Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

Economic and Capital Markets Outlook

January 2023

- The monetary policy tightening cycle remains the main factor behind a weaker global economic outlook entering the new year. The IMF anticipates global real GDP growth of 2.7% in 2023.

- Higher interest rates will lead to slower activity in the U.S. We forecast U.S. real GDP growth to range from 0-1% in 2023.

- Housing is expected to exert a drag on Canada’s near-term growth prospects but does not appear to pose a systemic risk to the broader economy. Our outlook is for Canadian real GDP to grow in 0.5-1.5% in the year ahead.

- Given energy supply concerns and tighter financial conditions, Europe is forecast to slow and risks recession. Fiscal support measures are cushioning the impact.

- The IMF expects real GDP growth in China to improve from 3.2% in 2022 to 4.4% in 2023 as the economy benefits from reopening. Elsewhere across emerging markets, a downshift in developed market growth and tighter global financial conditions present dual headwinds. On balance, real GDP for the region is forecast to expand by 3.7% in 2023.

- There is increasing evidence that inflation has peaked in many major economies. We believe central bank policy rates are nearing the terminal point of this current cycle.

- Given our baseline forecast of slower, yet still positive, global growth, as well as current attractive company valuations, we expect our equity holdings to provide meaningful value creation in the medium term. We continue to favour equities over bonds.

Summary

The world economy is on a slowing trajectory. While inflation has moderated from multi-decade highs in many countries, central banks are maintaining efforts to prevent above-target inflation becoming entrenched. The ongoing monetary policy tightening cycle remains the main factor behind a weaker global economic outlook entering 2023.

Although we expect growth to slow further in the year ahead, recent trends are encouraging. There is increasing evidence that inflation has peaked in several major economies. As a result, central banks have raised interest rates in smaller increments. We believe policy rates are nearing the terminal point of this current cycle.

The economies of the U.S. and Canada remain resilient, largely due to strong labour market fundamentals and accumulated household savings. Elsewhere, Europe is at a higher risk of recession than other regions due to the continued negative effect of the war in Ukraine on energy prices. To date, however, the region has avoided a severe downturn and fiscal support is cushioning the impact of higher utility bills. China’s relaxing of COVID-19 restrictions will provide a meaningful boost to domestic growth, with positive spillovers on the global economy. On balance, emerging market growth is expected to remain broadly stable in the year ahead.

The IMF anticipates global real GDP growth of about 2.7% in 2023, slightly less than our 2022 estimate of 2.9%.

U.S. economy cooling

In the October edition of our Economic and Capital Markets Outlook, we argued that U.S. economic data was inconsistent with recessionary conditions. Our assessment was that growth would continue to slow, but the economy possessed important offsets to current challenges. Macroeconomic indicators and developments since then corroborate this view.

In Q3, real GDP grew 0.8% quarter-on-quarter and 1.9% year-on-year. The U.S. economy created 263,000 jobs in November and, at 3.7%, the unemployment rate remained close to September’s 29-month low of 3.5%. However, labour market trends suggest the Federal Reserve may be beginning to have an impact on job creation. Over the last three months, job gains averaged 272,000 compared to 562,000 per month in 2021 – a sign that U.S. labour demand may be past its peak.

Meanwhile, average hourly earnings grew 5.1% against a year ago in November. Since reaching a high of 5.6% in March, the rate of wage gains is gradually moderating. Solid income growth, together with elevated household savings, help explain the continued resilience of household spending. Walmart, a bellwether of American consumer spending, reported same-store-sales growth of 8.2% year-on-year in Q3. Retail sales increased 6.5% in November against a year ago. Strong consumer spending trends reinforce the case for tighter financial conditions.

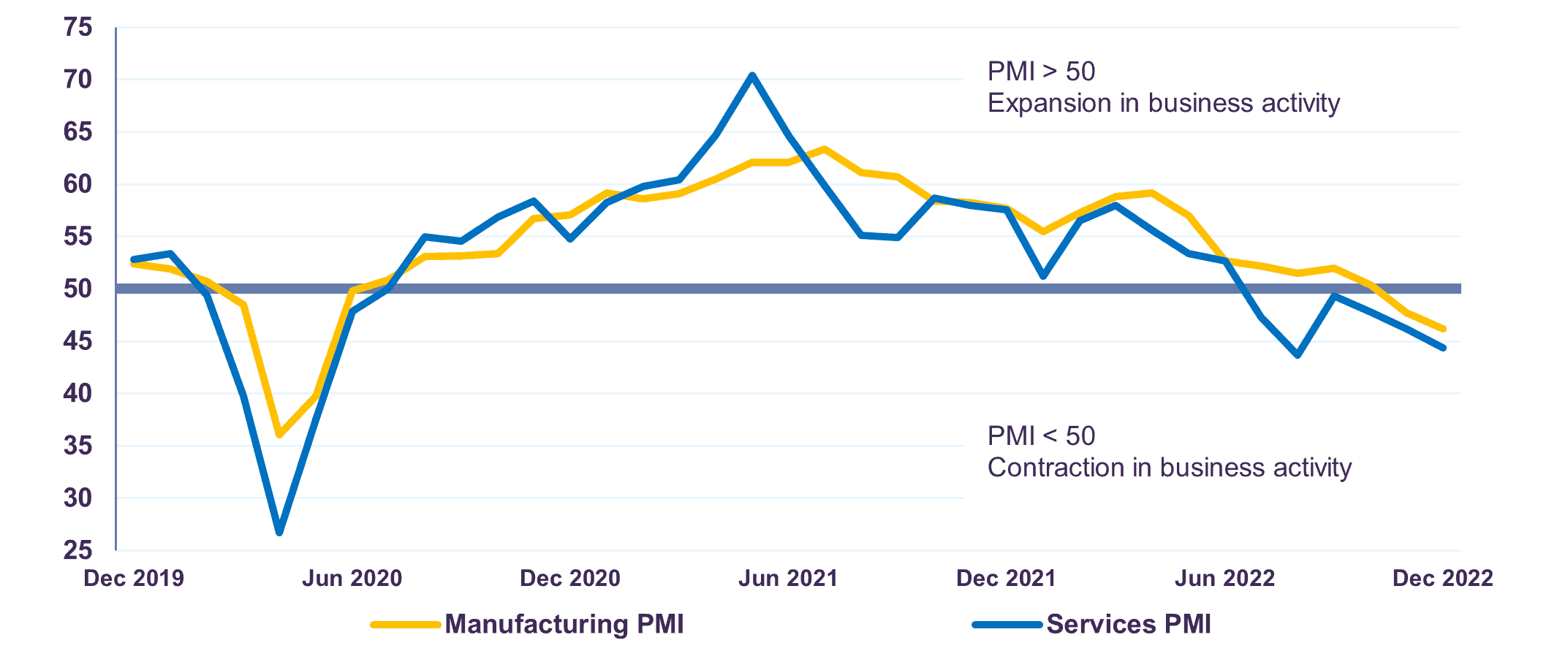

Activity has moderated substantially in interest rate sensitive sectors such as housing. Existing home sales declined 7.7% month-on-month in November, marking a tenth straight month of falling sales. With mortgage rates near multi-decade highs, the U.S. residential real estate market is expected to remain under pressure. We expect the broader economy to be more heavily impacted by tight monetary policy in the year ahead. Indeed, the S&P Global Purchasing Managers’ Indexes signal slowing activity in both the service sector and the U.S. industrial complex (Chart 1).

Given the aggressive interest rate increases of 2022, which should take between 6-12 months to be fully reflected in economic conditions, we anticipate higher U.S. unemployment in 2023.

The unusual level of volatility in inflation is adding complexity to the calculation of expected real economic activity. Consequently, we forecast U.S. real GDP growth in the range of 0-1% in 2023.

S&P Global U.S. Purchasing Managers’ Index

Source: S&P Global

Canada adjusting to high interest rates

Growth remained stable in Canada in Q3. The economy expanded 0.7% quarter-on-quarter and 3.9% year-over-year in real terms. The GDP implicit price index – a broad measure of changes in the prices of goods and services produced in Canada – fell by 1.4% quarter-on-quarter in the same period. This marked the first decline in the GDP price deflator since Q2 2020.

Trends in the underlying components of real GDP indicate that the Canadian economy is gradually adjusting to more restrictive financial conditions. While export growth and business investment continue to benefit from strong natural resource demand, other areas of the economy are losing momentum. In Q3, housing investment declined 4.1% quarter-on-quarter amid higher mortgage costs. Meanwhile, private consumption fell 0.3% as households pared back spending and increased savings in response to higher debt servicing payments and persistent inflation.

The Canadian labour market has thus far weathered the higher interest rate environment. Full-time employment registered a third consecutive increase (+51,000) in November, and the unemployment rate declined to 5.1% from 5.2% a month prior. While job market trends remain constructive, we believe labour demand will moderate in the months ahead. Indeed, the most recent Canadian Federation of Independent Business (CFIB) survey shows that the number of companies planning to expand headcount is roughly the same as the number planning to reduce it.

The Bank of Canada raised its target for the overnight rate by a cumulative 400 basis points in 2022, leading the prime lending rate at Canada’s five largest banks to reach its highest point since 2008. The state of Canadian mortgage debt is therefore facing considerable scrutiny.

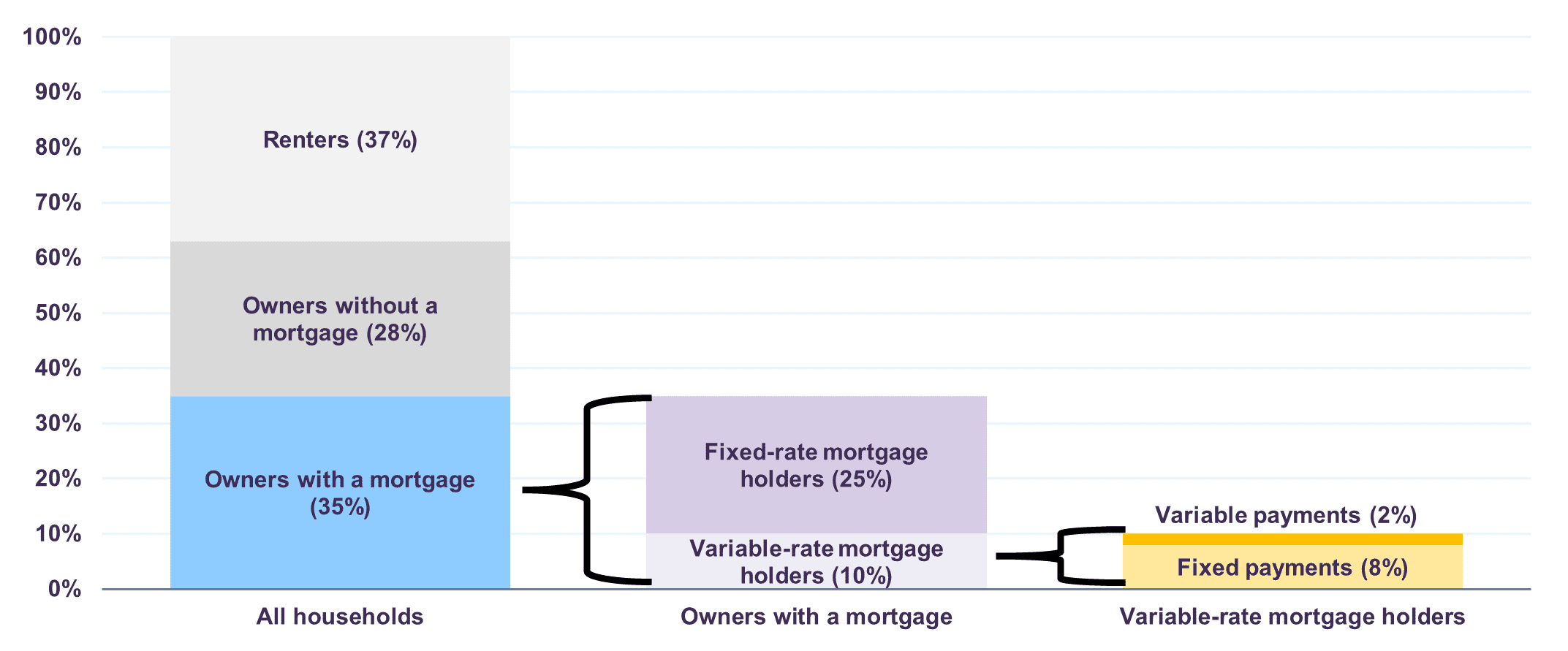

We believe household mortgage debt metrics are sustainable. Canadian mortgage delinquencies declined steadily through 2022 and reached a decade low 0.14% in Q3 despite rising rates. Indeed, Canadian homeowners are relatively well insulated from interest payment shocks. Only 10% of Canadian households carry variable-rate mortgage debt, and only 2% of the population has variable-rate, adjustable-payment mortgages. The remaining 8% owe variable-rate, fixed-payment mortgages (Chart 2). At present, the ratio of household mortgage debt payments to disposable income remains in-line with its long-term average.

As the Canadian residential real estate market continues to adjust to higher mortgage rates, we expect house prices, affordability and sales to remain under pressure in the months ahead. Housing will exert a drag on Canada’s near-term growth prospects, but it does not appear to pose a systemic risk to the broader economy.

Our forecast is for Canada’s real GDP growth to moderate to 0.5-1.5% in 2023 from about 3.0% in 2022.

Breakdown of Canadian households by mortgage characteristics

Note: 2022 estimates for Canadian mortgages, totaling C$1.7 trillion. Figures exclude C$0.2 trillion in home equity line of credit (HELOC).

Sources: Bank of Canada, Letko Brosseau

Likelihood of recession in Europe

The Eurozone economy continued to grow in Q3, albeit at a slower rate, as real GDP increased 0.3% quarter-on-quarter and 2.3% year-over-year in real terms. Household spending – the largest component of Euro Area GDP – advanced 0.9% sequentially despite a multitude of headwinds. At this juncture, growth has fared well relative to more negative expectations, but we believe Europe remains at a high risk of recession.

In December, the S&P Global Eurozone Composite PMI signaled a sixth consecutive month of contracting private sector activity. Meanwhile, the European Commission’s consumer climate index – an indicator of consumer confidence – remains near record lows.

Persistent inflation and energy supply concerns are weighing heavily on the outlook for both European businesses and households, especially as we enter the winter season. Additionally, with inflation running at around 10%, five times the European Central Bank’s target, financial conditions are set to tighten further in the months ahead. There is a high likelihood that the Eurozone enters recession in 2023.

Potential rebound in China

China’s trade data was weak in November. Exports contracted 8.7% year-on-year and imports fell 10.6%, reflective of slowing external demand, rising COVID-19 infections, and restrictive containment measures. While near-term uncertainty is high, the economic outlook is turning more constructive.

Recent adjustments to China’s COVID response system signal a pivot toward reopening. Many of the most economically damaging restrictions are beginning to be phased out, such as enforced quarantine in state-run facilities and city-wide lockdowns.

As reopening gains momentum, consumer spending could stage a meaningful rebound in the year ahead. Pent-up demand could be significant: Chinese households have accumulated excess savings worth more than 4% of GDP in the past year. However, we expect property market headwinds and slowing global growth to weigh on activity, partially offsetting the tailwind from reopening. The IMF anticipates real GDP growth in China will improve from 3.2% in 2022 to 4.4% in 2023.

Prospects vary across EM economies

Much attention has been paid to the actions of developed market central banks in the past year as they switched course from ultra-accommodative monetary policies to rapidly tightened financial conditions. However, in many emerging markets, this process began much earlier.

In Brazil and Mexico, where rate hike cycles have been among the most extensive, growth is expected to materially decelerate in the year ahead. The IMF forecasts real GDP in Brazil and Mexico to increase just 1.0% and 1.2% respectively, only a fraction of the growth rates estimated for 2022.

In contrast, activity in India is expected to be less affected by the central bank’s efforts to contain inflation. Less intense inflationary pressures allowed the Reserve Bank of India to raise interest rates more gradually than many of its emerging market peers. In turn, the IMF anticipates real GDP growth of 6.1% in 2023, marking the fastest growth rate among major economies.

Slowing developed market growth and tighter global financial conditions present dual headwinds to emerging markets. Given the asynchronous nature of conditions across developing economies, however, the region is expected to avoid a broad-based downturn. The IMF forecasts emerging market growth will be 3.7% in 2023, unchanged from a year prior, but below its long-term average of 4.5%.

Is inflation peaking?

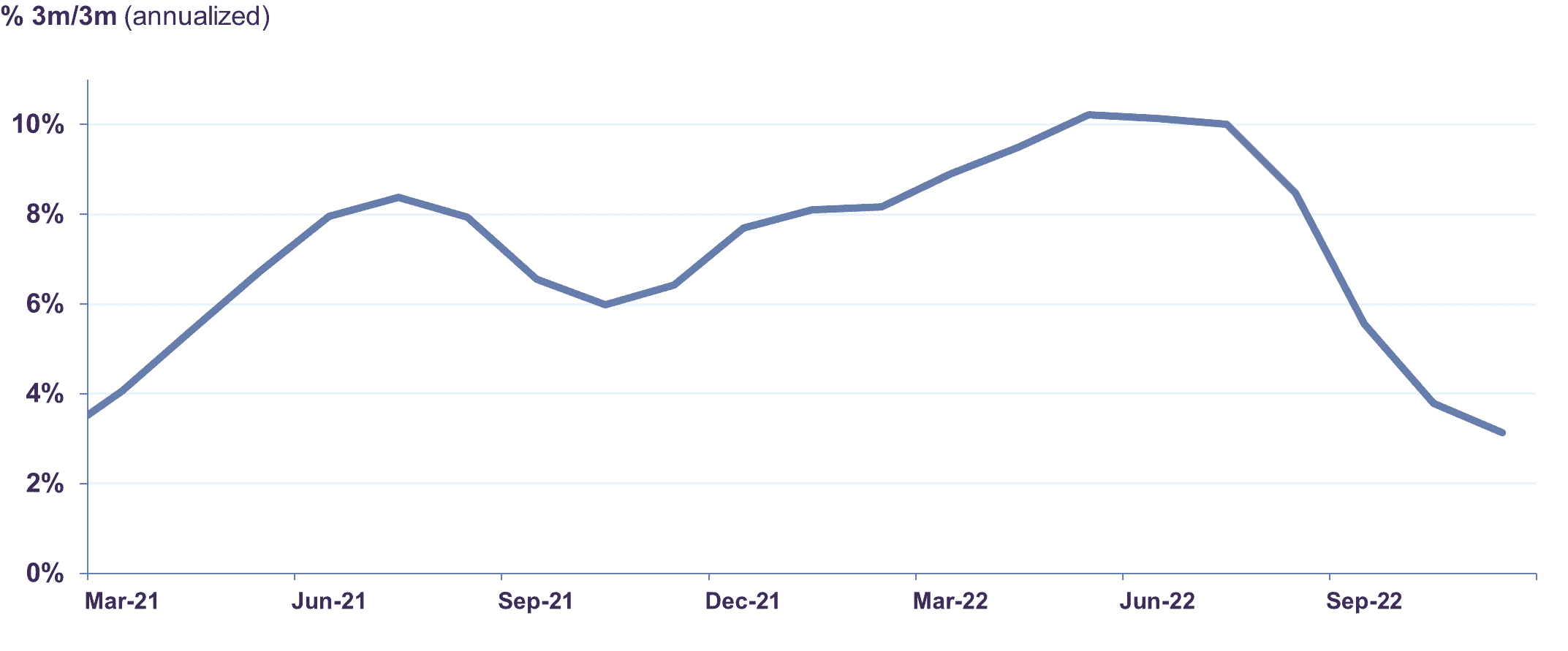

U.S. consumer price inflation declined to 7.1% year-on-year in November, the slowest rate of price growth since January 2022. Inflationary pressures may have reached an inflection point. Indeed, since peaking at 10.2% in May, three-month annualized inflation – a measure that reflects the underlying trend – has since moderated to just 3.1% as of November (Chart 3).

In the immediate months following Russia’s invasion of Ukraine, soaring food and energy prices drove headline inflation to multi-decade highs. Looking ahead, we anticipate a sustained deceleration in headline CPI, as the base effects corresponding to the previous year’s commodity price shock begin to exert downward pressure on annual inflation. In addition, price pressures are easing across U.S. supply chains. As per the U.S. Logistics Managers’ Index, transportation prices have fallen at an increasing rate for eight consecutive months. Warehousing costs recorded their slowest rate of growth in November in 26 months. Slowing global growth in the months ahead will reinforce these dynamics.

While headline inflation shows clear signs of abating, the outlook for core inflation (excluding food and energy prices) is more nuanced. U.S. wage growth measured on a year-on-year basis moderated in recent months but, sequentially, the month-on-month rate of earnings growth reached a 10-month high in November. Given the slow adjustment of employment and wages, core inflation may take some time before returning to its pre-COVID level of about 2%.

Our read of the data leads us to conclude that inflation has likely peaked in most major economies. Competing inflationary and disinflationary forces create the scope for additional central bank rate increases in the coming months. However, we believe central bank policy rates are nearing the terminal point of this current cycle.

Headline CPI

Source: U.S. Bureau of Labor Statistics, Letko Brosseau

Equities remain reasonably valued

Extraordinary uncertainty regarding the outlook for inflation, interest rates and the global economy shaped the performance of equity markets in 2022. The S&P 500 fell 12.2% (total return in Canadian dollars), while the S&P/TSX (-5.8%), MSCI Europe (-8.7%), MSCI World (-12.2%) and MSCI Emerging Markets (-14.3%) all closed the year in negative territory.

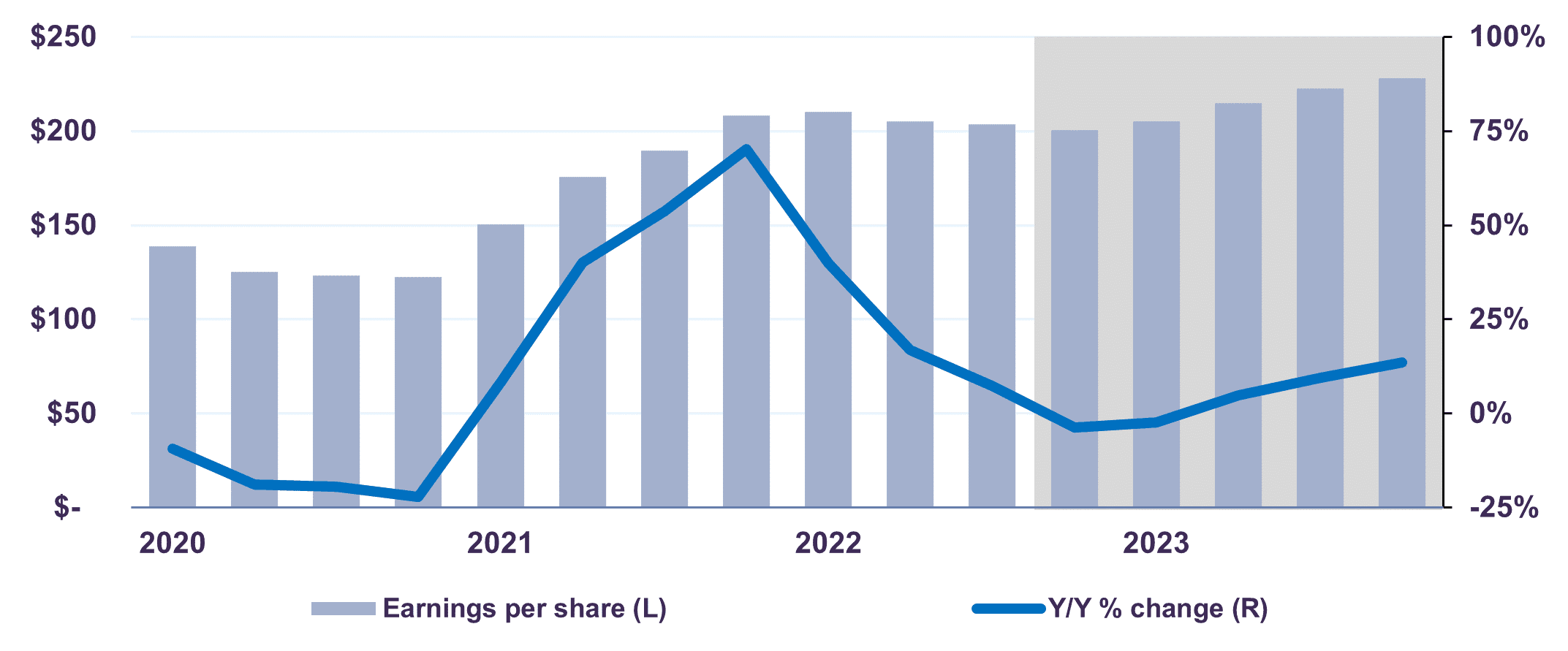

The equity market declines of the past year appear to reflect negative sentiment regarding the global economy and a contraction in valuations resulting from rising interest rates. We have not, however, seen a material deterioration in company fundamentals. In our view, earnings estimates are correctly reflecting the likelihood that 2023 will be another year of positive, but below-trend profit growth. Indeed, despite a challenging operating environment in the near-term, S&P 500 earnings are expected to rise 6.3% in 2023 in annual terms (Chart 4).

Valuations have adjusted downwards from loftier levels in the past year. U.S. stocks began 2022 with a forward price/earnings ratio of 21.4 times and by year-end, the S&P 500 P/E multiple declined to 15.4x, in line with its historical average of 15x. Meanwhile, the Letko Brosseau global equity portfolio trades at around a 35% discount to its benchmark and offers good value at 9.8 times estimated 2023 earnings. While the economy still faces a period of adjustment, there continue to be enticing investment opportunities for discerning investors with a long-term horizon.

In contrast, we continue to remain concerned about the disconnect between public and private market valuations. The performance of recent initial public offerings (IPOs) highlights this disconnect. After compiling data on the performance of 481 IPOs launched in the past two years on the NYSE, NASDAQ and S&P/TSX exchanges, we conclude that the average IPO share price declined 47% from launch to-date. There were even greater price corrections within the technology (-59%) and consumer cyclical sectors (-61%). Over this same period, the S&P 500 gained a cumulative 12.1% and the Letko Brosseau global equity portfolio rose 25.8%.

More broadly, only 13% of IPOs achieved a positive return since January 2021. Evidently, public markets have struggled to justify the elevated valuations from private market participants and investment banks. Looking ahead, we expect illiquid and opaque private companies to continue to undergo substantial re-valuations in the years to come.

Turning to the fixed income portfolio, we recently took the opportunity to increase our exposure to high-quality corporate bonds with maturities of six years or less. Current yields on these securities were around 5.5%, nearly a decade high. We believe this represented a material value opportunity, considering our medium-term growth and inflation expectations.

Although the risk/return profile of some fixed income securities has improved over the past several months, we maintain a tilt toward equities over cash and bonds within balanced portfolios. As we enter 2023, we are confident that our investments are well positioned for the current environment and continue to believe that patience in the face of volatility will be rewarded in the medium term.

S&P 500 Operating EPS

Source: Standard and Poor’s. Shaded area indicates S&P forecasts.

Legal notes

All dollar references in the text are U.S. dollars unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN