Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

October 2024

- The global monetary easing cycle is underway, increasing the probability that the world economy is on track for a soft landing. Our base case is for global real GDP to advance by 3.2% in 2025.

- We believe sustained spending by higher income U.S. households will keep consumption – the main driver of the American economy – in positive territory even as lower-income earners face challenges. Consequently, we forecast U.S. real GDP growth to moderate to 1.0-2.0% in 2025.

- Weaker labour market trends are expected to temper Canadian economic activity in the year ahead. Our outlook is for Canadian real GDP growth to advance between 1.0-2.0% in 2025.

- The potential for additional ECB rate cuts is increasing given substantial progress on the inflation front. We forecast Eurozone real GDP growth in the range of 0.5-1.5% in 2025.

- China’s growth prospects continue to depend on the magnitude of additional monetary and fiscal support in the year ahead. According to the IMF, real GDP is projected to expand by 4.5% in 2025.

- Emerging markets are set to benefit from easier global financial conditions. In 2025, the region is expected to grow by 4.3% in real annual terms per IMF estimates.

- Given the onset of a U.S. easing cycle and the dollar’s elevated valuation relative to its long-term parity, we see potential for a moderately weaker USD in the coming months.

- Stock markets hit new highs during the third quarter. While we sold several of our holdings that were approaching their intrinsic value and now hold a moderate cash cushion in our portfolios, we do not advocate any major changes in asset allocation. We continue to favour equities over cash and bonds within balanced mandates.

Summary

The post-pandemic recovery period has progressed in an unusual manner. Following a spike in inflation and sharp rise in policy rates, consensus forecasts called for an economic downturn in 2023 which never materialized. Instead, global real GDP advanced a strong 3.3%. While economic activity is now showing signs of slowing, recession predictions have again failed to play out and the world economy is on track for another healthy expansion in 2024.

Although the performance of the economy over the past two years has contradicted widely-held views for a more pessimistic outcome, the sustainability of global growth continues to attract scrutiny. The turbulent performance of equities in the third quarter highlights that investors remain nervous about the potential for a recession.

We have long maintained that the global economy would undergo a significant adjustment due to the lagged effect of two years of high interest rates. We continue to expect a modest deterioration in the economic environment but ascribe a lower risk to a pronounced downturn. Looser monetary and fiscal policies should help overall activity stabilize at lower, albeit still positive, levels next year.

In our view, the global economy is positioned for another year of subdued growth and is not on the cusp of recession. Our base case is for global real GDP to advance by 3.2% in 2025, unchanged from the 3.2% rate of growth expected in 2024 (Table 1).

Global Real GDP Growth

| 2024 | 2025 | |

| World | 3.2%* | 3.2%* |

| Advanced Economies | 1.7%* | 1.7%* |

| United States | 1.5-2.5%* | 1.0-2.0%* |

| Canada | 0.5-1.0%* | 1.0-2.0%* |

| Eurozone | 0-1.0%* | 0.5-1.5%* |

| United Kingdom | 0.7% | 1.5% |

| Japan | 0.7% | 1.0% |

| Emerging Economies | 4.3% | 4.3% |

| China | 5.0% | 4.5% |

| India | 7.0% | 6.5% |

| Brazil | 2.1% | 2.4% |

| Mexico | 2.2% | 1.6% |

The balance of risks argues against a U.S. recession

The U.S. economy remained resilient in Q2 2024. Real GDP expanded by 0.7% quarter-on-quarter, and 3.0% against a year ago. Household expenditures grew 0.7% quarter-on-quarter, reflecting solid spending on both goods (+0.7%) and services (+0.7%). While consumer spending patterns indicate American households continue to persevere, activity is likely to moderate as the year progresses.

Labour market conditions are returning to balance after a period of worker shortages that led to high wage inflation. Over the last six months, job gains averaged 164,000 per month compared to an average of 227,000 per month last year. In the same period, the number of job openings fell by 320,000 and the ratio of job vacancies to unemployed people – a measure of labour supply and demand – was equivalent to its long-term average of 1:1.

Companies have primarily responded to high interest rates and weaker demand by curbing hiring rather than laying off workers. Indeed, the unemployment rate rose slightly from 3.7% in January to 4.2% in August and remains near historical lows. Looking ahead however, weaker labour demand points to less job creation and a continued uptick in unemployment in the coming months.

Given the expectation of a softer labour market, there is increasing concern that higher joblessness will undermine consumer spending and, in turn, derail the U.S. economy in the near future. This view assumes that the savings buffer that helped households weather high inflation and elevated borrowing costs in recent years has been fully depleted. A decline in the personal savings rate to 4.8% in August, an 18-month low and significantly less than its pre-pandemic level of 7.5%, appears to justify this pessimistic view.

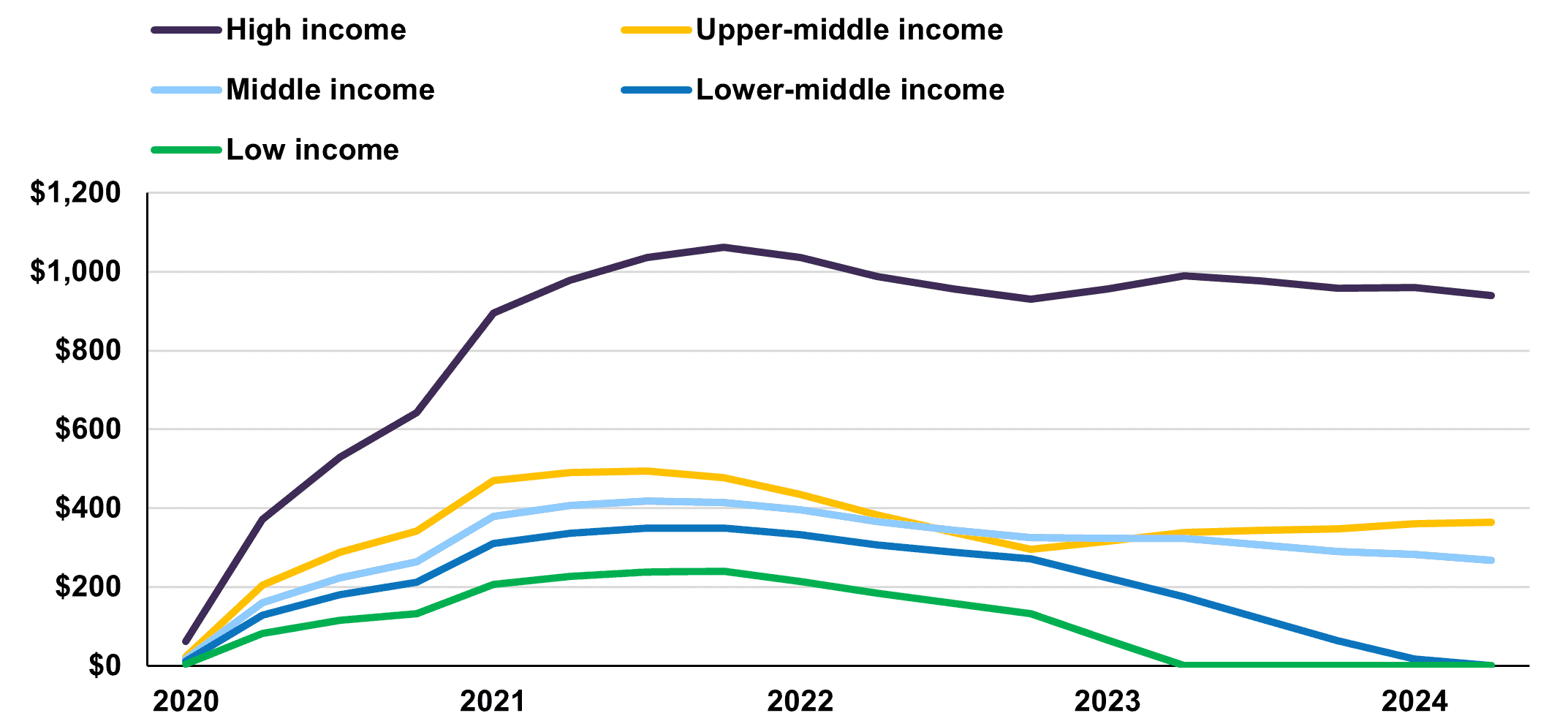

While many American consumers have much less surplus cash to spend compared to a year ago, their household finances vary considerably across the income distribution. High inflation and high interest rates have eroded the savings cushion of low- and lower-middle income households. An increasing number of consumers in this group could be forced to dial back spending going forward. In contrast, higher-income Americans have generally benefitted from surging interest income and asset prices in recent years, and these households have a substantial amount of reserve spending power (Chart 1).

U.S. Household Excess Savings by Income Quintile

(U.S.$ billion)

On balance, we believe continued spending by higher income earners will offset the drag from the bottom 40% of income earners. Although wealthier consumers spend a lower share of their incomes than their less affluent counterparts, they nevertheless account for a greater dollar amount of expenditures in the economy. In our assessment, aggregate consumption will slow but remain positive in the coming months.

We expect government expenditures will continue to make a positive contribution to growth. While the outcome of the U.S. presidential election is uncertain at this juncture, fiscal policy should remain accommodative. Both candidates’ proposals would add at least an additional percent to an already large U.S. Congressional Budget Office baseline federal deficit forecast of 6% of GDP over the next several years. On the monetary front, the U.S. Federal Reserve’s recent pivot to easier policy represents an additional support to growth going forward.

Our base case calls for domestic demand to slow further in the year ahead. We forecast U.S. real GDP growth to decelerate to between 1.0-2.0% in 2025, down from 1.5-2.5% in 2024.

Canada headed for a soft landing

In Canada, real GDP increased by 0.5% quarter-on-quarter in Q2. Higher government expenditures (+1.6%) helped mitigate slower household spending (+0.1%) and an ongoing decline in housing investment (-1.9%). In annual terms, real aggregate output rose 0.9% against a year ago.

The Canadian labour market has cooled noticeably. The unemployment rate rose to 6.6% in August, the highest rate of joblessness since September 2021. While unemployment is markedly higher than at the start of the year, the uptick is not due to job losses but rather that the number of new entrants into the labour force outpaced employment growth. Indeed, the Canadian economy added 22,000 jobs in August compared to labour force growth of 83,000 people in the same period.

While conditions are becoming more difficult for the unemployed to find jobs, the Canadian workforce continues to enjoy healthy wage growth. Average hourly wages increased by 5.0% year-on-year in August, tracking well ahead of inflation (2.0%). Meanwhile, the personal savings rate has increased from 6.2% at end-December to 7.2% in August, a sign that disposable incomes have outpaced expenditures to date.

Canadian households are continuing to stockpile excess savings, in contrast to their American counterparts. Accumulated savings currently total more than C$400 billion, around 14% of GDP. We expect sustained spending by households with steady incomes and jobs combined with the large stock of accumulated savings will keep aggregate consumption in positive territory, even as some Canadians face a challenging period.

In September, the Bank of Canada lowered its benchmark interest rate by 25 basis points to 4.25%, its third interest rate cut of the year. Looser monetary policy should help stabilize activity in interest-rate sensitive sectors such as housing. We believe this increases the likelihood that the Canadian economy is heading toward a soft landing. We forecast real GDP growth in the 1.0-2.0% range in 2025, compared to Canada’s long-term average growth rate of 2.0%.

Marginally improved prospects in the Eurozone

The Eurozone economy showed signs of marginal improvement following a broad stagnation in 2023. In the second quarter, real GDP grew 0.2% quarter-on-quarter and 0.6% in annual terms. However, regional disparities and weak domestic demand suggest the recovery remains tepid.

Germany, the Eurozone’s largest economy, contracted by 0.1% quarter-on-quarter in Q2 as persistent weakness in investment and manufacturing weighed on activity. Elsewhere, France and Italy recorded mild 0.2% expansions in the same period amid lackluster consumer spending. Real GDP increased an impressive 0.8% quarter-on-quarter in Spain but is largely explained by robust external demand.

The potential for monetary policy support is increasing given substantial progress on the inflation front. Headline inflation fell to a more than three-year low of 1.8% year-on-year in September. In the same period, core inflation (excluding food and energy) dropped to 2.7%. Meanwhile, union-negotiated wages – an important proxy for wage inflation pressure – slowed to 3.6% year-on-year in Q2 from 4.7% in the previous three months, allaying concerns over rising labour costs.

Core inflation is nearing the 2% target level and wage pressure is no longer likely to limit the scale of additional ECB rate cuts. While Eurozone economic activity is likely to remain subdued by historic standards, the risk of an adverse scenario is receding.

China’s growth increasingly reliant on government stimulus

China’s real GDP advanced 4.7% year-on-year in Q2. This marked a slowdown compared to growth of 5.3% in the first quarter. Recent economic releases have added to speculation that the economy might undershoot Beijing’s full year real GDP growth target of 5%.

China’s prolonged property market slump remains a significant headwind to activity. Real estate investment contracted by an annual 10.2% through the first eight months of 2024. While the housing sector has undergone a significant adjustment over the past several years – new home sales have dropped 50% since 2021 and construction starts are two-thirds lower in the same period – we anticipate real estate will remain a drag on the broader economy for some time. As we have highlighted in past reports, China’s housing demand is in the midst of a structural slowdown.

Encouragingly, the economy possesses important counterweights to declining real estate activity. In the first eight months of 2024, total fixed asset investment grew by 3.4% year-on-year even as real estate investment extended its contraction. Investment in manufacturing (+9.1%) and infrastructure (+4.4%) have proven to be capable offsets to the drag from housing.

Manufacturing activity has also been a key support to the economy to-date, but momentum is beginning to wane. Industrial production rose 4.5% year-on-year in August, a fourth-straight month of moderating output. Given the strong link between China’s industrial complex and trade sector, slowing global demand for Chinese exports could present more of a challenge to growth in 2025.

China is facing multiple headwinds, and timely data underscore a gradually cooling economy. The PBOC’s recent cuts to benchmark interest and mortgage rates mark the latest efforts in a growing list of monetary and fiscal support measures aimed at managing current challenges. We note that the country’s growth prospects will continue to depend on the magnitude of additional stimulus in the year ahead. Real GDP is projected to grow by 5% in 2024 and 4.5% in 2025 per IMF estimates.

Emerging markets show broad resilience

Following a strong 7.8% year-on-year expansion in real GDP during Q1, India’s economy advanced by 6.7% in the second quarter. This marked the slowest rate of growth in five quarters. However, the deceleration in headline growth reflected a significant slowdown in government spending (-0.2%), a usual occurrence during India’s two month-long general election.

India’s leading indicators confirm the country’s outlook remains positive. The HSBC India Services PMI came in at 58.9 in September, signalling healthy growth in service sector activity. In the same period, the HSBC India Manufacturing PMI extended a run of uninterrupted factory output growth that dates back to 2021. The IMF forecasts India’s real GDP to advance by 6.5% in 2025, the highest growth rate among major economies.

Outlooks are generally constructive in other large emerging markets. In Brazil, the central bank cut the benchmark interest rate by a cumulative 325 basis points between August last year and May 2024, bolstering the economy’s prospects. According to the IMF, real GDP in Brazil is on track to expand by 2.4% in annual terms in 2025. In Mexico, where there has been considerably less monetary easing to-date, growth is expected to decelerate in the year ahead. The IMF predicts real GDP will slow to 1.6% in 2025, in-line with Mexico’s long-term average growth rate of around 1.5%.

Emerging market activity has remained resilient despite a period of tight global financial conditions, weaker developed market demand and currency pressures. Looking ahead, the region is set to benefit from additional central bank rate cuts. While situations vary on a country-by-country basis, in aggregate terms, emerging market growth is forecast to remain stable. The IMF anticipates real GDP growth of 4.3% in 2025.

The U.S. dollar is overvalued by most measures

A unique feature of the ongoing global monetary easing cycle is that a host of emerging market and developed market central banks have cut their policy rates well ahead of the U.S. Federal Reserve. Indeed, while the Fed delivered its first interest rate cut in September, the Bank of Canada has been easing since May and policy interest rates have been coming down in some emerging countries for over a year now.

The subsequent divergence in interest rates between the U.S. and the rest of the world led to broad-based U.S. dollar strength. Indeed, in the past twelve months to September, the Fed’s trade-weighted U.S. dollar index – a measure of the value of the USD relative to a basket of trading partners’ currencies – gained nearly 5%. When comparing the dollar to a basket of emerging market currencies over the same period, the USD’s appreciation is even more substantial, nearing 10%.

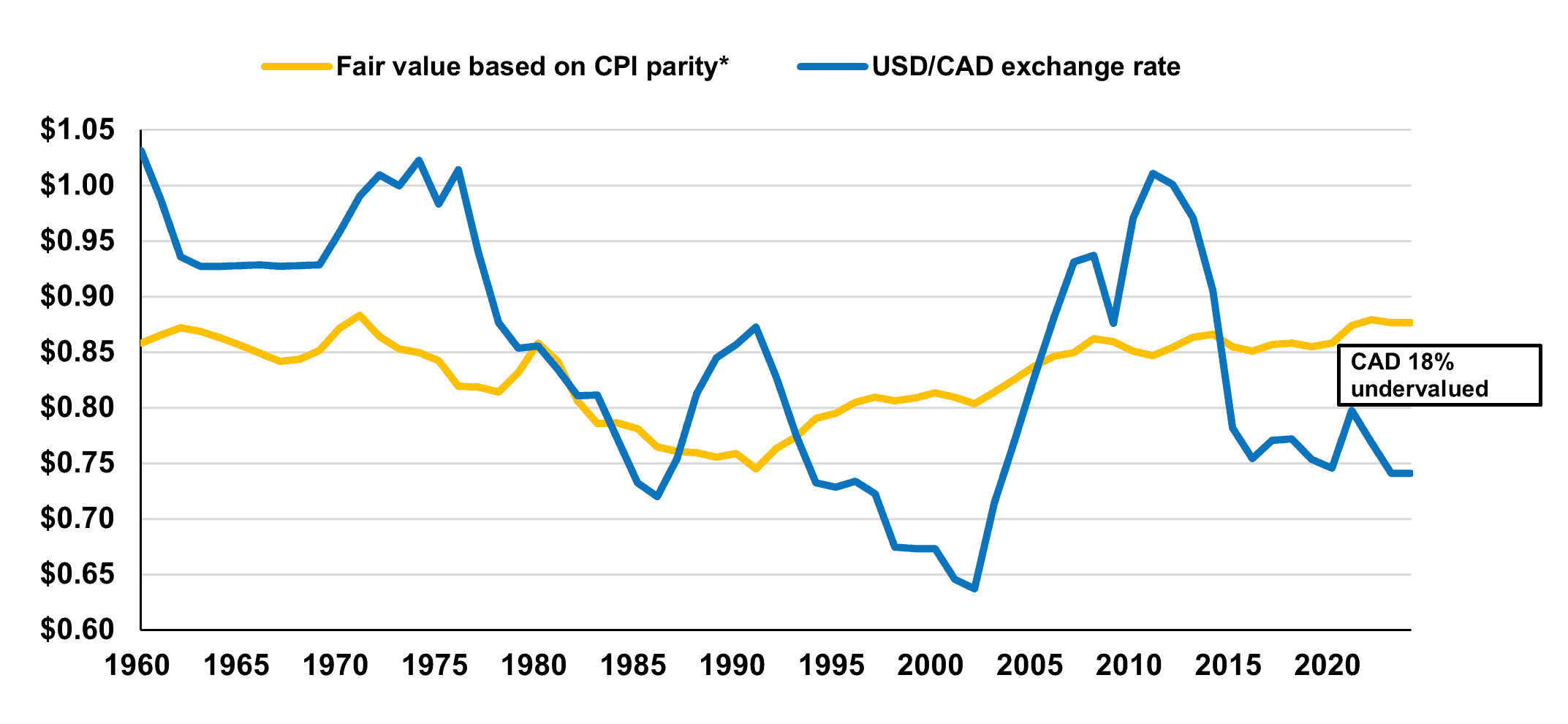

With the Fed’s recent pivot toward easier policy, we anticipate that this period of sustained USD appreciation may be nearing an end. Further, the dollar appears quite expensive relative to our own estimates of fair value. Based on our purchasing power parity models, the USD is 18% overvalued against the CAD (Chart 2). The dollar also screens as expensive against the Euro, where we estimate it to be trading 15% above parity. Meanwhile, the USD appears overpriced by 59% relative to the Japanese Yen despite the Yen’s recent gains. The global economy has navigated a period of pronounced dollar strength relatively well compared with past episodes. Given the onset of a U.S. easing cycle and the dollar’s elevated valuation relative to its long-term parity, we see potential for a moderately weaker USD in the coming months. Encouragingly, this dynamic should allow for sustained central bank rate cuts in the rest of the world, a key support to the outlook for global growth in 2025

U.S. Dollar vs. Canadian Dollar Exchange rate and fair value

Asset allocation strategy: a tilt towards equities with some cash on the sidelines

Global equities advanced to all-time record highs in the third quarter, despite a volatile August. The year-to-date total return of the S&P 500 was 25.1% (in Canadian dollar terms), while the S&P/TSX (17.2%), MSCI ACWI (21.6%), and MSCI Emerging Markets (19.7%) also closed the period in positive territory.

Resilient company earnings and the Fed’s decision to cut rates help explain the positive performance of equities in the past months. However, as we have long highlighted, a portion of the rise in U.S. and global indices has been driven by the Magnificent 7, a small group of large cap technology or tech-related companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) that have benefitted from generative AI exuberance. In our assessment, some of the Magnificent 7 companies necessitate a degree of caution from investors. Despite Nvidia and Tesla’s recent declines from their share price peak, the Magnificent 7 still account for a staggering 21% of the 2,757-constituent MSCI ACWI, and trade at an elevated weighted average P/E multiple of 30.3 times.

Aside from this subset of companies, valuations are not uniformly stretched. The S&P 500 currently trades at a forward price/earnings ratio of 20.8 times 2025 earnings. Meanwhile, the S&P 500 equal-weighted index, which is rebalanced quarterly to assign the same weight to each company, is valued at a less expensive 16.5 times. As illustrated in our July Economic and Capital Markets Outlook, valuations around 20 times earnings are consistent with past periods where inflation was around 3%. We believe opportunities still exist for price-sensitive investors with a longer horizon.

While prospects for company earnings are tempered by a projected slowdown in economic growth next year, we believe our holdings are well-positioned to remain resilient amid more challenging fundamentals. Our equity holdings possess strong medium- to long-term earnings potential, are well diversified across sectors and countries, and trade at a sizeable valuation discount to market indexes. The forward price-to-earnings ratio of the Letko Brosseau global equity portfolio is 11.1 times estimated 2025 earnings compared to 17.5 for the MSCI ACWI.

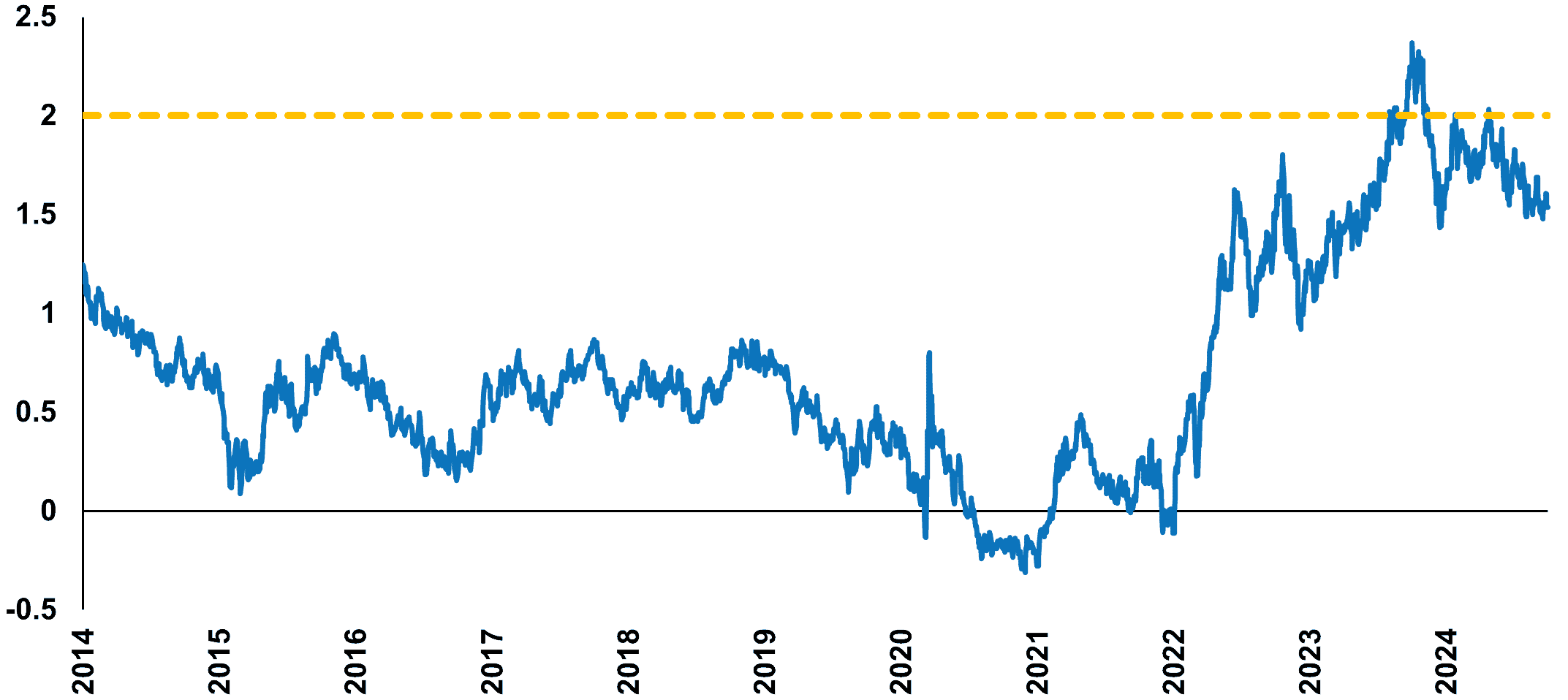

Turning to the fixed income portfolio, we modestly extended bond duration in a manner consistent with our risk/return approach. Even with the potential to benefit from lower interest rates, we have continued to avoid longer-dated bonds. At 3.1%, the 30-year Canadian federal bond yield is well below our fair value estimate of about 4.5%, based on our long-term assumption of real economic growth (2%) and inflation (2.5%). Furthermore, given the shape of the yield curve, these bonds offer only a marginal pickup in yield above shorter-dated instruments.

In contrast, we saw potential to add value in our fixed income portfolios during the last several months by building a modest exposure to Canadian federal real return bonds (RRBs) in the 15–25-year maturities. We determined that these bonds were attractively priced when real yields spiked to our fair value estimate of 2% and concluded that the risk/reward profile of these bonds was more compelling than their expensive nominal equivalents (Chart 3).

In addition to remaining active in the management of our fixed income holdings, we have also made strategic adjustments to our portfolio on the equity side. Prior to the recent turbulence in global stock markets, we sold several of our holdings that were approaching their intrinsic value. While we now hold a moderate cash cushion in our portfolios, we do not advocate any major changes in asset allocation. We continue to favour equities over cash and bonds within balanced mandates.

Canada 20-Year Real Return Bond Yield (%)

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the strategy(ies) may differ materially from those reflected or contemplated in such forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The S&P/TSX Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and TSX Inc., and has been licensed for use by Letko, Brosseau & Associates Inc. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Letko, Brosseau & Associates Inc. TSX® is a registered trademark of TSX Inc., and have been licensed for use by SPDJI and Letko, Brosseau & Associates Inc. Letko, Brosseau & Associates Inc.’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or Bloomberg and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/TSX Index.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN