Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

January 2022

- Economic activity is gradually transitioning to sustainable levels after a post-lockdown boom.

- Successive waves of COVID-19 and its variants remain a risk to our outlook, but we expect the transition from a pandemic to an endemic phase of the virus to continue.

- While inflation could persist at above-trend levels for some time, we remain confident that the risk of runaway inflation is low.

- Developed market indices climbed to new highs during Q4 as strong economic data confirmed a constructive outlook for stocks entering the new year.

- Broad market highs amid rising inflationary pressures is leading to speculation that equities may be overvalued.

- Though elevated relative to historical multiples, valuations are not uniformly expensive.

- We believe a backdrop of moderately higher inflation bodes well for value-oriented strategies.

- Higher inflation often brings about rising interest rates, which exert a disproportionately negative impact on higher-multiple growth stocks.

- From a sector allocation standpoint, our equity portfolios are exposed to industries that provide a natural hedge against inflation (commodities) and companies that tend to do well in rising rate environments (financials).

- Our optimism does not extend to fixed income markets, which have yet to reflect above-trend growth, inflation pressure or the upcoming normalization of monetary policies.

- We continue to view the risk/return profile of bonds as unattractive and are maintaining a tilt towards equities over cash and bonds within balanced portfolios.

- In our view, our portfolios are well positioned to capture both cyclical and secular value creation over the medium-term.

Summary

Global economic growth is transitioning back to sustainable levels following a post-lockdown boom in activity. Labour market fundamentals, such as job creation and wage growth, bode well for consumer demand around the world. Manufacturing and trade activity remain robust, having already returned to pre-pandemic levels. Service sectors, which were hit hard during the pandemic, are continuing to recover. Despite concerns over the impact of a new COVID variant, most indicators confirm that the expansion is self-sustaining.

The world economy is on track to deliver another year of above-trend growth. As a result, governments have begun to gradually withdraw extraordinary monetary and fiscal stimulus measures. The IMF forecasts that global real GDP will expand by 4.9% in 2022, well above its long-term average of 3.5%.

U.S. economic leadership continues

U.S. real GDP advanced 0.6% quarter-on-quarter in Q3, and 4.9% in year-on-year terms. The country’s economic recovery leads the developed world. Real output is 1.6% above its pre-pandemic level, the highest in the G7. Nominal consumer expenditure increased 1.8% quarter-on-quarter and imports surged 2.7%, indicating strong domestic demand.

The job market’s rebound and income gains point to a self-sustaining recovery. The unemployment rate declined to 4.2%, its lowest level since the beginning of 2020. The number of Americans filing new claims for unemployment benefits has declined to pre-pandemic levels, while the number of job openings is more than 1.5 times the 2019 average. Wage data reflects strong labour demand, as weekly payrolls increased 9.5% year-on-year in November.

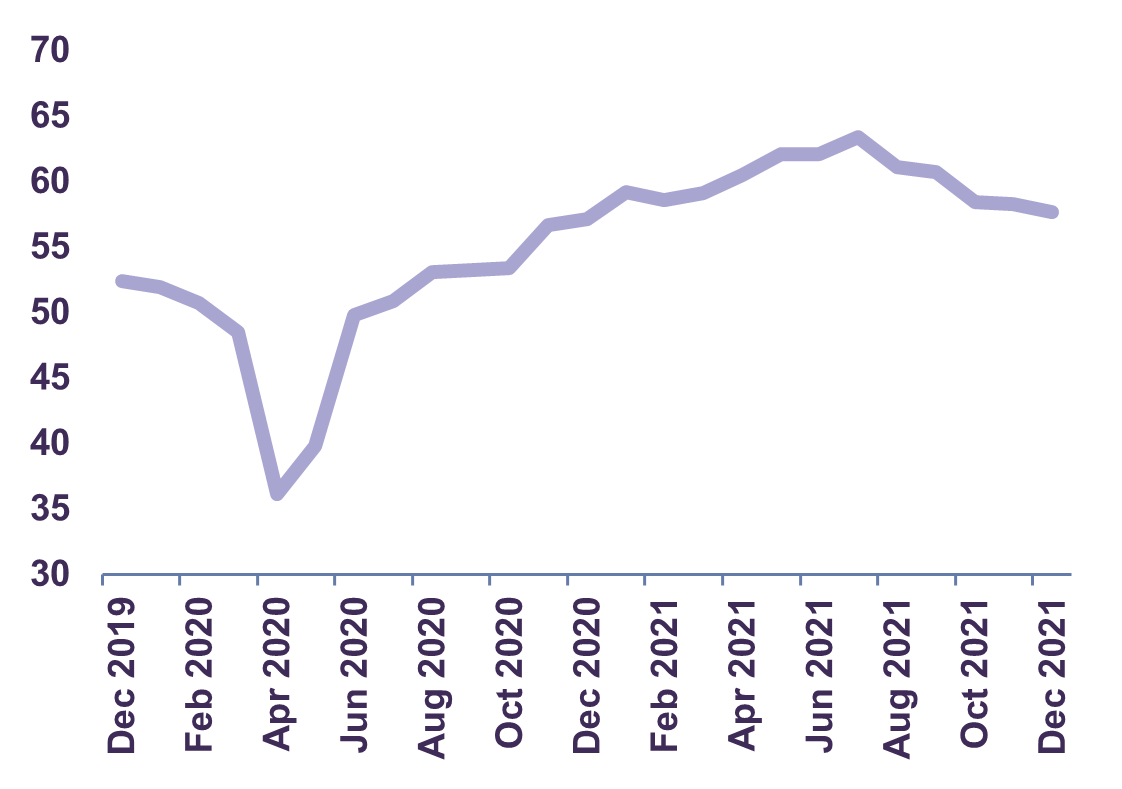

American consumer spending is on an upswing. Retail sales soared 18.2% year-on-year in November as holiday shopping lifted activity. Amid strong demand for goods, U.S. industrial production expanded 5.3% year-on-year. The Markit Manufacturing Purchasing Managers’ Index (PMI) signaled an eighteenth consecutive expansion of factory activity in December (Chart 1). Despite the persistence of supply-chain issues and higher input prices, the outlook for the U.S. industrial complex is robust.

U.S. Manufacturing PMI

On the fiscal front, government spending advanced 1.7% quarter-on-quarter in Q3, and the federal deficit decreased to 9.5% of GDP from 11.6% in the previous quarter. Fiscal policy should remain supportive of economic growth in the years ahead. The recently enacted $1 trillion bipartisan infrastructure bill includes $517 million in new spending and should provide a multi-year boost to the U.S. economy. Meanwhile, further fiscal measures, such as Biden’s proposed $3.5 trillion budget bill, are being contemplated by Congress. Although the amount and timing of future spending packages are uncertain given political disagreements, fiscal policy will nonetheless provide a boost to economic activity for years to come.

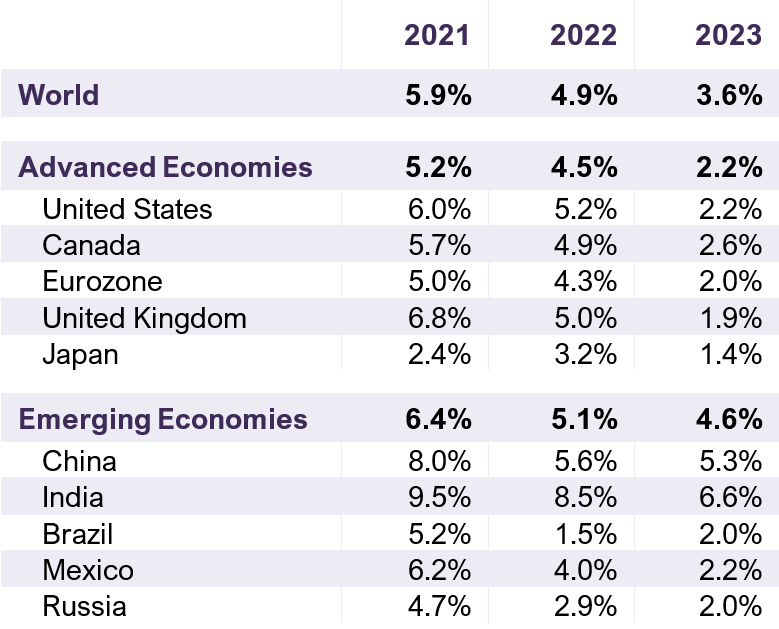

In our assessment, the U.S. economy possesses the momentum to successfully navigate the ongoing normalization of monetary policy. We forecast that U.S. real GDP will expand by 5.2% in 2022, well above its pre-pandemic average of 2.3% (Table 1).

Global Real GDP Growth

Strong year ahead for Canada

Real GDP in Canada expanded by 1.3% quarter-on-quarter in Q3. Strong consumer spending and trade activity underpinned the rebound. Relative to the same period last year, output increased 4.0%.

During the third quarter, nominal consumer spending on services surged 6.9% compared with the second quarter as health restrictions eased. Goods expenditure also increased by a solid 3.6% in the same period. Excluding pandemic support programs, disposable income grew 3.9% quarter-on-quarter. Despite the phase-out of most federal COVID-19 aid in Q4, the fundamentals behind consumer demand are constructive.

The unemployment rate declined to 6.0% in November, the lowest jobless rate since February 2020. Robust job creation in hard-hit sectors such as retail (+34,000) and information, culture, and recreation (+10,000) highlights the breadth of the labour market’s recovery. On the wage front, average hourly earnings increased 2.7% in November against a year ago, while weekly hours worked rose 5.4%. With household net worth rising to C$15.3 trillion, Canadian consumers are well-positioned to boost growth.

Meanwhile, Canada recorded a trade surplus of C$7.2 billion in Q3, as exports jumped 4.8% quarter-on-quarter. Total goods shipments increased by C$29.8 billion, largely due to the strong performance of energy products (C$35.9 billion). Indeed, the price of Western Canadian Select (WCS) heavy oil more than doubled year-on-year in Q3 and the energy trade surplus reached an all-time high of C$27.9 billion. Above-trend global growth and steady demand for oil should continue to support Canada’s trade balance going forward.

Canada is on track to deliver another year of robust growth in 2022. We forecast real GDP will expand by 4.9%.

Eurozone’s economic momentum strengthens in Q3

In Q3, the Eurozone economy expanded 2.2% quarter-on-quarter in real terms. Output in France surged 3.0%, Italy rose 2.6% and Germany advanced 1.7% as the three largest Euro Area economies led G-7 growth in the quarter. Nominal consumer spending jumped 4.9% in the same period amid continued reopening and strengthening labour market activity. The Eurozone workforce expanded by 1.1% quarter-on-quarter and wages grew 2.3% against a year ago. However, after a solid post-lockdown rebound in economic activity, the region is facing another resurgence of COVID-19 cases.

Fiscal policy will likely remain supportive in the Eurozone. The relaxation of budget and debt constraints under the Stability and Growth Pact gives E.U. member countries flexibility in adjusting fiscal policies to meet the ongoing challenges of the pandemic. Meanwhile, the €750 billion European Union recovery fund is scheduled to provide meaningful payouts to member countries through 2026. The IMF forecasts Eurozone real GDP will expand by 4.3% in 2022.

China moderating to trend growth

Real GDP in China grew 4.9% year-on-year in the third quarter, decelerating from a 7.9% growth rate in Q2 as supply chain issues, power shortages and a real estate market downturn weighed on activity.

Trade activity remained a bright spot in China’s recovery. Exports surged 22.0% versus a year ago to $325.5 billion in November, marking the fourteenth-straight month of double-digit growth. Rising holiday season demand from Western trading partners boosted shipments. Purchases by the E.U. jumped 33.5% year-on-year, sales to the U.S. increased by 5.3%, and exports to Canada rose 8.3%. Through the first eleven months of the year, exports have already eclipsed the record total from 2020. China’s trade surplus has risen to $71.7 billion in November and $582.3 billion year-to-date, its largest on record.

China’s property market slump persisted in November as home sales decreased 17% against a year ago. New home prices fell 0.3% month-on-month in November, marking a third consecutive decline. Regulatory constraints, including limits on property developers’ access to financing, restrictions on home purchases and higher mortgage rates, will likely continue to weigh on the housing market in the near-term, but should help promote stability over the long run.

In December, the People’s Bank of China delivered a surprise 50 basis point cut to the required reserve ratio for all financial institutions. This indicates a pro-growth stance from the monetary authority and should help ease liquidity concerns going forward. On the fiscal side, the approval of accelerated local government bond issuance is a positive signal for government investment entering the new year.

On balance, China’s economy is transitioning away from a post-pandemic boom toward a lower and more sustainable growth rate. The IMF forecasts real GDP in China will grow by 5.6% in 2022.

Diverging near-term outlook for BRICS

In India, following a record 20.1% year-on-year surge in real GDP in Q2, activity increased by 8.4% in the third quarter. Reduced pandemic-related disruptions and progress on vaccination coverage underpinned the fourth consecutive quarter of expansion. Most indicators of domestic activity point to a strong year-end 2021 and solid momentum in 2022.

Household expenditure grew 8.6% year-on-year and government spending increased 8.7% as the fiscal stance remained supportive. The benchmark policy rate ended 2021 at a record-low 4.0%, with the Reserve Bank of India reaffirming its commitment to keep monetary conditions loose. Against this favourable backdrop, India is poised to reestablish itself as leader of global growth in 2022. Real GDP is expected to increase 8.5% year-on-year, per IMF estimates.

Elsewhere in emerging markets, near-term growth prospects are less promising as accelerating inflation pressures are driving a rapid shift away from ultra-accommodative monetary policies. Indeed, excluding China and India, emerging market central banks in aggregate raised rates on more than 60 occasions throughout 2021.

Elevated public debt may limit the ability of some EM countries to use fiscal policy to mitigate the anticipated drag of monetary tightening in the years ahead. The pace of growth in large emerging markets such as Brazil, Russia and South Africa is expected to slow as both monetary and fiscal austerity weighs on activity. On balance, however, most economies in the region should still expand at above-trend rates in the new year given ample room for catch-up growth. Aggregate emerging market real GDP is forecast to grow by 5.1% in 2022.

Main risk to outlook: (1) Inflation

The U.S. Consumer Price Index for all items excluding food and energy surged 4.9% year-on-year in November, the largest annual increase in core consumer prices since 1991. With inflation reaching multi-year highs in the U.S. and elsewhere, it remains one of the key risks to the global economy entering the new year.

We continue to believe that the recent surge in inflation is largely attributable to disruptions in global supply chains and a handful of goods and services specifically impacted by the pandemic. As detailed in our October 2021 Economic and Capital Markets Outlook, we believe these factors are temporary. Encouraging signs are already starting to appear with respect to supply chain issues. For example, data from the Marine Exchange of Southern California show that logjams have eased significantly. The number of ships waiting to load or discharge containers at the Los Angeles and Long Beach ports declined from 116 to 72 in mid-November, compared with a pre-pandemic level of around 30 ships.

Similarly, high wage inflation appears concentrated in sectors that are the most exposed to COVID-19-related disruptions. The service sector continues to face a shortage of labour, despite the expiry of generous unemployment benefits. Wage data reflect this dynamic. Average hourly earnings for Americans employed in leisure and hospitality surged 14.7% year-on-year in November whereas wages for the aggregate workforce grew by 4.8%. Inflation in service sector earnings should ease as reopening continues and COVID-19 fears recede.

There are concerns that structural forces, such as an accelerated pace of baby boomer retirement, will stimulate strong wage growth and lead to entrenched inflation. We believe that the expiry of pandemic wage relief measures and a reopening of borders to immigration should offset this source of price pressure.

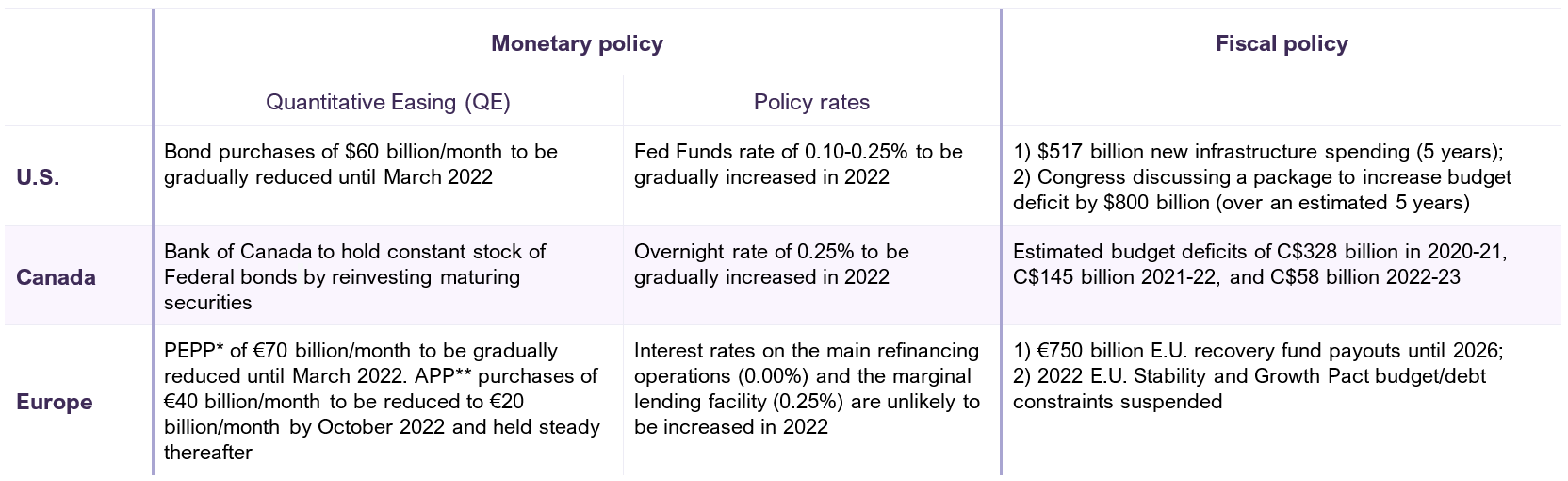

While inflation could persist at above-trend levels for some time, we are confident that the risk of runaway inflation is low. We do not foresee an abrupt end to monetary stimulus in advanced economies. Indeed, adjustments made to bond purchase programs by the U.S. Federal Reserve, the Bank of Canada, and the European Central Bank (ECB) indicate that the process of monetary policy normalization will be gradual (Table 2). At its December meeting, the Fed announced a reduction in the monthly pace of its asset purchase program and suggested that it would completely stop purchasing bonds by March 2022. Even as quantitative easing is being withdrawn, interest rates remain at levels that are extremely stimulative. Both the U.S. Federal Funds Rate and Bank of Canada policy rate are still 0.25% and are expected to increase only slowly in 2022.

Global growth will continue to benefit from developed markets’ accommodative monetary policy in 2022.

Policy support across developed markets

Main risk to outlook: (2) COVID-19

Nearly two years into the pandemic, successive waves of COVID-19 and its variants remain a risk to the global economic recovery. The emergence of the Omicron variant in late November has raised concerns within the scientific community, leading to increased volatility in financial markets. While uncertainty remains around Omicron’s profile, and various countries are renewing measures to limit its spread, we would caution against undue pessimism.

As was the case with the Alpha and Delta variants, vaccines should maintain some degree of efficacy, especially from hospitalizations and death. Antibody treatments appear effective from pre-clinical studies, new oral antivirals are promising, and existing testing platforms do not seem to be impacted by the mutation. The toolkit of countermeasures developed over the past two years remains robust. We expect the transition from a pandemic to an endemic phase of the virus to continue, and for the global economic recovery to remain on track in the months ahead.

Favourable backdrop for value-oriented strategies

Developed market indices climbed to new highs during Q4 as strong economic data confirmed a constructive outlook for stocks entering the new year. The S&P 500 Index increased 28.2% (total return in Canadian dollars) for the year as a whole, while the S&P/TSX (+25.1%), DAX (+7.2%) and MSCI World (+20.8%) all posted sizeable gains in 2021. In contrast, the MSCI Emerging Markets Index closed the year at -3.4%, largely as a result of volatility in Chinese stocks.

Broad market highs amid rising inflationary pressures is leading to speculation that equities may be overvalued. The S&P 500 Index currently trades at 21 times 2022 estimated earnings, 40% above its long-term average of 15x. Though elevated relative to historical multiples, valuations are not uniformly expensive. The S&P Value Index trades at a reasonable 17.4 times 2022 earnings, considerably lower than the S&P 500 Growth Index with a 2022 P/E multiple of 28.4. Meanwhile, the Letko Brosseau international equity and Canadian equity portfolios trade at around a 30% discount to their equity benchmarks and offer good value at 10.3x and 12.3x estimated 2022 earnings respectively. In addition, forecasted earnings growth over the next two years for our Canadian and international equity strategies should average a cumulative 20%.

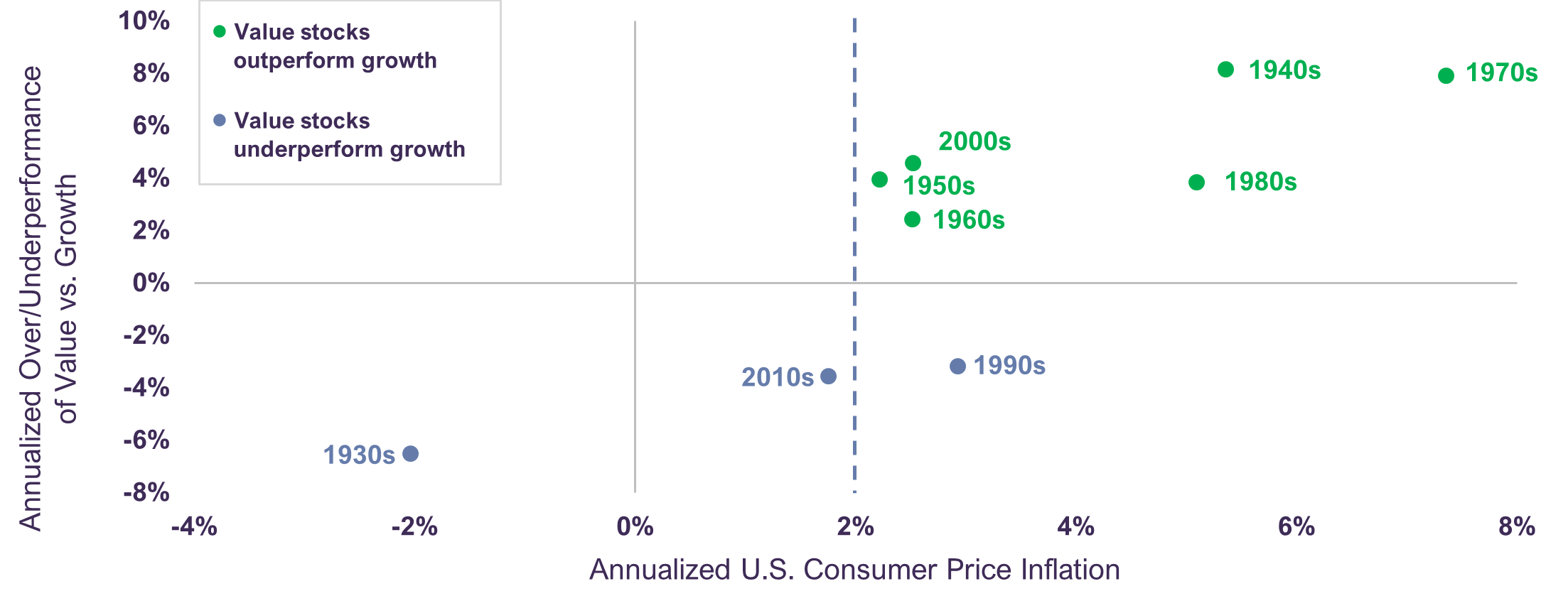

We believe a backdrop of moderately higher inflation bodes well for value-oriented strategies. Since 1930, value stocks outperformed growth in six out of nine decades. During the seven decades when annualized inflation exceeded 2%, value beat growth in all but one period (Chart 2). Higher inflation often brings about rising interest rates, which exert a disproportionately negative impact on higher-multiple growth stocks. From a sector allocation standpoint, our equity portfolios are exposed to industries that provide a natural hedge against inflation (commodities) and companies that tend to do well in rising rate environments (financials).

Relative Performance of U.S. Value and Growth Stocks vs. Inflation (1930-2019)

Sources: U.S. Bureau of Labor Statistics. All data references to growth and value are based on the Fama/French Data Library of historical returns of U.S. large cap companies in the NYSE, AMEX, and NASDAQ: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html#Research. Data include Letko Brosseau calculations.

Our optimism does not extend to fixed income markets, which have yet to reflect above-trend growth, inflation pressure or the upcoming normalization of monetary policies. In Canada, the 10-year federal government bond yield increased by only 5 basis points through the second half of 2021 despite a more than 100-basis-point acceleration in headline inflation over the same period. At 1.42%, the 10-year yield is well below 4%, a level that is consistent with long-run estimates of 2% real GDP growth and 2% inflation. Further, should rates rise by just 1%, the 10-year bond would incur a capital loss of 9%. We continue to view the risk/return profile of bonds as unattractive and are maintaining a tilt towards equities over cash and bonds within balanced portfolios. Capital preservation and low duration remain the focus of our fixed income strategy.

In our view, our portfolios are well positioned to capture both cyclical and secular value creation over the medium-term.

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN