Letko Brosseau

Veuillez sélectionner votre région et votre langue pour continuer :

Please select your region and language to continue:

We use cookies

Respecting your privacy is important to us. We use cookies to personalize our content and your digital experience. Their use is also useful to us for statistical and marketing purposes. Some cookies are collected with your consent. If you would like to know more about cookies, how to prevent their installation and change your browser settings, click here.

- Global stimulus currently totals $25.5 trillion or 30% of world GDP. 2021 could be a dynamic year for economic growth.

- The IMF expects the global economy will advance 5.4% in 2021, compared with -4.9% in 2020, a path consistent with our base case scenario.

- We are encouraged by continued progress on the countermeasures to COVID-19. A vaccine may be available for the general population around mid-2021, coincident with our timeline for economic recovery.

- Extraordinary monetary policy measures have driven interest rates to historic lows. The meagre incremental yield offered by longer-dated bonds does not compensate investors for future inflation. Bonds offer a poor risk-reward profile.

- Global equity markets rebounded into Q3. While certain sectors seem expensive, broad market valuations are not uniformly unreasonable. Careful stock selection is warranted.

- Our equity portfolios trade at attractive multiples. We believe they are well positioned to offer compelling value creation in the medium-term.

Summary

As COVID-19 cases surged around the world during the first half of 2020, government-mandated shutdowns plunged the global economy into its deepest recession since the 1930s. By IMF estimates, real GDP contracted by 13.6% in developed countries and 11.3% in emerging markets year-on-year during the second quarter. In response to the crisis, fiscal and monetary authorities worldwide injected massive amounts of stimulus in a bid to avert a full-scale global financial crisis.

At this juncture, we judge these efforts to have been a success. Paired with the gradual reopening of the economy and improvements in behavioural changes, testing, vaccines and therapeutics, the road ahead for the global economy looks less dire. Recent data point to many encouraging signs of a rebound in activity.

Considering that equity markets have rallied while the world is still in recession, there are concerns that investors are detached from economic fundamentals. Although the recovery will likely vary across countries and sectors, and we do not exclude the potential for short-term volatility should political uncertainty or a second wave of the virus come to the forefront, we believe anticipation of a promising 2021 is warranted. On balance, we expect global output to return to pre-pandemic levels in the second half of next year.

Challenges remain, but there are upside risks to the economic outlook. With an unprecedented amount of stimulus in the system and more on the way, 2021 could turn out to be a robust year for economic growth.

China well on the road to recovery

As noted in our Economic and Capital Markets Outlook – July 2020, China’s post-pandemic recovery offers a useful roadmap for the rest of the world. The country’s rebound is several months old and while certain sectors are well into a new phase of expansion, others remain severely impacted.

China became the first major economy to return to growth in the second quarter. Real GDP advanced 3.2% year-on-year following its record decline of 6.8% year-on-year in Q1. Since then, the balance of Chinese data has continued to improve.

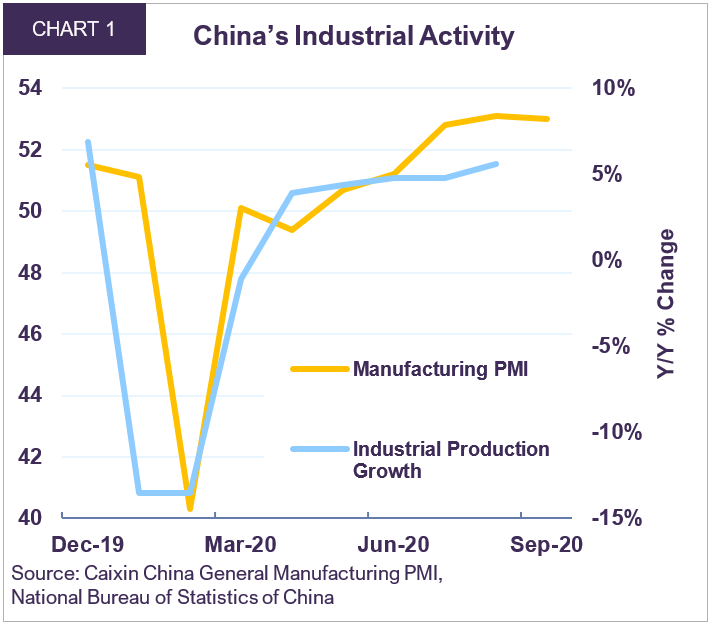

Industrial production expanded 5.6% year-over-year in August, marking five consecutive monthly increases since bottoming in Q1. The Manufacturing Purchasing Managers’ Index (PMI) has remained in +50 territory since May and now sits at a solid 53 as of September, suggesting continued improvement in industrial activity (Chart 1).

In August, passenger vehicle sales jumped to 1.76 million, an impressive 6.2% higher than the same time last year. Home sales rose 4.1% against a year ago. Consecutive increases in these consumer-driven sectors indicate households are confident in the recovery. In contrast, spending on areas at the forefront of the pandemic, such as travel, hospitality, and entertainment, is still constrained. These sectors will likely remain a drag on economic activity until physical distancing measures and mobility restrictions are eased, allowing consumer behaviour to return to normal.

The IMF forecasts that the Chinese economy will expand by 1.0% in 2020 as fiscal stimulus and accommodative monetary policy support a sustained upswing through the second half of the year. Further, China is expected to grow by 8.2% year-on-year in 2021 – a full 2% higher than its pre-COVID-19 growth rate.

Global upswing in 2021

The U.S. economy suffered its steepest decline on record during Q2, with GDP contracting $2.15 trillion in nominal terms and by 9.0% year-on-year in real terms. However, there is mounting evidence that the worst is past.

The American consumer is well-positioned to boost growth as the economy reopens. The unemployment rate improved to 7.9% in September, from its April peak of 14.7%, as 11.4 million jobs were created in the last five months. While U.S. retailers recorded negative sales growth nationwide between March and May, since then retail sales have expanded by an average of 5.4% year-on-year and are back to pre-COVID-19 levels. Consumer net worth reached a record high $119 trillion in the second quarter and a still-elevated August savings rate of 14.1% suggests household spending has room to run.

U.S. residential real estate is benefitting from historically low interest rates. Both new and existing home sales increased in August, up 43.2% and 10.5% respectively against a year ago. Strong housing starts and a booming market for renovations has led to a bumper year for building supplies. As at end-September, the price of lumber stood at $612 per thousand board feet, up 136% from its April trough.

While some slack exists in the U.S. industrial complex, factory production is steadily returning to pre-crisis levels. Industrial production was up 0.4% in August from a month earlier. Durable goods orders and rail car loadings were up 0.4% and 3.4% respectively month-over-month in August. The Manufacturing PMI came in at 53.2 in September, indicating the strongest expansion in factory activity since January 2019.

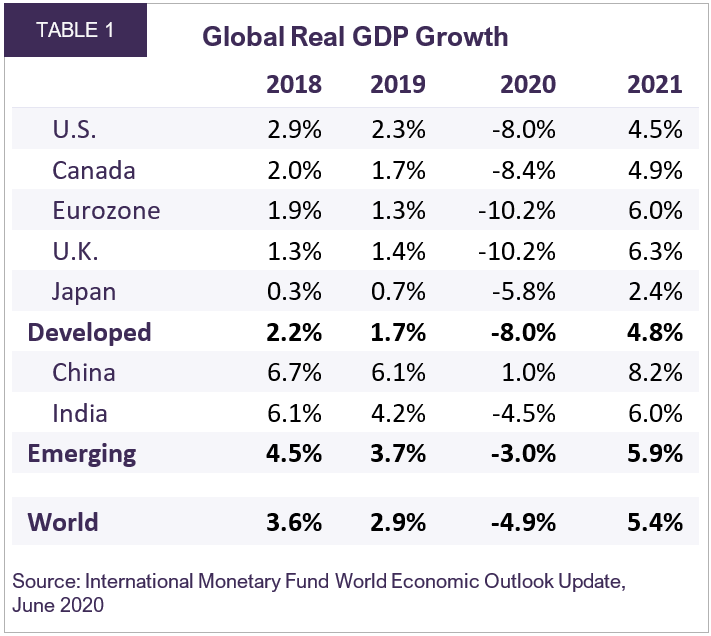

As is the case elsewhere around the world, businesses offering travel and hospitality services still face a challenging environment. However, we are confident that the U.S. economy is on an improving trajectory. The sheer magnitude of fiscal stimulus, monetary injections, pent-up demand, and promising developments in the fight against COVID-19 lead us to believe that the stage is set for a major rebound in 2021. We expect the U.S. economy to expand 4.5% in real terms in 2021, compared with -8.0% this year (Table 1).

Turning to Canada, real GDP fell 13% year-over-year in Q2. However, as observed in the U.S. and China, certain sectors of the economy are staging comebacks. Home sales soared 33.5% year-on-year in August while nationwide house prices rose 18.5% against a year ago. Retail sales were up 2.7% year-on-year in July. The Manufacturing PMI remained above 50, a level consistent with factory expansion, for the third consecutive month.

About C$81 billion worth of benefits have been paid out since the Canada Emergency Response Benefit (CERB) went into effect in April and more fiscal stimulus appears to be on its way. This, together with the Bank of Canada’s commitment to extraordinary monetary measures, indicates the macro policy backdrop will continue to support the recovery. We anticipate real GDP in Canada to rebound 4.9% in 2021, compared with -8.4% in 2020.

In Europe, economic activity is picking up from pandemic lows registered this spring. Both Manufacturing and Services PMIs were in plus-50 territory in July and August. Export data from Germany and France, the Eurozone’s two largest economies, surged 6.4% and 9.6% month-on-month respectively in July. Further, in the four months to September, the Euro Area Economic Sentiment Indicator has turned up and retraced about 68% of its decline from earlier in the year. We expect real economic activity in the Eurozone to bounce back to 6.0% in 2021, compared with -10.2% in 2020.

The timeline and trajectory for economic recovery in the Emerging Markets is somewhat less certain, given that several key countries are struggling to bring the pandemic under control. With China leading the way, the IMF forecasts real GDP for the region to expand by 5.9% in 2021, a notable turnaround from -3.0% this year.

Overall, the IMF expects the global economy will advance 5.4% in real terms in 2021, compared with -4.9% in 2020, a path consistent with our base case scenario.

Sustaining the stimulus

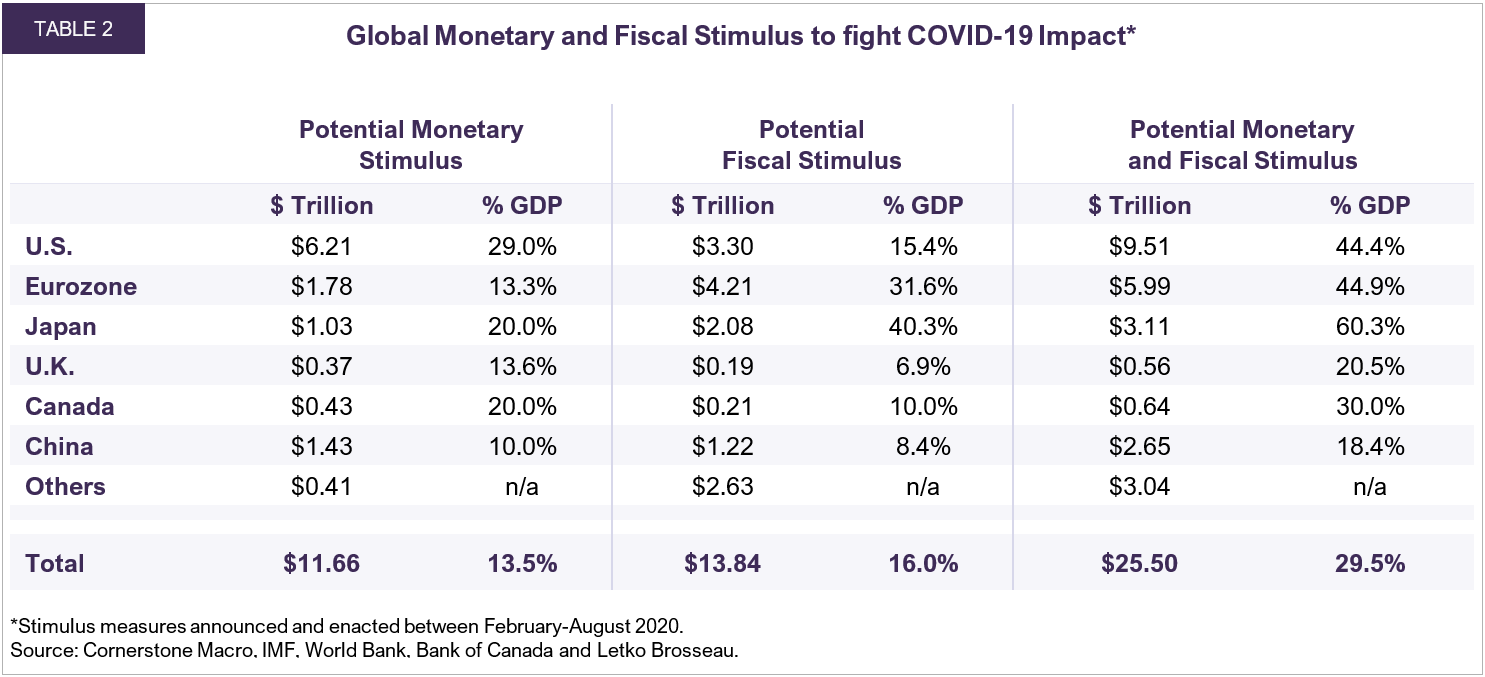

In response to the COVID-19-induced economic crisis, policymakers worldwide unleashed extraordinary amounts of monetary and fiscal stimulus into the global economy. As of August, injections totalled $11.7 trillion or 30% of world GDP (Table 2). This relief package is larger than the combined economies of the U.S. and Canada.

More stimulus appears to be in the pipeline. In July, the U.S. Federal Reserve provided details of its open-ended Quantitative Easing (QE) program, announcing it will increase holdings of Treasuries and mortgage-backed securities by a minimum of $1.2 trillion in the coming months. A month later, the Fed outlined a monetary policy strategy shift to inflation averaging from inflation targeting. In a nutshell, the central bank formally acknowledged a relaxed approach to inflation that will likely keep interest rates lower for longer.

The European Central Bank’s €1.35 trillion Pandemic Emergency Purchase Programme (PEPP) will run until June 2021, while reinvestment of maturing PEPP securities will continue until at least year-end 2022.

Elsewhere, the Bank of Canada reaffirmed its commitment to extraordinary policy support. The Government of Canada Bond Purchase Program will remain in place at C$5 billion per week (or 1% of GDP per month) well into the recovery. In Japan, central bank asset purchases are scheduled to continue until at least Q1 of next year.

On the fiscal front, a series of initiatives will help support economies for several years to come. A U.S. stimulus bill in the range of $1.5-$2.5 trillion is likely to be approved, although the timing remains uncertain given the upcoming presidential election. Meanwhile, the European Union’s €750 billion recovery plan, which is equivalent to about 5% of E.U. GDP, has been extended through 2024.

As monetary stimulus continues to flow through the system and the full benefits of fiscal policies kick in, 2021 could be a remarkable year for global growth.

Challenges on the horizon

The biggest risk to our forecast is the virus itself. Indeed, the evolution of the global pandemic dictates the timeline of the economic recovery. At this point, most developed nations have contained the spread and lowered the reproductive rate of the virus. In the majority of instances where a pickup in daily new confirmed cases is occurring, the share of daily positive tests in these countries is still low. Meanwhile, former hotspots, like the U.S. and Brazil, are beginning to turn the corner in the fight against COVID-19. In the U.S., daily new cases are receding from their peak levels and in Brazil the situation appears to be plateauing. Unfortunately, elsewhere in the world, new confirmed cases are accelerating. Recent upticks in India and Southeast Asia suggest that, with the exception of China, emerging markets may trail the global recovery.

Looking ahead, some near-term challenges on the virus front are specific to countries in the northern hemisphere. With students returning to school and people being driven indoors by colder weather, conditions are becoming more conducive to the transmission of the virus. The onset of the cold and flu season means overlapping symptoms of these ailments may further complicate the situation.

As outlined in our September Update on COVID-19, we are encouraged by rapid progress in the development of countermeasures to the virus. The increasing adoption of behavioural changes, such as wearing a mask in public and maintaining physical distance, indicate countries are better prepared for a second wave. In addition, both the volume and accessibility of testing is improving around the world. Vaccine development is advancing at record-breaking speeds. Our healthcare team anticipates a first-generation vaccine may garner emergency authorization for use in high-risk populations in late 2020 or early 2021. Approval for the broader population could occur by mid-2021. In the meantime, therapeutics may have a notable impact on health outcomes over the next year to year-and-a-half. We believe 2021 will see a return to normalcy, which coincides with our timeline for economic recovery.

Aside from the threat posed by the virus, a flare-up of U.S.-China tensions could destabilize global trade and undermine economic growth, as was seen in 2019. President Trump has publicly criticized China on a variety of topics in recent weeks, including technology and China’s approach to Hong Kong. It is difficult to weed out policy from campaign rhetoric, but with China on track to fall well short of meeting the targets outlined in the Phase One trade deal with the U.S., this could be a point of contention going forward. However, decoupling two highly integrated economies is a medium- to long-term risk. For the time being we continue to believe that a broad community of interests favours an eventual compromise on trade. Given the context of a global pandemic and nascent economic recovery, the political appetite for conflict may die down with U.S. general elections around the corner.

The final key risk on our dashboard is U.S domestic policy. The consequences of current interventions on future tax policy and spending priorities will boost economic uncertainty. The incumbent or incoming administration will also have to deal with complex issues of social discontent. We believe regardless of the victor, policies supporting an economic recovery will remain at the top of the agenda.

From rebound to rally

By the close of the third quarter, global equity markets had mostly recouped losses from earlier in the year. The S&P 500 was up 6.8% year-to-date (in Canadian dollar terms), while the S&P/TSX (-5.5%), DAX (2.6%), Nikkei (3.1%), MSCI World (2.9%) and MSCI EM (-0.4%) recovered from their lows.

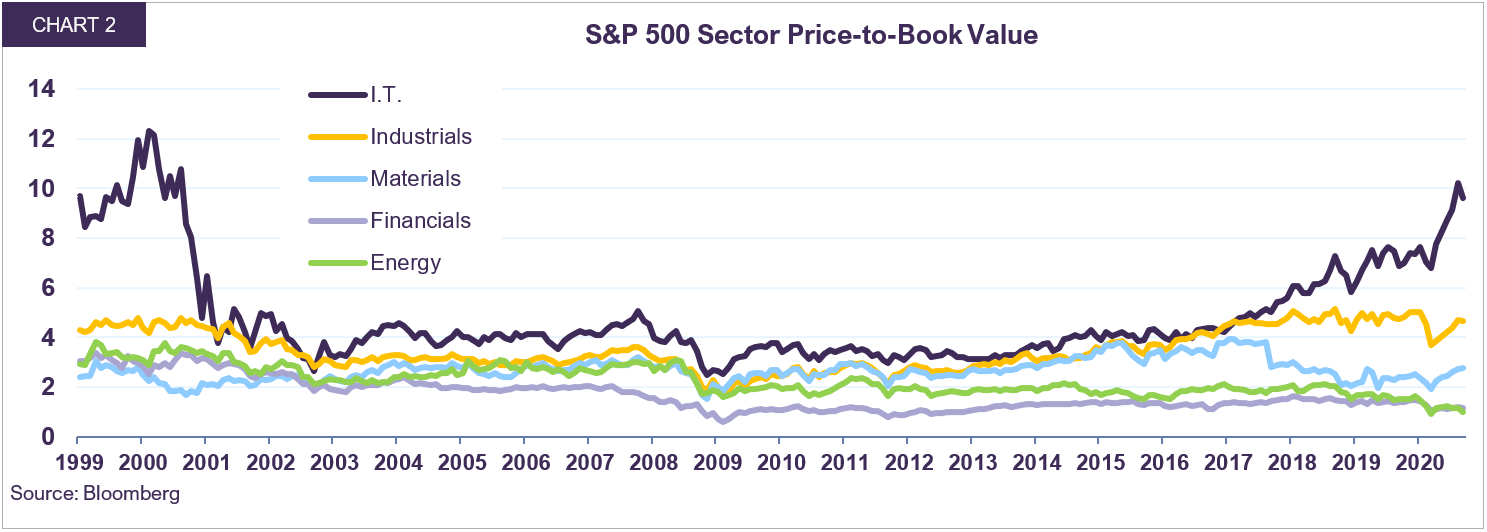

Broad market highs amid a global recession has led to questions over whether equity valuations have become disconnected from the reality of the pandemic. The S&P 500 Index currently trades at 20.3 times estimated 2021 earnings, 35% above its long-term average of 15x. While the market is not cheap, it may be premature to conclude that it is uniformly expensive.

Although very low interest rate environments tend to be consistent with somewhat higher valuations (discounting a company’s future cash flows at a lower rate results in a higher price today), it should be noted that the share price rebound has been uneven. Of the 500 companies in the S&P 500 Index, 56% are still down year-to-date.

Some pockets of the market are showing signs of froth and this is skewing broad market valuations higher.

For instance, the five largest companies in the S&P 500 by market capitalization, Apple, Microsoft, Amazon, Facebook and Alphabet, together account for nearly a quarter of the index and trade at a weighted average multiple of 33 times. While the U.S. technology sector is trading at levels last seen in the late 1990s tech bubble, other sectors’ valuations are still reflecting pessimism regarding their medium-term prospects (Chart 2). A closer look at companies with ties to the physical economy, such as commodities, industrials, financials and transportation, shows that they exhibit characteristics of value stocks, trading at low multiples to earnings and book value. Just as value stocks have been disproportionately impacted by COVID-19, they have strong upside potential as the economy normalizes.

With respect to fixed income, we acknowledge the recent policy shift by the U.S. Federal Reserve (and the likelihood that other central banks will follow its lead) suggests that interest rates could remain low for some time. The 10-year government bond yield in the U.S. was 0.69% (0.57% in Canada) at end-September. However, this does not change our assessment that bonds continue to offer a very poor risk-return relationship. As central banks tolerate higher inflation going forward, the meager return that bonds offer may not keep pace with price increases, resulting in real value destruction. In addition, heavier reliance on fiscal policy to boost economic growth may signal an end to the secular decline in interest rates. In this environment, we prefer to focus on capital preservation and maintain a very low duration in all our portfolios.

We are of the view that the global economy has turned the corner and is on a promising trajectory. Our global equity portfolio trades at 12.6x estimated earnings and provides a 3.7% dividend yield. We remain confident that our portfolios are well positioned to offer compelling value creation in the medium-term.

All dollar references in the text are U.S. dollar unless otherwise indicated.

The information and opinions expressed herein are provided for informational purposes only, are subject to change and are not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any companies mentioned herein are for illustrative purposes only and are not considered to be a recommendation to buy or sell. It should not be assumed that an investment in these companies was or would be profitable. Unless otherwise indicated, information included herein is presented as of the dates indicated. While the information presented herein is believed to be accurate at the time it is prepared, Letko, Brosseau & Associates Inc. cannot give any assurance that it is accurate, complete and current at all times.

Where the information contained in this presentation has been obtained or derived from third-party sources, the information is from sources believed to be reliable, but the firm has not independently verified such information. No representation or warranty is provided in relation to the accuracy, correctness, completeness or reliability of such information. Any opinions or estimates contained herein constitute our judgment as of this date and are subject to change without notice.

Past performance is not a guarantee of future returns. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

This presentation may contain certain forward-looking statements which reflect our current expectations or forecasts of future events concerning the economy, market changes and trends. Forward-looking statements are inherently subject to, among other things, risks, uncertainties and assumptions regarding currencies, economic growth, current and expected conditions, and other factors that are believed to be appropriate in the circumstances which could cause actual events, results, performance or prospects to differ materially from those expressed in, or implied by, these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

Concerned about your portfolio?

Subscribe to Letko Brosseau’s newsletter and other publications:

Functional|Fonctionnel Always active

Preferences

Statistics|Statistiques

Marketing|Marketing

|Nous utilisons des témoins de connexion (cookies) pour personnaliser nos contenus et votre expérience numérique. Leur usage nous est aussi utile à des fins de statistiques et de marketing. Cliquez sur les différentes catégories de cookies pour obtenir plus de détails sur chacune d’elles ou cliquez ici pour voir la liste complète.

Canada - FR

Canada - FR U.S. - EN

U.S. - EN