Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

October 2022

Q&A with the Economics Team

Equity markets closed the third quarter on a volatile note. Higher interest rates, headwinds from the Russia-Ukraine war and sporadic lockdowns in China have increased concerns about global growth.

As the world economy adjusts to a more restrictive policy environment, aggregate activity is set to decelerate. However, prospects vary greatly on a regional basis, with some economies better positioned to navigate the current environment than others.

In this edition of our Economic and Capital Markets Outlook, we take the opportunity to address some of the most crucial questions and concerns you have shared with us about the global economy.

Q: U.S. real GDP declined in Q2 from the preceding quarter, following a larger decline in Q1. Is the economy already in recession?

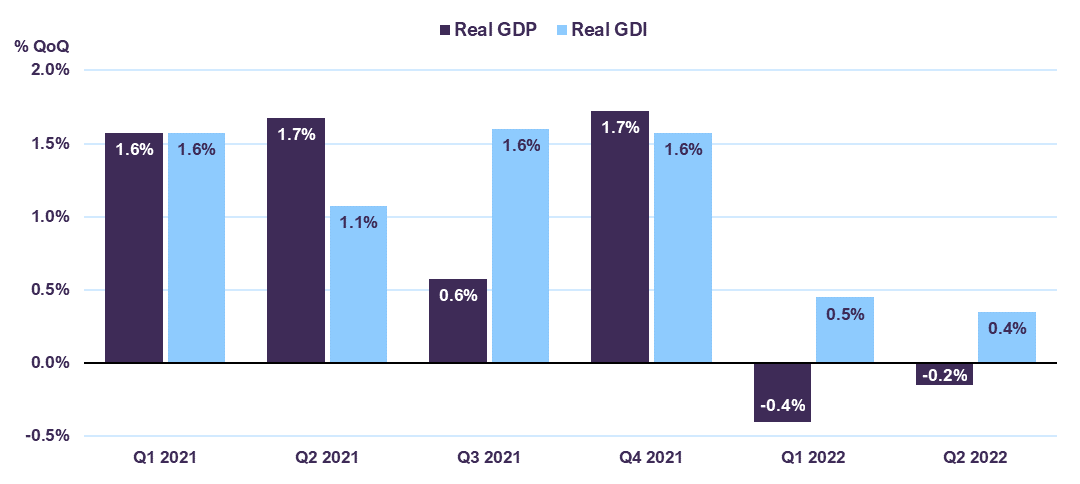

A popular rule of thumb is that two consecutive quarters of negative real GDP growth constitutes a recession. This definition is too narrow and simplistic. Indeed, U.S. real GDP data from the first and second quarters of 2022 are inconsistent with recessionary conditions. In the first half of the year, the most volatile components of GDP – inventories and trade – drove the headline number for U.S. real output lower. Meanwhile, household spending and business investment, which together account for more than 80% of GDP, both expanded. On the income side, U.S. real gross domestic income (GDI) – an income-based measure of broad economic activity – also rose in the same period (Chart 1).

U.S. Real Economic Activity

Source: U.S. Bureau of Economic Analysis

Robust labour market indicators help explain the continued strength in consumer spending. The U.S. unemployment rate is 3.7%, near multi-decade lows. Companies created 3.5 million new jobs year-to-date, and the number of open positions has reached more than 11 million, significantly above the pre-pandemic peak of 7 million. In September, the number of Americans filing new unemployment claims reached a three-month low and wages grew 8.6% year-on year, more indicative of an economy running hot than an economy in recession. These indicators suggest that the work force will likely continue to expand in the months ahead, the opposite of what typically occurs when an economy is in a downturn.

Company survey data also offers a mixed picture. On the one hand, the Duke survey of CFOs suggests that business leaders are as pessimistic about the economy as they were during the trough of the COVID-19 recession. Yet on the other, the same survey indicates CFOs remain optimistic about the prospects for their own company. Interestingly, senior management’s impression of their own firm’s prospects remains above the average of the last decade, a period of sustained economic expansion.

Q: With the Federal Reserve raising rates aggressively, how can the U.S. economy avoid recession?

It’s easy to forget that the U.S. central bank was holding its policy interest rate at around zero as recently as February 2022. Since then, the Fed has raised the target range for the federal funds rate five times, a cumulative 300 basis points of tightening in seven months. The forward markets are currently pricing in a further 200 basis points rise, for a target rate of 4.5% by March 2023. If, as we expect, inflation begins to ease in the coming months, this should remove pressure for even more aggressive rate hikes.

At present, tighter financial conditions are tempering sales in interest rate sensitive sectors such as housing and autos. Additional interest rate hikes will further weigh on consumers’ affordability of these big-ticket items and could limit spending elsewhere as financing costs rise. A marked slowdown in the main driver of the U.S. economy – consumption – is expected.

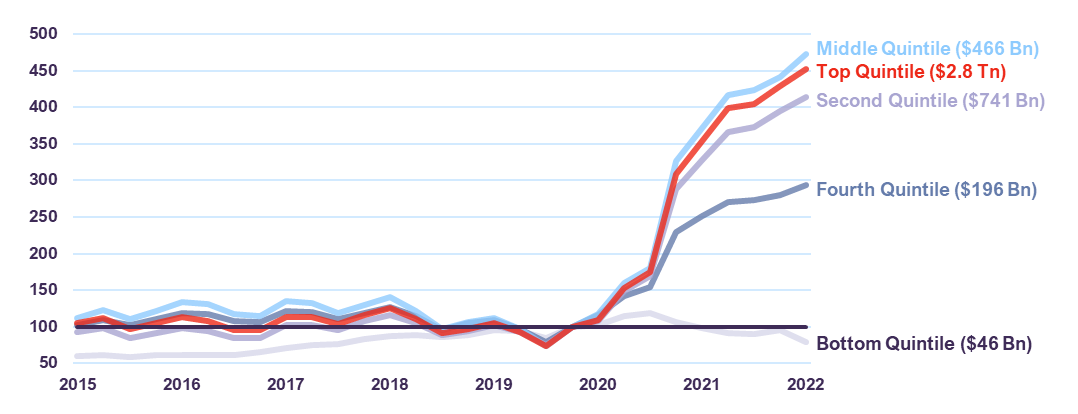

However, a large stock of savings will help consumers adjust to these headwinds. Households have accumulated $3.2 trillion in savings since the pandemic began, an amount equal to 20% of annual consumption. Meanwhile, the accumulation of savings has been broad based and not limited to only the wealthiest households (Chart 2), thereby providing a buffer to a majority of Americans.

U.S. Household Cash Deposits by Income Quintile (Q4 2019 = 100)

Note: Holdings of chequable deposits and currency split by household pre-tax income quintiles, indexed at Q4 2019 = 100. Level of cash position at Q2 2022 shown in parenthesis.

For example, the 20% middle-earning households had cash holdings of $466 billion in Q2 2022, compared with $99 billion in Q4 2019.

Source: Federal Reserve

Given consumers’ reserve spending power and our constructive outlook for employment, the U.S. economy possesses important offsets to current challenges. Nonetheless, we are lowering our forecast for growth due to the persistence of inflation and a more restrictive outlook for interest rates. We expect U.S. real GDP growth to stabilize at about 0-0.5% in 2022, before improving to 0.5-1.0% in 2023.

Q: What are growth prospects like elsewhere in developed markets?

Canada has fared well relative to other G7 economies since Russia’s invasion of Ukraine. Higher commodity prices – a consequence of the war – continue to benefit the country’s natural resources sector and exports. Indeed, the trade balance has been in surplus this year, an important support given slowing growth elsewhere in the economy.

In August, the unemployment rate rose to 5.4% from a record low 4.9% a month prior. This marked the first increase in joblessness in seven months. However, overall labour market conditions remain robust. The average hourly wage rate grew by 5.4% year-on-year and, excluding the pandemic, this marked the fastest rate of wage growth recorded since 1997. In the same period, weekly hours worked did not change.

Going forward, a tight labour market and above-target inflation will keep the Bank of Canada on track to hike rates, potentially into 2023. Our forecast is for the Canadian economy to slow, but not contract. We expect real GDP growth of about 2.5-3.0% in 2022 and 1.0% in 2023.

The outlook for the Eurozone is less promising. With inflation at an all-time high, the European Central Bank (ECB) raised its main policy interest rate by 75 basis points in September. While an increasingly aggressive tightening cycle presents a headwind to activity, a looming energy crisis poses a greater threat to the broader economy.

Energy bills have spiked, forcing households to pare back spending elsewhere. Firms operating in energy-intensive sectors are curtailing production. Russia’s cutoff of natural gas exports to Europe will push energy prices even higher. As Russian exports account for about 40% of Europe’s total natural gas supply, the possibility that European households and businesses will face blackouts in the months ahead is rising.

Despite a growing fiscal response to the energy crisis – combined support packages total about 3% of GDP – a recession in the Eurozone appears imminent.

Q: Are emerging markets heading for a broad-based downturn?

Prospects for emerging market countries are mixed, due to differing challenges affecting individual domestic economies.

China is facing renewed mobility restrictions and a property market downturn. Through the first eight months of the year, retail sales increased only 0.5% and industrial production grew just 3.6% against 2021, reflecting the impact of the constraints imposed by China’s zero-COVID strategy. In the real estate sector, home prices, housing starts, completions and sales all contracted in August.

Despite these challenges, China’s economy possesses positive underpinnings. Year-to-date, Chinese households have accumulated excess savings equivalent to 4% of GDP. Even a partial drawdown of these savings would provide a significant boost to consumer spending in the months ahead. Lower mortgage rates and a government-backed bailout of select property developers should also help to stabilize activity in the real estate sector.

Real estate support measures are just one aspect of a broader effort to boost growth. Combined monetary and fiscal stimulus during 2022 reached 8% in Q3, nearly double that seen in 2021. Real GDP in China is forecast to grow by 3.3% this year and 4.6% in 2023, per IMF estimates.

In India, recent indictors of activity confirm the economy continues to grow at a healthy level. In August, the S&P Global India Composite PMI signaled a 12th consecutive month of expansion of private sector output and the employment subindex increased at its fastest rate in more than a decade. The IMF forecasts real GDP in India will increase by 7.4% in 2022 before slowing to 6.1% in 2023.

Outlooks vary in other major emerging markets. Low inflation in Indonesia is allowing the central bank to tighten gradually; the economy is on track to expand by more than 5% in both 2022 and 2023. In Mexico, real GDP growth is expected to decelerate, but remain positive this year and next. The domestic economy remains resilient, providing some offset to slower growth in the U.S., Mexico’s largest trading partner. Meanwhile, Brazil faces a higher risk of recession due to a protracted monetary tightening cycle, constrained fiscal policy, and elevated political uncertainty.

Unsurprisingly, the war and subsequent sanctions are exacting a harsh toll on the economies of Russia and Ukraine. Both countries are set to experience multi-year recessions. Much like their developed market counterparts, intense price pressures and dependence on Russian energy imports will likely tip several emerging European economies, such as Poland and the Czech Republic, into recession in the near-term.

Given the asynchronous nature of conditions across emerging economies, we do not expect a broad-based recession in the region. Outlooks vary greatly country-by-country but, in general, emerging markets remain subject to significant external pressures, including tighter global financial conditions, increased currency volatility and cooling export demand. Consequently, the IMF anticipates emerging market real GDP will grow by 3.6% in 2022 and 3.9% in 2023, below its long-term average of 4.5%.

Q: What is the biggest challenge to the global economy post-pandemic?

In the U.S. and Canada, core inflation rates are much higher than official targets. The Eurozone headline CPI, at 9.1%, set a record in August amid intense energy price pressures. Emerging market countries such as Poland and the Czech Republic are grappling with double-digit inflation. Global inflation is running at a multi-decade high and presents the biggest risk to economic growth. We are further reducing our forecast for global real GDP growth to 2.8% in 2022 and 2.4% in 2023 to reflect a more pronounced softening of demand as central banks around the world continue to step up their fight against inflation.

Global monetary authorities are rapidly raising interest rates to curb demand and rein in inflation. While the full effect of tighter financial conditions is yet to be felt – monetary policy typically affects the real economy with a lag of at least six months – the impact will weigh on economic activity going forward. Indeed, activity is already moderating in interest rate sensitive sectors, an early signal that demand-side pressures are beginning to ease. As higher interest rates act to reduce consumption, corporate pricing power is evaporating. The price component of both the manufacturing and service PMI has now fallen materially from its peak, an early sign that inflation is moderating.

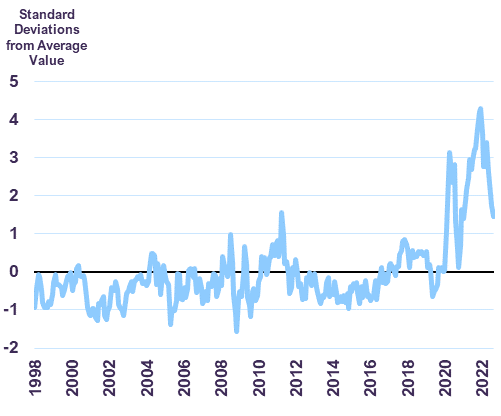

On the supply side, supply chain bottlenecks have been a key driver of higher inflation since the outbreak of COVID-19. However, as the pandemic continues to wind down, this source of price pressure appears to be receding (Chart 3).

Global Supply Chain Pressure Index

Note: The GSCPI integrates a number of commonly used metrics, such as global transportation costs and supply chain-related components from major industrial country PMI surveys, with the aim of providing a comprehensive summary of potential supply chain disruptions.

Source: Federal Reserve Bank of New York, Global Supply Chain Pressure Index, https://www.newyorkfed.org/research/gscpi.html

At present, the most intense price pressures remain concentrated in food and energy – items specifically impacted by the Russia-Ukraine war. Should food and energy costs remain elevated, households will have to pare back discretionary spending, possibly causing price pressures to ease in non-food and energy (i.e. core) items. While this would slow growth further, it would also help contain core inflation, the measure of inflation targeted by central banks.

Inflation could persist at above-trend levels into 2023, but we believe that the risk of runaway inflation is low. Though we cannot exclude the possibility of another commodity price shock from the Russia-Ukraine war, our read of the data leads us to conclude that disinflationary factors are emerging. Central bank actions taken to date and the continued recovery of global supply chains support this view.

Q: The housing market is vulnerable to rising interest rates. Is this an area

of concern for the Canadian economy?

There is no question that higher mortgage rates will reduce the financial flexibility of highly indebted households and those facing mortgage renewal. For the economy as a whole, however, Canadian mortgage debt is not excessive. At present, the ratio of household mortgage debt payments to disposable income is in-line with its long-term average and mortgage lending rates remain low by historic standards.

About one-third of Canadian households carry mortgage debt. Within this population, the number of mortgages subject to an interest payment shock from higher rates is significantly less. Households with variable-rate, fixed-payment mortgages represent only 8% of Canadians, while only 2% of the population has variable-rate, adjustable-payment mortgages. In addition, the most vulnerable households, those with down payments of less than 20% of the value of their home, are insured by CMHC, a government-owned entity.

While the housing market is set to cool in the quarters ahead, the medium-term outlook for the Canadian housing sector remains constructive. The country now boasts the fastest growing population in the entire G7, having surpassed the U.S., for the first time ever, in 2021. Further, Canada’s prime-aged working population (ages 25-54) registered its largest expansion ever in the same period. Sound demographics suggest the demand for housing should remain strong for years to come.

Q: What are the red flags to watch for in 2023 and beyond?

Structural imbalances tend to form during long periods of low interest rates and unwind as interest rates rise. During the pandemic, U.S. corporate debt rose steadily against a backdrop of ultra-low borrowing costs. Now, with interest rates increasing, some are questioning whether corporate debt levels are sustainable.

At present, U.S. private sector debt metrics suggest that balance sheets are not unduly extended. The ratio of debt-to-earnings before interest, taxes and depreciation (debt/EBITDA) for the non-financial corporate sector, a measure of leverage, has improved since the pandemic and stands at 4.6x compared to a 2020 high of 6.4x. The earnings to interest ratio (EBITDA/interest), which measures non-financial firms’ ability to service debt, is 9.1x, its strongest level since the 1960s.

As the U.S. Federal Reserve continues to raise interest rates and shrink its balance sheet, debt service costs are expected to increase further. However, we believe that the debt burden of U.S. non-financial corporations is manageable. U.S. corporate spreads appear to confirm this view: while the gap between both high yield and investment grade corporate bond yields and Treasuries has risen from their lows of last year, it remains far from recessionary levels. We also do not see significant signs of capital misallocation that could lead to losses in entire sectors of the economy.

Emerging market external debt is another area of the global economy facing renewed scrutiny. Since the beginning of the pandemic, several developing economies have defaulted or renegotiated foreign debts, the latest being Sri Lanka. U.S. dollar strength and tighter global financial conditions have prompted fears that emerging economies may not be able to refinance as existing debts mature. However, many large emerging markets are well-insulated from rollover risk. In China, India and Brazil, as example, foreign exchange reserves more than cover short-term U.S. dollar liabilities.

On balance, emerging market external funding requirements and external debt levels are significantly lower than in previous episodes of stress, such as the 1980s and 1990s. While some frontier economies appear overstretched, in aggregate, debt service in large emerging markets remains sustainable.

Q: In today’s uncertain environment, what is your asset allocation strategy?

Equity markets have been plagued by volatility throughout the year. Investors seem to be scrutinizing data on a daily basis to detect whether inflation is overheating or cooling, geopolitical conflict is intensifying or stabilizing, and central banks are tightening too much or too little. Year-to-date to September, the S&P 500 total return was -17.2% in Canadian dollars, the S&P/TSX -11.1%, MSCI Europe -22.6%, MSCI World Index -18.9% and MSCI Emerging Markets -20.8%.

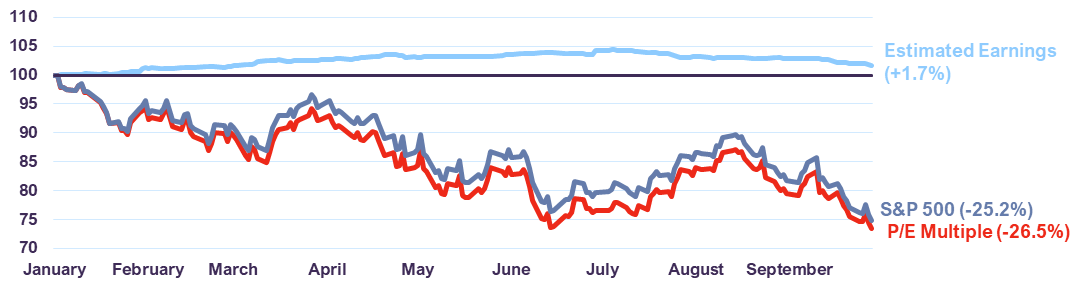

The sell-off in equity markets and the decline of P/E multiples appears to reflect a pessimistic outlook on the global economy rather than actual weakness with respect to companies’ fundamentals. In December 2021, the forward P/E ratio for the S&P 500 was 21 times, in September 2022 it had contracted to 16 times. However, over the same period, earnings estimates were upwardly revised as companies continued to deliver strong results despite the more challenging operating environment (Chart 4).

In the meantime, bonds also saw significant declines, undermining their status as a traditional safe haven in times of uncertainty. The 30-year Canadian Federal government bond is down 27% year-to-date and a more persistent inflation picture could put even further pressure on long-term fixed income securities. Short-term T-bill rates are around 3.5%, making cash a reasonable alternative to park funds. What is an investor to do?

As we explained in our August Portfolio Update, it is unwise to try to time entry and exit from the markets. Correctly identifying when to sell and, more importantly, when to buy back is difficult, if not nearly impossible. We believe the most effective way we can limit equity market risk in this uncertain environment is to focus on careful stock selection and continuously review our holdings for all risks, including excessive exposures, extended valuations and risk of permanent impairment.

Our holdings are diversified by sector and geography, with a healthy allocation to less economically-sensitive industries such as healthcare, telecommunications, utilities and consumer staples. We have also taken advantage of the significant rise in share prices of oil-producing companies to take profits on these investments and reduce our exposure. From a valuation standpoint, our global equity portfolio trades at a compelling 9 times 2023 earnings and provides an attractive 4% dividend yield.

Looking ahead, with the recent market decline, many valuation indicators are no longer stretched. P/E multiples for market indices are generally back at historical levels and, with a long-term horizon, many pockets of the market are now beginning to offer great opportunities.

Turning to fixed income, we continue to minimize risks and focus on capital preservation in our bond holdings by prioritizing quality and avoiding long duration securities. Overall, we are maintaining a tilt towards equities over cash and bonds within balanced portfolios as we believe patience in the face of volatility will be rewarded in the medium term.

S&P 500 Performance Decomposition

Note: All data indexed to January 3 = 100.

Source: Bloomberg and Letko Brosseau calculations

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN