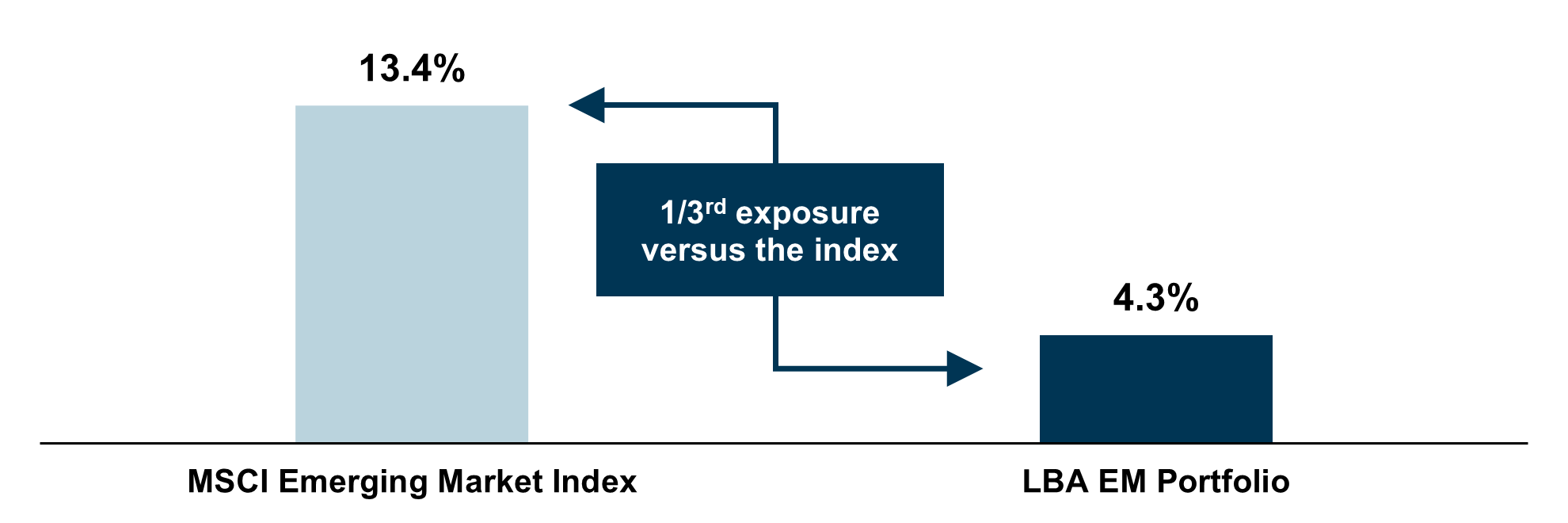

Long-term secular trends, including urbanization, a rising middle class and increasing domestic consumption, support sustained economic growth within emerging markets. Importantly, the earnings base for most companies in these markets is primarily domestic. Our analysis indicates approximately 80% of revenue from our emerging market holdings is generated within their respective domestic economies. Collectively, these holdings have just one-third of the MSCI EM Index’s exposure to U.S. revenue, limiting our portfolio’s vulnerability to external trade shocks (Chart 2).

LBA EM Portfolio Weighted U.S. Revenue Exposure versus MSCI EM Index

Case Study: Manila Water

One of our high-conviction holdings in our EM portfolio is Manila Water, a leading water utility company in the Philippines. Operating under a government concession since 1997, the company provides water access and services to over seven million people in the East Zone of Metro Manila and Rizal Province. Over the past two decades, it has significantly expanded access to clean water, reduced water losses and expanded 24/7 supply.

The company has since grown its footprint in other regions of the Philippines, including Ceba, Davao and Clark, and has entered international markets such as Vietnam, Thailand, Indonesia and Saudi Arabia. Backed by its parent company, Trident Water, Manila Water continues to invest in infrastructure and sustainability, aiming to provide reliable, environmentally responsible water and wastewater services through long-term public-private partnerships. The company currently trades at an attractive 2025 estimated price-to-earnings ratio of approximately 7x and offers a 4.3% dividend yield.

Concluding Thoughts

Navigating emerging markets requires a nuanced and research-intensive approach. At LetkoBrosseau, our decision-making framework is informed by a diverse team of industry specialists—seven of whom were born in emerging markets and collectively speak over a dozen languages—providing us with deep insight into local markets. Our investment professionals travel extensively to meet directly with company management, suppliers, customers and local experts. This level of engagement is essential in markets where disclosure standards, governance practices and investor coverage vary. We believe avoiding missteps is just as important as identifying strong performers.

Reflecting our conviction, our global equity portfolios currently hold an allocation of approximately one-fifth to emerging markets. Since the start of the year, our emerging market holdings have contributed to over a quarter of the total net gains in both our global equity and balanced portfolios. Our strategy is to maintain a meaningful exposure to these regions, not only as a source of growth but also to provide diversification against the growing concentration in developed market indices.

We continue to monitor evolving market conditions closely, applying disciplined research and active management to identify opportunities and ensure our positioning remains aligned with our investment philosophy and client objectives.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

Start a conversation with one of our Directors, Investment Services, a Letko Brosseau Partner who is experienced at working with high net worth private clients.

Asset Alocation English

Canada - FR

Canada - FR U.S. - EN

U.S. - EN