Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

January 2024

- The lagged impact of cumulative monetary tightening points to softer economic activity in the year ahead. The IMF forecasts global real GDP growth of 2.9% in 2024.

- We expect real GDP in the U.S. to moderate from 2.1% growth in 2023 to between 0.5-1.5% in 2024 as a weaker job market weighs on domestic activity.

- Excess savings of C$369 billion should help Canadian households navigate a period of higher unemployment and elevated borrowing costs. We forecast Canadian real GDP growth in the range of 0.5-1.5% in 2024.

- Economic prospects are poor in the Eurozone and the region has failed to expand in three of the past four quarters. We believe the risk of recession remains high.

- China’s stimulus campaign is reason for cautious optimism, but property market malaise is likely to persist. The IMF forecasts real GDP growth in China will slow to 4.2% in the year ahead.

- Apart from China, most large emerging market economies have fared better than predicted. The region is expected to avoid a broad-based downturn. According to the IMF, emerging markets will advance by 4.0% in 2024.

- We see many signs that the global economy has turned the corner on high inflation. We believe policy interest rates may be at or near their peak in the cycle.

- Remaining invested in equities during the uncertainty and market turbulence that characterized 2023 was the right call. Our asset allocation strategy remains unchanged. We continue to favour equities over cash and bonds within balanced mandates.

Summary

Given 2023 began with consensus forecasts calling for a recession, the year turned out to be a remarkable one for the global economy. Growth forecasts were revised upwards as significant progress was made in the fight against inflation. The swing in investor sentiment from a recession scenario to an economic soft landing drove stock prices higher at year-end, while bond yields fell from their October peak levels.

Global economic growth is indeed slowing and inflation is trending lower. As a result, most major central banks are at or near the peak of their hiking cycles and some emerging market economies have already started to cut interest rates.

Our base case forecast for global real GDP growth remains unchanged: we expect further deceleration and ascribe a lower risk to a more pronounced downturn. We anticipate that the disinflationary process will continue through 2024 as most central banks have taken the necessary steps to restore price stability. The IMF anticipates global real GDP growth of about 2.9% in 2024, a slightly slower expansion than its projection of 3.0% for 2023.

U.S. resilient, but slower growth ahead

The U.S. economy saw a robust third quarter, with real GDP expanding 1.2% versus Q2. Strong increases in consumer spending, business investment and government expenditures highlight the continued resilience of domestic activity. In annual terms, real aggregate output rose 2.9% against a year ago.

More recent economic data signalled slower growth in the final months of the year. Nominal retail sales grew by a moderate 0.1% month-on-month in November following a 0.3% contraction in the prior month. Softer household spending coincided with slower wage growth. In November, average hourly earnings grew 4.0% against a year ago. While still tracking ahead of U.S. inflation, it marked the smallest annual wage increase since June 2021.

Tight monetary policy is weighing on the jobs market. Over the last six months, job gains have averaged 186,000 per month compared to 376,000 per month over the same period last year. The number of job openings in October fell to the lowest level in more than two years, another sign that U.S. labour demand is waning.

A softer labour market, higher prices and tighter financial conditions have led U.S. households to draw on accumulated savings to sustain spending. Indeed, excess consumer savings have declined by more than $300 billion to date. Given the extensive drawdowns of the past year, fewer American households will have surplus cash to spend in 2024.

We expect domestic demand will moderate in the year ahead. We forecast U.S. real GDP growth to slow to between 0.5-1.5% in 2024, down from 2.1% in 2023 (Table 1).

Global Real GDP Growth Forecast

| 2023 | 2024 | |

| World | 3.0% | 2.9% |

| Advanced Economies | 1.5% | 1.4% |

| United States | 2.1% | 0.5-1.5%* |

| Canada | 1.3% | 0.5-1.5%* |

| Eurozone | 0.7% | 1.2% |

| United Kingdom | 0.5% | 0.6% |

| Japan | 2.0% | 1.0% |

| Emerging Economies | 4.0% | 4.0% |

| China | 5.0% | 4.2% |

| India | 6.3% | 6.3% |

| Brazil | 3.1% | 1.5% |

| Mexico | 3.2% | 2.1% |

Canadian economy cooling

In Canada, real GDP advanced 0.5% year-on-year in the third quarter. However, sequential activity weakened. Real GDP declined 0.3% quarter-on-quarter following an upwardly revised 0.3% gain in the prior period. Household spending – the largest component of Canadian GDP – stalled as consumers pared back purchases in response to higher borrowing costs and persistent inflation. A sharp 2.6% fall in capital investment underscored that tighter financial conditions are restraining business spending as well as household expenditures.

The Bank of Canada’s steep rate hiking cycle has begun to impact employment. The number of unemployed Canadians increased by 11,000 in November and the unemployment rate rose to 5.8%. The rate of joblessness has steadily edged higher from its near-record low of 5.0% at the beginning of 2023.

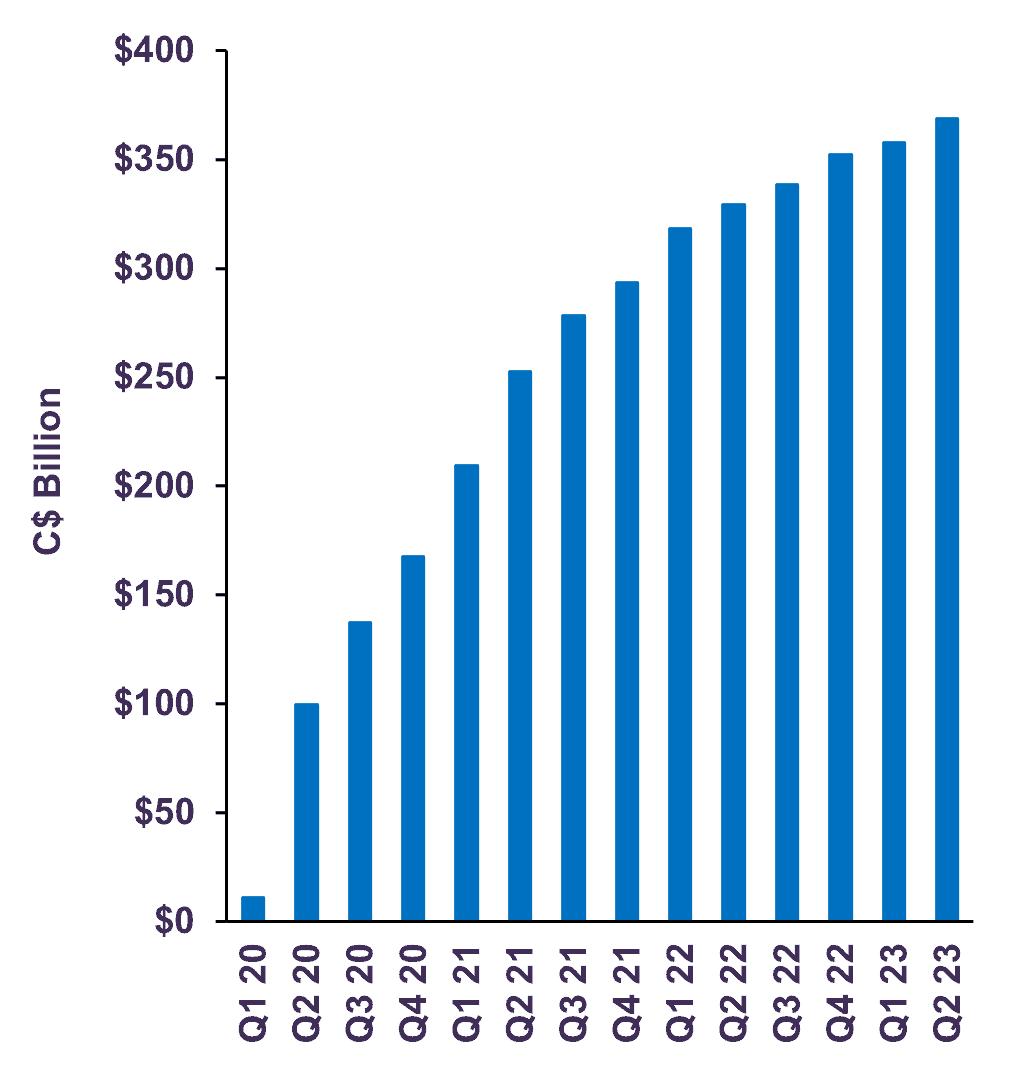

While recent indicators confirm a loss of momentum, the economy possesses an important offset to current challenges. The household saving rate climbed to 5.1% in the third quarter from 4.7% in Q2. Canadian households continue to stockpile excess savings, a marked contrast to their American counterparts. Accumulated savings currently total C$369 billion (13% of GDP) and should provide a buffer against higher debt service costs and labour market headwinds in the months ahead (Chart 1).

Excess Canadian Household Savings

The effects of monetary policy tightening over the past two years should become increasingly reflected in economic conditions in the months ahead. Consequently, we forecast Canadian real GDP growth to slow to a range of 0.5-1.5% in 2024.

Europe at risk of a downturn

Economic prospects remain poor in the Eurozone. Real GDP shrank by 0.1% quarter-on-quarter in Q3, and the bloc has now failed to grow in three of the past four quarters. In the wake of the sharpest rise in borrowing costs since the creation of the currency union, activity is likely to weaken further in the months to come.

The S&P Global Eurozone Composite PMI signalled a seventh consecutive month of contracting private sector activity in December. Notably, the employment sub-index saw its second decline in a row, an indication that unemployment may be on the cusp of an uptick.

Though price pressures have moderated recently, elevated living costs and restrictive financial conditions will continue to weigh on the region’s outlook in 2024. We believe the Eurozone is in or near recession.

China is on a slowing trajectory

Despite facing challenges from faltering real estate activity and sluggish export demand, a slew of economic readings improved in China toward year-end. Consumer spending accelerated in November as retail sales jumped 10.1% year-on-year compared to 7.6% a month earlier. This marked the eleventh consecutive month of sales growth and the fastest expansion in retail activity since May.

Elsewhere, China’s industrial sector recorded its fastest increase in twenty-one months in November. Industrial production rose 6.6% against a year ago, led by strong manufacturing and mining output. Investment in manufacturing – an important offset to declining real estate investment – grew by a solid 6.2% year-on-year in the same period.

In contrast, property market activity remains depressed. Real estate investment shrank 9.4% year-on-year in November, and the sector continues to weigh heavily on near-term growth prospects. While property market malaise will detract from growth in the year ahead, we are encouraged by recent indications of policy support. Newly announced urban redevelopment projects, affordable housing construction and public infrastructure spending total around RMB 1 trillion – around 8-9% of annual real estate investment – and should help cushion the slowdown of housing-related activities in 2024.

China’s broadening stimulus campaign is reason for cautious optimism. However, we believe the property market will continue to weigh on activity and growth is expected to remain subdued by historical standards in the year ahead. The IMF forecasts real GDP growth in China will slow to 4.2% year-on-year in 2024.

India to lead emerging market growth

Following a strong 7.8% year-on-year expansion in real GDP in Q2, India’s output increased by 7.6% in the third quarter. Investment rose 11.0% in the same period and government spending surged 12.4%. We expect fiscal policy will remain accommodative in the coming months given 2024 is an election year.

The outlook for India’s domestic consumption and investment remains positive. The country is well positioned to retain its status as the fastest growing major economy in the year ahead. Real GDP growth is expected to remain stable at 6.3% year-on-year in 2024, per IMF estimates.

The lagged effect of extensive interest rate hikes remains the main factor behind weaker economic outlooks for Brazil and Mexico. After a strong 2023 that saw several upward revisions to growth, the IMF forecasts real GDP growth will moderate to 1.5% in Brazil and 2.1% in Mexico in 2024.

Slowing developed market growth and tight global financial conditions continue to present dual headwinds to emerging markets. Apart from China, however, most large emerging market economies have fared better than predicted and the region is expected to avoid a broad-based downturn. The IMF forecasts developing economies will grow by 4.0% in 2024, unchanged from 2023, but below the long-term average growth rate of 4.5%.

The disinflationary process continues

Headline inflation continued to moderate throughout the developed world. In the U.S. and Canada, CPI inflation declined to around 3% at the end of 2023, half its level from the start of the year. Similarly, inflation in the Eurozone eased to just 2.4% year-on-year in November compared to a rate of 10.1% a year prior. Annual price growth across OECD economies fell to a two-year low in the same period.

Meanwhile, core inflation (excluding food and energy) has also decelerated rapidly. Indeed, U.S. core CPI inflation slowed to 4.0% year-on-year in November, its weakest rate of growth since September 2021. In both Canada and Europe, core inflation has receded by more than 200 basis points from cyclical highs.

Inflation is broadly slowing in emerging markets as well. Many of the region’s central banks raised interest rates sooner and more aggressively than their developed market peers. In general, EM economies are further along the disinflationary process. Core inflation has decelerated for ten consecutive months in Mexico, moderating by more than 300 basis points over this same period. In Brazil, core CPI peaked well over a year ago and is steadily approaching target levels. Meanwhile, softer growth and food price deflation have kept price pressures subdued in China.

We see many signs that the global economy has turned the corner on high inflation. As the lagged impact of previous rate hikes continues to feed through to real activity, we expect more demand-driven disinflation in the year ahead.

Global tightening cycle nearing a conclusion

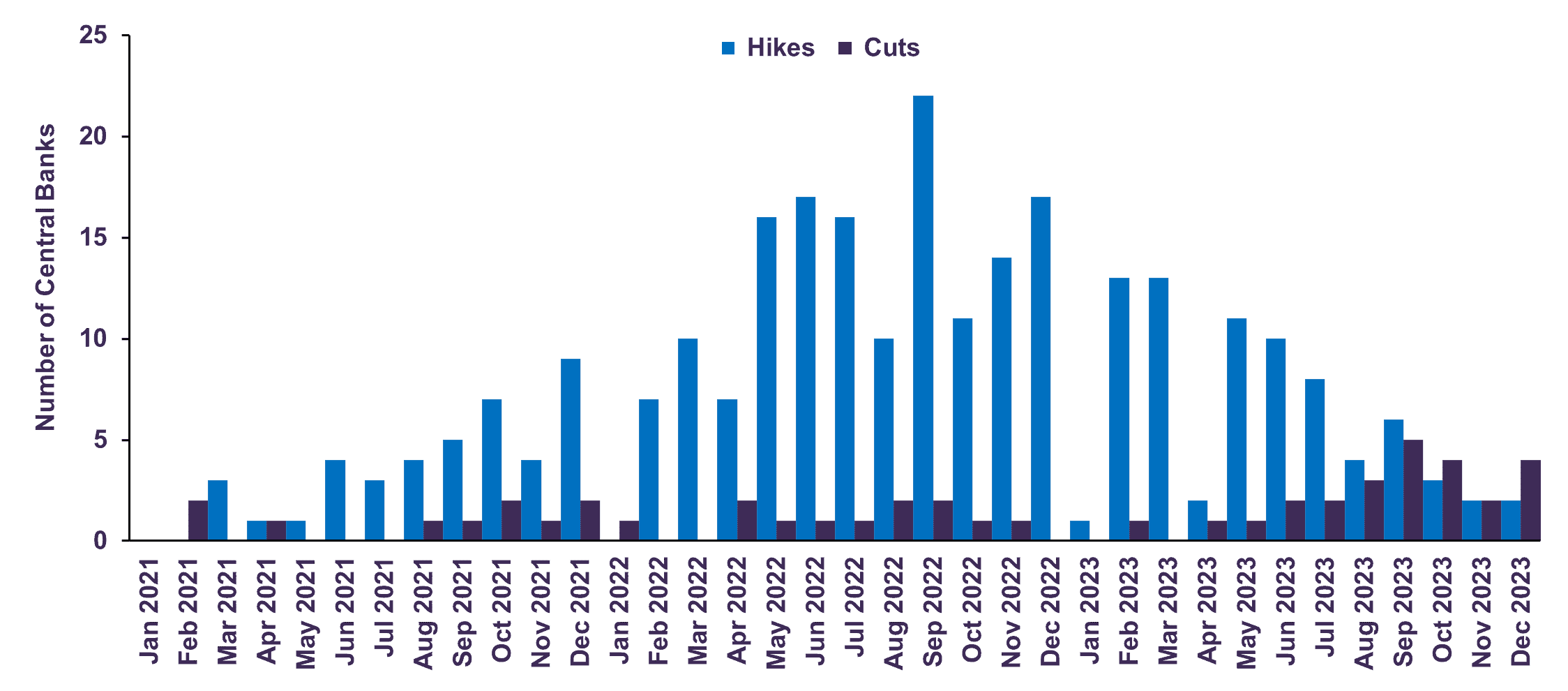

Most major central banks remain committed to a tight policy stance at this juncture, notwithstanding a deceleration in inflation. However, policymakers have recently signalled that rate hiking cycles are drawing to a close and some officials have begun to entertain cuts to borrowing costs in 2024 (Chart 2).

Rate Actions of the 30 Largest Central Banks

Meanwhile, markets are not only pricing in an end to rate hikes but are instead forecasting imminent interest rate cuts – a significant change in expectations from a just few months ago.

In recent weeks, U.S. interest rate futures have swung from pricing a high chance of a 25-basis point rate increase at the Federal Reserve’s March 2024 meeting, to now signalling a 70% probability of an equivalent rate cut.

The shift in expectations has been equally dramatic in Canada. Consensus estimates have changed from an 80% likelihood of a 25-basis point rate increase at the Bank of Canada’s March meeting, to a 70-80% chance of a rate cut. Similarly, European markets are now forecasting close to 150 basis points of cuts in 2024 compared to around 75 basis points in late November.

There have been some mixed signals by officials on the policy rate front. On the one hand, official communications from major monetary institutions including the Bank of Canada, the Federal Reserve and the ECB have indicated a willingness to deliver additional rate hikes if necessary. On the other, the Fed’s dot plot – a chart that displays where each Federal Open Market Committee (FOMC) member thinks interest rates will be at the end of the next several years – shows officials now see 75 basis points worth of cuts in 2024. Given the fluidity of projections, it may still be too early to speculate on when exactly policy cuts might begin in advanced economies. However, the remarkable progress made on the inflation front and our expectation of below-trend growth in the year ahead give us confidence we are at or near peak policy rates this cycle.

Market Outlook

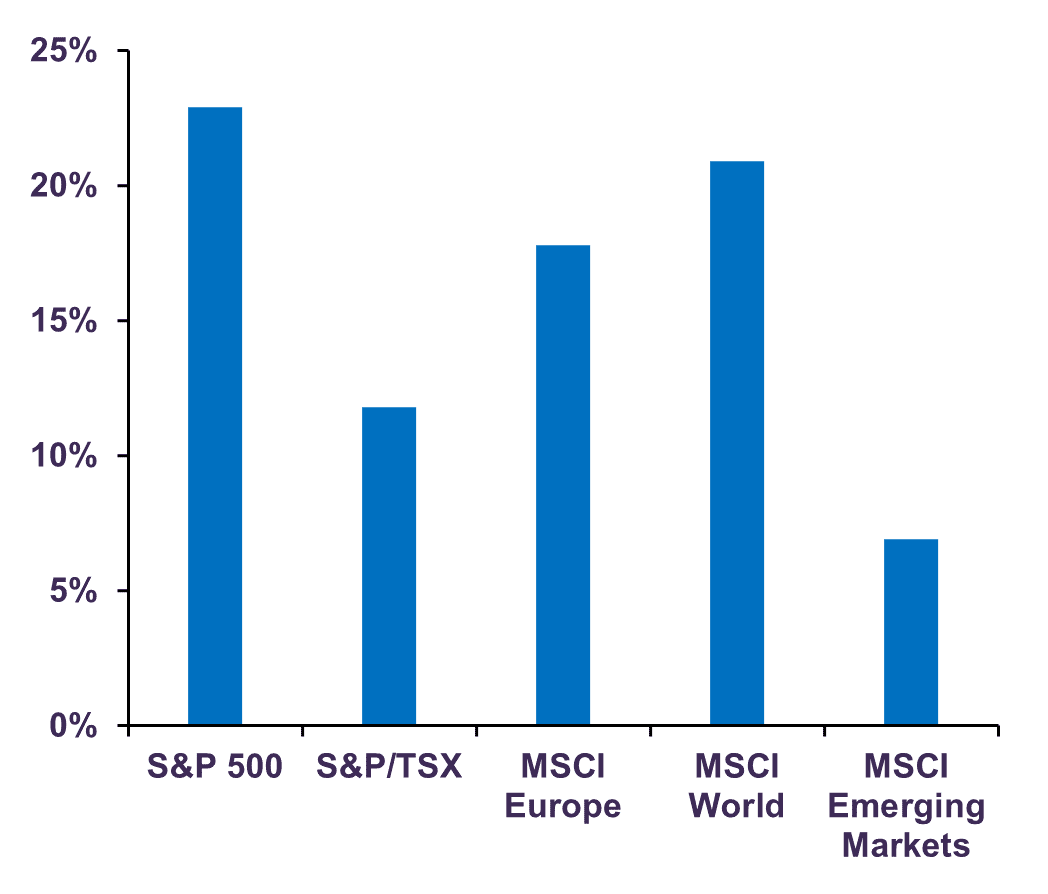

Despite fears of recession, concerns over inflation and policy rate uncertainty, equity markets rallied strongly in the fourth quarter and ended the year in positive territory. The S&P 500 gained 22.9% (total return in Canadian dollars), while the S&P/TSX was up 11.8%, MSCI Europe 17.8%, MSCI World 20.9% and MSCI Emerging Markets 6.9% (Chart 3).

Total Return in C$ (2023)

Better-than-expected company earnings and the Federal Reserve’s decision to keep interest rates unchanged as price pressures have receded help explain some of the positive performance of equity indexes in the past months. However, as highlighted in our November Portfolio Update, most of the rise in U.S. and global stock markets has been driven by a small subset of technology or tech-related companies. Indeed, the seven mega-cap companies referred to as the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) contributed more than 60% of the S&P 500’s annual gain in 2023.

The S&P 500 now trades at 19.7 times 2024 estimated earnings, 31% above its long-term average of 15 times. However, like the underlying trend behind the S&P 500’s performance, this too is due to the outsized effect of the “Magnificent 7”. At the end of 2023, the Mag-7 accounted for a remarkable 31% of the S&P 500 – up from 21% at end-2022 – and traded at a weighted average multiple of 28 times 2024 earnings. In contrast, the index’s valuation trades at a more reasonable P/E of 17.5 times if we exclude the seven stocks. Of note, if we weighted all companies in the index equally, the S&P 500 would have risen by 11.6% (price return in U.S. dollars) instead of 24.2% during the year. This level of differentiation – valuations are lofty in some substantial parts of the market, but not uniformly expensive – presents opportunities for price-sensitive investors with a longer horizon.

While prospects for aggregate company earnings are tempered by an expected slowdown in economic growth, we believe our portfolio holdings are well-positioned to remain resilient despite more challenging fundamentals. Our equity holdings are well diversified across sectors and geographies, and trade at a discount to market indexes. The forward price-to-earnings ratio of the Letko Brosseau global equity portfolio is 11.1 times estimated 2024 earnings compared to 16.8 for the MSCI ACWI. We expect our portfolio companies to provide meaningful value creation over the next 3-5 years.

On the fixed income front, we extended the duration of our portfolios and increased exposure to high-quality corporate bonds over the past two years – strategic decisions that have paid off handsomely. However, our broad-based strategy for fixed income remains unchanged. We continue to avoid instruments with a term above 10 years and maintain a lower duration than the benchmark. We estimate the fair value of the 10-year Canadian government bond yield to be around 4-4.5%, compared to its current yield of 3.1%. This suggests longer-dated Canadian bonds are still expensive. We do not advocate for any material changes in asset allocation. We continue to favour equities over cash and bonds within balanced mandates.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN